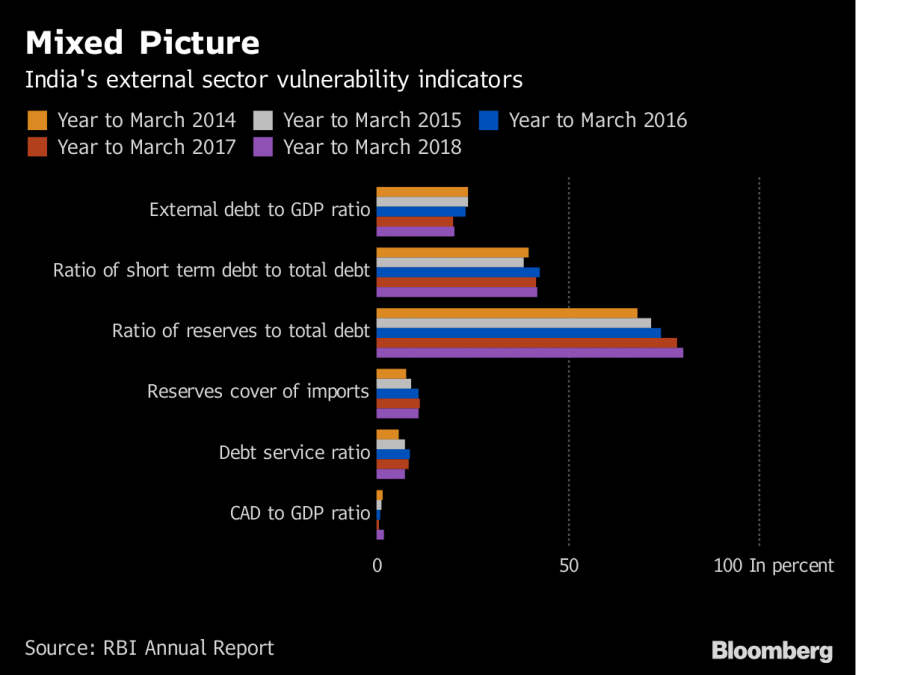

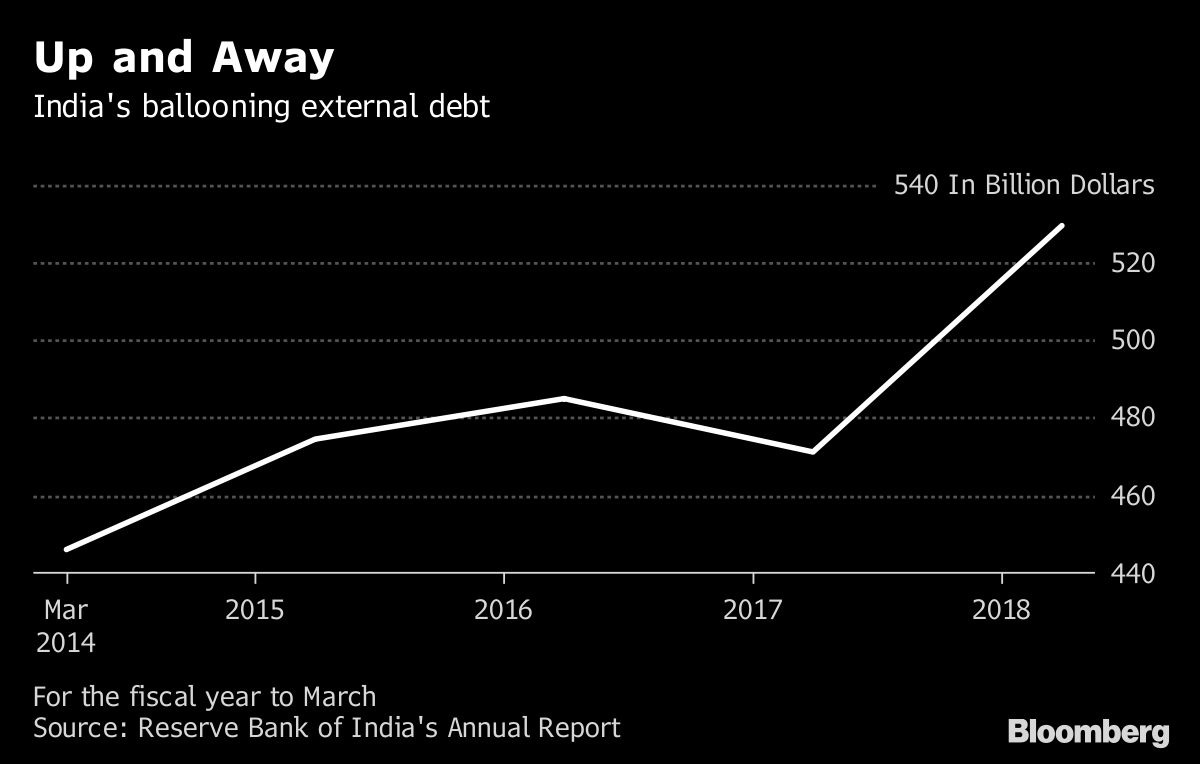

While foreign currency debt has zoomed, various external vulnerability indicators paint a rather mixed picture, according to RBI’s annual report.

Mumbai: India’s rupee owes its tag of Asia’s worst-performing currency this year to the selloff sweeping emerging markets. There’s more pain in store from beyond its borders.

While foreign currency debt has zoomed, various external vulnerability indicators paint a rather mixed picture, according to the Reserve Bank of India’s annual report. Indeed, data due as early as next week will probably show the nation’s current-account deficit widened in the June quarter to 2.6 per cent of gross domestic product, the highest in 4 1/2 years.

The widening in the gap is the weakest spot for Asia’s third-largest economy and one of the reasons why the rupee has been among the worst-hit in Asia this year. The currency dropped to a record 71.5750 per dollar on Tuesday.

The sliding rupee and expectations of a faster-than-anticipated pace of monetary tightening by the United States (US) Fed saw more than $3 billion of foreign portfolio investments moving out in the April-June period, the RBI said. Elevated oil prices and the trade tensions between the US and China contributed to the outflows.

“Oil imports continue to pose a challenge to the trade deficit. Non-oil imports also remain high,” said Shashank Mendiratta, an economist with ANZ Banking Group in Bengaluru. “We are looking at 2.7 per cent of GDP,” he said, referring to the current-account gap.

Some analysts including those at JPMorgan Chase & Co. and Commerzbank AG are expecting the RBI to raise borrowing costs sooner than later to shore up the currency. The central bank raised rates twice this year and is due to review policy in the first week of October.

“Strengthening of domestic macroeconomic fundamentals holds the key to ensuring a viable external sector that is reasonably buffered against global shocks,” the RBI said.- Bloomberg