New Delhi: Indian banks are flush with funds but reluctant and unable to lend amid the lockdown, and hence, are parking their funds with the Reserve Bank of India at a rate of interest as low as 3.75 per cent.

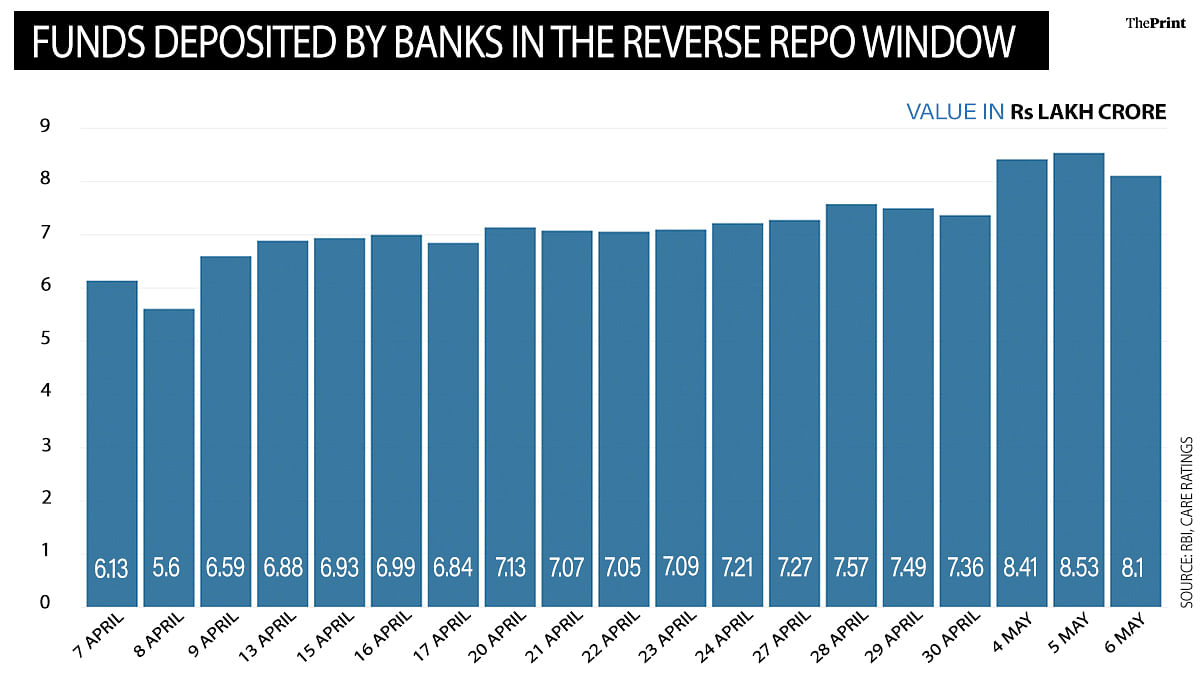

The reluctance, which is due to increasing risk aversion and a lack of credit demand following a slump in economic activity, has seen banks depositing record amounts with the RBI, according to bankers and analysts. The average amount deposited between 4 may and 6 May was more than Rs 8 lakh crore.

However, despite sufficient liquidity, banks are paying a comparatively higher interest rate of 5-6 per cent on fixed deposits without being able to lend out these funds to borrowers. Typically, banks raise money from deposits and then lend at higher interest rates. The difference between the deposit and lending rates makes the lending a profitable business for banks.

The Narendra Modi government imposed a national lockdown, effective 25 March, to curb the spread of the Covid-19 pandemic. The lockdown has been extended twice and is now slated to end on 17 May.

In the interim, the RBI also announced several measures to encourage banks to lend to different sectors of the economy, and infused liquidity into the system through various measures. However, this has not yielded desired results as banks, fearing a rise in bad debts, have been reluctant to lend to businesses.

Also read: India to grow between 0 to -2%: Economists lower forecast as 3rd lockdown delays revival

Lakhs of crores every day

On May 6, banks deposited Rs 8.1 lakh crore with the RBI under the reverse repo window, data released by the central bank Wednesday showed. The previous day, the amount had been Rs 8.5 lakh crore, and on 4 May, it was Rs 8.4 lakh crore. The data for 8 May has not been released yet, while 7 May was a bank holiday. The reverse repo is the rate at which RBI borrows from banks.

In the previous week, beginning 27 April, banks had deposited an average of Rs 7.4 lakh crore daily (during working days), while in the week beginning 20 April, banks had deposited Rs 7.1 lakh crore on average.

SBI Chairman Rajnish Kumar attributed the excess funds to a cautious approach followed both by banks and borrowers during these times of uncertainty.

“SBI has the money and willingness to lend but I am not finding the people who are willing to borrow,” Kumar said in an ‘Off the Cuff’ conversation with ThePrint’s Editor-in-Chief Shekhar Gupta last week.

Kumar added that corporates have consciously de-leveraged over the last few years, and don’t have the confidence now to over-leverage, given the expected deceleration in economic growth.

“Bankers and borrowers are both being prudent in their approach,” Kumar said, adding that SBI is depositing Rs 1.5 lakh crore with RBI through the reverse repo window due to lack of lending opportunities.

“In the current situation, we don’t need to take any fixed deposits. Whatever incremental money is coming in fixed deposits, it is a loss making proposition for the bank,” he said.

Also read: Rural economy showing positive signs, but lockdown must be lifted for recovery: SBI chairman

Govt & RBI nudge to banks

The government and the RBI have both been nudging banks to lend. Last month, the Department of Financial Services asked state-run banks to step up lending to stressed sectors of the economy.

Similarly, in a meeting between bankers and RBI Governor Shaktikanta Das last week, credit flow to different sectors of the economy, including non-banking finance companies, microfinance institutions and mutual funds, was discussed.

“Most economic activity has stalled and borrowers are not demanding credit. There is also risk aversion among banks due to uncertainty about the future. Banks are not willing to lend as, at the end of the day, it is a commercial decision,” said Soumyajit Niyogi, associate director at India Ratings and Research.

“Added to this, the RBI has also pumped in enormous liquidity into the system. A clearer picture will emerge once the lockdown ends and economic activity resumes,” Niyogi said.

Covid-19 impact on bank credit

In the year ending March 2020, growth in bank credit to different sectors decelerated to 6.7 per cent, from 12.3 per cent in the year-ago period.

Covid-19 and the extended lockdown have adversely impacted business activities of banks due to weak demand and increased risk aversion, said Care ratings in a note dated 5 May.

Going ahead, “retail loans may witness marginal contraction in credit offtake as consumer demand moderates due to disruptions caused by Covid-19. The real estate sector may also face severe stress, as individuals would delay home purchases, which may impact the housing loans as housing loans account for more than 50 per cent of retail loans”, it said.

Also read: Wage support, loan relief, interest-free working capital — govt plans lockdown aid for MSMEs

Ram Nam Satya hai

The timing factor is important in these dynamic decisions. After vacating the shop and locking it

for an indefinite period , and the whole city is under curfew where is the need for a night watchman?

RBI ‘s munificence both in money supply and rates are needed ,when the business is alive and going.

Banks cannot be expected to sit on hoards of cash unless there is a near term demand for it.

Also ,we have to discontinue the universal banking concept of the west for India ,as we have to

have separate institutions and policy framework for term lending vis-a -vis working capital or short

term lending.

The period starting from mid june or July, Banks may get into a start mode depending on customer

demand and the speed may pick up from the third quarter of the FY2020-2021