New Delhi: The Life Insurance Corporation of India (LIC) is currently sitting on a profit of nearly Rs 11,000 crore on the stocks it holds in the Adani group of companies, an analysis by ThePrint has shown.

In reply to a question in the Lok Sabha, Minister of State for Finance Bhagwat Karad Monday cited a January press release by LIC which said that the “total purchase value of equity, purchased over the last many years, under all the Adani Group companies is Rs 30,127 crore”.

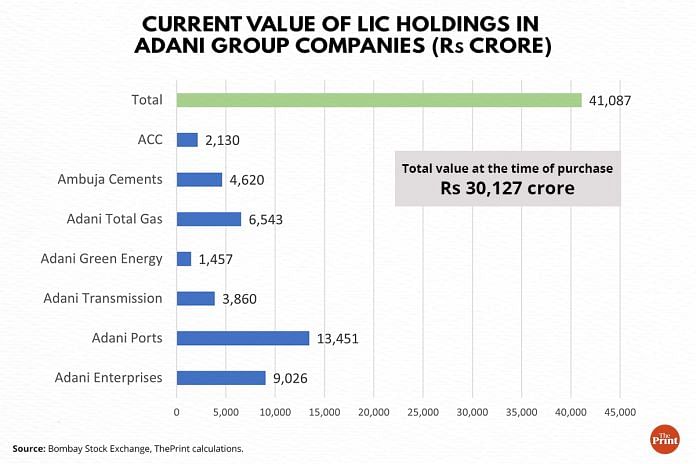

Data from the stock exchanges shows that LIC owns 50.98 crore shares spread across six Adani companies. Taking the closing price of these shares Monday, ThePrint calculated that the market value of LIC’s shares in these companies currently stands at Rs 41,087 crore.

This means that, since the time LIC invested in the respective Adani companies, it has made a profit of Rs 10,959 crore. In other words, it has seen the value of its investment grow by more than 36 per cent.

The value of LIC’s holdings in Adani companies has become a political issue ever since the short-seller Hindenburg Research released a report on 24 January making several allegations of corporate misgovernance and fraud against the Adani Group.

The subsequent precipitous fall in the stock prices of Adani companies brought into question why LIC had invested in these companies and how much of a loss it was taking on its investments.

Members of the opposition have taken to social media, made comments to the press, and also spoken in Parliament to highlight the “losses” incurred by LIC, and how this was a loss of taxpayers’ money.

To be sure, neither these profits nor losses incurred by LIC on Adani shares in the early days of the stock rout are real. That is, they exist only notionally. The profits or losses will become real only when LIC chooses to sell its shares in Adani companies.

The LIC’s holdings in Adani companies make up less than 1 per cent of its total portfolio. Therefore, even a loss on its investments here wouldn’t make a dent on its overall finances.

In fact, according to the reply in Lok Sabha, the five public sector general insurance companies have an exposure to Adani companies of just 0.14 per cent of their total assets under management.

Also Read: Hum Adani Ke Hai Kaun, Episode 2: Congress questions Modi govt over LIC investments in Adani

‘Secrecy’ around Adani debt exposure to banks

However, what is much more real is the Adani companies’ debt exposure to Indian banks, or the loans they have taken from Indian banks that are outstanding. Here, the government and the banks have been less forthcoming.

“The Reserve Bank of India has informed that RBI does not collect borrower level investment data and such information is not maintained by it,” Karad said in his reply Monday.

He added: “Further, the State Bank of India (SBI) and the nationalised banks have informed that as per provision for obligation as to fidelity and secrecy…they can’t divulge any information relating to or to the affairs of their constituents.”

Minister Karad, however, did refer to statements that the SBI has made to the media, where it said that the “SBI’s exposure to Adani group is well below the Large Exposure Framework of RBI”, and that the Indian banking system has been seeing its exposure to the Adani companies, as a percentage of their total debt, come down over the last 2-3 years.

(Edited by Gitanjali Das)

Also Read: ‘PM’s favourite & favoured,’ Sonia questions govt policies at expense of poor, middle class