RBI governor Urjit Patel says the reason for the the hike was to ensure and maintain the 4% inflation target.

India’s central bank raised its benchmark interest rate to the highest in two years as it stepped up efforts to curb inflation and stem capital outflows.

Five of the six members of the monetary policy committee voted to raise the repurchase rate by 25 basis points to 6.5 per cent, with Ravindra Dholakia the only one opposing it, the Reserve Bank of India said in a statement on Wednesday. The decision was in line with the forecasts of 40 of the 53 economists in a Bloomberg survey. The committee kept the policy stance neutral.

“The main reason for changing the policy rate is to ensure that on a durable basis that we come to and maintain the 4 per cent target,” governor Urjit Patel said in Mumbai, referring to the medium-term inflation goal. “We have been away from” that target for several months now and back-to-back hikes were to “maximise our chances that we don’t drift away,” he said.

The RBI’s rate move is the second in eight weeks and follows emerging-market counterparts in Indonesia, the Philippines and elsewhere who are trying to counter currency routs and inflation risks triggered by higher U.S. rates and a stronger dollar. The rupee is down nearly 7 per cent against the dollar this year to be the worst performer in Asia.

Bonds extended gains, with the yield on the 10-year benchmark note down 5 basis points to 7.72 per cent.

“The pre-emptive hike in response to the inflation pick-up should prevent any need for an aggressive move in the future,” said Rajni Thakur, an economist with RBL Bank Ltd. in Mumbai.

Key Points

Inflation projection for 2H FY2019 raised to 4.8% from 4.7% FY19 growth projection retained; 1Q FY20 growth seen at 7.5% Risks to the outlook have increased with rising trade tensions

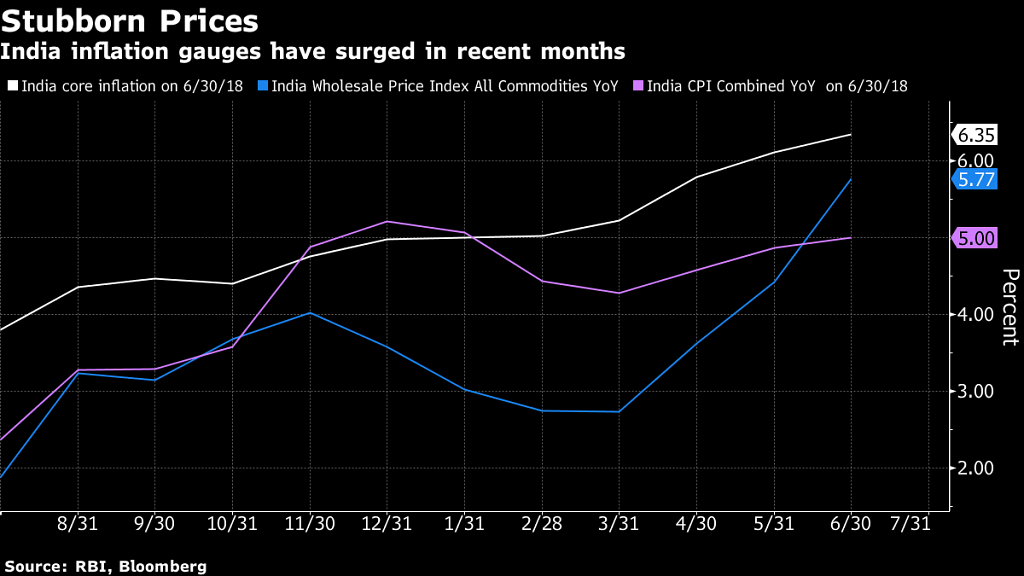

Inflation has been running well above the central bank’s medium-term target of 4 per cent, with the outlook set to worsen as oil prices stay elevated and the currency weakens. Higher government prices for some food crops also poses upside risk to inflation.

The currency and inflation woes come against the backdrop of an economy that’s growing faster than any other major nation, strengthening Prime Minister Narendra Modi’s position as he prepares for elections next year. But risks to the outlook are formidable: as the world’s fastest-growing oil consumer, higher crude prices will push up the current-account deficit, while global trade tensions threaten exports and investment.

While acknowledging that geopolitical tensions and elevated oil prices continue to be sources of risk to global growth, the RBI was confident that domestic economic recovery was well entrenched.

Monsoon Outlook

“Various indicators suggest that economic activity has continued to be strong,” the central bank said in the statement. “The progress of the monsoon so far and a sharper than the usual increase” in support prices for some crops are expected to boost rural demand by raising farmers’ income, the RBI added.

What Our Economists Say…

The hike will probably deal a blow to a still-nascent recovery in growth. We had expected a hold, based on our view inflation has already peaked and that the economy needs support in the face of high borrowing costs and oil prices, and a weak banking sector.– Abhishek Gupta, Bloomberg Economics

High frequency indicators from purchasing managers’ surveys to auto sales data show the economy is likely to grow above 7 per cent, although the recovery could be uneven. The RBI expects growth to pick up in the next financial year, starting 1 April.

The economy’s strong performance gives policy makers another reason to hike rates. Core inflation — which strips out volatile food, fuel and light prices — has been sticky at a four-year high of more than 6 per cent, indicating demand pressures in the economy. Slackness in the economy was disappearing fast, the RBI said. –Bloomberg