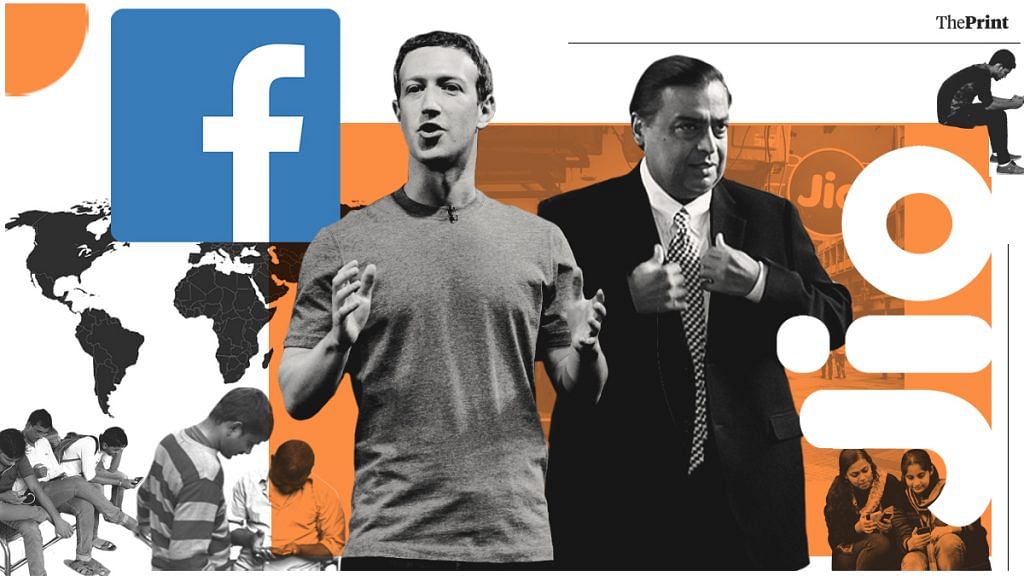

Mark Zuckerberg-led Facebook has bought a 9.99 per cent stake in Mukesh Ambani’s Reliance Jio Platforms for Rs 43,574 crore. This is the largest FDI for a minority investment and makes Jio the fifth-largest firm in India. Facebook wants to use WhatsApp for e-commerce opportunities with small businesses. Its competitors will be Alibaba-backed Big Basket, Amazon’s Pantry and Walmart-owned Flipkart.

ThePrint asks: Jio-Facebook deal: Boosts India as FDI destination or threatens to be e-commerce monopoly?

Amazon, Flipkart can’t compete with Jio-FB because they don’t have edge on data. It will upturn e-commerce ecosystem

National Co-Convener of Swadeshi Jagaran Manch

Facebook and Jio’s alliance will not only counter competitors like Amazon and Flipkart, but will rupture the entire ecosystem of e-commerce in India. Although I doubt with the Covid-19 crisis anything significant will happen in the next 3-6 months, so we need to look at the long-term impact of this deal.

First, it is important to remember that Facebook is piggybacking on Jio providing internet access in India. With an edge on data, this partnership threatens the very concept of net neutrality and opens the door to even more deep anti-competition tactics like deep discounting, etc. Amazon and Flipkart won’t be able to compete because they won’t have the leverage of data. Apart from this, digital payment apps like PayTM and PhonePay already facing cash crunches will be forced to join Jio and Facebook’s platforms.

This deal will even change the way the Indian public receives information, through news, songs, media, and possibly monopolise it. Reliance already has JioSaavn, and Viacom18 under its belt. Therefore, we can’t just laud this deal as a win for FDI but must also recognise the e-commerce ecosystem that it threatens to upturn. This deal should, therefore, be looked upon as anti-competitive and it calls for appropriate response from the regulator, that is, Competition Commission of India (CCI).

Jio is betting on ‘small is big’, while FB wants to make it big in its biggest market — India

Business journalist

The FB-Jio deal is the coming together of one of the world’s biggest data platforms and India’s biggest data platform.

India’s is the biggest market, in terms of subscribers, for the social networking giant’s flagship products, Facebook (over 250 million) and WhatsApp (400 million). The timing of the deal couldn’t have been better to bolster India’s image as a destination for foreign investment. The partnership creates a powerful entity for the Indian market, with competitors like Amazon and Walmart-owned Flipkart. That means smaller e-commerce rivals will be unable to match their might.

