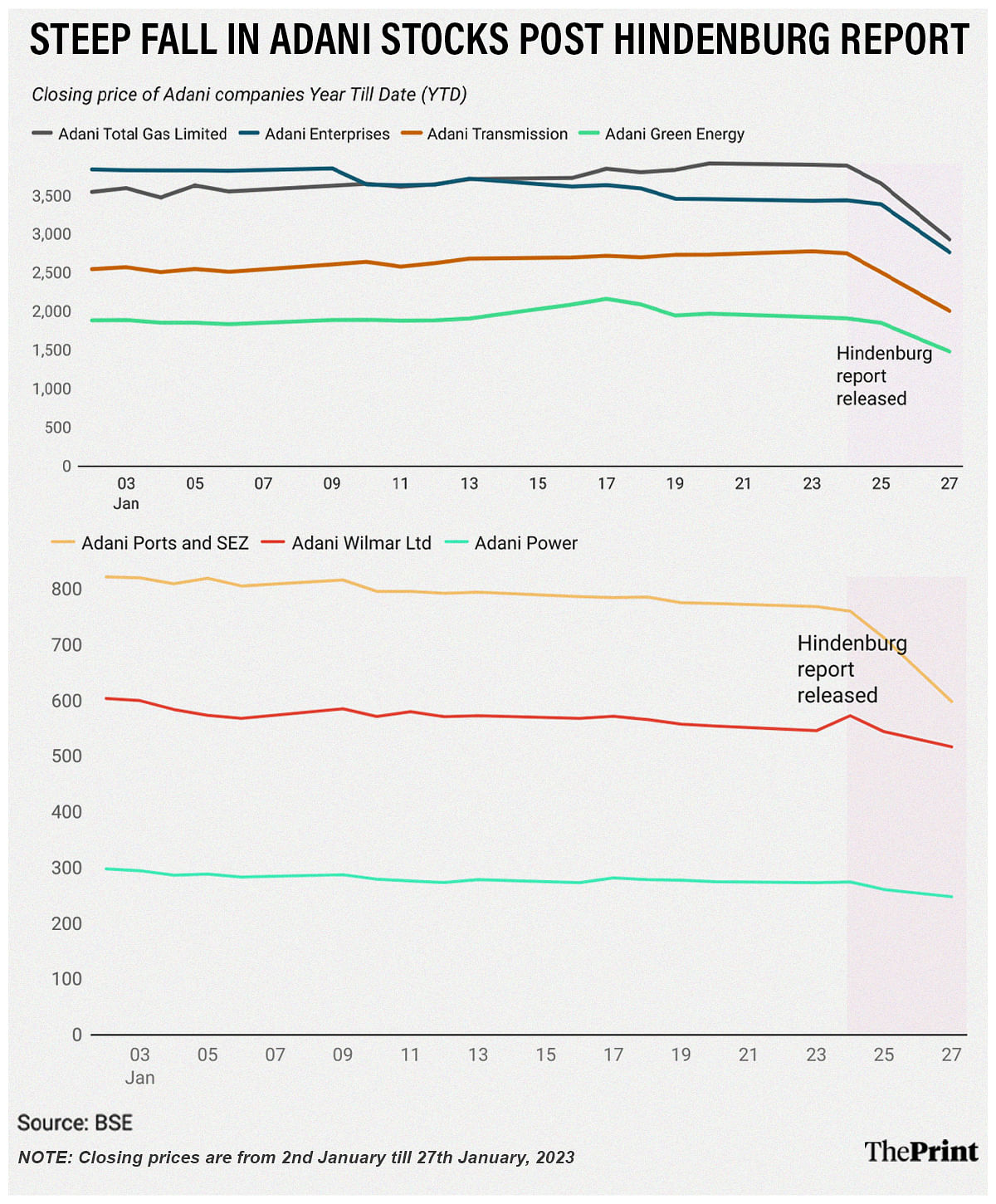

New Delhi: The stock values of Adani Group of companies are on the downslide after US short-seller Hindenburg Research’s controversial report on the finances of the Indian conglomerate.

The report released Tuesday started having an impact on the stock prices from the next day and its effect extended Friday as well. Stock exchanges were closed Thursday on account of Republic Day.

