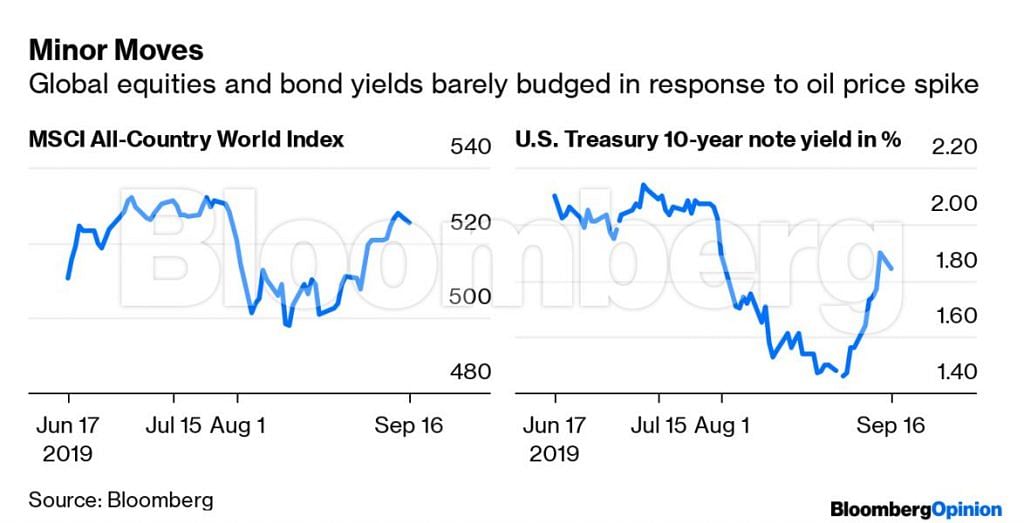

The main takeaway from the biggest-ever surge in oil prices after an attack wiped out about half of Saudi Arabia’s output capacity over the weekend is that it may not truly matter. The global stock market as measured by the MSCI All-Country World Index fell to its lowest — wait for it — since Wednesday. And while there was a flight to safety, the yield on the benchmark 10-year U.S. Treasury note only dropped to its lowest since Thursday.

Also read: Oil spike sends India assets lower as inflation concerns revive

Those moves may seem less than proportionate to the attack, which resulted in the sudden loss of 5.7 million barrels of oil a day, more than the 4.3 million lost during the 1990 Gulf War or the 5.6 million during the 1979 Islamic Revolution. But losing such a large amount of production in an $84.8 trillion global economy isn’t the same as when the economy was just $37.9 trillion in 1990 or $27.4 trillion in 1979. The relatively muted moves also underscore how the global energy market has become more diversified, with the U.S. now a net exporter of crude oil and refined products. And while this may change if Saudi production doesn’t come back online as quickly as forecast or if geopolitical risks escalate as a result of the attack, West Texas Intermediate crude prices — at about $63 a barrel on Monday, up more than $8 on the day — are still less than the $66.60 they reached in April and less than last year’s high of $76.90 in October. Looked at another way, oil prices are up only 48% from last year’s low on Christmas Eve. That may sound like a big move, but DataTrek Research notes that every U.S. economic downturn since 1970 has been preceded by a doubling of oil prices in the previous 12 months. Based on that, the firm figures that oil wouldn’t be a problem for the economy until it reached $80 a barrel.

LPL Senior Market Strategist Ryan Detrick points out that the last 10 times West Texas Intermediate crude futures surged more than 10%, the S&P 500 rose eight times. That fits the glass-half-full narrative, which is that with the U.S. a net exporter, higher oil prices might even spark investment in its energy-related industries. Even so, it’s not as if the world is desperate for oil. As my Bloomberg Opinion colleague Julian Lee pointed out, it was just a few days ago that OPEC and its allies were bemoaning the excessive inventories still sloshing around the world after more than two and a half years of supply restrictions.

Also read: Trump vows US ‘locked and loaded’ if Iran was behind attacks

Stagflation ahead?

The big surge in oil prices had the bond market sending a rare and unusual signal Monday. On the one hand, U.S. Treasury yields fell as investors sought haven assets in case the attack escalates into a broad geopolitical crisis that further weighs on economic growth. On the other, breakeven rates on five-year Treasuries, a measure of what traders expect the rate of inflation to be over the life of the securities, rose to the highest since July. Of course, it’s still early days, but so-called stagflation, in which economic growth slows to a stall and inflation accelerates, is a deadly combination for markets as seen in the 1970s. Federal Reserve Chairman Jerome Powell is sure to get questions on what the oil spike means at his press conference on Wednesday after the central bank’s policy meeting where it’s expected to cut interest rates for the second time since July. Even before the jump in oil prices, investors were becoming jittery about evidence of faster inflation. The Labor Department said last week that the core U.S. consumer price index rose 0.3 percent in August, the first time it has risen that much for three consecutive months since the 1990s. If the report signals that the slowdown in inflation earlier this year truly was “transitory,” as Powell has described it, it could call into question the need for further rate cuts as well as the historic low in bond yields.

