New Delhi: India’s stock market has seen a post-pandemic surge in amateur investors, who invest without gauging the fundamentals of the stocks they are investing in. This trend has inflated the bubble in the small- and mid-cap stocks and led the markets’ regulator to step in and curb investments in these segments, according to stock market analysts.

Last week, Securities and Exchange Board of India (SEBI) Chairperson Madhabi Puri Buch said “froth” or a bubble had formed in the stock market’s small- and mid-cap indices. Since then, SEBI has asked mutual funds to conduct stress tests on their small- and mid-cap investments, and several mutual funds have stopped bulk investments in these stocks.

The small- and mid-cap stock indices have corrected somewhat over the last week. But, according to analysts, there is still some way to go, and investors should consider moving their investments to large-cap stocks or risk seeing their investments being “slaughtered”.

A bubble is said to have formed when stock valuations far exceed what they realistically should be, based on the underlying fundamentals of those companies. Small-cap stocks are stocks with a market capitalisation of less than Rs 5,000 crore, and mid-cap ones are those with a market capitalisation of Rs 5,000-20,000 crore.

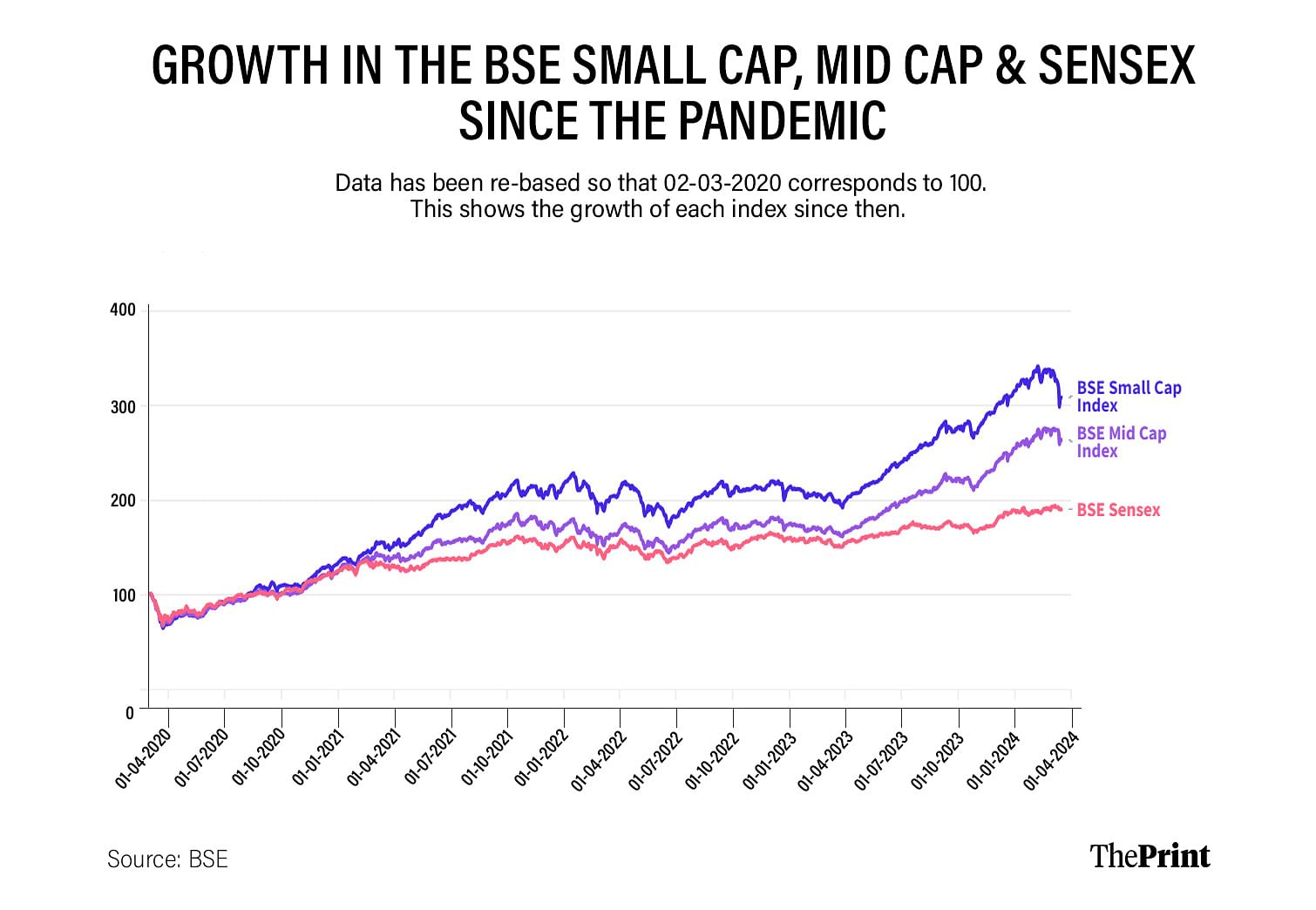

