Despite the excitement in Indian and global aviation circles around the recent agreements inked by IndiGo and Air India to purchase a record number of aircraft – 500 and 470, respectively – from Airbus and Boeing, a sense of deep unease engulfs the industry. Almost all Indian airlines are bleeding red and struggling to stay afloat. With a stunning mortality rate, more than 30 airlines have gone belly-up in the last 30 years, many of which have been regional airlines. Unlike many sectors that go through cycles of boom and bust, the Indian aviation sector seems to be caught in the throes of headwinds and tailwinds at the same time. Why is there such a unique situation, and how will the future play out in this state of paradox?

Also Read: IndiGo, Air India soar at Paris Air Show. But Indian aviation must stay grounded by reality

What fuels Indian aviation?

The promise of Indian skies is fuelled by a host of factors. One factor is that, as per an IATA report from 2018, the country is expected to become the third-largest aviation market in terms of the number of passengers by 2024. On the back of India recently overtaking China as the most populous country in the world — with a strong middle and working-class — domestic passenger traffic soared to around 132.67 lakh in May 2023, a 15 per cent year-on-year growth. A regional connectivity scheme, Ude Desh ka Aam Nagrik (UDAN), launched in 2016, aimed to operationalise 1,000 UDAN routes and revive 100 unserved and underserved airports by 2024. As of December 2022, 453 routes have commenced, and 70 airports are operationalised. Unsurprisingly, the country will need about 2,500 aircraft by 2038.

These are reasonably well-known numbers, but what is not so known is the metrics of Indian aviation when compared to international numbers. For example, India has around 1,000 aircraft as compared to China’s 4,500.

Also Read: IndiGo places largest order in aviation history — 500 aircraft from Airbus

Indian aviation today

Among the 148 airports that are now in India, Gujarat has three international and nine domestic airports, Maharashtra has five international and six domestic airports, Karnataka has two international and seven domestic airports, and Uttar Pradesh has three international and five domestic airports.

