New Delhi: The quantum of loans written off by Indian banks every year fell more than 27 percent in 2023-24 as compared to the pre-pandemic year of 2019-20, data provided by the Ministry of Finance shows.

Further, an analysis of the data shows public sector banks (PSBs) have done significantly better than their private and foreign peers, accounting for a falling share in overall written-off loans and a higher success rate in recovering these loans. That said, the level of recoveries still remains low, at 18.6 percent for the entire banking sector.

Notably, especially in light of the allegations faced by the government over these write-offs benefiting only large corporates, the data shows that large industry accounts for a falling share of written-off loans, both at the aggregate level as well as for just PSBs.

The data on loan write-offs and recoveries was submitted to the Rajya Sabha by Minister of State for Finance Pankaj Chaudhary in reply to two separate questions.

A loan write-off is a technical requirement imposed by the Reserve Bank of India (RBI), wherein a bank has to make provisions for a defaulted loan, and then move it off the balance sheet. The process of recovering these loans continues, unlike with a loan waiver.

The argument in favour of this practice is that it frees up the balance sheet so that further lending can take place.

Also Read: Who are wilful defaulters & what happens to them? RBI lays out new rules

Falling write-offs, rising recoveries

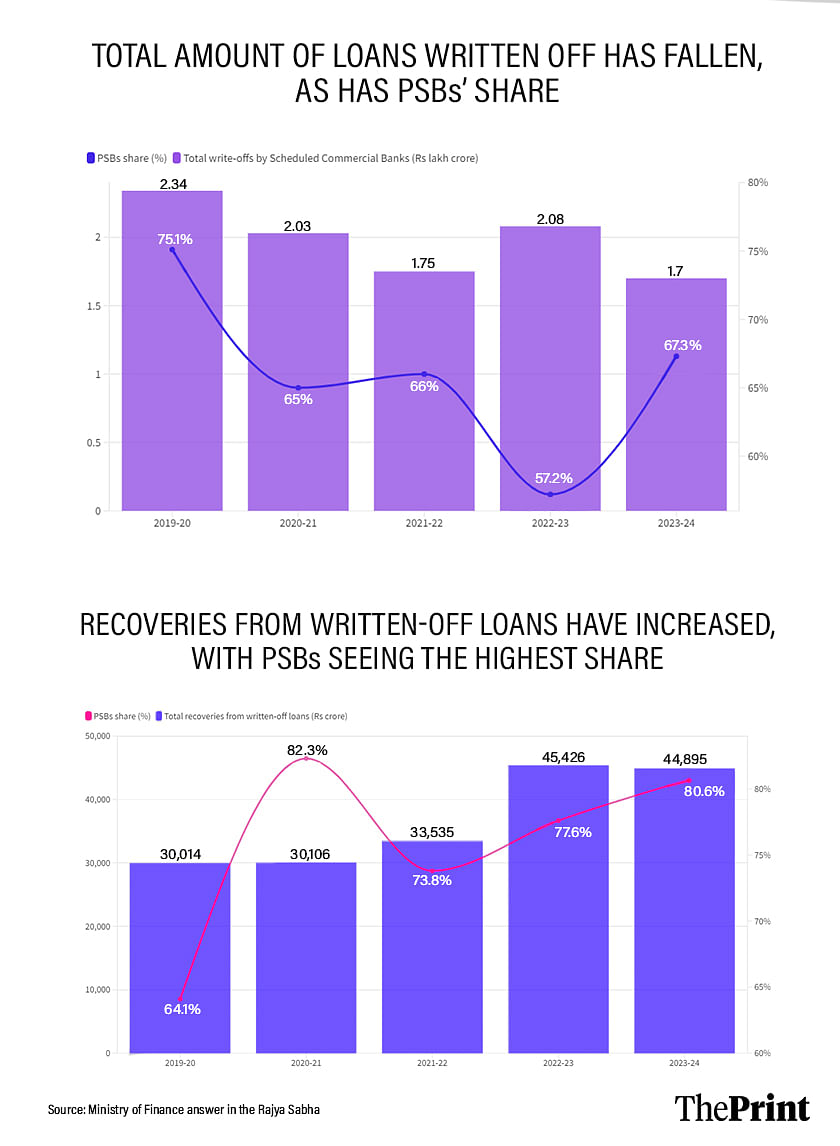

The data submitted to the Rajya Sabha, sourced by the finance ministry from the RBI, shows that the total amount written off by banks fell from Rs 2.3 lakh crore in 2019-20 to Rs 1.7 lakh crore in 2023-24, a 27 percent fall.

