Many people feel that the Vastu of SEBI is defective. Being dragged into controversies is in its DNA. It started with the selection of its second chairman, G.V. Ramakrishna (G.V.R. to many). He became the first chairman to function under the newly enacted SEBI Act. Other bureaucrats and he himself felt that because he could not be accommodated as a secretary in the Government of India in a ministry that he deserved, he was shunted to SEBI in Mumbai, an organization that was not yet fully functional.

When SEBI came into existence in 1988, the first chairman was S.A. Dave. G.V.R. was appointed in 1990 at a time when there was no certainty when the SEBI Act would be passed. The stock exchanges did not want SEBI. The brokers did not like it as they had to pay fees to SEBI out of their own revenue. Several court battles later, which were settled in the Supreme Court, brokers agreed to pay fees to SEBI.

G.V.R.’s tenure saw the foundation for a solid institution being laid. He was a well-meaning person with vast knowledge of the government and public institutions. Public interest was uppermost in his mind in all situations. He was succeeded by D.R. Mehta, another respected person who had worked in the ministry of finance as well as in the RBI as a deputy governor. But in all these appointments, the question that remained unanswered was whether the government was selecting somebody out of expediency or actual suitability for the job. There was no consistency about the tenure of the chairman, and different people were selected for different lengths of time. A search-cum-selection committee was created. But who would be the members of the selection committee and who would be heading it was always left to the discretion of the finance minister. This left the impression that there was no objective and consistent criterion being followed.

Also read: Karvy crisis shows SEBI must clean up or clear out dodgy stock brokers

My initial years at SEBI

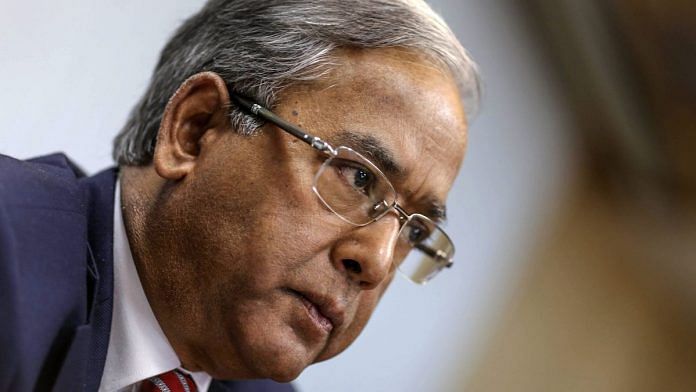

The interview for the post of chairman of SEBI took place in December 2010. That same evening, I got a call informing me that the committee had unanimously recommended my name for selection as the chairman. While I was hoping to be appointed this time and for the revised tenure of five years, to my surprise, the appointment order stated that I was to take the post ‘initially for a period of 3 years…’ In spite of this setback, I joined SEBI in February 2011.

One of the first major challenges that I immediately faced was to take a stand before the Supreme Court in the PIL filed by Mohan Gopal in the C.B. Bhave– NSDL matter. This matter had been placed before the SEBI board. It was felt that the earlier stand of refusing to relook at the matter would be an affront to the Supreme Court since it had specifically asked the views of the SEBI board under its new chairman. A decision was taken to inform the Supreme Court that the case would be re-evaluated. When the matter was heard by SEBI, an order was passed against NSDL. The latter then appealed before the SAT, which set aside the SEBI order. SEBI has gone to the Supreme Court against this order and until the time of this writing, the matter is still pending.

Immediately after the decision was taken by the SEBI board to relook at the matter against NSDL, a series of very strong attacks, against me in particular and SEBI in general, were initiated.

For the first three months after joining SEBI, I did everything to learn about the inner workings of the organization. I tried to understand the issues, had a series of internal meetings, and met market participants and other experts so as to draw up a strategy and vision for SEBI.

In May 2011, I had a very big town hall meeting with officials at various levels. It was a fairly long conversation trying to identify the role of and current expectations from SEBI, the strength and weaknesses of the organization, the path it needed to take and how it should go about it. I unfolded my plan about what I wanted to focus on and what I expected from the team. As is customary, a summary was presented by one of the wholetime members after this talk. He was effusive in his praise for my understanding, knowledge and vision about SEBI and the securities market. He also made a remark that he was unlucky that his tenure would be coming to an end shortly and he would not be there to implement this vision. But within two to three weeks of this meeting, the same person wrote a letter to the prime minister making allegations against the finance minister and his Officer of Special Duty (OSD) Omita Paul, and also drew me into the controversy by saying I am not able to withstand pressure from the minister and his team about helping a few business houses, which he named in the letter. The letter got leaked in the media and sparked off serious discussions across the country.

Also read: Top mutual funds risk SEBI wrath for giving Zee group more time to repay debt

When the existing chairman was denied a two-year extension and the selection process for a new chairman was initiated, it became clear that this person was not likely to be granted another term as a whole-time member. He then approached the chairman to appoint him as the director of National Institute of Securities Markets (NISM), Navi Mumbai. NISM had been created by SEBI to be a nodal centre for studies and research in securities market. It has a board of governors headed by the chairman of SEBI. The proposal was approved by the chairman of the board of governors of NISM, i.e. the SEBI chairman. However, the process also required a separate approval from the chairman of SEBI, although they were one and the same person. For some reason, may be because of the controversy that had already surfaced, the chairman did not back up his own recommendation. He rang me up to say that since my notification as chairman of SEBI had been issued by the government and I was about to join shortly, he would like to record in the file that he had discussed the matter with me and that I had no objection to the appointment of the wholetime member as the director of NISM. I advised the exisiting chairman that it would not be proper because until I had assumed my duties I had no locus standi in SEBI. He should function as the SEBI chairman with full authority until his last day in office and take decisions that he thought were right.

The chairman recorded in the file that the matter should be placed before his successor and did not approve the appointment. When I came to SEBI, the whole-time member approached me to approve his NISM appointment so that he could stay on in Mumbai. However, I found that the board of governors of NISM had erred in not following the procedure of appointment of the director. The rules also required that a set of names should be recommended by NISM, so that SEBI could select one of them. But only one name had been sent to SEBI in this case. No reason had been recorded as to why the procedure prescribed under the rules had not been followed. The whole-time member was naturally disappointed with me. Another reason I didn’t want to bypass the rules was that there were allegations of misuse of power and influence related to a property purchased by this person in Mumbai. The government sent a communication asking for SEBI’s views.

Also read: SEBI, ED and CBDT – the new hurdles in Modi govt’s war on bad loans

I got the matter examined by the Chief Vigilance Officer (CVO), and she found that there was no evidence of any irregularity in the purchase of the property. A report with these findings was sent with my approval to the government. But the government did not close the matter and kept on sending many supplementary queries. I did not want to appoint this member as director of NISM bypassing rules, especially when a vigilance matter against him was still pending in the government. I suspect that all these matters put together must have weighed on his mind when he decided to write that letter to the PM, dragging me into the controversy.

One day he informed me in a very agitated manner that some income tax officers had also visited his home and his income tax filing was being scrutinized. He believed that there was a conspiracy against him, and was feeling harassed. This could have been the immediate provocation for the letter he wrote. His tenure ended on July 2011, within five months of my joining.

This excerpt Going Public: My Time at SEBI by U.K. Sinha has been published with permission from Penguin Random House India.