Although their share in the total NPA pool has reduced, bank NPAs from agriculture have shot up by at least 23% in a year.

New Delhi: The spate of farm loan waivers being announced by state after state has thrown the spotlight on the other bad loan problem being faced by banks — those in the farm sector.

And they have only been rising steadily over the past few years although their share in total bad debts of banks has come down, ThePrint has found.

This is an indication that the serial loan waivers by states are hurting the credit culture of rural borrowers and leading to a rise in non-performing assets (NPAs), analysts said.

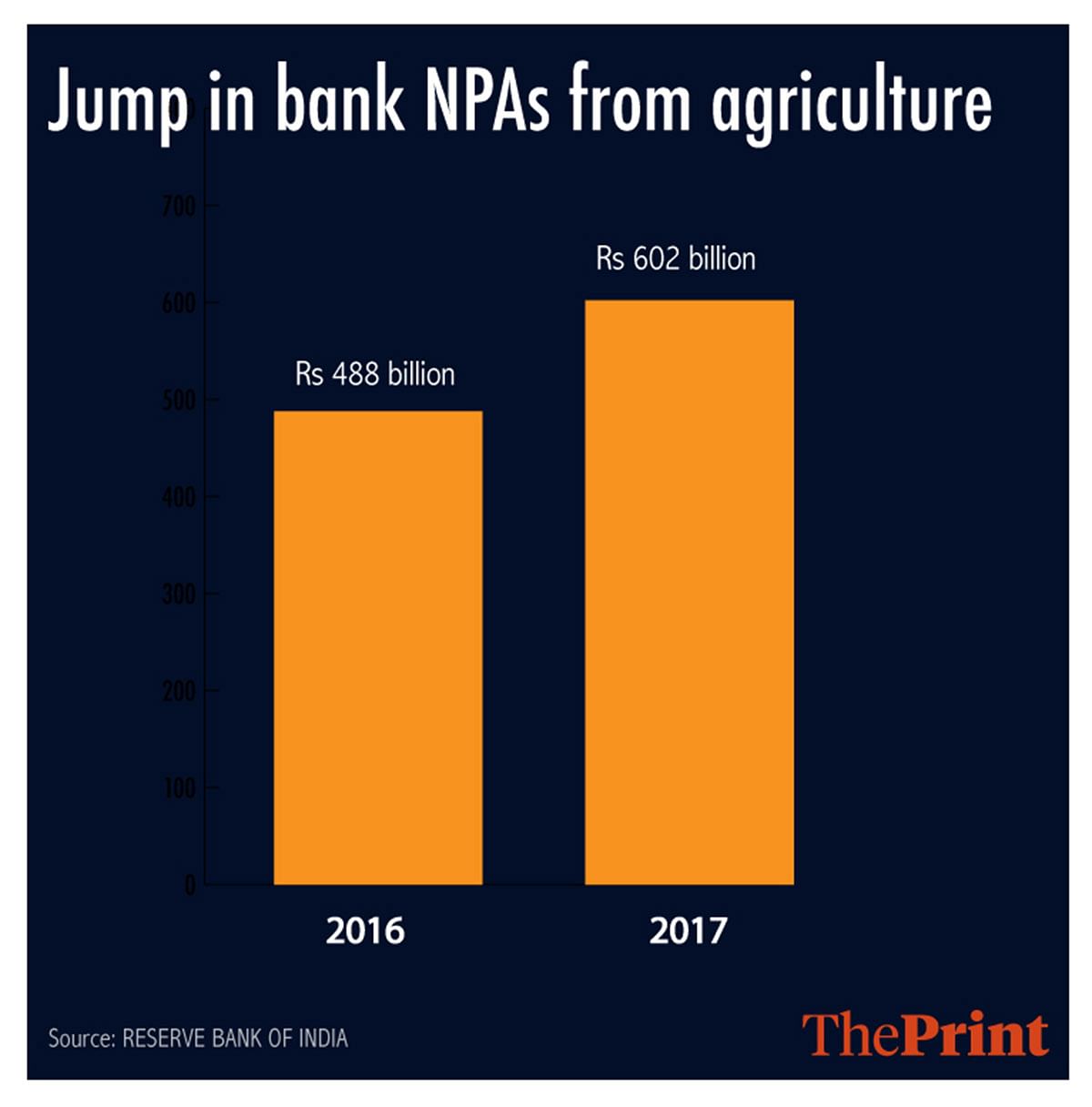

Data with the Reserve Bank of India (RBI) reveals that bank NPAs from agriculture shot up to Rs 602 billion as of March 2017, as against Rs 488 billion in the same month in 2016.

The share of agriculture in the total pool of NPAs, however, has been reducing and has dropped below 10 per cent. The RBI data shows that it fell to 8.3 per cent in March 2017 from 8.6 per cent in 2016.

To be sure, more than three-fourths of the bad loans at Rs 5,585 billion were in the non-priority sector in 2017, with industry and infrastructure contributing the bulk of the NPAs.

