Budget 2023 is around the corner, in which the Union government is likely to announce some modifications to the personal income tax regime. In the context of direct taxation in India, one neglected issue concerns the impact of inflation on income tax payments.

India, like most countries, has a progressive income tax system. The government sets sequentially higher rates for each tax bracket. These are known as marginal tax rates.

Inflation is an increase in the average price level compared to the previous year. Inflation tends to increase our tax burden. Imagine you receive a salary hike of 6 per cent and you move into a higher tax bracket to pay a higher tax rate on the additional income. Now suppose inflation is also 6 per cent. In effect, your real income or your purchasing power hasn’t changed. But you will end up paying a higher income tax, and your after-tax-real income will be lower. If inflation were 8 per cent, then your real income would be even lower.

This phenomenon is known as ‘bracket creep’ as some taxpayers ‘creep’ into the higher tax bracket, even when they should not. Also known as ‘fiscal drag’—since taxpayers are ‘dragged’ into paying income tax at a higher rate—it helps governments achieve a faster tax revenue growth without raising the tax rates.

Also read: Why Oxfam report on inequality in India doesn’t add up — old data, unlikely tax burden on poor

Old and new tax regime

To avoid the above situation, annual inflation adjustments for tax brackets are announced in some countries, such as the United States. For example, for 2023, the US Internal Revenue Service has raised the income threshold for all tax brackets by 7 per cent compared to 2022.

India currently has a dual personal income tax regime, and taxpayers are free to choose any one. Under the old regime, the taxpayer could claim several exemptions to reduce the taxable income. These include standard deductions, deductions under Section 80C to encourage long-term savings, and house rent allowance, among others. Making changes to the exemptions is one way governments try to manage the impact of inflation. Also, under the old regime, the long-term capital gains are inflation-indexed.

Under the new tax regime, introduced in 2020, there are only a few exemptions, such as a deduction towards contribution made by an employer to the new pension scheme (NPS). Only a minority in the private sector can avail the NPS deduction.

The government aims to discontinue the old tax regime but before finalising the new tax regime, it needs to carefully re-consider the tax brackets and the marginal tax rates to factor in the inflation impact on income tax payable. The question is this: suppose an individual’s income had risen only in line with inflation during the last decade, would her income tax payable under the new tax regime increase in line with inflation, more than inflation, or both will grow at the same rate?

We illustrate this point through a simplified case of individuals with only salaried income and the inflation over the last decade.

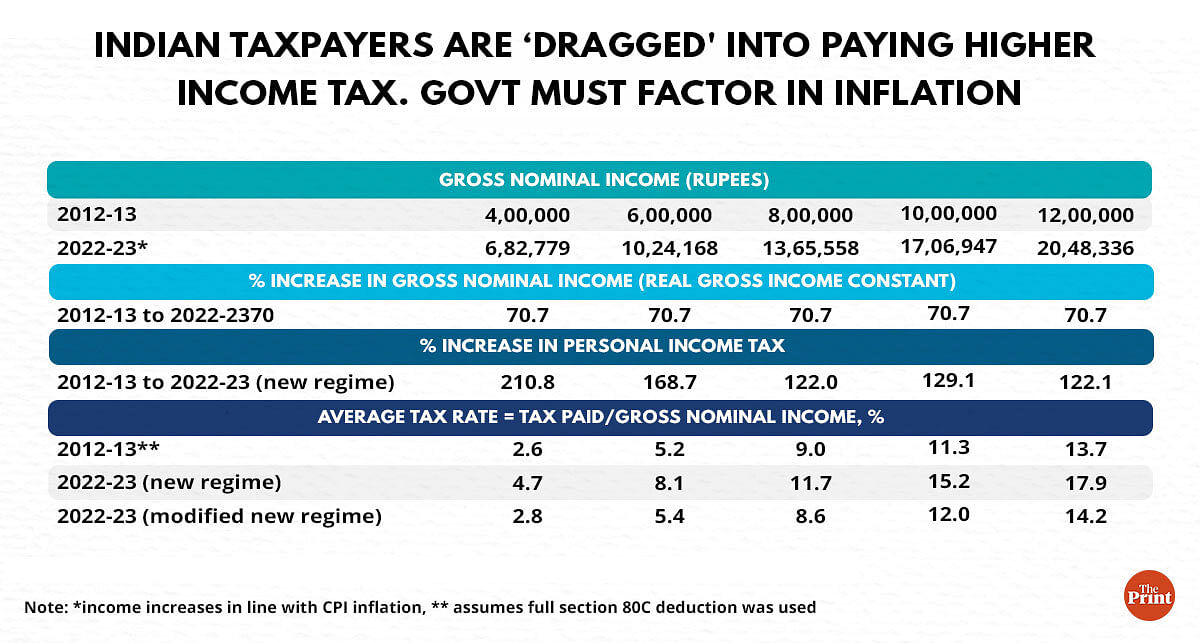

Take five individuals with a salaried income of Rs 4, 6, 8, 10, and 12 lakh in 2012-13. To keep it simple, we assume that there was no other income source. We increase their nominal income by the average retail inflation to calculate their salary income for 2022-23. In essence, we keep their real incomes the same in both years.