‘Small is big’ – that is Reliance Jio’s mantra for the future. It hopes to hem together myriad small businesses on its Jio platform to build India’s biggest e-commerce engine. That vision matches Facebook’s, which monetises its platform with listing of small businesses and would like more business to be done via Facebook and WhatsApp in India.

Jio Money and WhatsApp Pay could have an important role as the enablers of e-commerce. While online commerce could be the beginning, healthcare could be the next big opportunity for the platform.

Several state governments, in tie-up with Jio, are now offering the poor smartphones as part of its official programme. That could swell usage for the platform. The future of India’s online commerce is unfolding.

Large-scale deal like Jio-FB should adhere to letter and spirit of India’s FDI norms and be business enablers

National Secretary General, Confederation of All India Traders

India is one of the largest consumer markets in the world and so this deal comes as no surprise. I expect more such initiatives to take place in the future. E-Commerce, especially digital payments, has a good future in India as it is popular among the younger generation (18-40 years).

However, there are two expectations from any new and large-scale deal like this. First, it should adhere to the letter and spirit of India’s FDI norms. Second, capital infused should be used to develop the Indian market and overall infrastructure rather than rout competition and gain dominance. The first kind is key to development while the second negatively impacts India’s core strength of its diverse businesses.

We also shouldn’t forget that when it comes to data sharing, Facebook has been found to violate domestic laws across the world. Therefore, I would be extremely sceptical if WhatsApp is used as a tool for Facebook’s deal with Jio.

Thankfully, Indian consumers are getting wiser. For example, during the Covid-19 lockdown, they saw which kind of business helped them keep their homes stocked with food and goods and which kind sat silent. Consumers have a clear sense of business opportunists and business enablers.

I expect Indian consumers will support businesses that are working for the long-term greater good.

Facebook-Jio deal indicates that India’s post-Covid recovery will be fuelled by its retail sector

Senior Fellow & Head of Research, Pahle India Foundation

The Facebook-Jio deal indicates that India’s post-Covid recovery will be fuelled by its retail sector. Foreign businesses have always wanted their finger in the retail pie. It is also no surprise that digital companies and payment service providers are also vying for the same pie. The FDI should be a welcome in the strained balance sheet of the too-big-to-fail Reliance.

The fear of monopolies being created in the e-commerce space, relevant or remote, remain irrespective of Facebook’s buy-in. What is, however, interesting is the proposed business model of JioMart.

The model proposes to co-opt kirana stores. This could mean that kirana stores would face competition from their own kind from other markets in the vicinity. This model seems to have evolved organically in certain geographies in India for some of the existing large e-commerce players.

In India, retail will never be a zero-sum game. The neighbourhood kirana store has always been the cornerstone of the Indian food and grocery retail sector. Kirana stores have always weathered competition and upgraded to remain in business. However, India’s retail market is evolving. We must create a uniform retail policy, not just e-commerce, to facilitate new models of collaborative competition.

Facebook investment in Jio is welcome news for economy and will attract plenty of eyeballs globally

Policy analyst, The Takshashila Institution

The Facebook investment is welcome news for the economy. With government investment constrained, and corporate investment drying up, Facebook’s bid will attract plenty of eyeballs globally. In a climate where the world is struggling to find a bright spot for growth, this is exactly the right kind of attention to grab.

It is also not a foregone conclusion that the deal will establish an e-commerce monopoly. There are seven key assets to a standards war — control over an installed base of users, intellectual property rights, ability to innovate, first-mover advantages, manufacturing abilities, strength in complements, brand name and reputation. Given the deal, Jio-Facebook will have the first-mover advantage thanks to WhatsApp and JioMart.

However, a first-mover advantage on its own does not rule out either Amazon or Walmart (Flipkart) competing in this space. There is every chance it may end up being one of those times where doing it right is more important than doing it first.

The deal is a great opportunity for Facebook to monetise WhatsApp and morph it into a version of WeChat for India. For kirana stores, in the near future, it might mean making a wider range of cheap fast mover consumer goods available to more consumers.

Also read: Coronavirus is bad news for FDI in emerging markets. But there is a silver lining

By Pia Krishnankutty, journalist at ThePrint