Also read: Karnataka announced farm loan waiver in May but a software delayed launch till December

Similar story from bank-level data

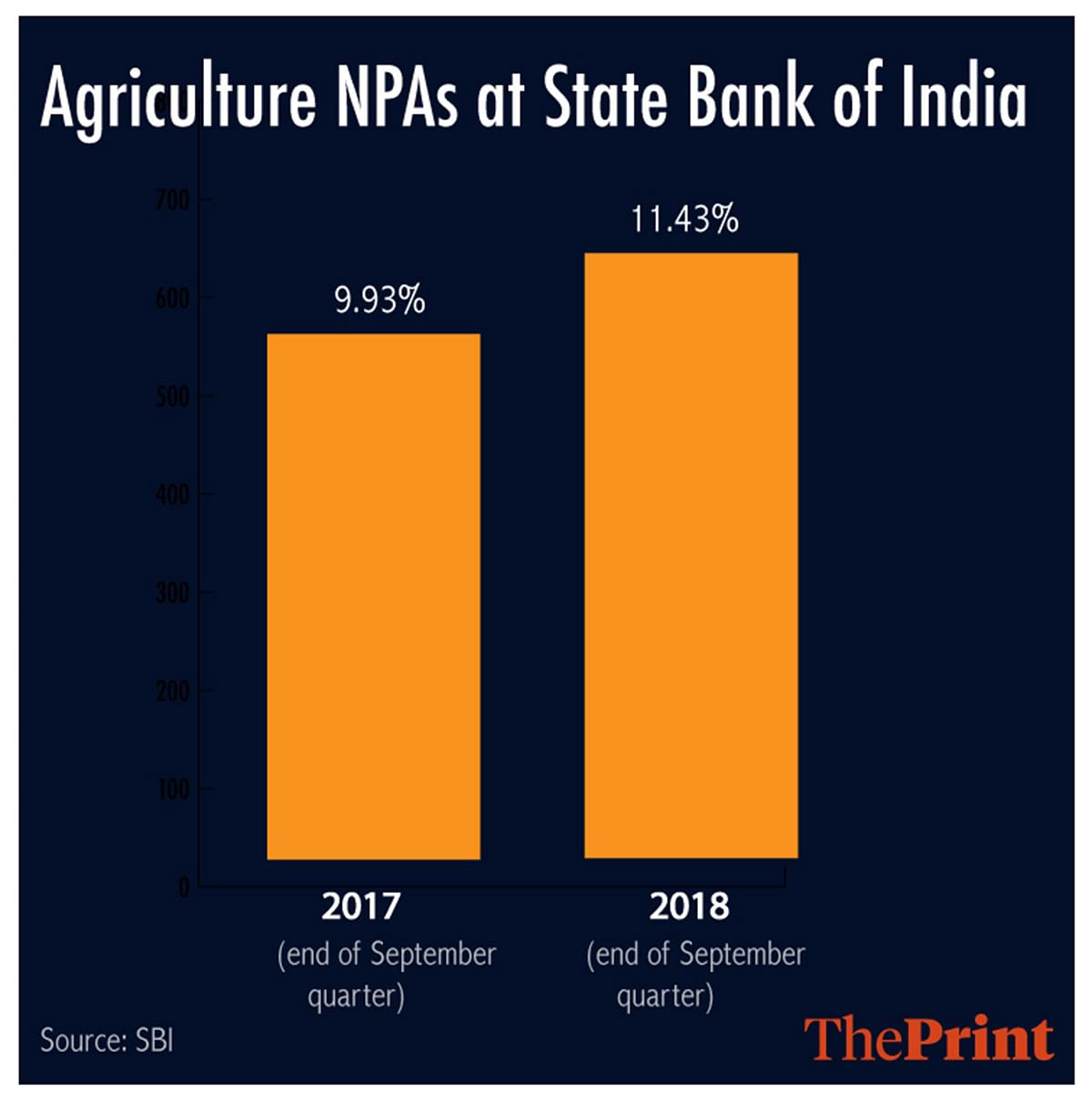

More recent data also shows that agriculture loans are turning into NPAs for banks. The NPAs in this sector at the country’s largest lender, the State Bank of India, were at 11.43 per cent at the end of the September quarter, as against 9.93 per cent in the same period a year ago.

This is despite the fact that India had a normal monsoon in 2016 and 2017 and only a marginally deficient monsoon in 2018.

