New Delhi: When the Atal Bihari Vajpayee government decided to relinquish control of Maruti Suzuki in 2002, the firm was valued at Rs 4,339 crore.

In the 17 years since, Maruti Suzuki’s fortunes have soared — the company’s market capitalisation has increased to over Rs 2.18 lakh crore and it has managed to hold onto its position as the market leader in the auto industry despite competition having intensified with the entry of a number of global players.

The numbers only accentuate the fact that Maruti Suzuki, once a joint venture between the Indian government and the Japan-headquartered Suzuki Motor Corporation, is a shining example of successful public sector undertaking (PSU) disinvestment.

It could also provide valuable cues to the Modi government, which is now aggressively pushing through disinvestment in the hope of boosting its revenue receipts, among other things. The government has given in-principle approval for strategic disinvestment of 23 Central Public Sector Enterprises. The list includes Air India, Pawan Hans, BEML and BPCL, among others.

Also read: Govt sold 45% of Hindustan Zinc for Rs 769 cr in 2002. Its 30% stake is now worth Rs 27,000 cr

The Maruti Suzuki disinvestment

The Vajpayee government decided to give up control of the automobile manufacturer as part of its strategy to privatise firms in sectors not considered to be of strategic importance.

At the time, the government’s stake of 49.74 per cent was valued at Rs 2,158 crore. But when it finally gave up its entire stake and handed management control to Suzuki Motor Corporation in 2007, the central government eventually received Rs 5,928 crore.

The five-year period, from 2002 to 2007, witnessed a four-phase transaction involving a rights issue, an initial public offering (IPO) and private placement.

Roughly put, the value of the government’s stake in 2002 would have now been more than Rs 1 lakh crore. The stock has also proven to be a good investment for retail investors. The price of the automobile major’s stock has increased nearly 5,700% to Rs 7,243.75 as of closing on 14 November from Rs 125 at the time of listing.

The performance of Maruti Suzuki

Maruti Suzuki was first set up in 1982 as a 74:26 joint venture between the Indian government and Suzuki to realize the government’s dream of making a “car for the people”.

The company started working on Maruti 800, a reasonably priced car that was produced for nearly three decades before the company stopped its production in 2014.

Subsequently, in two transactions, the foreign firm increased its stake in the joint venture first to 40 per cent and then to 50 per cent. It was classified as a private company in 1992 after the government shareholding fell below 50 per cent. Ten years later saw the government completely handing over management control to the foreign partner and eventually exiting the company in 2007.

