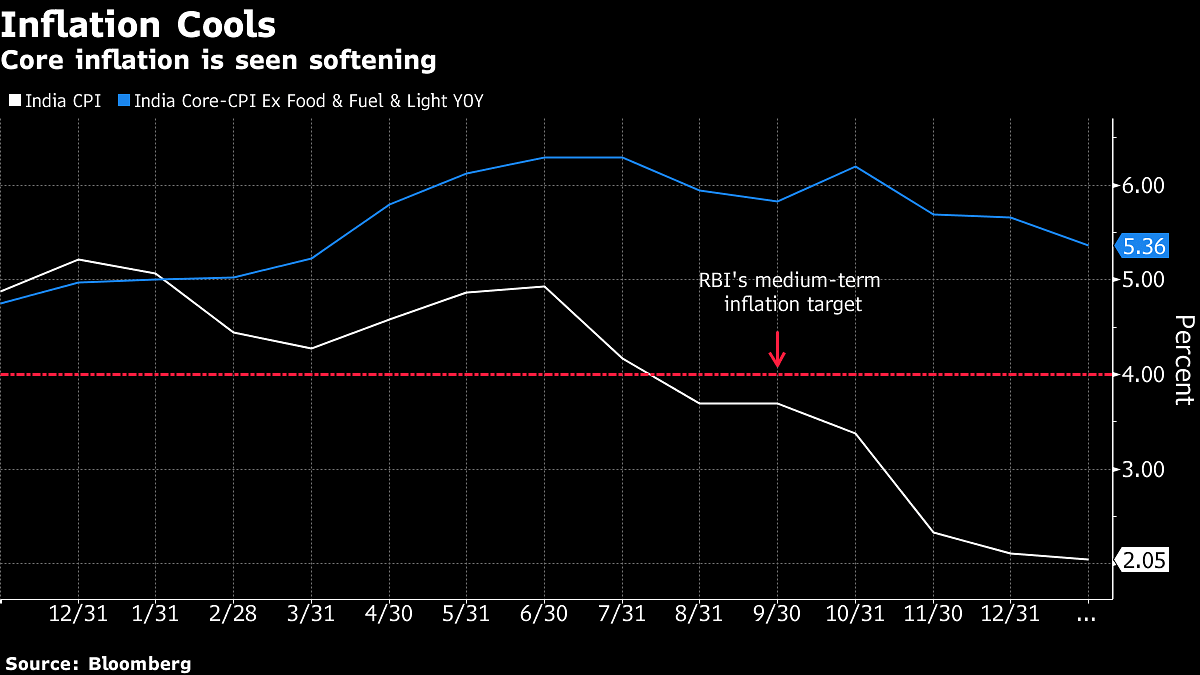

Mumbai: India’s headline and core inflation rates are set to converge in the coming months as the economy slows, increasing the chance of more interest rate cuts.

The core measure — which strips out volatile fuel and food costs — has remained sticky at around 6 percent and is a key reason economists cautioned against more rate cuts after last week’s surprise easing. It softened to 5.4 percent in January, according to economists at Yes Bank Ltd. and Axis Bank Ltd. Pranjul Bhandari, chief India economist at HSBC Holdings Plc, sees it slowing to as low as 4 percent this year.

For now, headline inflation eased further as food prices extended their fall, albeit at a slower pace. Consumer-price growth reached 2.05 percent in January, well below the Reserve Bank of India’s medium term target of 4 percent.

“It looks like headline inflation will begin to move towards core,” HSBC’s Bhandari said. “With rupee and fuel costs stabilizing, the core could also start coming down.”

The convergence of the two measures, along with recent surveys from the central bank suggesting slowing inflationary expectations among households and industry, will be key for a clearer assessment of policy actions by the Monetary Policy Committee. The six-member panel last week voted 4-2 to lower the key interest rate.

Shaktikanta Das, the RBI’s new governor, voted for a cut despite only weeks earlier acknowledging the challenges posed by the divergent paths taken by core and food inflation.

Split Matters

Viral Acharya, the RBI’s deputy governor in charge of monetary policy who was among those who sought to keep rates unchanged, has in the past pointed to core inflation as being a more reliable indicator.

“The reason why the split matters is because food tends to be more volatile, the core inflation tends to be more persistent,” Acharya told reporters Feb. 7, referring to the divergence.

Those differences may disappear as slowing economic activity is set to drag core inflation down and also as the pass through impact from food and fuel prices fades. The MPC flagged that the output gap — the difference between an economy’s actual output and its potential — has opened up.

With the central bank now forecasting headline inflation to remain within its medium-term target for the next 10 months, chances are the two measures may converge.

“The implication is that second round effects are much more muted, and shocks to food and fuel prices do not propagate as strongly into core inflation,” JPMorgan economists Sajjid Chinoy and Toshi Jain wrote in a recent note. “Correspondingly, core inflation is relatively more responsive to slack.”

Key Points From Tuesday’s Price Print:

Consumer prices rose 2.05% in January from a year earlier That’s slower than the 2.5% median estimate in a Bloomberg survey Consumer food price inflation fell 2.17% in January vs a 2.65% fall in December India’s factory output rose 2.4 percent in December, faster than the revised 0.3 percent gain in the previous month, figures released separately by the government showed Data due Thursday will probably show India’s wholesale price inflation softening to 3.7% and the trade deficit widening further in January.-Bloomberg