Mumbai: After being lulled into complacency as recently as February that India’s central bank will not tighten policy anytime soon, investors and economists have swung the other way and are factoring in sharp increases by the monetary authority that is grappling with surging inflation much like its counterparts globally.

Nomura Holdings Inc. expects the Reserve Bank of India to raise its benchmark repurchase rate to 5.75% by end-December, up from its 5% forecast earlier. Barclays Plc said the RBI’s aggressive tightening has fueled expectations of a 75-point increase in the June policy, while Citigroup Inc, and DBS Group Holdings Inc. see hikes of around 100 basis points until April 2023.

The Reserve Bank of India stunned markets Wednesday with a 40 basis point rate increase and a move to suck out billions from the banking system. That was a remarkable U-turn from February, when it announced an ultra-dovish policy, highlighting a relaxed stance toward inflationary pressures at home and U.S. tightening abroad.

“We believe the rate hike is a belated acknowledgment of the inflation risks and that policy has been behind the curve,” Nomura analysts Sonal Varma, Aurodeep Nandi and Nathan Sribalasundaram wrote in a note.

Yields on the benchmark 10-year bond jumped as much as 30 basis points on Wednesday to 7.42%, the highest since 2019, while the shorter 4-year yield saw a nearly 50 basis point jump. Yields extended gains on Thursday.

“The ‘shock and awe’ was visible with bond yields rising sharply, especially at the shorter end of the curve,” said Arvind Chari, chief investment officer at Quant Advisors Pvt. in Mumbai. “The markets, mollycoddled by previous comments and supporting the RBI’s earlier stance, will feel cheated.”

The RBI made a hawkish pivot in April, which saw economists and swap markets factor in a rate hike in June — when the monetary policy committee is due to meet next. That view was based on the assurance from Governor Shaktikanta Das that any move will be calibrated and well telegraphed as he switched his focus to inflation from growth.

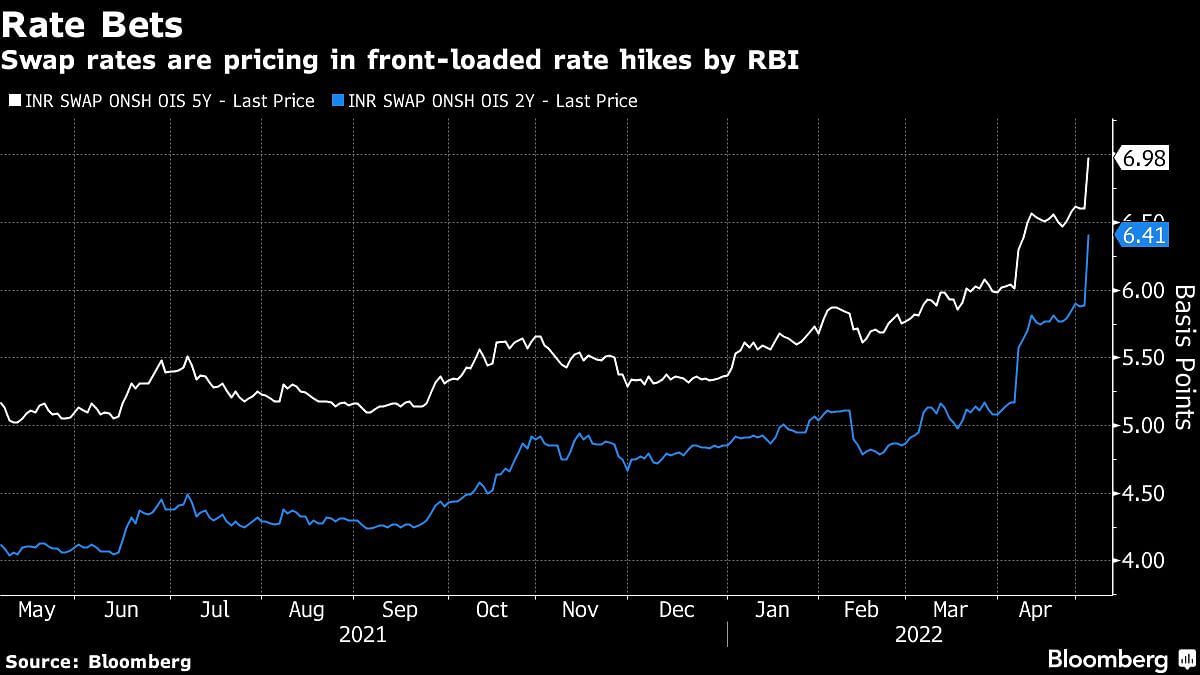

The sudden RBI hikes shook markets. That was visible in the pricing: the two-year swap jumped 53 basis points on Wednesday to 6.41%, its highest level since 2019, while the five-year swaps rose 38 basis points.

The sharp repricing in swaps now reflects the overnight rate moving 110-115 basis points higher over a five-week period until the June 8 decision, instead of an eight-month transition over four meetings earlier, according to Barclays.

Later Wednesday, the U.S. Federal Reserve raised its key rate by 50 basis points as inflation concerns rose. Increases in fuel and food prices, exacerbated by Russia’s invasion of Ukraine and sustained pandemic-related supply chain disruptions, have run hotter than the expected, forcing central banks to take note.

Nomura also expects the central bank to revise up its fiscal 2022-2023 inflation forecast from 5.7% to 6.6%. Ananth Narayan of Observatory Group expects the April headline inflation print closer to 8%, which could have prompted the hurried rate action by the RBI.

India’s retail inflation in March rose to a 17-month high of 6.95%, a third straight month of remaining above the MPC’s mandate of 2%-6%.

“While the normalization process now undertaken by RBI is fully understandable what is somewhat more perplexing is its somewhat of a disregard to the forward pricing mechanism of the market,” said Suyash Choudhary, head of fixed-income at IDFC Asset Management Co. Unless the RBI addressed this, investors will be uncertain about where the repo rate will end in this tightening cycle, he added. —Bloomberg

Also read: Oil advances ahead of OPEC+ meet after surging on EU’s Russian oil ban