New Delhi: Soon, customers will be able to transfer money electronically via National Electronic Funds Transfer (NEFT) and Real-Time Gross Settlement System (RTGS) free of cost. The Reserve Bank of India (RBI), in its bi-monthly monetary policy meeting Thursday, decided to waive charges applicable to banks for online money transfers routed through NEFT or RTGS.

Banks, in turn, have been asked to pass on this benefit to their customers. The move, aimed at boosting digital transactions, will come as a huge relief to users.

“In order to provide impetus to the digital funds movement, it has been decided to do away with charges levied by the RBI for transactions routed through RTGS and NEFT systems. Banks will be required, in turn, to pass on these benefits to their customers. Instructions to banks in this regard will be issued within a week,” the RBI said in a statement.

Several banks said that once a detailed guideline is received from the central bank, they will take necessary steps to pass on the benefits to their customers.

“This could take another couple of days but it should not be a problem. We are ready,” said a senior executive at a private bank, who did not wish to be named.

What are NEFT, RTGS?

These are online modes of fund transfer, which have made transactions from one account to another seamless, easy and quick.

NEFT can be availed via Internet banking and also by visiting a bank branch. Smaller branches, however, do not have this facility. The transaction is completed within a few hours. RTGS is used for high value transactions — the minimum transfer amount should be of Rs 2 lakh.

Also read: Message from RBI: Expect more rate cuts this year

How funds transfer took place via NEFT, RTGS before RBI’s announcement?

The central bank has been levying a minimum charge on banks for all transactions routed through NEFT or RTGS. And banks have been passing on this burden to their customers. Essentially, this means that each time a customer undertakes an NEFT or RTGS transaction, she or he has to pay a charge.

Lenders such as the State Bank of India and ICICI Bank have multiple fee slabs, depending on the amount transferred. NEFT transaction charges for an amount of up to Rs 10,000 would typically be about Rs 2.50. The charges increase with higher amounts for transaction. For RTGS — large value transaction — the charges are even higher.

Government’s digitisation drive

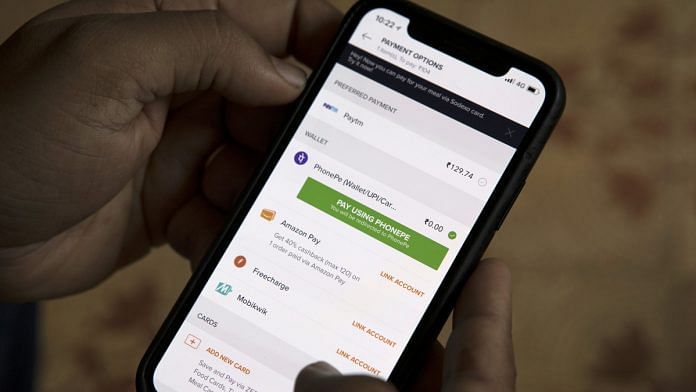

The Narendra Modi-led government, while coming down heavily on black money, has been pushing for a “less-cash” economy by boosting digital payments. Post-demonetisation, in November 2016, the NDA government had laid thrust on expanding online payments by promoting various digital payment modes, including use of plastic money and e-wallets — which are electronic cards meant for online transactions through a computer or smartphone.

Also read: RBI is becoming the model central bank to the world

Sbi bank chgs MAB monthly charges n also for deposits after 4 th transaction in saving account for rural areas . For common man this both charges needs to be removed. If anyone from RBI read this pls suggest to SBI as crores pour in bank from this two charges.