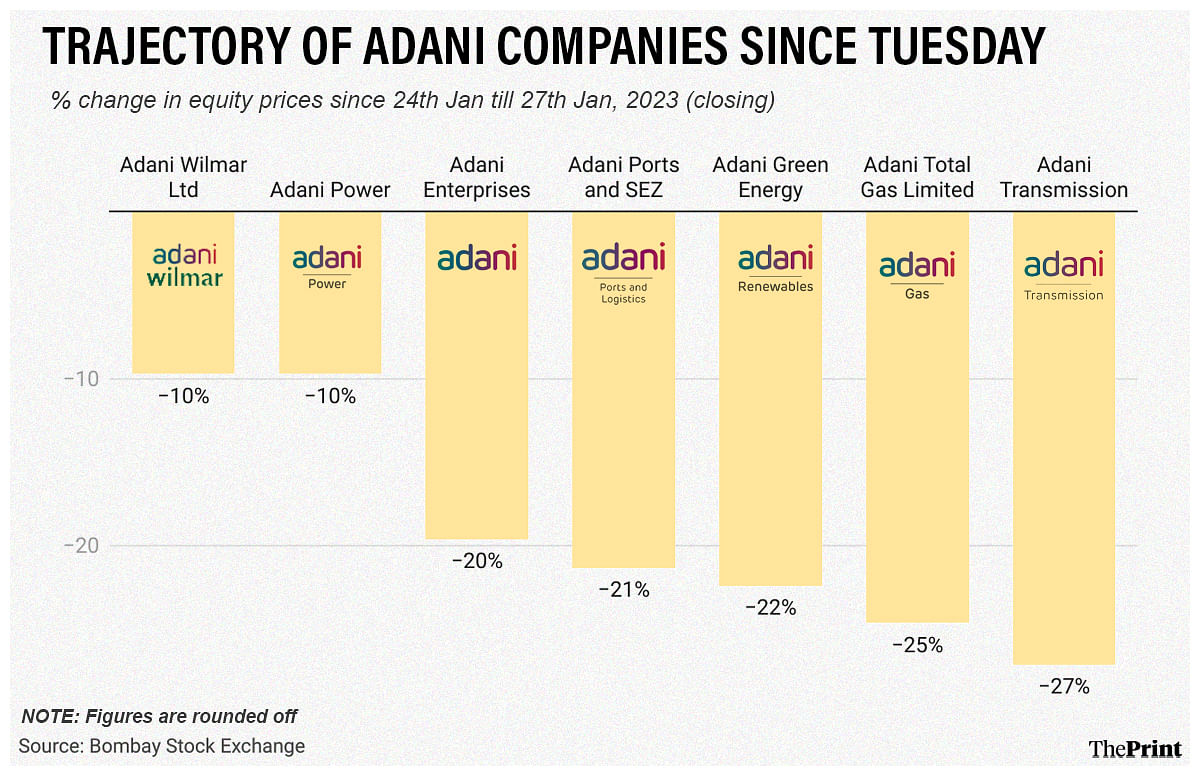

ThePrint looked at the closing prices of the seven companies of the Adani Group listed on the bourses, and the damage to the stock prices of these companies ranged between 10 and 27 per cent.

For this report, ThePrint used the closing prices on Tuesday (24 January) and measured the changes in the stock prices on close of trading on Friday.

Of all the seven listed entities of the Ahmedabad headquartered group, Adani Transmission — which claims to be India’s largest private transmission — witnessed the steepest fall.

The company reported a closing price of Rs 2,756.15 on Tuesday, which dropped by 27 per cent to Rs 2,009.7 on Friday. In simpler words, for every Rs 1 lakh invested in the company till Tuesday, more than Rs 27,000 was lost within just two trading days.

Adani Transmission is followed by another utility provider Adani Total Gas Limited, which is also the most valued stock of the group.

On Tuesday, the private piped gas provider reported a closing price of Rs 3,891.75, which fell by 24.6 per cent by the end of trading on Friday to Rs 2,934.55. A Rs. 1 lakh investment made till Tuesday now is worth around Rs 75,000, i.e. shareholders have lost almost a fourth of the invested values in just two days.

Similarly, the infrastructural companies — Adani Green Energy and Adani Ports and Special Economic Zones — have reported a loss of more than 20 per cent each in the two trading days following the release of the Hindenburg report.

While Adani Green Energy’s stock prices slumped from Rs 1,913.55 to Rs 1,484.5 (a decline of 22.4 per cent), the stock price of Adani Ports and SEZ came down from Rs 760.85 to Rs 598.6 (a decline of 21.3 per cent).

Considered the Adani Group’s flagship company, Adani Enterprise witnessed a slide of 19.6 per cent in its stock value since the release of the report.

The least impacted companies were Adani Wilmar and Adani Power Limited, which witnessed a stock price fall of about 9.7 per cent each.

Founded in 2017, Hindenburg Research released a report on Tuesday that alleged potential stock manipulation and accounting fraud conducted over decades.

“Even before examining the evidence put forward in this report and based solely on financials taken directly from its companies, the Adani Group appears to be highly overvalued,” the US-based financial forensics firm said in its report.

Responding to the findings, the Adani Group has called the report “maliciously mischievous, (and) unresearched”, and is in the process of evaluating “remedial and punitive” actions.

(Edited by Tony Rai)

Also Read: Despite Adani Group’s high debt levels, risk to Indian banks is relatively low