New Delhi: Home Minister Amit Shah and his wife, Sonal Shah, together saw their investments in the stock market grow a solid 71 percent over the past five years to Rs 37.4 crore as of 15 April 2024, according to the affidavit Shah filed with the Election Commission of India Saturday.

This works out to 57 percent of their total assets, with the rest held in the form of property, savings account deposits, mutual funds, gold, and investments in schemes like the National Small Savings Scheme.

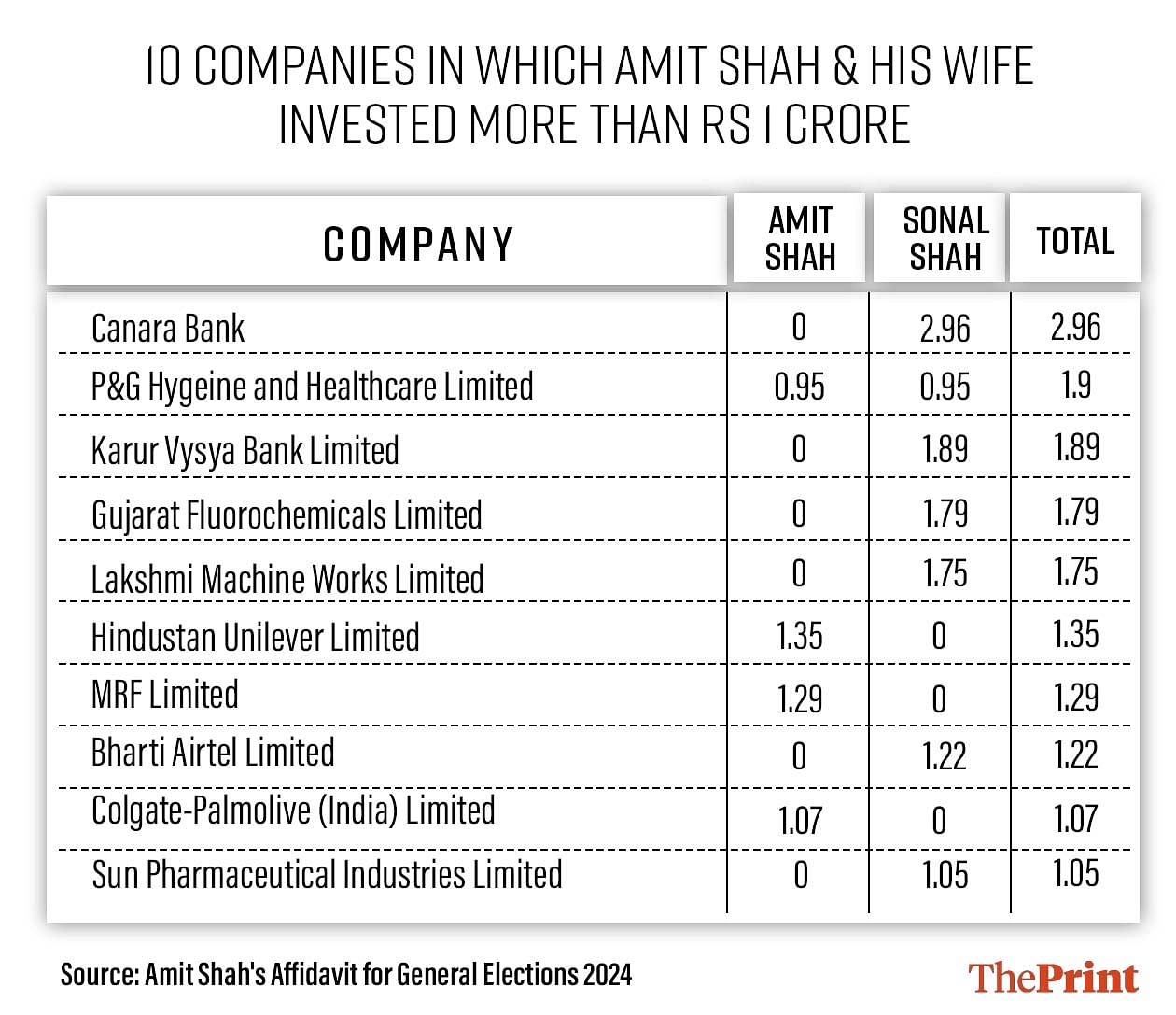

The investment decisions taken by Shah and his wife do not exhibit a clear pattern, since their investments are spread across 242 companies spanning multiple sectors. What is notable is that they have invested more than Rs 1 crore in just 10 companies. These account for 43 percent of the total investments that the couple have made in listed companies.

A deeper look at Sonal and Amit Shah’s equity investments shows that banking and FMCG stocks are of particular interest to them. Just two banks — Canara Bank (Rs 2.96 crore) and Karur Vysya Bank Limited (Rs 1.89 crore) — accounted for about 13 percent of their entire stock market allocation. Apart from this, the two also made smaller investments in Bandhan Bank, and the State Bank of India and some of its subsidiaries.

The affidavit also shows that several FMCG majors feature on the list of companies in which the two have together invested more than Rs 1 crore. For example, they invested Rs 1.9 crore in Procter & Gamble Hygiene and Healthcare Limited, Rs 1.35 crore in Hindustan Unilever Limited, and Rs 1.07 crore in Colgate-Palmolive (India) Limited.

Together, these three made up nearly 12 percent of their stock investments.

Other companies where they invested more than Rs 1 crore were Gujarat Fluorochemicals Limited (Rs 1.79 crore), Lakshmi Machine Works Limited (Rs 1.75 crore), MRF Limited (Rs 1.29 crore), Bharti Airtel Limited (Rs 1.22 crore), and Sun Pharmaceutical Industries Limited (Rs 1.05 crore).

Overall, Shah and his wife saw their total assets — both movable and immovable — grow to Rs 65.7 crore in 2024, from Rs 40.3 crore in 2019, amounting to a growth of 63 percent. The two saw their investments in movable assets grow 82 percent, while the value of their immovable property grew just 36 percent over these five years.

(Edited by Mannat Chugh)