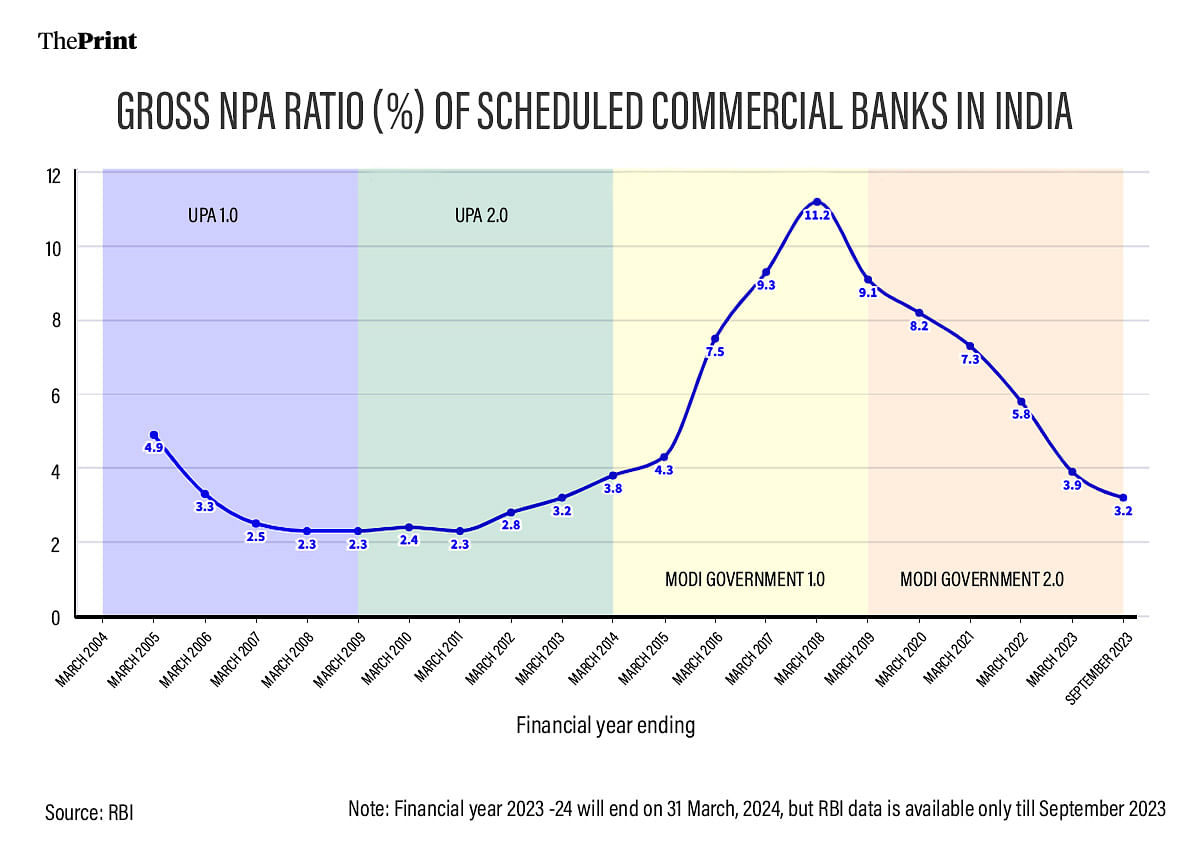

New Delhi: The ratio of bad debt in the Indian banking sector fell to 3.2 percent in the first half of the current financial year, the lowest it has been in more than a decade, according to the latest report by the Reserve Bank of India.

The RBI’s annual Trend and Progress of Banking in India report for the financial year 2022-23, released Wednesday evening, showed that the gross non-performing assets (GNPA) ratio fell to 3.9 percent in 2022-23, the lowest it had been in nine years, before falling further in the first half (April-September) of 2023-24.

