New Delhi: China’s investment in the Asia-Pacific region picked up momentum in 2023, touching $37 billion in comparison to $29 billion in 2022, even as its own economy faltered throughout the year, a new report has found.

China has focused its funds largely in the technology, metals and mining sectors.

The report by Brisbane-based Griffith Asia Institute at Griffith University found that Beijing’s investments across the Asia-Pacific region totalled $20 billion in 2023, while $17 billion was through construction contracts – some of which were partly financed by Chinese loans.

Published Thursday, the report highlighted that 94 deals were struck between Chinese companies and state-owned enterprises (SOEs) in countries across the region.

According to the report, Chinese financial engagement in the Asia-Pacific region has normally been through investments — where Chinese investors take equity stakes at higher risks and “use economic and cultural ties” to gain access to markets.

The average size of investments in 2023 stood at $499 million, while for construction projects it was $401 million according to the report. Global foreign direct investment (FDI) to developing countries in Asia saw a steep 12 percent drop in 2023, which was in stark contrast to China’s increasing investments in the region.

“In recent years, China has been focusing on its neighbouring regions – the Greater Bay Area (Macau, Guangdong, Hong Kong) and Southeast Asia. The increasing assertion of Beijing’s economic prowess is seen in this region,” said Aravind Yelery, associate professor at Jawaharlal Nehru University.

“Its domestic economic headwinds should not be seen as a reason for a downturn in foreign investment by its companies,” he told ThePrint.

The report comes after China’s premier Li Qiang announced a growth target of “around 5 percent” for 2024 during the ongoing session of the National People’s Congress.

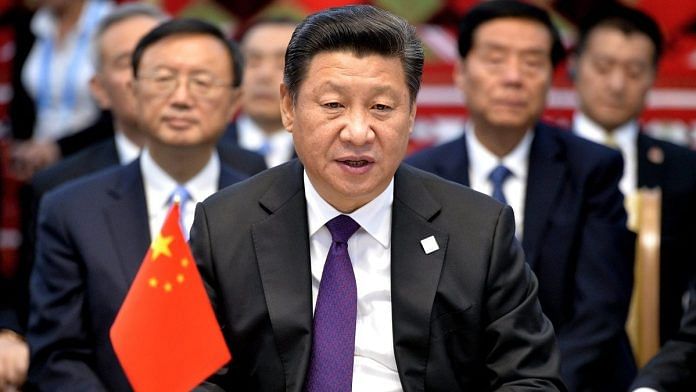

The lower growth estimate builds on President Xi Jinping’s admission that the Chinese economy faced “headwinds” earlier this year.

Fifty-three economies were considered in the report. They include countries from Central Asia, South Asia, Southeast Asia, Oceania and East Asia.

Indonesia was the single largest recipient of Chinese investments with about $7.3 billion in 2023, followed by Malaysia ($2.7 billion), Singapore ($2.6 billion) and South Korea ($2.3 billion).

Sri Lanka, which witnessed no engagement in 2022, signed a deal worth $4.5 billion with the China Petroleum and Chemicals Corporation (Sinopec) in November 2023 to build a refinery in Hambantota.

Kazakhstan received the highest amount of construction projects worth $1.8 billion. Singapore ($1.7 billion), Uzbekistan ($1.4 billion) and Cambodia ($1.2 billion) are the other countries that round up the top four.

Six countries, however, saw a 100 percent drop in engagement, including the Philippines, Mongolia, Mongolia, Papua New Guinea and Tajikistan.

Also read: 2 sessions in Beijing show the country isn’t just evolving but fully turning into Xi’s China

‘Investments to ensure soft-landing for SOEs’

China directs its infrastructure companies to invest in foreign markets, to help keep its own domestic manufacturing capacity running, said Gunjan Singh, an associate professor at O.P. Jindal Global University.

“Through this diversion of capacity, it ensures a soft-landing for its state-owned enterprises, even as its domestic markets struggle. When the Belt and Road Initiative (BRI) was launched in 2013, China sufficiently developed its own domestic markets. The BRI helped in reducing its overcapacity of manufacturing issues,” Singh added.

The Belt and Road Initiative is Beijing’s flagship infrastructure initiative. More than 150 countries are part of President Xi’s BRI, touted as the “project of the century”. It envisages new trade routes connecting China with the rest of the world.

In the past 10 years, China’s investment to the Asia-Pacific region cumulatively stood at $530 billion, the report said. About $245 billion has been invested through construction contracts and $285 billion in non-financial investments.

“The BRI has matured over the years. It is no longer looking at rudimentary engagement. The focus is now on green technology, internet of things (IoT), services and critical minerals. It is looking at its backyard to upgrade its capacities in investments and supplies,” Yelery told ThePrint.

He added: “Beijing has identified its future strengths — critical minerals, smart technologies and smart financing. Its projects focus on building its own ecosystem — not just mining of minerals, but the construction of roads, airports and ports to support its investment.”

For China, such projects are less of an issue, Yelery explained, given that its companies, often SOEs, have a captive manufacturing market at home, to process the metals and minerals. This is in contrast with Western companies, who are forced to first bid on such projects and then focus on creating a market for goods, he said.

For Singh, China’s investment in metals and mining is a part of its strategy to ensure a greater chokehold on the sector, tempered with the knowledge of western attempts to de-risk supply chains.

( Edited by Tikli Basu)

Also read: India was right to block China-led investment pact at WTO. It protects global order