Further, the PSBs account for a falling share of these amounts that have been written off — from 75 percent in 2019-20 to 67 percent in 2023-24.

Over the years, the Congress party has taken swipes at the government over the issues of write-offs, saying that not only are these meant to favour large corporates, but also that the recovery of these loans has been paltry.

The data does show that, of the total amount written off in the last five years, only 18.5 percent has so far been recovered. However, PSBs perform better than their private and foreign peers here.

The public sector banks increased their share in the amount recovered from 64 percent in 2019-20 to nearly 81 percent in 2023-24. In other words, of every Rs 100 recovered by the entire banking sector in 2023-24, Rs 81 was recovered by PSBs.

Deeper look at recovery ratios

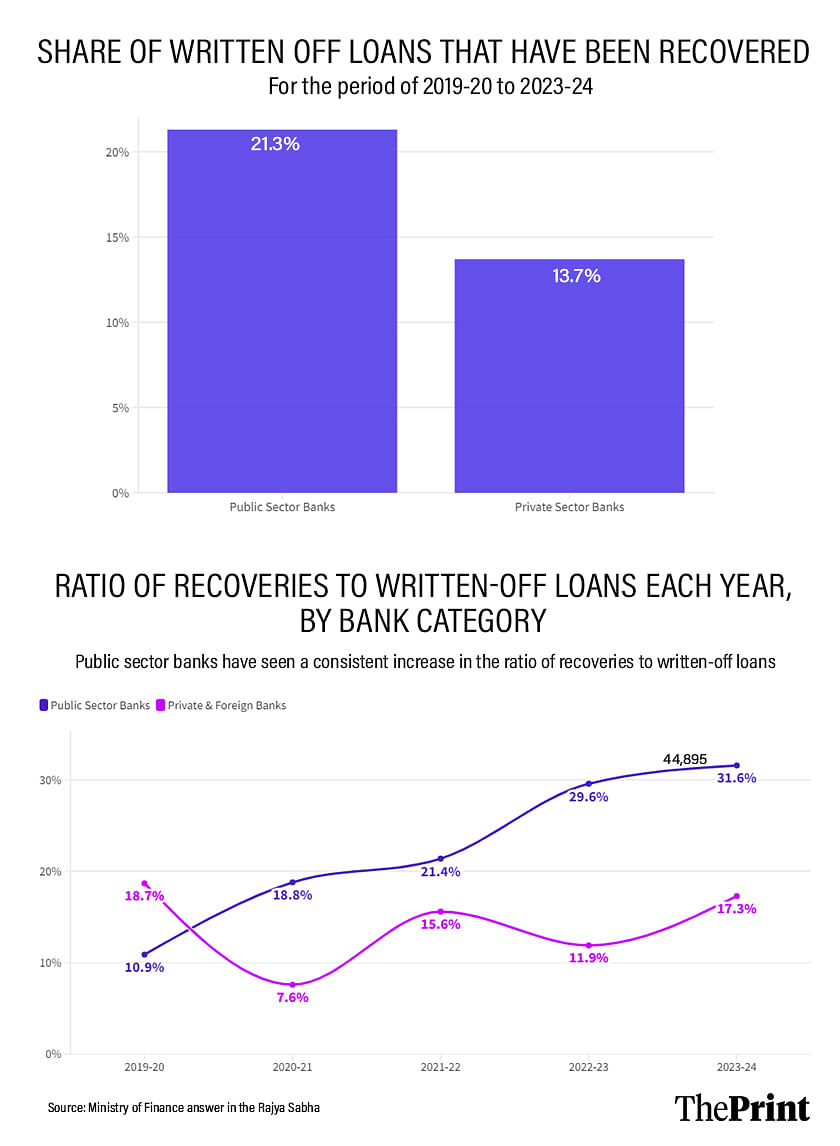

Another way to look at the recovery performance is to see what proportion of loans written off by each bank category has been recovered. Here, too, PSBs outperform.