Data from the BSE (formerly called the Bombay Stock Exchange) shows that the small- and mid-cap indices had grown 221 percent and 174 percent, respectively, between 1 March 2020 and 11 March 2024, a day before the SEBI chairperson made her ‘bubble’ statement. In contrast, the overall BSE Sensex grew 93 percent over this period.

Since chairperson Buch’s 12 March statement, the small- and mid-cap indices have corrected somewhat—by around 4 percent each—but remain overvalued, V.K. Vijayakumar, chief investment strategist at Geojit Financial Services, told ThePrint.

“This doesn’t mean the correction is over,” Vijayakumar said. “Even now, the valuations are excessive and elevated. You cannot have a small cap, with a price-to-earnings ratio of 29:30, where large caps are available at 22, and that, too, for only those particular large-cap stocks, where there is safety, the sector is doing very well, and growth prospects have been high.”

A price-to-earnings ratio is a metric derived by dividing the stock price by the value of its earnings per share. It is one of the most commonly used measures to gauge whether a company is overvalued or undervalued.

“We anticipate further challenges ahead for the small- and mid-cap stocks,” Sunil Damania, chief investment officer at Mojo PMS, an asset management company, said. “Therefore, we strongly advise exercising caution when considering investments in this segment.”

Also read: Visible infra progress, Make in India push — what’s driving PSU stocks to meteoric highs