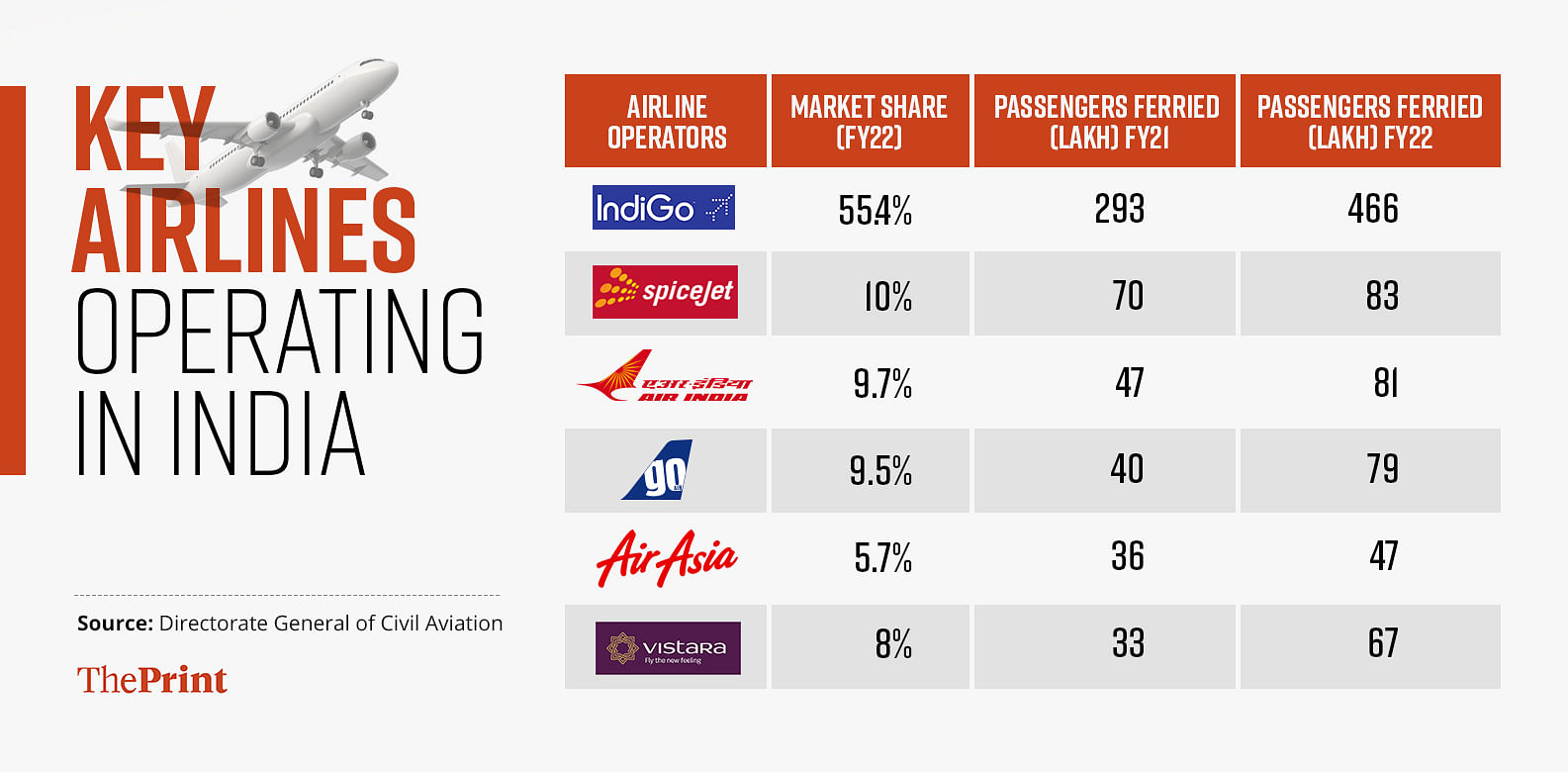

It is posited that in the next 10 years, India will cumulatively have more than 250 airports. Today, of India’s 901 city pairs (city-to-city routes), the Mumbai-Delhi pair makes for one of the world’s busiest domestic routes. The interesting dimension about the 901 city pairs is that 618 of them are monopolies while 145 are duopolies. In the Skytrax World Airlines ratings for 2022, India’s Vistara is at the 20th rank, AirAsia is 27th, and IndiGo, which has a monopoly on over 500 routes, is ranked at 45. Qatar Airways, Singapore Airlines and Emirates are in the top three positions.

Given the above and considering that the country is posited to become the third largest economy by 2030 and a developed nation in another 25 years, the sky is the limit for Indian aviation.

Also Read: IndiGo co-founder’s family likely to sell stake upto $909.58 million, reports CNBC Awaaz

On a wing and a prayer

Golden linings notwithstanding, headwinds for Indian aviation are strong. Go First is the latest airline to be stranded, and many of those that have survived so far, such as Spice Jet and Air India, are awash in red.

Despite the growth, mortality rate and profitability remain question marks.

Harvard Business School professor Michael E. Porter in a seminal article titled, The Five Competitive Forces that Shape Strategy, analyses the aviation sector globally and argues that historically it has been one of the least profitable sectors of the global economy even though it may be a glamorous one that attracts heightened attention.

“The important reason for low profitability of airlines is that, typically, suppliers and vendors, aircraft and aviation fuel suppliers, airports, maintenance and repair organisations and pilot unions — have a lot of power,” says Rahul Mishra, professor of strategy at Institute of Integrated Learning in Management (IILM) University.

Also Read: GoFirst crisis: IndiGo biggest gainer; Air India too sees uptick in market share in May

What the future holds

Analysts say there could be a price war in India in the near term, even though fares are currently at stratospheric levels. Over a period of time, there could be growth in the trunk routes between big cities like Delhi, Mumbai, Bengaluru, Chennai, Kolkata and Hyderabad.

Second, premium and corporate flyers could become more discerning and look for aspects like wide-body aircraft during monsoon or winter that would not affect flight schedules. Business and high net-worth flyers could also shift to hiring private aircraft, where players like IndiaJets could slowly chip off a small slice of the market.

“The market will happen. At what pace will depend on the number of planes that will be introduced into commercial flying. It is not going to happen tomorrow morning; it will take about five to 10 years,” says Shiv Shivakumar, operating partner of private equity firm Advent International.

IndiGo is a good case example of a company that has got its act right. This is also a good example of business model innovation that other airlines can replicate.

IndiGo has one type of aircraft, the A320s, which, when used well, will bring cost advantages through economies of scale. Buying a single type of aircraft means they can negotiate a maximum discount from manufacturers. The economies of scale also lead to the learning curve effect. A low turnaround time enables more aircraft to be in the sky simultaneously, ensuring higher employee productivity and profitability.

The airline also has the balance sheet benefit of low fixed cost as it has created a leasing subsidiary under which the parent company buys aircraft on lease from the subsidiary. IndiGo’s cost sheet indicates its expenses are roughly 30 per cent lower than other airlines.

“If your cost is lower and if you are charging almost the same price [as other airlines], then you are in reasonably good shape in terms of the revenue. Even if the market goes into recession, I think you have got the buffer of 30 per cent, and you survive,” says Mishra.

Shiv adds that the market will consolidate between three to four players. “Apart from the Air India-Vistara-Air Asia combine and IndiGo, I think there is space for a third or fourth player.”

Clearly, Indian aviation is at an interesting crossroads.

George Skaria is the former editor of Indian Management and Asian Management Review. Views are personal.