New Delhi: India could finally be seeing a revival in private sector investment sentiments, as borne out by an analysis of data with the Ministry of Finance, the Reserve Bank of India (RBI), and several private agencies.

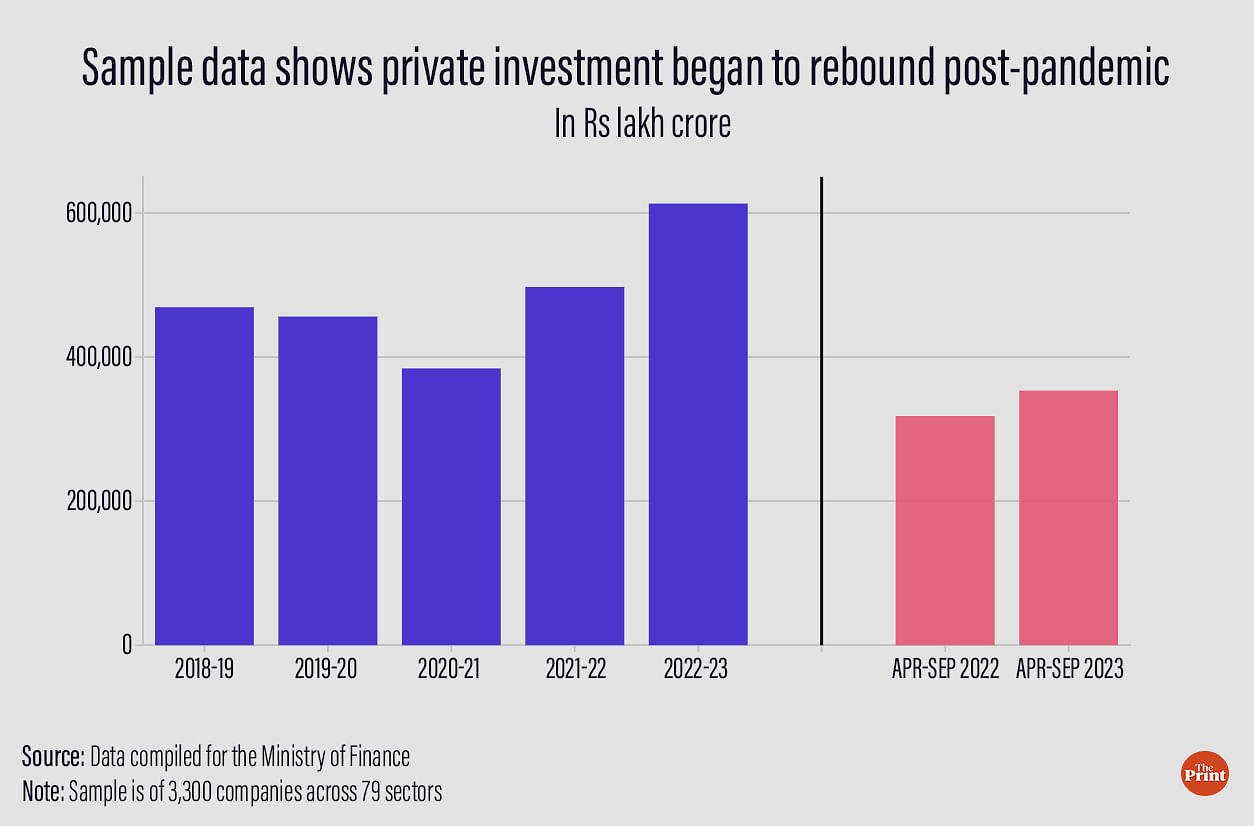

Private sector investment in the Indian economy grew in double-digits in the first half of the financial year 2023-24, albeit at a slower pace than in the previous two years, a look at preliminary data compiled for the Ministry of Finance has found.

However, the data also showed that investments remain concentrated among a few large companies rather than broad-based across each sector.

Officials in the Ministry of Finance said that more than the quantum of private investment — which will be known for the entire economy and the full financial year only with a lag — the important factor to keep in mind was the turnaround in private sector sentiments, which was clear from the sample data.

This revival in private sector sentiment seems to be visible in other metrics as well, such as the growth of bank credit to large industries, and the quantum of new projects that have been announced in the last year.

ThePrint analysed data compiled by private agencies for the Ministry of Finance consisting of investment data from 3,300 companies across 79 sectors.

The data showed that in the first half of FY24 (April-September 2023), the private sector companies in this sample invested about Rs 3.53 lakh crore, up 11 percent from the Rs 3.18 lakh crore invested in the first six months of FY23.

