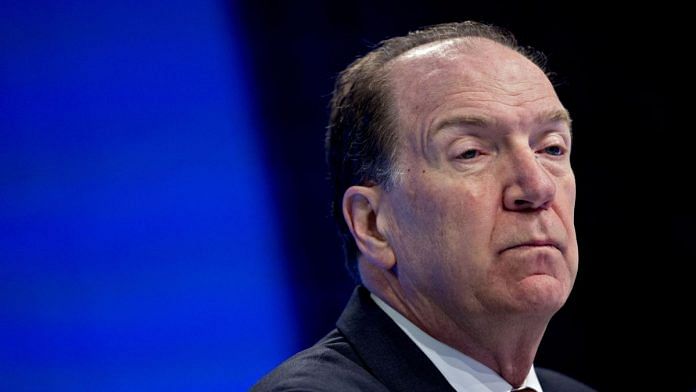

Washington: The World Bank is looking at ways to reduce the amount of debt owed by poor countries — rather than simply delaying payments — to attract more investors in the wake of the global pandemic and recession, President David Malpass said.

The coming months and the annual meetings of the World Bank and International Monetary Fund in October present a good time horizon for action, Malpass said Wednesday in a Bloomberg Television interview with Tom Keene. Malpass said he also sees an opportunity to extend relief under the Debt Service Suspension Initiative that started in May into 2021, an option that he believes will have support from the Group of Seven and Group of 20 leading economies.

“The next step is harder — agreement to actually do haircuts or writedowns,” Malpass said. “But that has happened in the past; for example in the 1980s in the Latin debt crisis, it got to the point of haircuts, but it took so long that the countries were in deep, deep trouble by the time that happened. So one of the things we’re trying to do is accelerate that so you can get to a good outcome sooner.”

At a July meeting, the G-20 said it will decide on extending the current debt-payment suspension closer to the end of the year, putting off assurances of additional relief as the coronavirus pandemic continues to burn around the world. Even with the G-20’s April agreement to waive bilateral debt payments from vulnerable countries, the cost of servicing obligations crowds out health and social expenses.

China is owed almost 60% of the money that the world’s poorest nations would be due to repay this year, according to World Bank data, and the nation has made many loans to developing countries with terms that aren’t transparent and at higher interest rates than the nations can afford, Malpass said. That highlights the importance of China’s participation in the debt relief, he said.

Many of the Chinese creditor agencies, including the Export-Import Bank of China, “are participating in the DSSI with the restructuring terms that other countries are using,” Malpass said. “Some of them are not, so that creates the challenge that we’re working on — by disclosing that.”

China’s Ex-Im Bank and the China Development Bank fund one-fifth of big infrastructure projects in Africa, according to consulting firm Deloitte. In a separate interview later on Wednesday, Malpass said that based on the characteristics of its outstanding debt, the CDB should be participating in the global debt-relief initiative as an official bilateral creditor rather than a private creditor, as it has sought to do.

Official creditors are committed by the G-20 agreement to participate in the debt-payment suspension initiative; private ones are only strongly encouraged to.

Also read: Covid has cost tourism up to 5.5 cr jobs, Rs 1.58 lakh cr revenue — govt tells House panel

Creditors Advantaged

In many developing countries, lending is balanced in favor of creditors rather than debtors in terms of legal structure, creating a moral hazard that incentivizes loaning ever more because creditors are advantaged in restructuring scenarios, Malpass said.

“That makes it difficult to come to debt resolutions that allow light at the end of the tunnel for the developing countries,” he said.

Malpass has repeatedly called on the private sector to participate more in debt relief alongside official creditors and said that the language regarding the need for comparable treatment could be strengthened. He cautioned that official bilateral relief shouldn’t be conditioned to the private sector’s level of involvement.

Malpass said that the World Bank and IMF are working on assessing the debt sustainability of developing countries and will be discussing that in annual meetings in October. He said that the World Bank wants to avoid a situation where a significant amount of its assistance is used by countries at risk of debt problems to service past borrowing.

“We want good outcomes for developing countries and in particular for the poorest,” he said. – Bloomberg

Also read: Saudis expected to join historic Israel-UAE peace deal, Trump says