London: OPEC may have no appetite to cut oil production deeper when it meets next month, but flaring political crises across the group are once again threatening supply.

Unrest erupted in Iraq and Iran this month — two of the Middle East’s biggest producers — as people took to the streets protesting financial hardship and bad governance. That’s adding to the range of supply threats already afflicting the Organization of Petroleum Exporting Countries, from economic collapse in Venezuela and simmering discontent in Algeria to the recent missile attack on Saudi Arabia.

“We kind of had a second Arab spring, but it’s been under the radar,” said Helima Croft, chief commodities strategist at RBC Capital Markets. “The real question is what is going to happen in Iraq.”

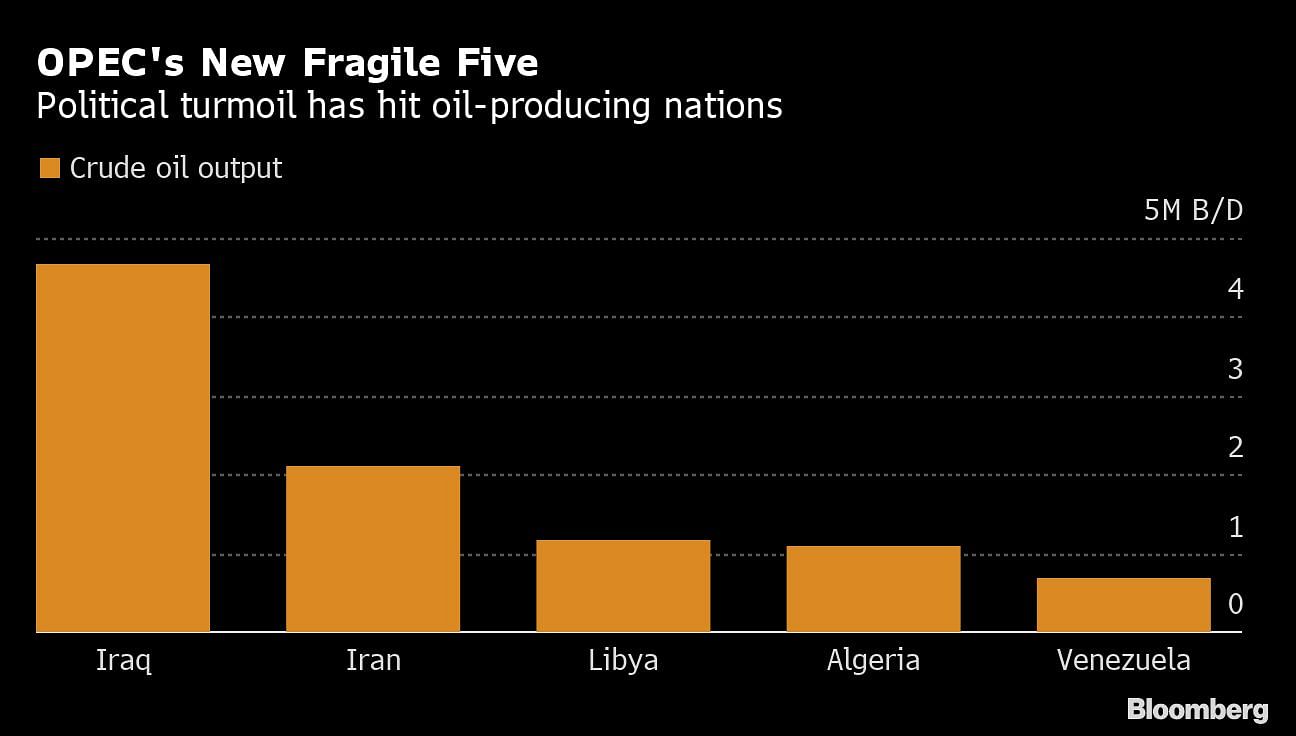

Iraq, OPEC’s second-biggest member, has violently cracked down on demonstrations against corruption in recent weeks that have spread to the southern oil hub of Basra. Iran has seen its oil exports slashed by U.S. sanctions and is brutally suppressing protests spurred by the resulting economic stagnation.

Also read: India asks OPEC not to cut oil production, seeks better commercial terms

OPEC and its allies — who together pump about half the world’s oil — will meet in Vienna in early December to consider production levels for 2020, having cut output this year to prevent a global surplus. Despite signs that fragile global demand and surging U.S. shale supply will unleash a new glut, they’ve signaled no desire to reduce output further.

They may not have a choice.

In recent years, unplanned supply disruptions within OPEC nations have done as much to keep markets balanced as the cartel’s deliberate cutbacks. Iran and Venezuela have lost a combined 1.7 million barrels a day since last October, more than all 24 nations in the OPEC+ coalition agreed to cut this year.

As turmoil intensifies across the group, next year could see more accidental losses: oil prices of about $60 a barrel are already below levels most OPEC nations need to cover government spending, and a further slump would only deepen the strain.

“There is no better way to put it: the geopolitical risk is rising in the Middle East again,” said Tamas Varga, an analyst at PVM Oil Associates Ltd. in London.

Algeria is struggling to placate a mass youth-led movement seeking change after ousting long-term President Abdelaziz Bouteflika earlier this year, and Libya remains split by armed factions. Ecuador, which will leave OPEC in January, suffered a 20% slump in oil production last month amid riots and looting.

Also read: Saudi oil shock will probably not matter as much to the world as it could to India

The biggest risk is posed by Iraq, according to RBC’s Croft. While the country’s oil sector has proven robust during recent turbulence, even boosting output when Islamic State militants captured swathes of territory five years ago, the latest demonstrations reflect a new level of popular discontent.

“If you had attacks on infrastructure, oil workers going on strike — Iraq is the place that could surprise the market,” she said.

Iraq’s current unrest is partly driven by widespread anger at Iranian interference in its politics, but as Iran’s own troubles worsen that involvement will only intensify, according to Croft.

As it reels from President Donald Trump’s campaign of “maximum pressure” — aimed at forcing the Islamic Republic to curtail its nuclear program — Tehran will likely retaliate by asserting its influence in the region, she said.

Iran could try to destabilize oil production in the south of Iraq, where American companies such as Exxon Mobil Corp. operate, Croft said. There may also be consequences for Saudi Arabia.

Half of the kingdom’s output capacity was temporarily knocked out when its Abqaiq processing facility was blasted by drones and missiles on Sept. 14. The brief disruption halted 5.7 million barrels a day, or about 5% of global oil supply.

Also read: The world’s oil glut is much worse than it looks

Yemen’s Houthi rebel group claimed credit and U.S. officials blamed their allies in Iran, though Tehran denied responsibility. It followed a spate of attacks on oil tankers in the region, which Washington also blamed on the Islamic Republic.

Unless Tehran is given relief from the sanctions squeezing its economy, further incidents are likely, said Bob McNally, president of Rapidan Energy Group and a former oil official at the White House under President George W. Bush. That could dramatically alter the anticipated picture of oversupply.

“Barring a diplomatic breakthrough, the next Iranian attack on Saudi oil facilities is more a matter of where and when than if,” said McNally. – Bloomberg