New Delhi: Disinvestment in public sector firms has always been a political hot potato, irrespective of the party in power.

But if the Narendra Modi government — which is set to implement an ambitious plan to privatise or sell stakes in PSUs — wants to convince critics of disinvestment why it makes eminent economic sense, it just needs to cite the example of Hindustan Zinc Ltd (HZL).

HZL was incorporated as a public sector firm in 1996, and Atal Bihari Vajpayee’s NDA government, in August 2000, decided to disinvest 26 per cent of its equity through a strategic sale. Sterlite Industries emerged as the highest bidder, offering Rs 40.5 per share for the government’s stake. The transaction was completed in April 2002.

Further, as part of the ‘call option’ part of the deal, the government further divested around 19 per cent stake at the same price to the private entity in November 2003.

Through this two-phase transaction, the government sold 45 per cent of its stake in the firm for around Rs 769 crore.

Fast forward to 2019 and the government’s remaining 30 per cent stake in HZL is valued at Rs 27,523 crore (as of 29 October 2019), substantially higher than the Rs 769 crore it received while selling its stake to Sterlite, a subsidiary of Vedanta Ltd — an indication of the value unlocked in the firm post-privatisation.

Also read: Privatisation comes to the rescue of Modi govt, but accompanied by political risk

Change in fortunes

Hindustan Zinc is the second largest zinc-lead miner in the world after Swiss firm Glencore, and the fourth largest zinc-lead smelter globally. It has now also broken into the top 10 list of silver producers in the world.

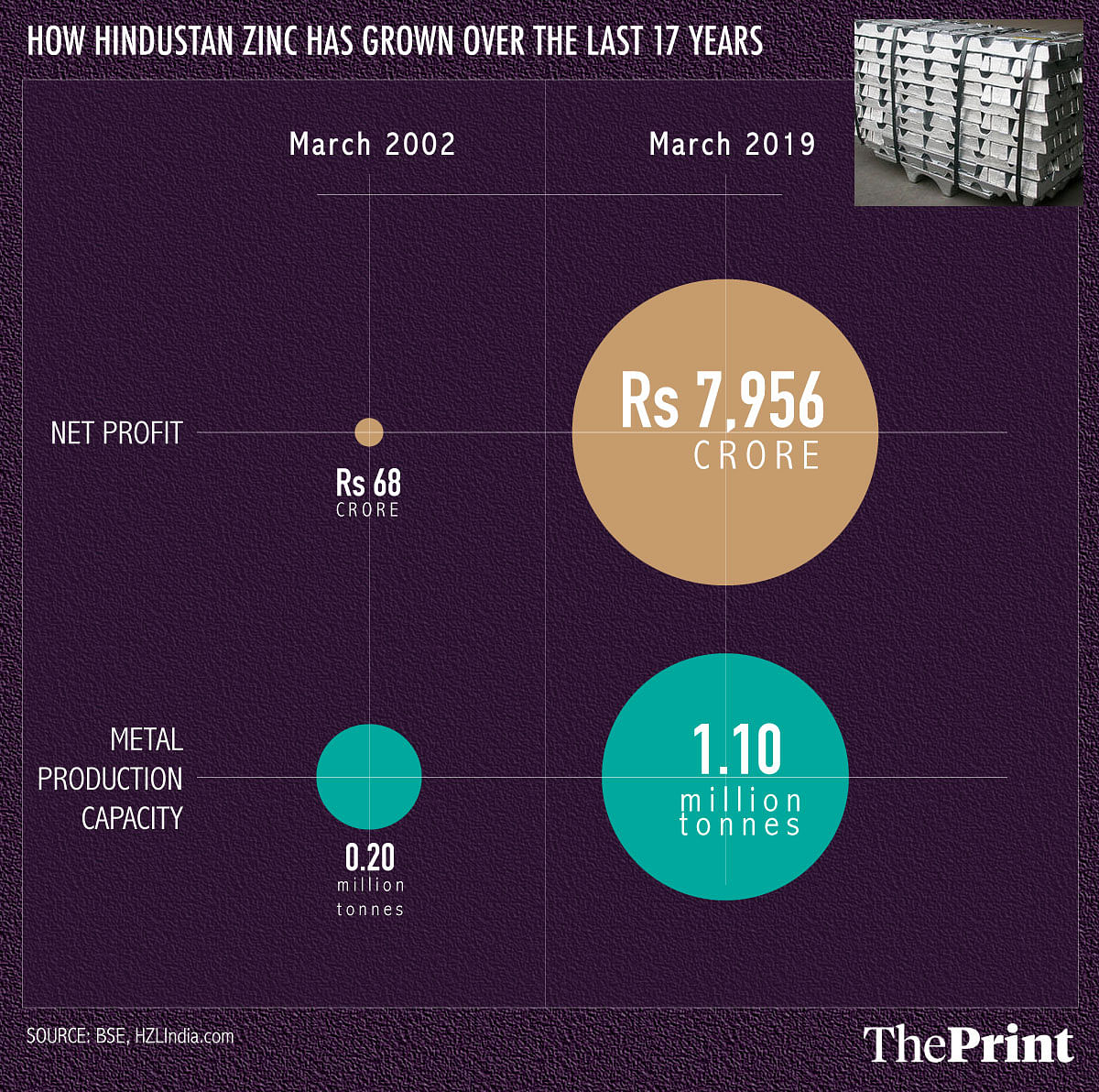

The former PSU, headquartered in Rajasthan, saw its profits rise manifold in the 17 years after privatisation. The full-year profits as on 31 March 2019 stood at Rs 7,956 crore, as against Rs 68 crore in the full year ending March 2002.

