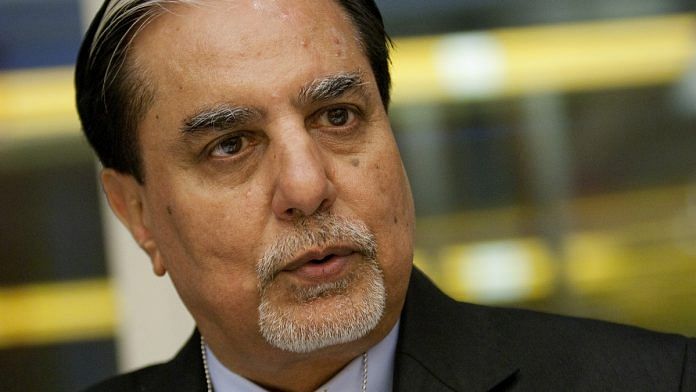

Mumbai: India’s top mutual funds risk running afoul of the country’s securities regulator for granting more time to media mogul Subhash Chandra for repaying nearly a billion dollars in debt.

Shares of the group’s flagship Zee Entertainment Enterprises Ltd. have steadied since hitting a five-year low Monday after the group said the money managers had agreed to extend the repayment timelines on obligations due by September-end.

What’s unclear is how the extension will be looked at by the regulator, who in June invalidated pacts between funds and their borrowers. On Thursday, Chairman Ajay Tyagi reiterated the watchdog’s stance, saying “there is no confusion” and that all market participants must adhere to the rules.

Chandra’s Essel Group has repaid 44.50 billion rupees ($628 million) after selling stake in Zee to Invesco Oppenheimer Developing Markets Fund and divesting solar farms and other non-media assets. The sales still leaves a large repayment gap for the conglomerate.

The first extension, known as standstill agreement on sale of the group’s shares pledged as collateral, was granted after Zee’s shares tumbled as much as 37% in a single day in January amid worries about the group’s debt, increasing the risk of default.

Some of India’s biggest asset managers, including Aditya Birla Sun Life Asset Management Co. and HDFC Asset Management Co., hold shares of Zee as collateral against dues owed by Essel Group.

A spokesman for Essel declined to comment. Representatives for Birla and HDFC mutual funds didn’t respond to email and phone calls seeking comments.

Also read: Clock ticking for Anil Ambani, Subhash Chandra to save shares they’ve pledged

Not just in this case. With so many stressed accounts, don’t rely on IBC procedures alone. Encourage creditors to sit with firms that owe them money, find tolerable solutions. Five years ago, no one could have foreseen the tsunami that would wash over the economy.