Why this bubble formed

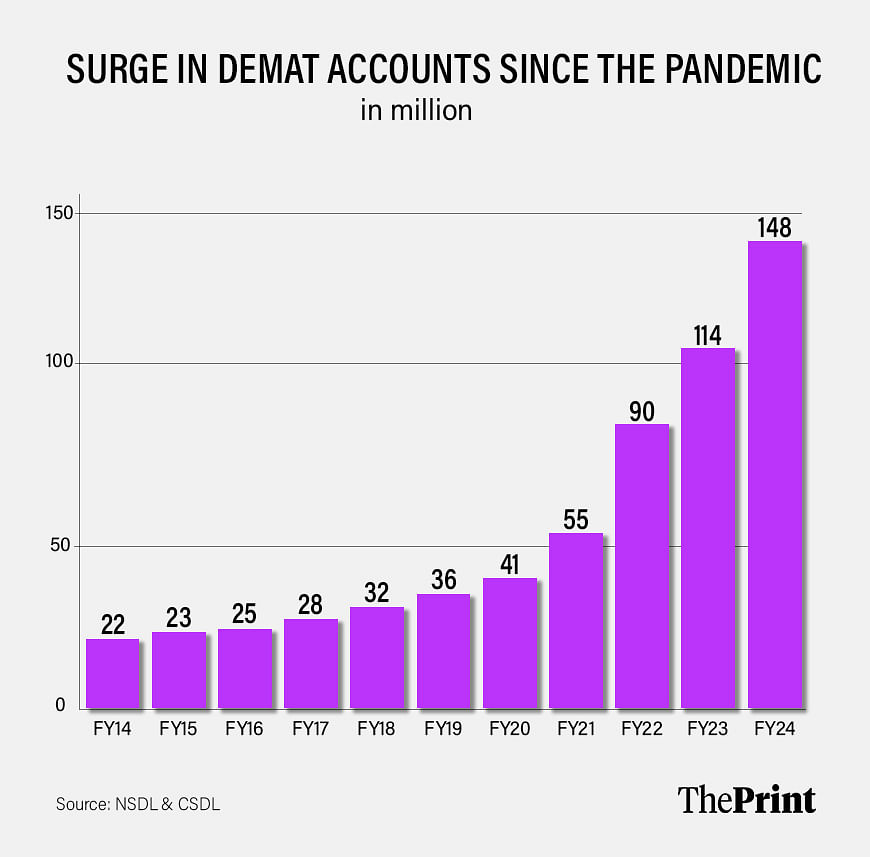

This bubble in small- and mid-cap stocks has been forming for some time and has largely been led by investors who newly joined the stock market after the pandemic.

This can be seen in the surge in demat accounts—mandatory for investors looking to invest in the stock market—from 41 million (4.1 crore) as of 31 March 2020 to 148 million (14.8 crore) as of 29 February 2023.

According to analysts, these new investors gravitate towards small- and mid-cap stocks because of the perception that they will offer quicker returns and also due to the advice given by social media influencers.

“As investors enter the equity market, their primary aim often revolves around seeking rapid returns,” Damania said. “They harbour the belief that investing in the small- and mid-cap stocks offers the swiftest path to achieving their financial goals.”

“Compounding this trend, numerous ‘experts’ frequently offer investment tips, typically centered around small- and mid-cap companies, further enticing investors to allocate their funds in this direction,” he added.

He said this has meant that over the last few years, out of every Rs 100 directed into equity mutual funds, Rs 33 has been invested in mid- and small-cap schemes.

Vijayakumar said that new investors often suffer from a ‘recency bias’, where recent events influence current investment decisions.

“Recent events influence investor behaviour, especially if the investors are amateurs like the new breed of investors,” he said. “I have spoken to many retail investors at investor conferences, and the vast majority has no idea about basic metrics like valuations, the significance of market cap to GDP, and the price-to-earnings ratio.”

These investors draw the erroneous conclusion that since the small caps have been outperforming for the last several years, they will continue to do so.

“It is very important for investors blindly investing in small caps to be very cautious,” he added. “If there is a strong correction, they will be slaughtered. And I don’t use that word lightly.”

Also read: Credit where credit’s due—Modi govt has scripted an unbelievable banking success story

Market correction to continue

As the BSE data shows, there has been a recent market correction in the small- and mid-cap stocks. However, this correction will likely continue longer as these stocks remain overvalued and regulatory actions continue to weigh on the markets.

“It’s not just about SEBI’s view of a bubble,” Sandeep Abhange, research analyst at LKP Securities, said. “Before that also, things have been happening such as RBI’s actions on PayTM and SEBI actions against IIFL and other NBFCs (non-banking financial corporations).”

Vijayakumar and Damania said considering the risk of a further fall in the small- and mid-cap indices in the coming years, their respective companies have already begun taking action to secure their clients’ investments.

“We have been communicating to our clients, right from early January this year, that there is froth in the small- and mid-cap segments, particularly in the small caps,” Vijayakumar said. “We have been suggesting to them to switch from small caps to large caps, where there is safety.”

“We’ve undertaken a significant reshuffling of our portfolios, transitioning from small- and mid-caps to large caps,” Damania said. “Our allocation to large caps, which stood at a modest 15 percent by the close of 2023, has now surged to 75 percent.”

Abhange, however, said there’s no need for a complete exit from small- and mid-cap stocks and investors should instead do their due diligence before investing.

“If you see the quality mid-caps, they have fallen but not as much as the significantly overvalued stocks,” he said. “We are recommending the stocks we have been recommending so far because their fundamentals are healthy, and the valuations will eventually match those fundamentals.”

(Edited by Madhurita Goswami)

Also read: Paytm shares rise by 5% as NPCI allows digital payments through third-party apps