Move is raising red flags for bond investors given its potential to harm inflation management and government coffers.

India Prime Minister Narendra Modi is about to decide where to set support prices for farm products. And the bond market is waiting with bated breath as his call may well decide the next direction for interest rates.

Faced with a distressed rural class, Modi is out to woo farmers ahead of his re-election bid next year by promising to boost their incomes, including raising the prices of crops at which they sell to the government. The populist move is raising red flags for bond investors given its potential to jeopardize inflation management, not to mention the government’s coffers.

“The key worry is that the extent of the suggested hike could be a sharp departure from the subdued increases of the recent past, and more in line with the years during UPA’s second term that were highly inflationary,” said Kuldeepsinh Jagtap, executive vice president at ICICI Securities Primary Dealership Ltd. in Mumbai. UPA is the previous United Progressive Alliance government.

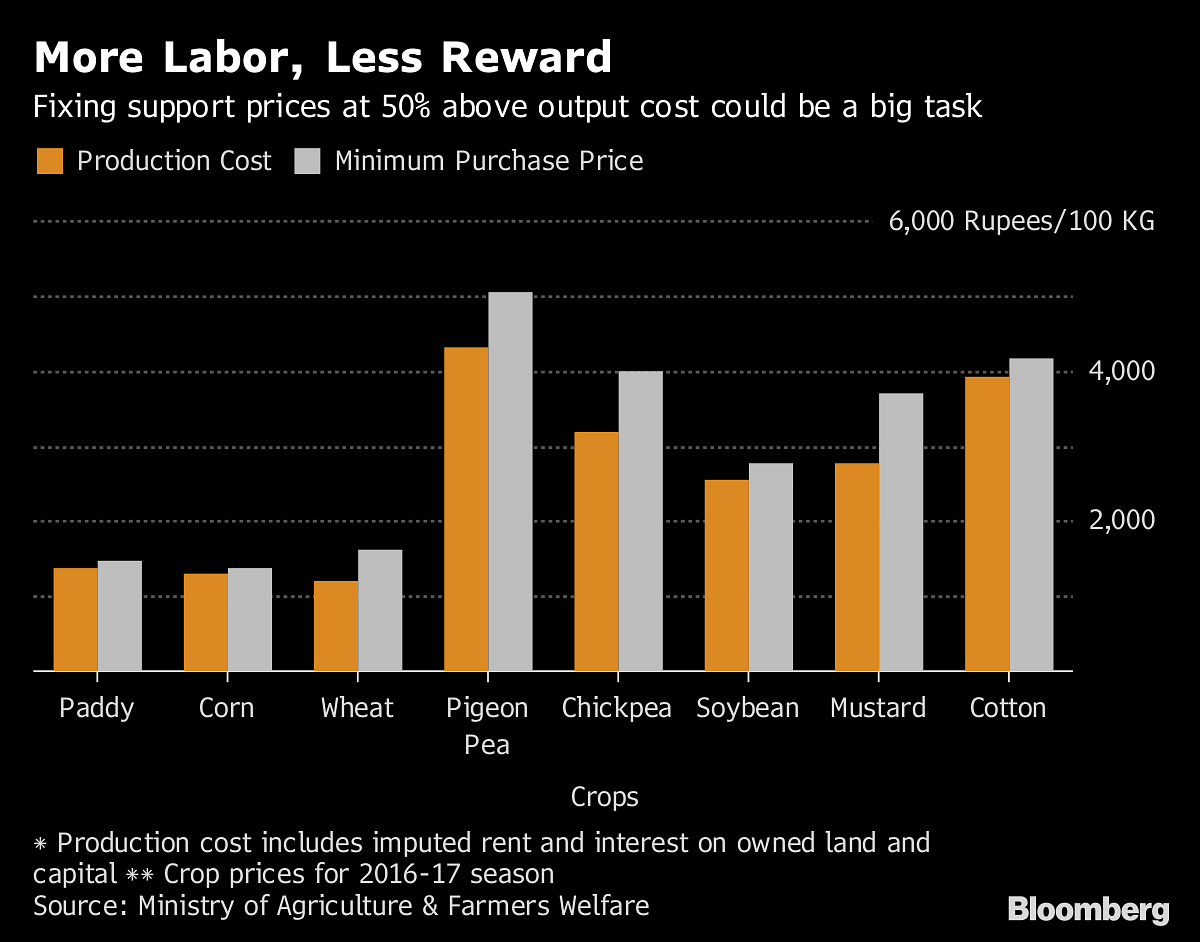

Modi has promised to double farm incomes by 2022. In his February budget, he pledged to boost farmers’ returns by increasing the government’s purchase prices for crops by more than 50 percent of the output cost.

Inflation grew 4.87 percent last month, fastest since January, due to rising food and fuel prices. The Reserve Bank of India raised interest rates this month for the first time since 2014. Keeping the cost of the minimum support price program down is also important for Modi as he seeks to narrow India’s budget deficit — one of the widest in Asia.

The prime minister’s move will be key to the central bank’s next rate decision, according to JPMorgan Chase & Co. Any sharp increases in support prices may change the policy committee’s view of currently-benign food prices outlook and compound the pressures from core inflation, economists Sajjid Chinoy and Toshi Jain wrote in a note Wednesday. This will likely be enough for the RBI to hike rates in August, they said.

Bonds rallied for a fifth day Thursday after minutes from the RBI’s policy meeting released the previous day showed the central bank was less hawkish than some market participants had expected. Yield on the 10-year note has risen 38 basis points since end-March on concern the central bank has begun a tightening cycle.

“The elephant in the room is of course the MSP announcement by the government,” economists A Prasanna and Abhishek Upadhyay at I-Sec PD wrote in a note Thursday. “We surmise that the government is still grappling with the mechanics and fiscal costs involved in implementing the higher prices.” – Bloomberg