New Delhi: Just about 1-2 per cent of all Indians actually pay income tax and contribute as much as 27 per cent of India’s total tax collections, data presented to Parliament shows.

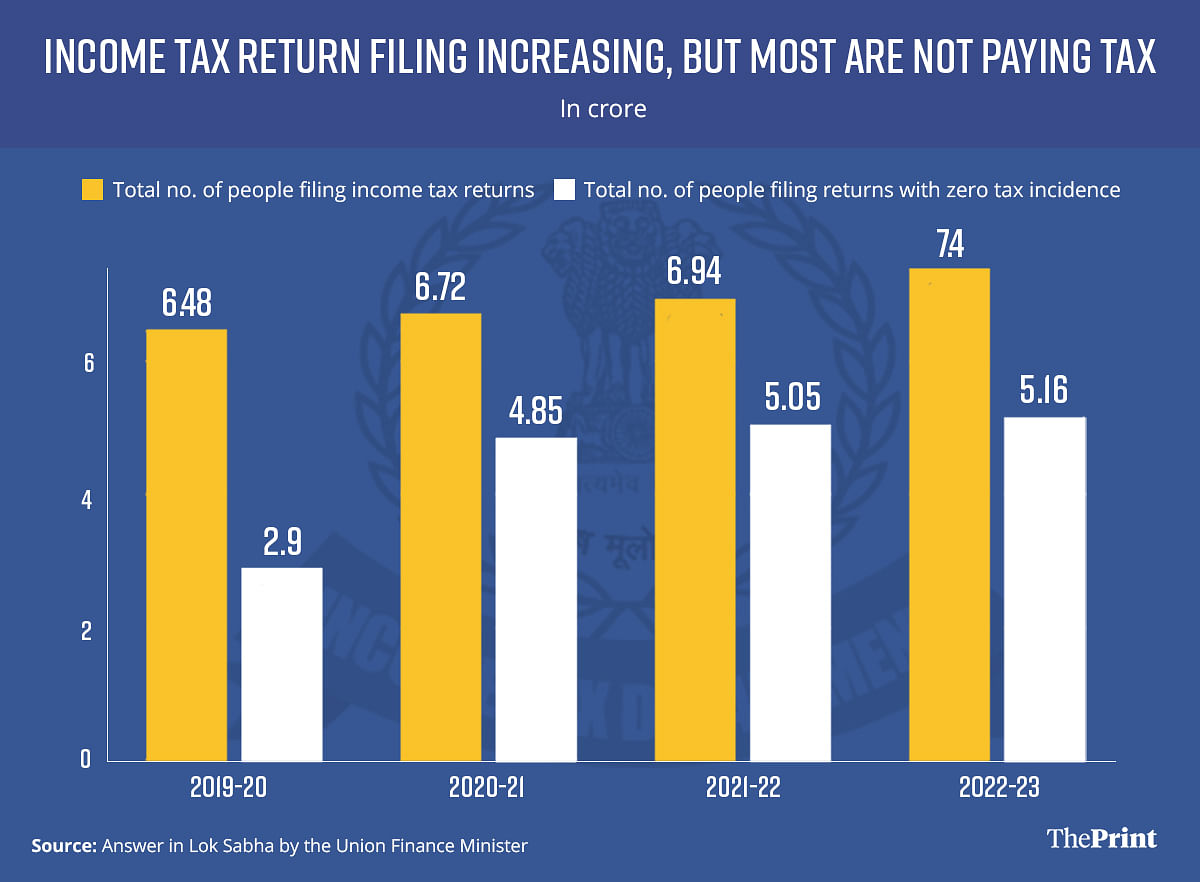

Finance Minister Nirmala Sitharaman presented this data as part of a reply to a question in the Lok Sabha Monday. The data shows that income tax compliance has increased over the period 2019-20 to 2022-23, as measured by the number of people filing tax returns. However, within this, the number of people with zero tax incidence has grown faster.

While the number of people filing income tax returns has grown by a compounded average growth of 3.4 per cent between 2019-20 and 2022-23, the number of people filing returns but who have no tax incidence has grown by 15.5 per cent over the same period.

The data shows that 7.4 crore people filed income tax returns in 2022-23, of which 5.16 crore people, or 70 per cent, had zero tax liability. This means that just 2.24 crore people paid income tax in 2022-23, which works out to just about 1.6 per cent of the total population in India.

Of course, the total population of India includes those who are not liable to either file returns or pay tax, such as those below the age of 18 years, but tax experts feel that even after taking this into account, only a tiny proportion of the population actually pays income tax.

The government has, over the past few days, released data on the number of returns filed, number of taxpayers including individuals and corporates, and number of EPFO subscriptions.

“All of this data seems to suggest that only 1-2 per cent of India’s population actually pays income tax,” said Archit Gupta, Founder and CEO, Clear (formerly Cleartax), to ThePrint.

In other words, just 1-2 per cent of India’s population accounts for nearly 27 per cent of India’s total tax collections, as per what the government expects in its revised estimates for 2022-23.

It is important to note that this does not mean only 1-2 per cent of Indians pay any tax at all. Goods and Services Tax (GST), which is estimated to have made up about 28 per cent of India’s total tax collections in 2022-23, is paid by anybody who makes a purchase.

Also read: Tax India’s corporates and super-rich more. They can and will take it

Government driving higher compliance

Speaking at an event to commemorate ‘Income Tax Day’ Monday, Sitharaman said that the government’s direct tax collections have been increasing steadily in recent years despite there not being any increase in tax rates.

“It has been made possible through an increase in efficiency of the (Income Tax) Department,” she said.

This has been corroborated by tax experts as well, who say that the government has put in place various measures to enhance tax compliance, some of which also include making better use of the indirect tax regime under GST.

“The government has taken several steps to increase compliance by encouraging people to file returns even if they don’t have to pay tax at the end of the year,” Gupta explained. “These include people whose income is lower than the tax-paying threshold but those who have refunds due to them.”

“Those who are eligible for a refund can get that refund only if they file their returns online,” he added. “Some of the other measures include mandating that the rate of TDS (tax deducted at source) will be higher for those who do not file returns. In general, the government has made use of the TDS mechanism to encourage people to file returns.”

In her Lok Sabha answer as well, Sitharaman said that the scope of TDS and tax collected at source (TCS) has been expanded to bring several transactions within their ambit, such as “huge cash withdrawals, foreign remittance, purchase of luxury car, e-commerce participants, sale of goods, acquisition of immovable property, purchase of overseas tour programme, transfer of virtual digital assets, net winnings from online games, and interest on listed debentures paid to the resident”.

Another reason for higher compliance in filing tax returnsis the government’s use of GST data.

“The GST database is comprehensive and has given data regarding individual tax defaulters, allowing government agencies to better identify individual tax evaders, which has also played a role in increasing the amount of direct tax netted,” M.S. Mani, senior director of indirect tax at Deloitte India, told ThePrint.

However, this push to file returns has meant that the government has also been paying much higher income tax refunds since even though people pay TDS or TCS on their income, they might have made use of tax-saving investments throughout the year, which reduce their tax incidence to nil.

The government’s latest direct tax collection data for 2022-23, released on 3 April, 2023, shows that income tax refunds increased a whopping 37.4 per cent that year over the previous year.

With inputs from Aditya Sen

(Edited by Zinnia Ray Chaudhuri)

Also read: Indian taxpayers are ‘dragged’ into paying higher income tax. Govt must factor in inflation