The data also shows that within this sample, private sector investment has been increasing since the pandemic, rising from Rs 3.8 lakh crore in the pandemic year 2020-21 to Rs 4.9 lakh crore in 2021-22 and Rs 6.1 lakh crore in 2022-23.

“This data is a small sample, but the idea is to spot the trend using this information,” a senior official in the Ministry of Finance told ThePrint on condition of anonymity. “The trend reversed in 2021-22 for the better and continued in 2022-23.”

The trends identified in this dataset are confirmed by data compiled by other private agencies and for other samples of companies such as the BSE 500 companies, the official said. “There is a revival in sentiments that can be seen.”

Investments largely by big players

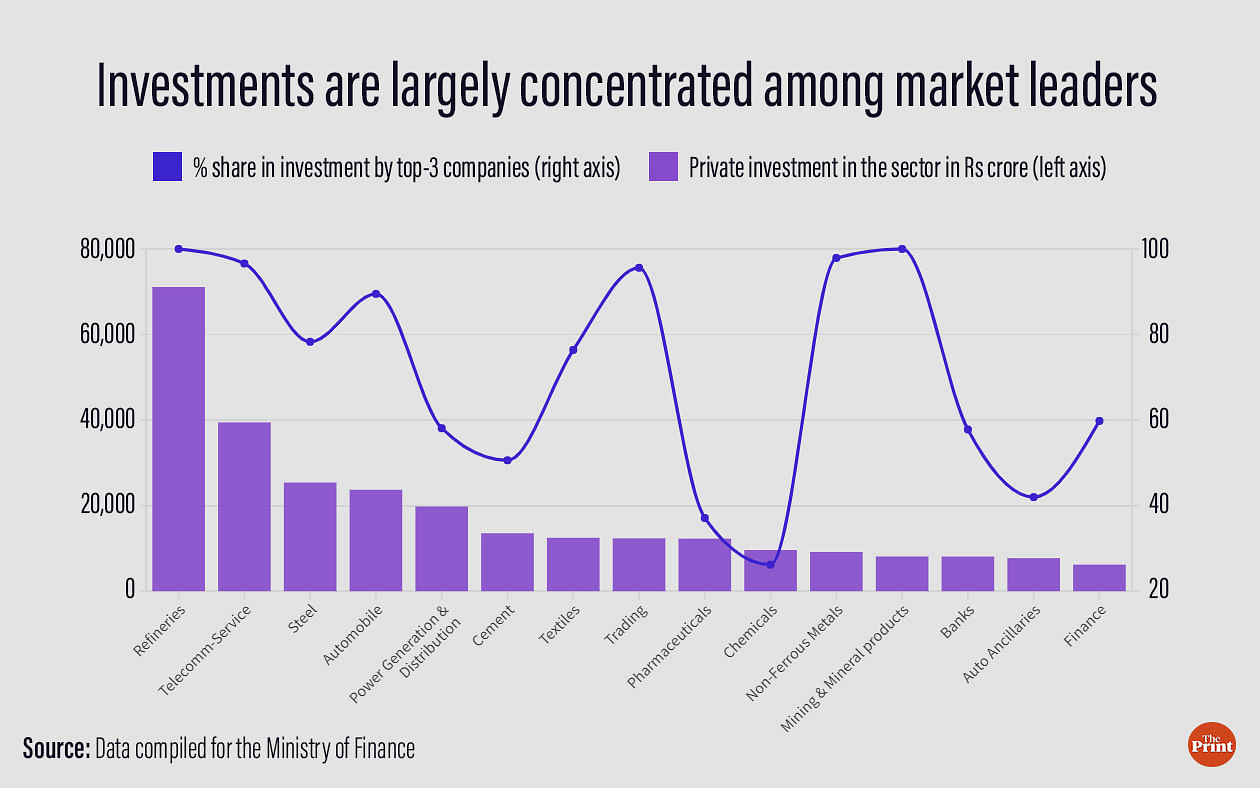

The sample data from the Finance Ministry also showed that of the 79 sectors looked at, just 15 of them accounted for about 80 percent of the total investment that had been captured in the data.

The largest investment, according to the data, came in the refineries sector, which itself accounted for one-fifth of the total private investment in the first half of FY24. However, this sector also highlighted how concentrated the investments were, with a single company itself accounting for 92 percent of investments made in the sector during this period.

This trend can be seen in most of the top 15 sectors that attracted private investment. Of the 15, 12 sectors saw their top 3 companies accounting for more than half of the investment in that sector.

In some cases, where there is already market consolidation and only a few players remain — such as in telecom services — it stands to reason that the top three companies would account for nearly 97 percent of private investment in the sector, as the data showed was the case.

However, it also showed that sectors with much higher levels of competition, such as non-ferrous metals and mining and mineral products, also saw a high degree of concentration of investments, with the top 3 companies accounting for 98 percent and 100 percent, respectively, of the total investments in the sector.

