Bangkok/Mumbai: Aberdeen Standard Investments, with $669 billion in assets, remains positive on Indian stocks even as the nation’s economic growth is at a six-year low.

“India is least impacted by the global trade war,” Devan Kaloo, global head of equities at Aberdeen, said in an interview in Bangkok Thursday. “If you are pessimistic on the world and global growth, then India is actually an interesting place to invest.”

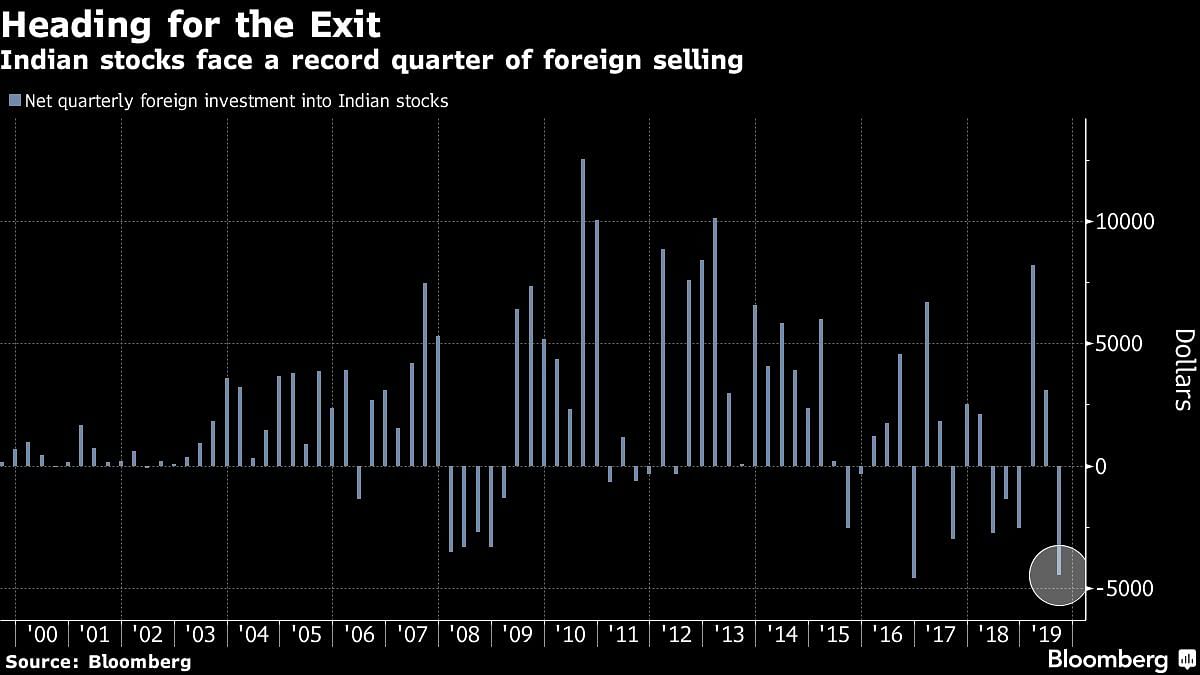

Kaloo’s view may be an outlier. International money managers have sold $4.7 billion of the nation’s shares since June, with quarterly outflows on course for the biggest since at least 1999. Bullish calls are scarce after economic growth decelerated for five straight quarters to the weakest level since early 2013, with car sales plunging and the banking system strapped by the world’s worst bad-loan ratio.

Aberdeen agrees that growth hasn’t picked up as much as people had hoped and the government has limited fiscal scope to spend. Still, the fund is focusing on the long-term effect of changes to the country’s tax structure, plus efforts to clean up the banking system and make affordable housing available.

“We think India has policy responses to the slowdown,” Kaloo said. “Once you start seeing them coming through, people will look at India to see the investment opportunities.”

Here are some excerpts from the meeting:

- “Valuation of Indian market is cheaper than before, but it is still not a cheap market. Selectively, we think there is a good value there.”

- Long-term benefits of policy changes affecting the property market — particularly affordable housing — have a good “multiplier effect.”

- India remains a good investment story from a long-term investment horizon, he said.