Also read: India condemns drone attacks on Saudi Arabia oil sites

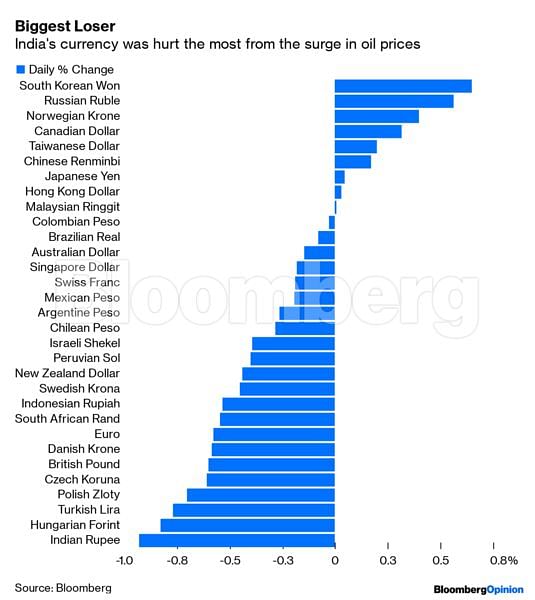

India loses the most

One place where the surge in oil prices is likely to have a big impact is India. The rupee was the biggest loser in the currency market Monday, weakening as much as 1.06% and extending its decline over the past two months to 4.26%. The currency suffered a disproportionate hit not only because India is one of the world’s biggest importers of oil, but because it also suffers from a deficit in its current account, which is the broadest measure of trade because it includes investment. Economists estimate that every dollar increase in the price of oil adds about $2 billion to India’s costs to import crude. The timing is also not good, with the rupee already under pressure on concern that foreign funds may continue to head for the exits after economic growth slipped below trend of two consecutive months. Foreign funds pulled $2.3 billion from Indian shares in August, the biggest outflow since October. “If crude prices stay up, the Reserve Bank of India may not be able to deliver more than 25 basis points of cuts,” Naveen Singh, head of fixed-income trading at ICICI Securities Primary Dealership in Mumbai, told Bloomberg News. As the “I” in the BRIC acronym that also includes Brazil, Russia and China, any lasting strength in Indian markets has the potential to lift emerging-market assets globally; the opposite can also happen.

One less bear

It didn’t receive a lot of attention, perhaps because the news broke late Friday after markets had closed and then the Saudi oil attacks happened, but one prominent bear on the stock market has capitulated. Tobias Levkovich, Citigroup Inc.’s chief U.S. equity strategist, raised his year-end target for the S&P 500 Index to 3,050 from 2,850, going from the fourth-bearish among Wall Street prognosticators tracked by Bloomberg to one of the few who still see gains for the rest of 2019, according to Bloomberg News’s Lu Wang. The new target represents a 1.4% increase from Friday’s closing level of 3,007.39. Levkovich’s newfound optimism is built on a scenario in which a glut of supply has dwindled, setting the stage for a recovery in production. Industries such as semiconductors have suffered profit declines amid excessive inventory, and earnings among S&P 500 companies are expected to fall 3% in the third quarter before rebounding to a growth pace of 3.8% in the fourth, analyst estimates compiled by Bloomberg showed. “A required inventory correction is ending, with production likely to pick up modestly just to meet end-market demand,” Levkovich wrote in a note to clients. As a result, fourth-quarter “earnings estimates may not need additional trimming.” Wang notes how strategists have been forced to play catch up with a market that has risen about 20% this year. Based on the last Bloomberg survey in mid-August, all but six of 21 strategists have seen the benchmark exceed their year-end targets.

Market plumbing goes haywire

The repurchase, or repo, market may be tremendously opaque, but few things are more important when it comes to making sure markets broadly are running smoothly. That’s why it’s often referred to as the market’s plumbing system. So when there’s a glitch in the repo market, it pays to take notice — like now. ICAP pricing shows that the rate on overnight repurchase agreements soared by 1.53 percentage points to 3.80%, the largest daily increase since December, according to Bloomberg News’s Alexandra Harris. The spike may be a sign that the Federal Reserve is having trouble controlling short-term interest rates. Market participants are watching to see how long these elevated levels persist, as any prolonged pressure could signal unruly funding markets at the end of the year, Harris reports. A combination of factors seem to be behind the move higher, including the settlement of the mid-month Treasury coupon auctions, which pushed more collateral into the repo market. At the same time, cash is leaving the funding space as corporations withdraw from banks and money-market funds to make their quarterly tax payments. The surge suggests the next few months could be volatile given the expected increase in Treasury borrowing, bloated dealer balance sheets, regulatory issues and a banking system where reserves are already scarce.

Tea Leaves

Data from the Treasury Department last week showed that the U.S. budget deficit surpassed $1 trillion in the first 11 months of the fiscal year through August. That means the U.S. needs to do a lot of borrowing to finance the shortfall. One big source of demand is foreign central banks and investors. They have piled into U.S. debt this year, increasing their holdings by $380 billion, or 6.08%, through June to $6.64 trillion, Treasury data show. Both the absolute and percentage increase is the most for any full year since 2012. The Treasury will give an update on foreign purchases on Tuesday, but with U.S. debt yielding so much more than the rest of the world on average, July should be another banner month. U.S. Treasuries on average yield about 1.83 percentage points more than government debt anywhere else. As recently as 2013, Treasuries yielded less than their peers on average.