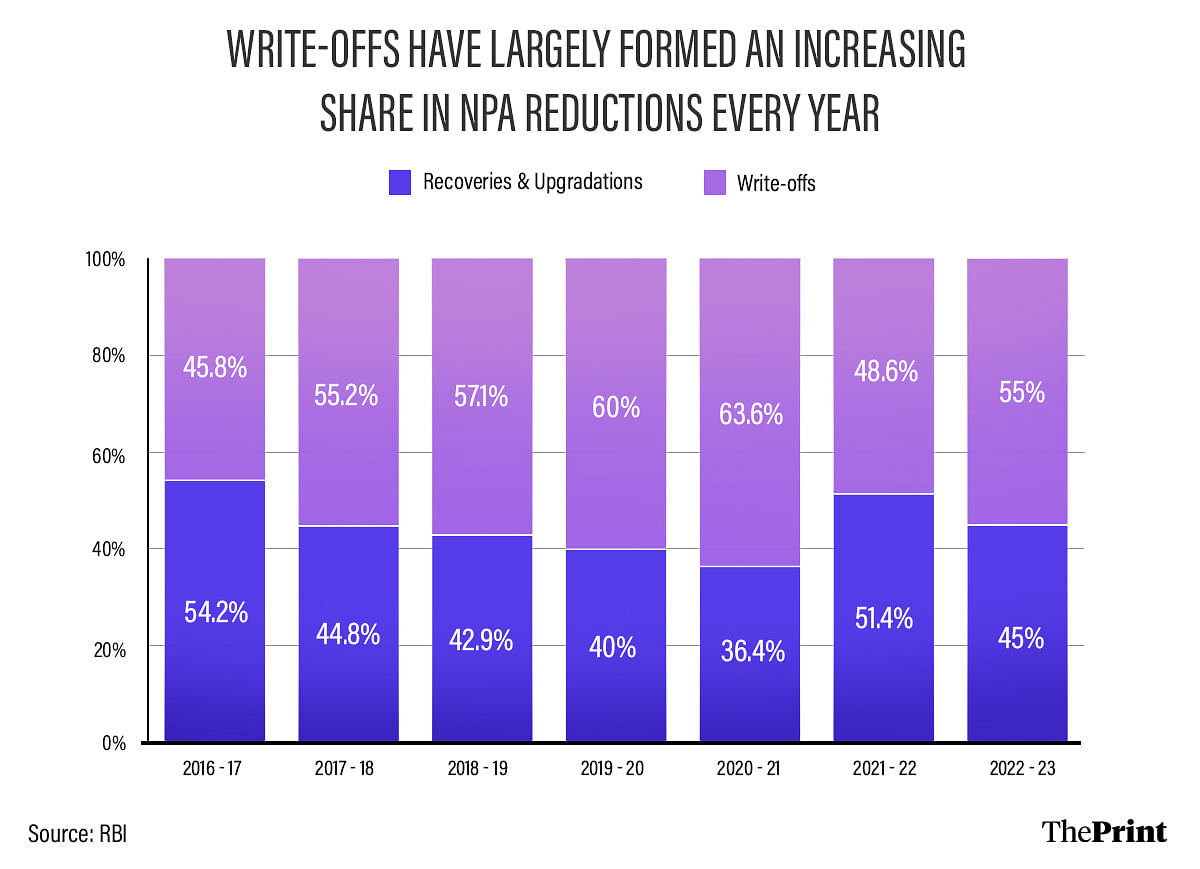

However, the report found that the bulk of the reduction of NPAs in 2022-23 was due to write-offs done by the banks, and not due to recoveries of these bad loans. This was a reversal of what happened in the previous year 2021-22, where recoveries of loans were the bigger factor behind the reduction of NPAs that year. The report does not provide the break-up of reduction for the first half of 2023-24.

NPAs are loans given by financial institutions — in this case banks — that have not been repaid. The gross NPA ratio is the ratio of these NPAs to the loans given out by the banks. A lower gross NPA ratio means that bad loans form a lower share of the banks’ outstanding loans.

“The improvement in asset quality of banks, measured by their GNPA ratios, that began in 2018-19 continued during 2022-23,” the RBI’s report said. “The GNPA ratio of Scheduled Commercial Banks (SCBs) fell to a decadal low of 3.9 percent at end-March 2023 and further to 3.2 percent at end-September 2023.”

The report added: “During 2022-23, around 45 percent of reduction in GNPAs of SCBs was contributed by recoveries and upgradations”.

Rise and fall of NPAs

RBI data from the past 20 years shows that the GNPA ratio fell over the course of the Congress-led United Progressive Alliance’s (UPA) first term in power at the Centre — from 4.9 percent in 2004-05 to 2.3 percent by the end of 2008-09.

Thereafter, however, the ratio of gross NPAs rose pretty steadily to 3.8 percent by March 2014, the year when the UPA lost to the Bharatiya Janata Party (BJP) at the Lok Sabha Elections.

During the course of the Modi government’s first term, the GNPA level shot up to 11.2 percent by March 2018. This increase in NPAs, however, was more a factor of recognising bad loans that had earlier been kept off the books, rather than due to fresh additions of bad loans, the government has said in various Parliament answers over the years.

This more comprehensive recognition of the state of the banking sector was done as part of the RBI’s Asset Quality Review in 2015. As the recognition of bad debt progressed, the GNPA ratio peaked in 2017-18 at 11.2 percent.

Since then, the fall in the NPA ratio of banks has been sustained. It fell to 9.1 percent by the end of the Modi government’s first term (2018-19), and came in at 3.2 percent by September 2023, the halfway mark of the final financial year of the second term of this government. This is the lowest it has been since March 2013.

Also read: RBI must see crypto as assets, not currencies. No one’s using it to buy grocery

NPA fall driven by write-offs

While some of the fall in the GNPA ratio can be attributed to improved governance and lending practices, a large part also has to do with the accounting practices of the banks — in particular, write-offs.

Write-offs are technical requirements of the RBI, where the banks first make provisions for the bad debt and then take that bad debt off their balance sheets. Provisioning refers to banks putting aside a part of their profits to protect against a portion of their outstanding credit turning bad.

This allows the banks to resume lending and not get bogged down by bad debt, even as the recovery process of this bad debt continues.

The RBI data shows that write-offs have largely been forming an increasing share of what’s driving the reduction in NPA levels every year. For example, while banks reduced gross NPAs by Rs 2.4 lakh crore in 2016-17, 54 percent of this was because of recoveries and 46 percent was due to loans being written off.

By 2022-23, this situation had flipped, with write-offs accounting for 55 percent of the Rs 4 lakh crore reduction in NPAs that year, and recoveries accounting for 45 percent.

A dependence on write-offs to reduce NPA levels would be okay if these written-off amounts are eventually recovered.

However, the data shows that while write-offs have been increasing under the Modi government, the recoveries from these write-offs remain low. That is, while banks have written off a total of Rs 10.42 lakh crore during the period 2014-15 to 2022-23, they have recovered just Rs 1.61 lakh crore or 15.5 percent from these written-off loans over this period.

There is no separate data on recoveries from written-off loans of private sector banks.

(Edited by Poulomi Banerjee)

Also read: Not just risk to banks, RBI’s curbing unsecured lending to rein in shady recovery practices too