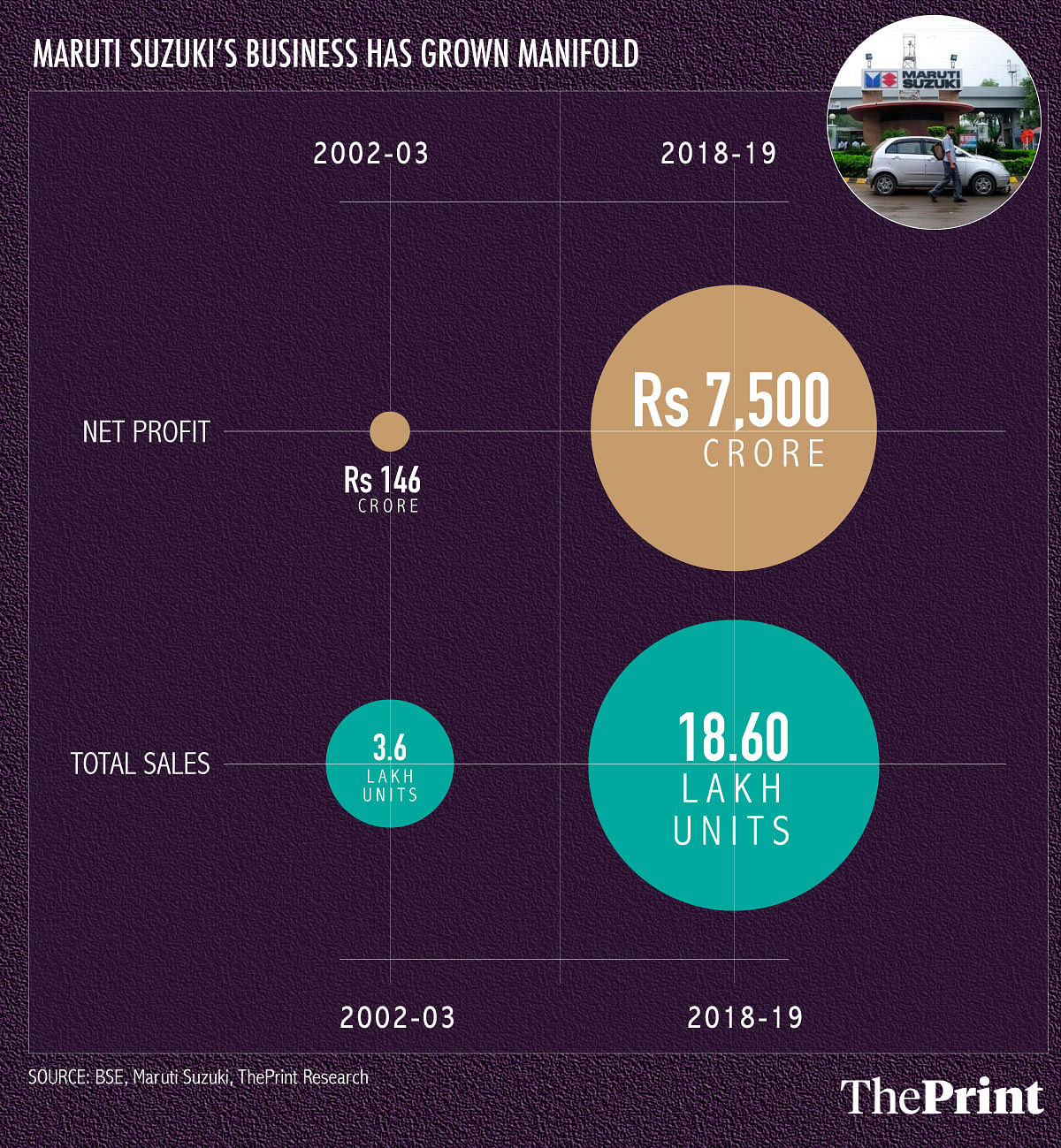

The firm — catering to both the domestic and international markets — has seen its automobile sales increasing manifold with many new car models added. Total sales reported by the firm were at 18.6 lakh units in 2018-19 as against 3.6 lakh units as of 2002-03. The profitability of the firm has also increased sharply over the last one and a half decades. The firm reported a profit of Rs 7,500 crore in 2018-19 as against 146 crore in 2002-03.

Also read: Maruti Suzuki posts first jump in sales in 9 months amid auto sector slowdown

A continued edge in the market

Dolat Capital, in a research note dated 30 October, pointed out how Maruti Suzuki continues to hold an edge over its competition.

“MSIL is better positioned than its peers in terms of transition of its products from BS4 to BS6 (MSIL has transitioned over 70 per cent of its portfolio to BS6),” the report said, adding that a proven product portfolio, strong dealer network and rural presence add to MSIL’s “unique moats and intrinsic strength”.

In a report dated 24 October, Reliance Securities pointed out that a “better visibility on company’s BS-VI products and its affordable incremental pricing” may help the firm in gaining market share and improving its profitability margins going forward.

Maruti Suzuki had a 48.4 per cent market share in the passenger vehicles segment and 58.5 per cent market share in the passenger cars segment as of September-end.

R.C. Bhargava, former chairman, Maruti Suzuki, recalls the positives of the firm, then known as Maruti Udyog, becoming a private company in 1992.