Bank credit to large industries gradually reviving

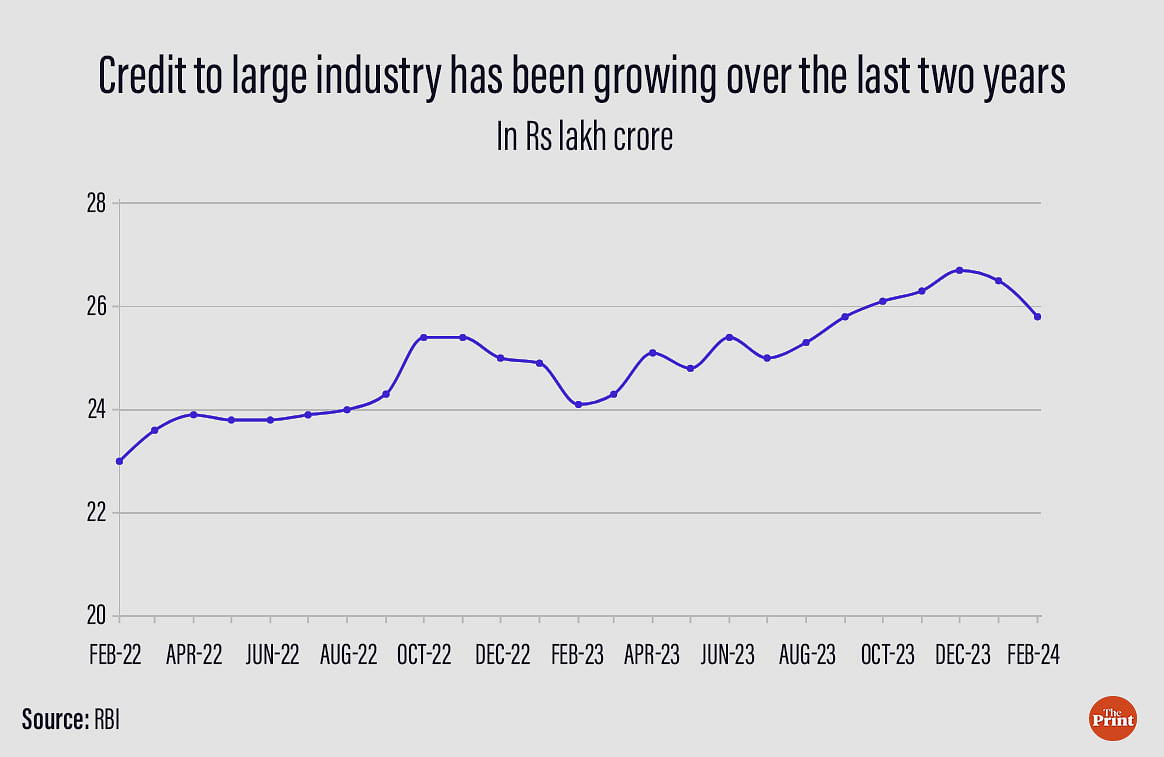

Another metric that seems to suggest that the private sector’s sentiments are beginning to revive is the growth in bank credit to large companies.

Broadly, the reasoning is that when the private sector wants to invest more, it will borrow more, and when it doesn’t want to invest, it will borrow less and try to clear its debt.

Reserve Bank of India data shows that outstanding credit to large industries stood at Rs 25.8 lakh crore in February 2024. While this was lower than the two months immediately preceding it, it was still substantially higher than the Rs 23 lakh crore in February 2022.

New project announcements on a high

Analysis by the Bank of Baroda, using the database of the Centre for Monitoring Indian Economy (CMIE), showed that new project announcements by the private sector in 2023-24, worth Rs 27.1 lakh crore, were the second-highest in a decade.

However, the report did note that these were still only announcements, and did not yet represent actual spending.

“The level of Rs 27.1 lakh crore is the second highest in the last 10 years,” the report said, adding that this is “indicative of confidence levels being higher which will hopefully fructify”.

Looking ahead, the report was optimistic about private investment levels, which it said would be buoyed by robust economic growth and a revival of consumption.

“With GDP growth expected to be maintained in the region of 7.8 percent next year, it is but natural that support will be provided partly by private investment,” the report said.

“There are expectations that both consumption and investment will be better in FY25 relative to FY24.”

Higher consumption, it added, would lead to better utilisation of existing factory capacity, which, in turn, could trigger higher demand for investment to increase capacity.

Madan Sabnavis, chief economist at Bank of Baroda, also noted that “these are only intentions which would fructify over a period of time and reflect the mood of companies”, and added that the investments are concentrated in sectors such as electricity and transport services, where the government is creating capacity.