We calculate the tax (including cess) paid by these individuals in 2012-13 by applying the relevant tax brackets for that year. And we assume that the individuals avail only one deduction under Section 80C of Rs 1 lakh in 2012-13. Section 80C is the most commonly used deduction that encourages long-term savings into pension funds, long-term equity funds, etc.

To calculate the tax payable in 2022-23, we apply the tax brackets and the tax rates under the new income tax regime. We assume that no deductions are availed under the regime.

We find that an increase in personal income tax burden is much higher than a rise in nominal incomes for all five individuals, even when their real income is the same as a decade ago (Table 1). As a result, the average tax rate, the ratio of total taxes paid to total income, is higher in 2022-23.

Inflation does not affect everyone equally, even if their income grows at the same rate. The taxpayer with the lowest income among our five is most adversely affected under the new tax regime. While the cumulative inflation was around 70 per cent between 2012-13 to 2022-23, her tax burden has more than doubled.

Also read: ‘Halwa ceremony’ on 26 January to herald Budget, and the ‘lock-in’ of finance ministry staff

Changes needed in new tax regime

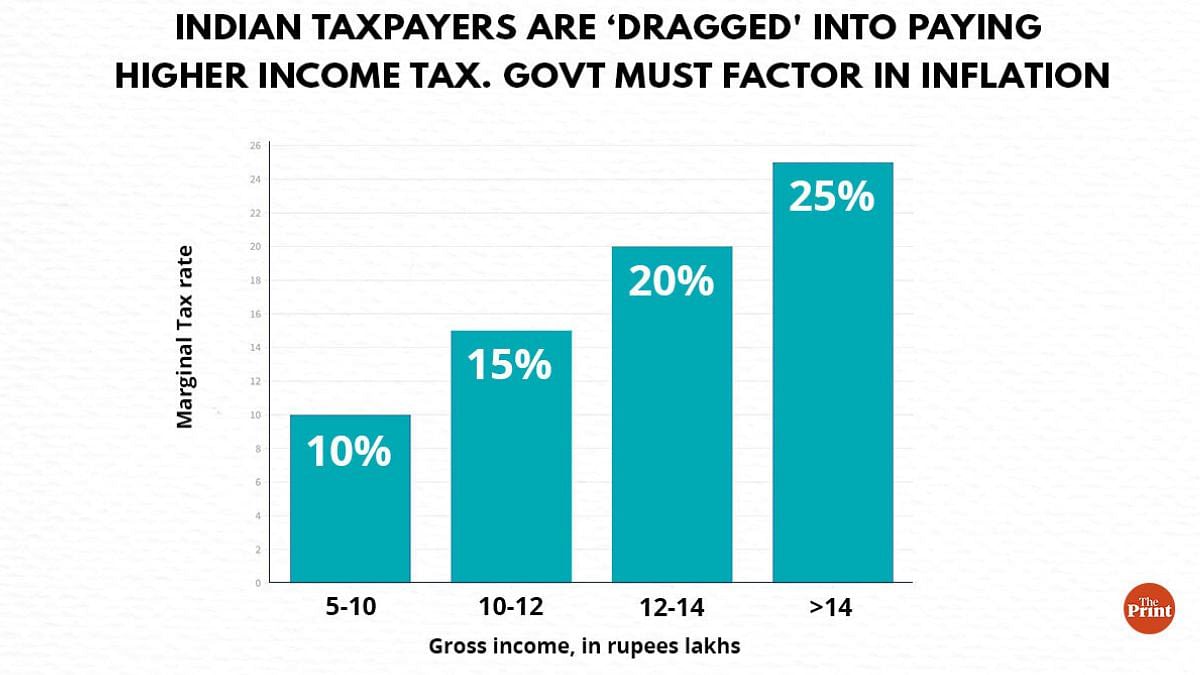

What should be the tax brackets and marginal tax rates that would have nullified inflation’s impact on tax burden for these individuals with only salaried income? Our back-of-the-envelope calculations suggest three changes to the existing new tax regime to compensate for the inflation impact on the average tax rate during the last decade (Table 1 – the row – 2022-23 modified tax regime). These would also simplify the tax system.

First, no tax should be payable for between Rs 2.5 lakh and Rs 5 lakh when gross income exceeds Rs 5 lakh. Second, there should be only four tax brackets (Table 2). Finally, the highest marginal tax rate is 25 per cent compared to the current 30 per cent.

We emphasise that these calculations are only for illustration purposes and for a simple case where there is only salaried income. A sophisticated modeling exercise would reveal the most appropriate tax brackets and rates to keep the average tax burden the same if income increases in line with inflation. Once the government finalises the proper brackets and the rates, the inflation indexation for tax brackets should happen each year.

There are implications for government finances of reorganising tax brackets, tax rates, and the annual inflation indexation. But, this would be a fairer system for taxpayers. To overcome any negative impact on tax buoyancy and tax revenue, we need to expand our tax base—the number of people who pay income tax.

The government intends to make the income tax system fairer. It would be worthwhile to look into reforming the new tax regime.

Vidya Mahambare is a Professor of Economics and Director (Research) at Great Lakes Institute of Management, Chennai. She tweets @mahambare_vidya. Praveen Kumar is a graduate of Great Lakes Institute of Management. Views are personal.

(Edited by Ratan Priya)