“The working system of a government company is different from that of a private company,” he said. “A government company has to fulfill many legal obligations. It is an instrument of the state. People can take a government company to court through a writ. A government company has to work commercially while following government rules whether it’s audit or financial.

“A private company does not have to worry about these rules,” he added. “After 1992, the company was subject to a commercial audit and not of the CAG (Comptroller and Auditor General of India). None of the financial rules applicable to a government company applied. Becoming a private company certainly makes decision-making faster. One can take higher levels of risks.”

Vajpayee-era successful disinvestment

The Vajpayee government successfully completed some other strategic sale transactions in firms such as VSNL, BALCO, Hindustan Zinc and CMC Ltd. The government chose to retain a small stake in Hindustan Zinc and Balco while completely exiting from Maruti Suzuki.

Yashwant Sinha, former Union finance minister, recalled how in his first budget in 1998, the government announced its intent to bring down its stake to less than 50 per cent in all non-strategic industries.

“We realised that government need not be in businesses that are not of strategic importance. Revival of perpetually loss making companies was only possible with privatisation,” he said explaining how the government’s strategy was refined further in later years to ensure that its stake was sold as strategic stakes with transfer of management control rather than in small lots to obtain a better value.

Also read: Fiscal stress offers Modi govt great opportunity to push disinvestment

The report has been updated to accurately reflect the growth in Maruti’s stock price.

If private sector is so helpful then why private aviation firms didn’t fly back our Indian Citizens from abroad.

Think if AIR INDIA been already privatized.

If you study the economics you may find that government sector should never mint to make profits where as they mint to serve common people. They are there to build foundation stone for private sector also.

At the time of Independence many other countries got their freedom. But today we can proudly stood in top 10 nations because of policies government had adopted at the time of Independence.

Also you can see current situation of banks which are being in NPA problem due to so called private sector (is it not a private sector scam/corruption). They are also feeding on people’s money. When will we see other side of coin.

Kanker khera meerut 250001

Same should be done to AIR INDIA, ELECTROSTEEL CASTING, BHUSHAN STEEL, SAIL, BPCL, NTPC, OIL, IOCL, ONGC, CMERI, IIT, NIT, ALL GOVERNMENT RUN ORGANISATION, PAY SCALE HIKE AND DA HIKE EVERY YEAR FOR NO OUTPUT SHOULD BE HANDED OVER TO PRIVATE ORGANISATIONS. I FAIL TO UNDERSTAND AFTER RECRUITING TOP BRAINS FROM THE COUNTRY UNDERGOING RIGOROUS INTERVIEW PROCESS WHEN THESE PEOPLE ARE RECRUITED YEAR AFTER YEAR, PROFITABILITY DECREASES YOY AND BECOMES A LIABILITY, STILL CONTINUES TO GO ON SHAMELESSLY ON PUBLICS MONEY.

One Clarification required :wealth creation by privatisation who gains more and who pays for it .While this thought is keeping in mind a Product buyer,Market Share holder,The owners or the Financiers. In short who gets the burden.Its all a game.

5700% (57x) has been repeatedly referred to as 5700 times.

Glaring mistake, by a factor of 100.

Maruti was under Suzuki management even before 2002. It is economic upturn post 2004 that created wealth for big companies like Maruti.

Maruti Suzuki was always under Suzuki management even prior to 2002 period. GoI made an IPO @ 125/- per share to sell its residual stake to public. It was the turn-around in the economy post-2004 period that lifted the fortunes of strong companies like Maruti Suzuki. Writer need to have proper historical perspective.

We need more of these articles, because we should never forget how destructive and uncaring govt ownership is. Just a few years ago, Kejriwal was threatening to nationalize the power companies – it’s as if everybody forgot how corrupt and incompetent public distribution was in Delhi. Nobody remembers now – how the MTNL and VSNL employees fought against the introduction of cell phones into India. It used to take years to get a phone and corruption was endemic – the introduction of private companies wiped all that away. It is easy to complain today because there is always scope for improvement but it helps to remember the horrific past.