The last financial year (FY 2023-24) was another year of healthy bank credit growth. Lending to industries saw a pick-up, but loans to services and households continued to be the key drivers of bank credit. Housing loans showed an upward trajectory.

A problem in this field is the merger of a non-bank, HDFC, with HDFC bank, which took place in July 2023. This generated a one-time spurt in key credit statistics, making comparison with previous years a challenge. To assess the trajectory of credit, it is useful to look at data, without factoring in the impact of the merger.

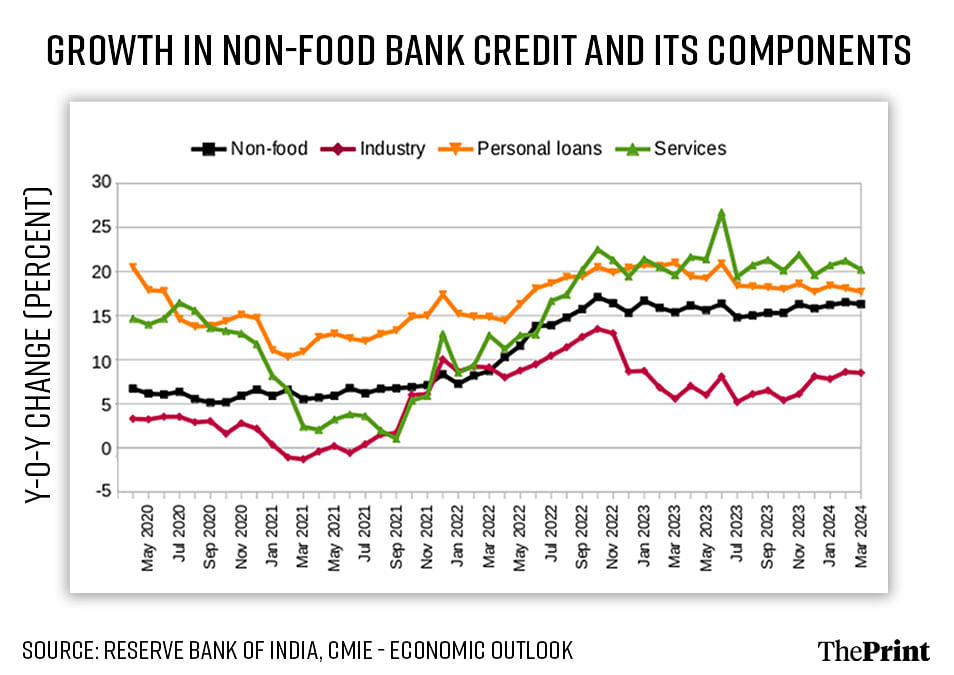

Excluding the impact, the growth in non-food bank credit accelerated to 16.3 percent in March 2024, compared to 15.4 percent a year ago. Bank loans to services grew faster at 20.2 percent than personal loans at 17.7 percent. Credit to industry picked up pace and grew by 8.5 percent in March, versus 5.6 percent last year.

Credit boom in housing market

The demand for home loans continued to register strong growth in FY24. Credit outstanding to the housing sector rose by nearly Rs 10 lakh crore in the last two years to reach a record high of Rs 27.23 lakh crore in March. Even after excluding the merger impact, housing loans rose by Rs 6 lakh crore in the last two years.

The revival in the housing market after the pandemic-induced slump and the pent-up demand by people, who delayed buying houses, contributed to the rise in demand for housing and loans for housing. Policy interventions in the form of Real Estate Regulatory Act (RERA) helped in improving confidence in the sector, which was earlier marred by lack of transparency, unclear contracts and project delays.

In addition to the above factors, the structural transformation in India’s exports sector post the Covid pandemic has also contributed to the credit boom in the housing segment. The upsurge in services exports in recent years is not just driven by the IT space, but by a wide range of professional and management consulting services.

In addition, there has been an increased proliferation of Global Capability Centres (GCCs), the offshore units established by multinational corporations to perform strategic functions. These two factors have contributed to the creation of good quality jobs and rise in incomes. These individuals, possibly, are a major source of demand for housing loans.

Reports by property consultancy firm, Anarock, show that the sales of housing units have been rising since 2021, and reached a new peak in 2023. Correspondingly, the available inventory of housing has seen a dip.

High salaried jobs emerging from the services sector has led to a growing demand for luxury housing (above Rs 10 million). The share of luxury housing increased to 30 percent in 2023 from 18 percent in 2019. Reflective of the boom in the housing segment, loans to commercial real estate grew by 23 percent in FY24.