“It (investment) is still to become more broad-based, which hopefully will be the case in FY25,” Sabnavis said.

Why private investment has been a concern

Private investment has been a concern for some years now, with ministers, government officials, and independent economists highlighting the sluggishness of private sector capital creation.

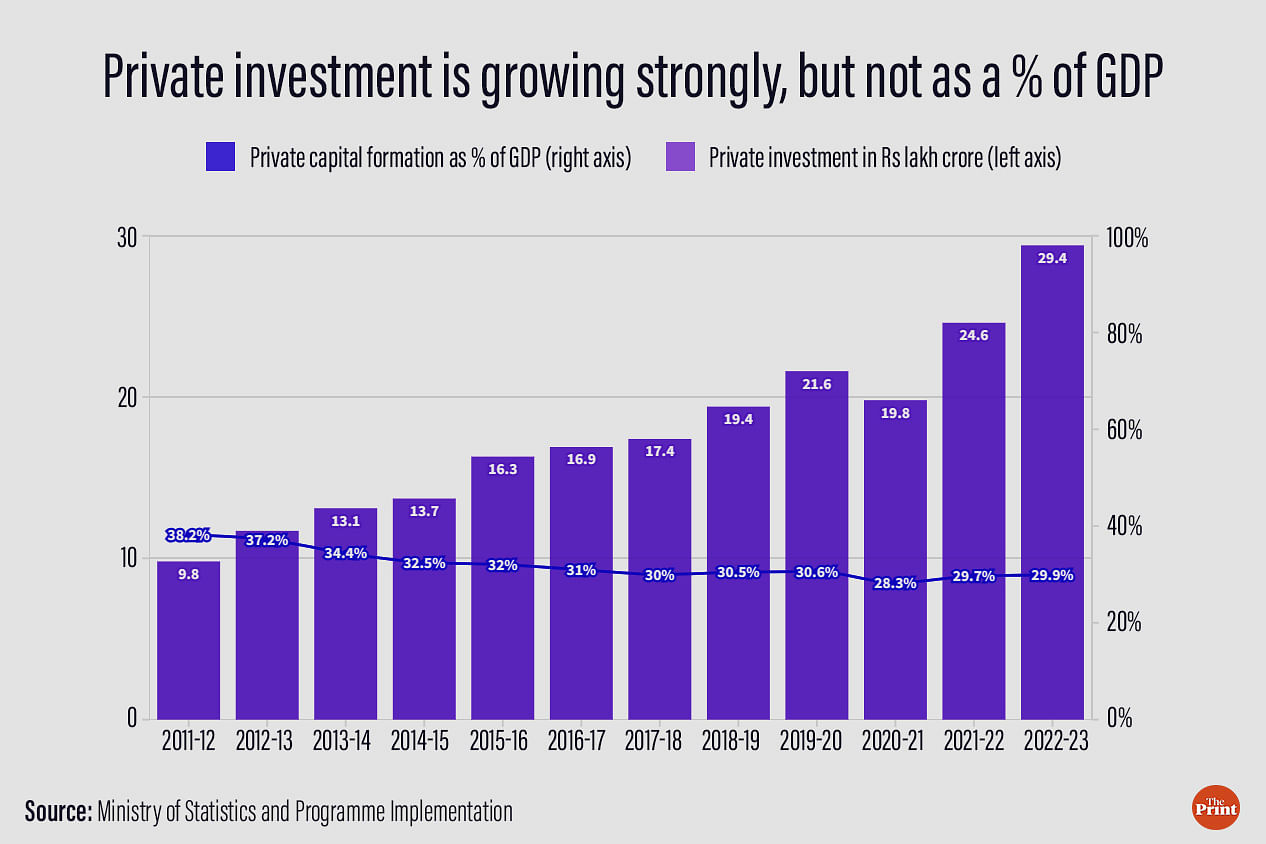

Data released at the end of February by the Ministry of Statistics and Programme Implementation showed why this is the case.

Capital formation by the private sector has been growing strongly in absolute terms, from Rs 9.8 lakh crore in 2011-12 to Rs 29.4 lakh crore in 2022-23 — a growth of about 200 percent.

However, the economy has grown even faster during this period, and so private sector investment — a vital engine of growth — has been contributing a diminishing share of the GDP.

Private sector capital creation made up a little more than 38 percent of the GDP in 2011-12. This fell steadily to 28.3 percent in the pandemic year 2020-21, before recovering marginally to 29.9 percent in 2022-23.

(Edited by Uttara Ramaswamy)

Also Read: Modi can’t prove India is 5th largest economy. Data will fail him