A finance ministry official indicated last week that it would not be a concern even if the rupee fell to 80 given the decline in peers.

The Reserve Bank of India appears to have turned less aggressive in defending the rupee, letting the currency slide closer to its real-effective exchange rate amid an emerging-market selldown.

The central bank, which intervened actively until the rupee hit 69 per dollar, has mostly stayed on the sidelines after the currency broke past the 70 psychological mark last week, according to foreign-exchange traders familiar with the RBI’s market transactions. They asked not to be identified because they aren’t authorized to speak publicly.

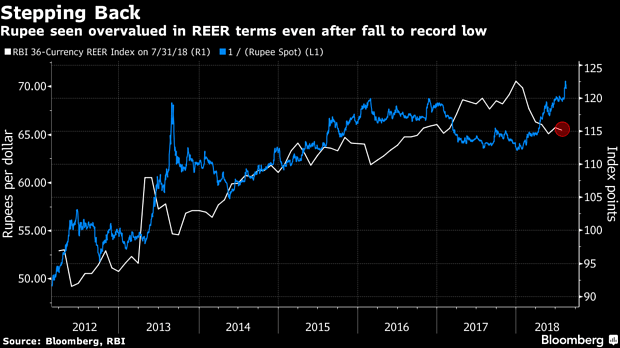

Policy makers signalled a tolerance for a weaker currency last week when a finance ministry official said it won’t be a concern even if the rupee fell to 80 given the decline in peers. The RBI’s own 36-currency real-effective exchange rate index indicates the currency remains overvalued, with Australia & New Zealand Banking Group Ltd. pegging its fair value at 73.50.

“Over the last couple of years the RBI had been keen to deploy reserves whenever the rupee approached 69, but last week’s action suggests the RBI may be shifting its red lines as a result of peer currency weakness,” said Maximillian Lin, an emerging-market Asia strategist at NatWest Markets Plc in Singapore. Lin sees the rupee at 70.40 by year-end.

The rupee fell 0.1 per cent to 70.19 per dollar on Friday, widening its year-to-date loss to 9 per cent, the worst in Asia. The currency hit an all-time low of 70.3950 on 16 August While the RBI’s headline foreign-currency reserves fell $1.8 billion for the week of 10 August, the drop was probably largely due to valuation effects, according to Bloomberg Intelligence economist Abhishek Gupta. India held $400.9 billion of reserves as of 10 August, down from a record $426 billion mid-April, with the latest weekly data due today.

“We are in a very uncertain world, and I think the RBI would like to keep reserves in their pocket, not trying to spend too fast,” said Gopikrishnan MS, head of foreign exchange, rates and credit for South Asia at Standard Chartered Plc in Mumbai. “If it’s going to be a global phenomena, outside India’s control, then the intervention will be low.”

The Reserve Bank of India has said it does not target any particular level of exchange rate and steps in only to curb undue volatility in the currency. Data on intervention is published with a two-month lag.-Bloomberg

Translated into simple English, the mandarins seem to be saying, We don’t really mind rupee depreciation – with all that it does to push up inflation and trouble India Inc while servicing its foreign borrowings – so long as we can blame it on someone else. We take full ownership of all hits, have nothing to do with the misses.