Considering the extent to which the rise in home loans is linked to the strength of India’s services exports, a slowdown in these exports could possibly result in a drop in housing credit.

Also Read: How poll-bound states are grappling with price rise, a factor likely to impact voter sentiment

RBI curbs on unsecured lending, uptick in loans to industry

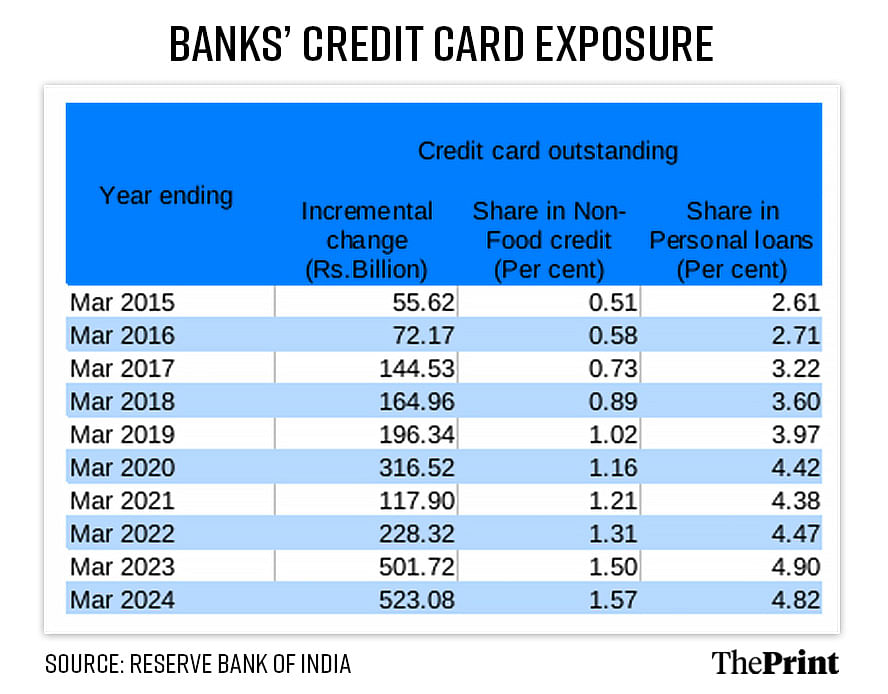

Barring the merger impact, overall personal loans grew by 17.7 percent. The unsecured personal loans (not backed by collateral) continued to see high growth in FY 2023-24. Credit card dues had shot up by 25.5 percent in March last year. Banks’ exposure to credit cards has been seeing an upsurge of more than Rs 500 billion in the last two years.

Concerned about the exuberance in unsecured personal loans, the Reserve Bank of India undertook prudential measures to restrict unsecured lending by banks and NBFCs, and by banks to NBFCs. Going forward, there could be a slowdown in high-risk, small-ticket lending by banks and NBFCs.

Loans to industry increased at a faster pace in March 2024, compared to last year. However, the share of the industry segment in the outstanding non-food bank credit fell. At 22.4 percent, the share of industry is lower than that of services at 28 percent, and personal loans at 32 percent.

While incremental bank credit flow to the industry is likely to stay stable, companies are likely to rely on the bond market for raising funds in FY25. Yields on government bonds are likely to fall due to inclusion in global bond indices, this will have a salutary impact on corporate bond yields.

Monitoring “excessive” credit growth

While credit is needed to serve developmental needs, what constitutes “excessive” credit growth is an important policy question for central bankers. Excessive and unhindered growth in lending has been associated with financial crises.

