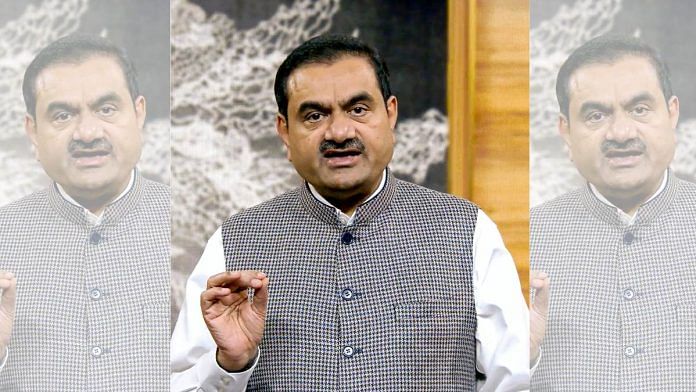

New Delhi: The Adani Group saw its market value nosedive by nearly 52 per cent or by a whopping Rs 10.25 lakh crore to Rs 9.54 lakh crore in the six month period to 30 April, 2023 from 30 October, 2022, according to a report released Tuesday. The value of the top 500 non-state owned firms in the country registered a modest decrease of 6.4 per cent, says the report.

In January, American short-seller Hindenburg Research released a report alleging corporate malpractice, stock price manipulation and fraud by the Adani Group. The stock values of Adani Group of companies reported a downslide after the controversial report.

The ‘Burgundy Private Hurun India 500-Special Report’ by Burgundy Private – Axis Bank’s Private Banking Business, and research firm Hurun India – lists the 500 most valuable non-state-owned companies in India, while also tracking changes in their value in the period mentioned above.

The report notes that the value of the top 500 companies from their list decreased marginally to Rs 212 lakh crore from Rs 227 lakh crore. The eight companies in the Adani Group constitute 4.5 percent of the total value of 500 top companies.

Adani Enterprises and Adani Total Gas moved out of the top 10 during the period under review, the report said, adding that Adani Total Gas lost 73.8 per cent (about Rs 2,92,511 crore) and reached a value of Rs 1,03,734 crore, while Adani Transmission saw a decline of 69.2 percent and Adani Green Energy was down by 54.7 percent during the period.

According to the report, the Tata Group topped the list of the most valued industrial groups with a combined market capitalisation of its 15 companies at Rs 20.97 lakh crore, followed by the Adani Group, the Aditya Birla Group, the Murugappa Group, the Bajaj Group, the Jindal Group, the TVS Group, the Godrej Group, and the Rajan Raheja Group.

Anas Rahman Junaid, managing director and chief researcher, Hurun India, said in a statement, “We are witnessing a unique confluence of events, with the Russia-Ukraine war causing a surge in inflationary pressures worldwide, central banks increasing their key lending rates and funding winter for startups.”

He added that amid these challenging times, the companies featured in the Burgundy Private Hurun India 500 – Special Report, experienced a modest decline of 6.4 percent over the past six months.

‘7 of top 10 in Mumbai’

Of the 500 companies, 287 experienced a decline in total value, while 14 remained flat, and 24 dropped out of the list. The combined value of the top 10 companies remained flat at Rs 71.4 lakh crore, equivalent to 37 percent of India’s GDP. Interestingly, seven of the top 10 companies are headquartered in Mumbai.

With a value of Rs 16.3 lakh crore (after decline of about 5 percent from the previous list), Reliance Industries emerged as India’s most valuable company, followed by TCS (up 0.7 percent to Rs 11,76,385 crore), HDFC Bank (up 12.9 percent to Rs 9.41 lakh crore), ICICI Bank (up 1.4 percent to Rs 6.41 lakh crore) and ITC (up 22.5 percent to Rs 5,29,682 crore).

Among the unlisted companies, Serum Institute of India, the most valuable company in the list, declined by 13 percent to Rs 1,92,000 crore, followed by National Stock Exchange of India (up 18.7 percent to Rs 1,65,300 crore), BYJU’s (down 62 percent to Rs 69,100 crore), Dream 11 (down 0.6 percent to Rs 65,800 crore) and RazorPay (down 0.6 percent to Rs 61,700 crore). Swiggy, which is number six on the list, saw its value decline by 34 percent to Rs 58,400 crore.

The companies on the Burgundy Private Hurun India 500 list are in 15 states; Maharashtra, Karnataka and Tamil Nadu being the top three states followed by Delhi, Haryana and Gujarat. By city, Mumbai led with 155 companies, followed by Bengaluru with 62 companies, New Delhi with 40 companies and Chennai with 39 companies.

(Edited by Smriti Sinha)

Also read: Boost for aviation maintenance providers as sector grows. Revenue to triple by FY28, says CRISIL