The company’s production capacity of zinc, lead and silver has also increased more than five-fold since disinvestment — to 1.1 million tonnes from 0.2 million tonnes per annum in 2002.

The silver production has also been boosted by the ramped-up volumes at HZL’s Sindesar Khurd Mine in Rajasthan. The company produced 610 tonnes of silver in 2018, as compared to 47 tonnes in 2002.

HZL’s performance has resulted in India posting the biggest growth in silver output of any Asian country in 2018, according to the World Silver Survey by the Silver Institute.

“The company’s underground operations increased its mining output, while better silver grades boosted silver production by 33 per cent in relation with 2017, to a record level of 19.6 Moz (610 t). The company expects silver output to further increase in 2019,” the survey report said, adding that HZL’s operations accounted for over two-thirds of total silver production growth in Asia, making it the ninth-largest silver producer in the world.

The company, which runs five mines in Rajasthan, managed to completely transition to much more capital-intensive underground mining from open cast operations, starting in March 2018.

HZL’s CEO Sunil Duggal, in an earnings call on 30 October, said the firm expects to achieve a metal production capacity of 1.2 million tonnes by the end of this fiscal. An email sent to the firm remained unanswered until the time of publishing this article.

Also read: India has met its disinvestment target only once in the last 10 years

Lessons for the govt

The success of HZL’s privatisation and the increase in the value of the government’s remaining stake are important lessons for the Modi government for the next wave of disinvestment. Air India, Bharat Petroleum Corporation Ltd and Container Corporation of India are on the block, as the government looks to move away from the practice of forcing a cash-rich PSU like ONGC to buy another PSU to meet divestment targets.

“The privatisation of Hindustan Zinc has helped the firm in bringing in the latest technology to run its business,” said an analyst with a leading brokerage firm, who did not want to be identified as he is not the authorised spokesperson.

“Use of modern exploration technology and high-cost underground mining have ensured that the firm’s output is one of the largest in the world.”

Prithvi Haldea, founder-chairman of Prime Database, added, “PSUs are not the most efficient units when it comes to tech upgradation, human resources, marketing and business processes. Strategic disinvestment brings in the private sector and is a good way of maximising profits.

“It has been seen, both internationally and in India, that any government company that is privatised manages to increase its value with the introduction of new technology and business processes.”

Haldea said this creates wealth for the government as well, in instances where it has retained a stake in the company. The government, he added, should not be in any business except for “strategic reasons”.

Also read: Fiscal stress offers Modi govt great opportunity to push disinvestment

Was HZL valued correctly? It was and is a monopoly.Was it sold for a song? A deeper analysis needs to be done on HZLs divestment

Divestment of hzl is ok as per policy. But the matters highlighting regarding technology is not correct. The plant commissioned in 90was having latest technology. This I know as I served hzl for 20yrs.another important point is that mining plans was ready for next 10years with all exploration plans etc.

Private organisation used that for Increasing business.

If the same grp can not turn fortune of balco after takeover then hzl got the changeover due to it’s monopoly and no competition from. Other area

When HZL was divested,it had 5000 employees,now it has 20000+ employees

It is being touted that private sector is like a Midas touch that can convert any govt cmpny to goldmine.

If private sector has all the means, speed in decision making why private companies like Jet airways fail.Why lakhs of crores loans due from pvt sector companies.

I feel that there are some PSUs which are more professional then pvt companies.

An instance is one oil field which was handed over to Enron in erstwhile Vajpayee govt. from oil & natural gas corp citing that private sector will be able to increase production, in which pramod mahajan et al raked the moolah. however the production continued to decline.

Another story is turnaround of MRPL which was purchased by ongc and was declared sick. The company started running in profit after being procured by ongc.

What about ICICI and HDFC.? They were also once Govt. Run companies. So, reducing the stake of Govt. Below 51% makes a better sense, where the management can take a call on expansion and raising capital freely. The increase in valuations will help the government to sell residual stake at higher prices.

After taking over HZL by Vedanta Group, they trimmed excess Staff, increased productivity. Than they expanded production capacity by bringing latest Technology,increased Captive Power generation by adding over 1000 MWA Power equipment. They increased Captive Mining production. Increased Production & productivity, addition of new technology cost cutting, adding Captive Power Plants & increased Mining Production & mining productivity are main reasons for increased Profit & in increasing Market value of HZL. This Magic can be done only by Private Sector & not by Govt Sector. Because Private Sector top management have more Power to take quick decision in the interest of Company. Even on oral permission of Promoters,can take day to-day decision & later can take written Approval. In Govt Sector, file move from desk to desk to CMD & then to Govt Ministry. Then file move downward from Ministry to CMD to bottom for clarification & justification. Every Proposer will write his recommendation carefully,will not take slightest risk to avoid future Vigilance case. To get approval finally takes months & months & some time years to get final approval. That is how zeal & enthusiasm is killed in Govt Sector. Everybody work carefully & work for personal career growth & not bothered about growth of Company & whether Company runs on Profit or Loss.

What about IPCL?