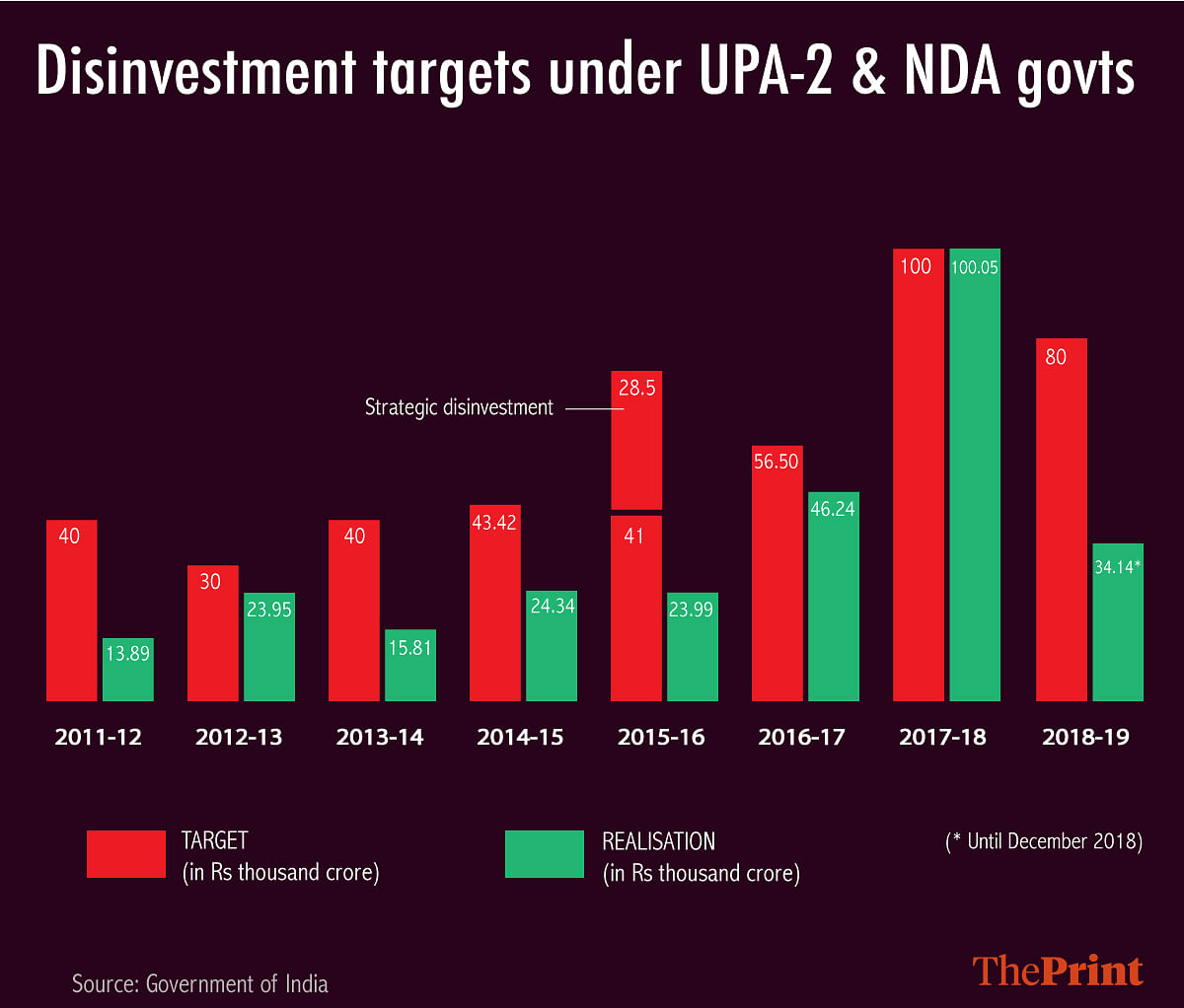

What will worry the NDA govt amid a tight fiscal situation in an election year is that till December 2018, it accrued less than half its Rs 80,000-crore target.

New Delhi: The central government has managed to meet its disinvestment targets only once in the last 10 years, and is struggling to do so again this financial year.

The successful year was 2017-18, when the government exceeded its Rs 1 lakh crore target by taking in actual proceeds of Rs 1,00,056 crore. However, its earnings till December 2018 are just Rs 34,142.35 crore, less than half the Rs 80,000-crore target it set itself for 2018-19.

This shortfall in realisation will worry the NDA government amid a tight fiscal situation in an election year.

What’s more, a closer look at the data reveals that a substantial chunk of the accruals in 2017-18 came from stake sale between central public sector enterprises (CPSE) and buybacks — a scheme which allows companies to repurchase part of the outstanding shares.

Also read: Weak India industries prompt calls for RBI to downgrade growth

Exits a problem area

According to Prime Database, a top source for capital market information, 36.62 per cent of the disinvestment target last year came from CPSE to CPSE sales.

In other words, PSUs failed to exit businesses despite meeting the target — stakes merely changed hands — diluting the purpose of the exercise.

“Exits have remained a problem area and this does not seem to have any immediate solution,” former chief economic adviser Arvind Subramanian told ThePrint.

Last year, in January, the government-owned Oil and Natural Gas Corporation (ONGC) announced it was buying out the Centre’s entire 51 per cent stake in the Hindustan Petroleum Corporation for Rs 36,915 crore.

That apart, the public sector insurance behemoth Life Insurance Corporation (LIC) has been actively supporting the government’s disinvestment and initial public offering (IPO) exercise, including those of Hindustan Aeronautics Limited and New India Assurance.

A study by Pahle India Foundation showed that over the last few years, LIC has consistently subscribed to CPSE shares during the disinvestment process.

“In 2015, LIC bought almost 50 per cent of Coal India’s and 86 per cent of Indian Oil’s issue size. A year earlier, it had bought roughly 72 per cent of SAIL’s offer size and subsequently 5 per cent of the government’s stake in BHEL through private placement, since going to the market had been ruled out,” the study said.

This year too, NBCC — a major construction company of the Government of India — announced the buyout of the Hospital Services Consultancy Corporation (HSCC), under the Ministry of Health and Family Welfare.

“The disinvestment process must be handled more efficiently. The breakup of 2017-18 disinvestment proceeds indicates that ownership of government has barely reduced,” said Nirupama Soundararajan, senior fellow and head of research, Pahle India.

Also read: 45% increase in e-filing by taxpayers who earn less than Rs 10 lakh a year

The way ahead

Sources said the government is likely to accelerate its stake sale in Axis Bank and ITC Ltd in next few weeks. The Centre’s stake in ITC, which has a market capitalisation of Rs 3,60,916.62 crore, stands at around 7.97 per cent, while it has over 9 per cent stake in Axis Bank with a market capitalisation of Rs 1,69,873.83 crore.

“Going by residual stake sale in just these two companies, the government can garner over Rs 40,000 crore, and these are low-hanging fruit,” said a senior government official.

Besides, the government is expected to continue pushing its disinvestment exercise through the exchange traded fund (ETF) route. An ETF operates more like a mutual fund, which essentially comprises a group of shares. Once the government sells its equity stakes to the fund company, the latter then sells those units to public investors.

Finance Minister Arun Jaitley had announced the setting up of Bharat 22 ETF — a vehicle to achieve the divestment target — in the Union Budget 2017.