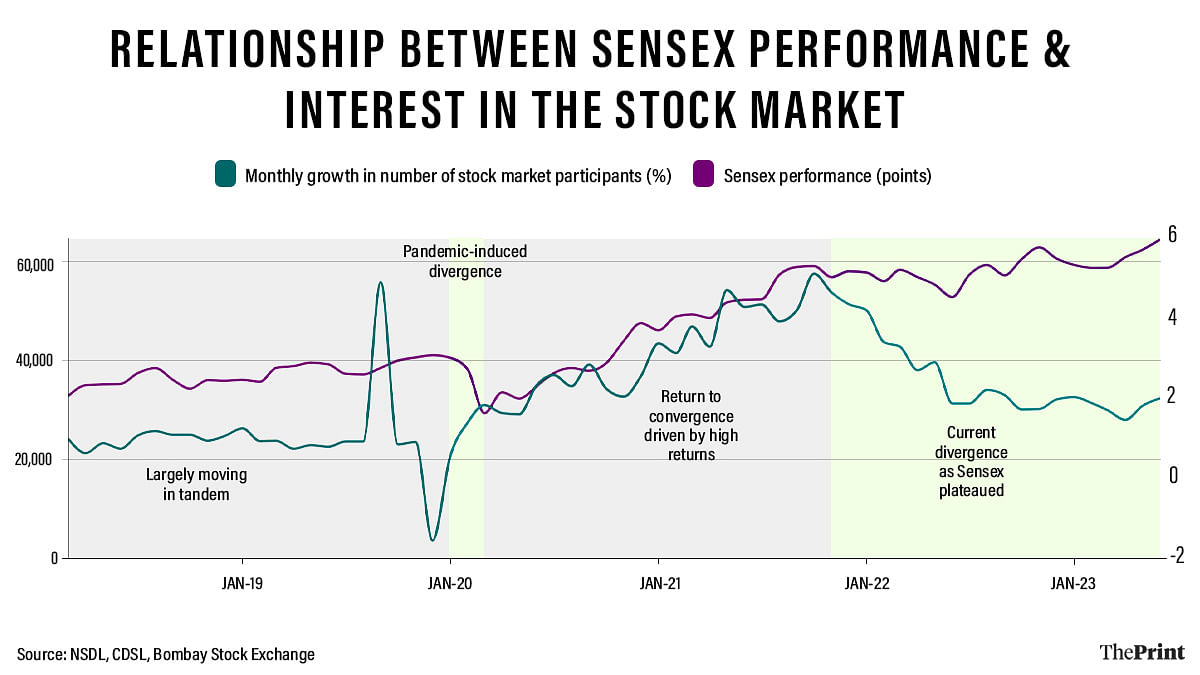

New Delhi: The Covid-19 pandemic saw a surge in investor interest in the stock market, driven by a combination of work-from-home and attractive returns on investments. However, since the market rally ended in November 2021, this interest has waned sharply, an analysis of stock market data has shown.

ThePrint analysed the growth in the number of active stock market participants from data available with the National Securities Depository Ltd (NSDL) and the Central Depository Services Ltd (CDSL) — the two bodies that compile this data — and compared it with the performance of the BSE Sensex from March 2018 to June 2023.

The data shows there was a surge in the growth of stock market participants during the pandemic period in reaction to the sharp rise in the Sensex. However, once this market boom levelled out, interest in the stock market also waned.

During the pre-pandemic period (March 2018 to February 2020), the number of stock market participants was largely growing in tandem with market performance.

The data revealed that, while the Sensex grew by a compounded average of 0.63 percent every month over this period, the number of stock market participants grew 0.96 percent.

However, this trend was temporarily disrupted by the nationwide lockdown in March 2020, which caused the Sensex to plummet by 23 percent that month, while the number of participants continued to grow.

The stock market then staged a remarkable recovery, rising from 33,717 points in April 2020 to 63,099 points in October 2021, an increase of 87 percent.

A combination of work-from-home due to the pandemic and the prospect of cashing in on this bull run in the stock market resulted in a large number of first-time investors entering the market, the data revealed.

Speaking to ThePrint, V.K. Vijayakumar, chief investment strategist at Kochi-based Geojit Financial Services, explained that following the imposition of the lockdown in March 2020, there was a surge in new entrants to the stock market. This was for two broad reasons, he said.

“The first was that work-from-home also became ‘trade at home’. That is, people found themselves with the time and opportunity to start trading on the stock market,” he said.

The second reason was that the Sensex and Nifty witnessed a significant surge over the 18 months following this period, he added. “The stock market returns were 24 percent in 2021.”

As a result, the total number of stock market participants jumped to 10.6 crore from 4.14 crore between April 2020 and October 2021— a growth of 156 per cent, the data revealed.

Also Read: Modi govt’s reforms lack finesse. It must raise the bar to make India $10 trillion economy

The downward trend

However, this growth was not sustainable. With each stock market boom comes a correction, and that’s what happened with the Sensex as well.

“Following this surge, from about November 2021, the incremental growth in the number of participants began to slow down,” Vijayakumar said.

This, he explained, was because of the lower-than-expected returns the stock market was generating. According to him, the returns fell to just 4 per cent in 2022 from 24 per cent in 2021. “Even now, the returns are just 5 per cent so far in 2023,” he added.

“So, while seasoned investors remain, the surge in new entrants has significantly slowed down,” he concluded.

The data also confirmed this observation, as the monthly growth rate of market participants fell to 1.9 percent in the period November 2021 to June 2023.

(Edited by Richa Mishra)

Also Read: LIC would make Rs 11,000 crore profit if it were to sell its Adani stocks today