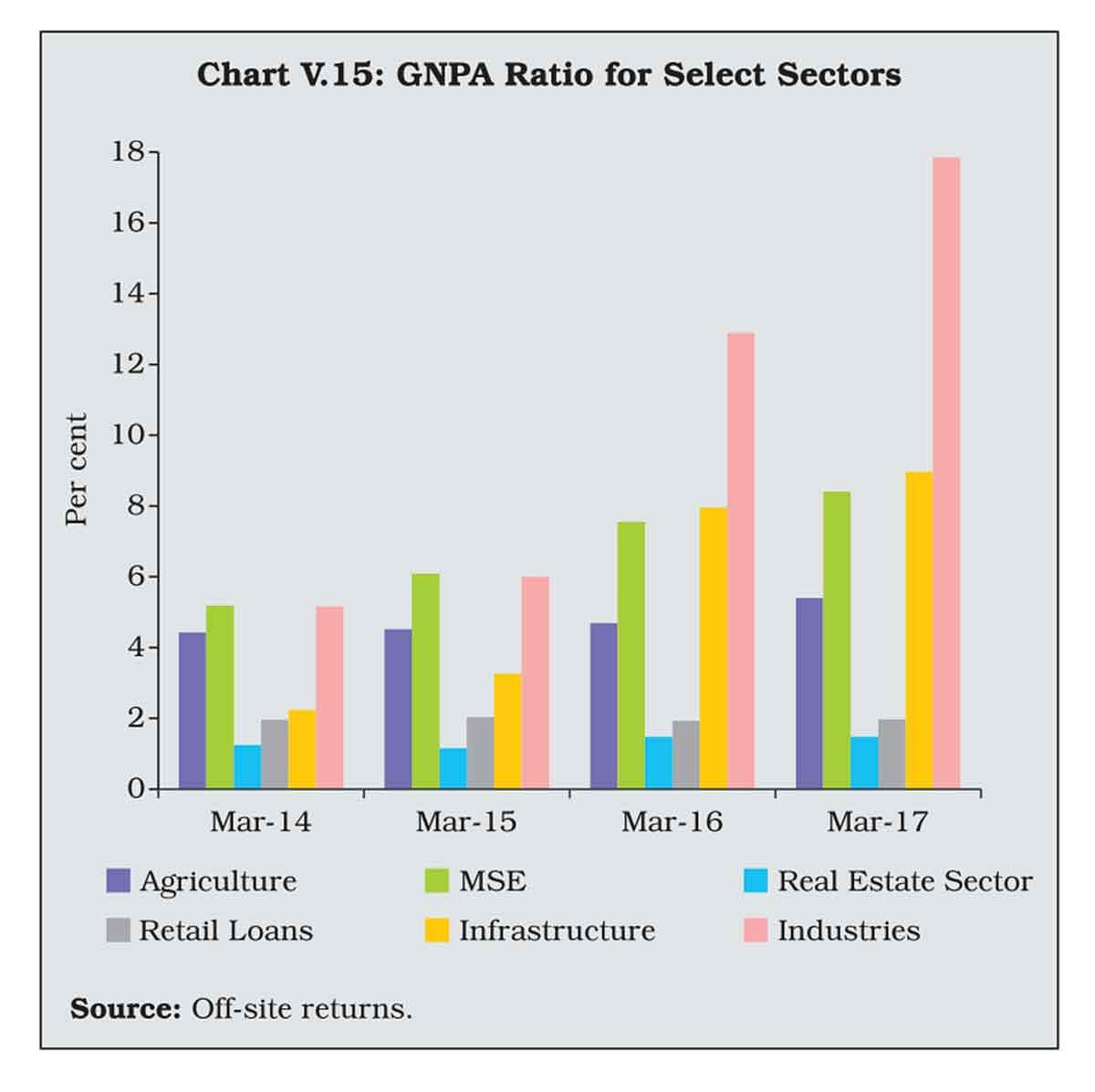

The ratio of bad loans to total loans or advances also tells a similar story. While in 2013-14, the gross NPA ratio in agriculture was slightly more than 4 per cent, this steadily increased to over five per cent in 2016-17. At the same time, the gross NPA ratio for industry has zoomed from 5 per cent in 2013-14 to nearly 18 per cent in 2016-17.

Although agriculture NPAs form a smaller share of the bad debt pool, these sets of data are indicative of the fact that debt waivers by state governments have adversely impacted the credit culture of rural borrowers.

A spate of farm sops

Many state governments, including Punjab, Uttar Pradesh, Chhattisgarh, Madhya Pradesh and Rajasthan, have announced farm debt waivers. This has stepped up pressure on the Modi government to announce an all-India debt waiver ahead of the 2019 Lok Sabha elections.

The RBI and economists, however, have been warning against these farm waivers. Banks also oppose any debt waiver arguing that borrowers do not repay loans in the future years as well, anticipating such measures from the government.

“Loan waivers, as the RBI has repeatedly argued, vitiate the credit culture, and stress the budgets of the waiving state or central government. They are poorly targeted, and eventually reduce the flow of credit,” former RBI governor Raghuram Rajan had argued in a recent note on banking reforms.

“The debt waiver can significantly impact the credit culture among the farmers in other states. More importantly, demand for debt waiver may also come in from other states,” the India Ratings and Research said in a report dated 19 December.

“The waivers may mask the delinquencies for the time being. Nevertheless, it carries the risk of significantly impairing asset quality. The unintended outcome of this could be reduced availability of credit to the farmers from banks, forcing them to resort to the unorganised lending sector.”

The report also noted that five of the six largest public sector banks reported an increase in the delinquency level in the agricultural loan portfolio, despite normal monsoons in 2016 and 2017, and marginally deficient monsoon in 2018.

Also read: India’s growth not leading to jobs, farm loan waivers don’t help poor – Raghuram Rajan

the article needs to get its facts right. If farm loans are waived , what are banks doing with bad farm loans? maybe these are the loans to corporates masquerading as farm loans for interest benefits ? Regardless facts need to be checked