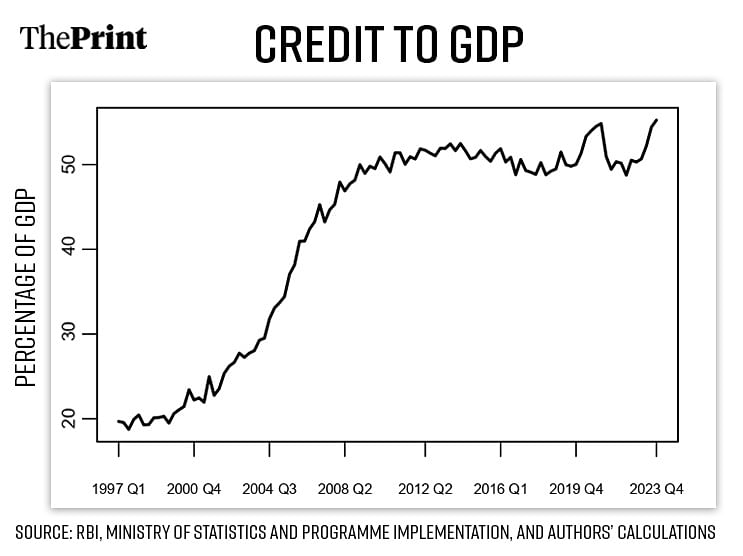

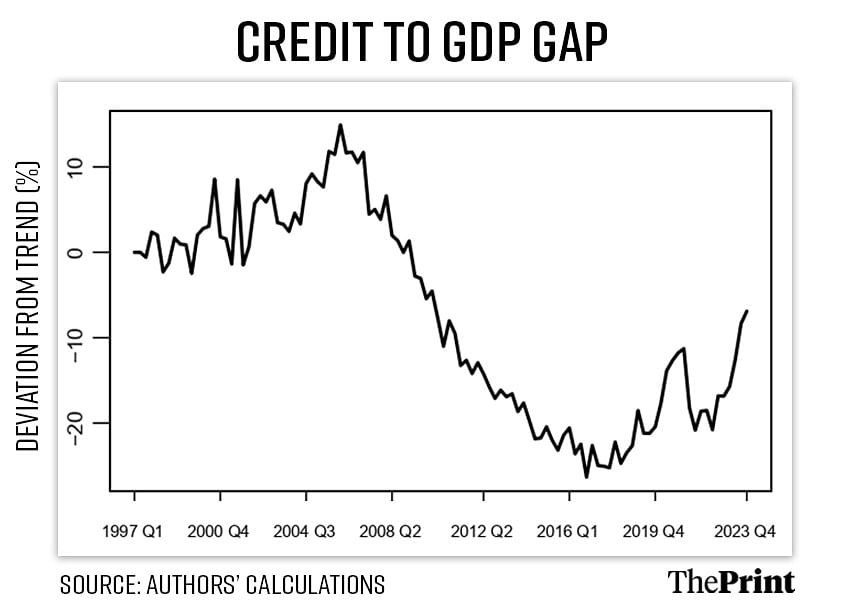

A simple measure of excessive growth, which could serve as an early warning indicator for banking crises, is the credit-to-GDP gap. This is defined as the difference between the credit-to-GDP ratio and its long-term trend. The Bank for International Settlements (BIS) publishes this series for countries.

The input series for computing the credit-to-GDP gap is simply the ratio of non-food credit to GDP. What does this ratio look like for India? The credit-to-GDP ratio showed a sharp rise during the early 2000s — a period of credit boom. Post the onset of the global financial crisis, the ratio remained static at around 50 percent. There was a short period of uptick during the Covid years, primarily led by a deceleration in GDP. The ratio seemed to have bottomed out in the mid-2022, and since the second half of 2022, it is exhibiting a surge.

If the ratio exceeds its long-term trend by a wide margin, that is, if the credit-to-GDP gap is positive beyond a certain threshold, it could be an early warning sign of overheating. Regulatory requirements in the form of maintenance of capital buffers kick in to restrict indiscriminate lending.

For India, the credit-to-GDP gap has been in the negative territory after the credit boom of the early 2000s, indicating that it is below its long-term trend. Mirroring the trend in the ratio, the gap series has been rising since the second half of 2022. In summary, there is a trend reversal in both the credit-to-GDP ratio and the credit-to-GDP gap since 2022. At this stage, the pick-up in credit-to-GDP-gap is not alarming, but it is something that needs to be monitored, going forward.

Radhika Pandey is associate professor and Madhur Mehta is a research fellow at National Institute of Public Finance and Policy (NIPFP). Views are personal.

Also Read: Central banks on buying spree, strong retail demand — what’s fuelling the big gold price rally

Few months ago there was an article here on print that said owning a house in Delhi NCR, especially in Gurugram, was expensive beyond IT/Tech employee’s salaries that they had to change job and relocate to Noida. The same article said Harayana gov’s plan for affordable housing failed miserabley.

And this article praises growing housing loans, but god forbid if we talk about affordable housing let alone provide it.

Credit (pun not intended) to growing services export but India still lags way behind in large capital industrial/manufacturing exports.