The public sector banks have so far recovered 21.3 percent of the amount they themselves have written off in the last five years. This share is 13.7 percent for private and foreign banks.

Yet another way to look at the write-off and recovery behaviour of banks is to measure the recovery ratio — the amount recovered in a year as a percentage of the amount of fresh write-offs done that year. This shows whether recoveries are growing faster or slower than write-offs.

Here, the PSBs have displayed a strong performance, steadily increasing this ratio from 10.9 percent in 2019-20 to 31.6 percent in 2023-24, showing that recoveries have consistently grown faster than fresh write-offs.

Private banks, on the other hand, have seen this ratio rise and fall over the five years, but remain largely unchanged in 2023-24 compared to 2019-20.

Write-offs of large industry loans falling

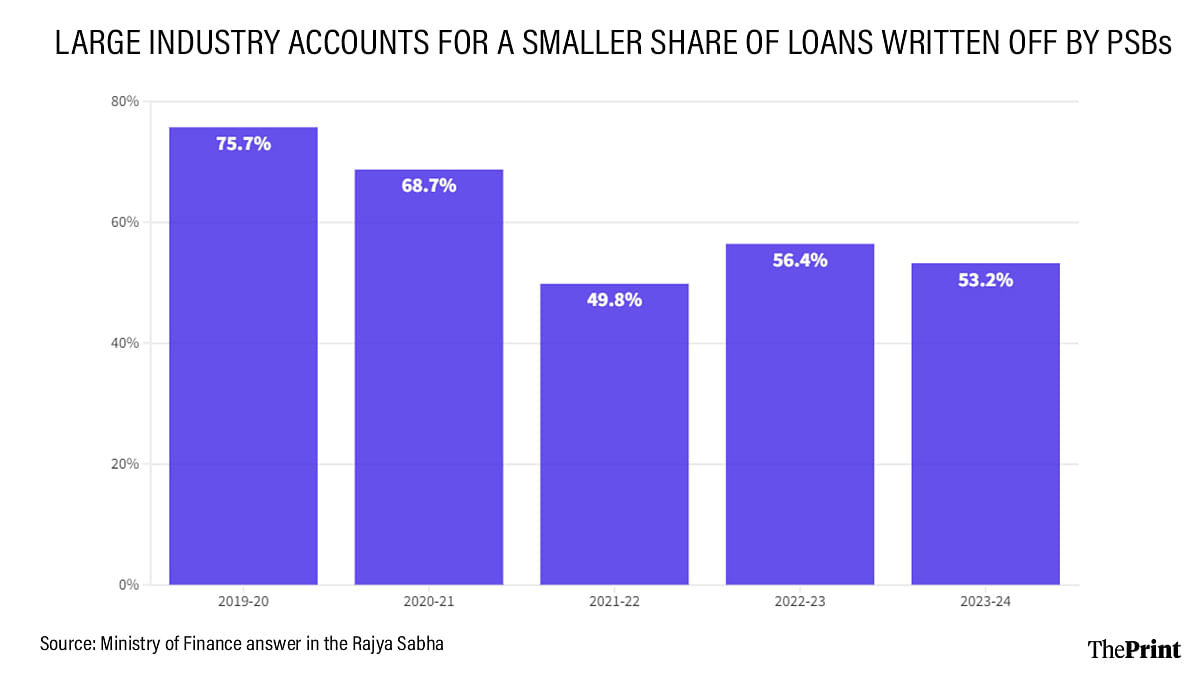

Loans to large industry and services — as opposed to micro, small and medium enterprises — comprise a falling share of the amounts written off every year by all banks. These large industry loans made up 68 percent of the loans that were written off by the banking sector in 2019-20, and it fell to about 42 percent by 2023-24.

Within this, loans to large industries made up more than 75 percent of the loans written off by PSBs in 2019-20. This has since fallen to 53 percent, indicating that a rising share of the write-offs have been on account of loans to other categories of borrowers.

(Edited by Tony Rai)

Also Read: Govt-run banks no longer need external help for capital buffers, issuing bonds to fund lending