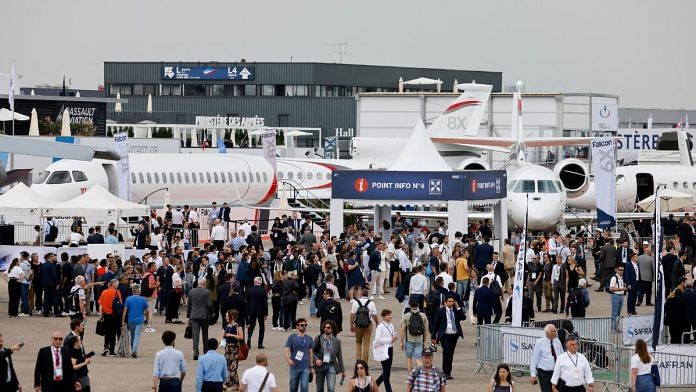

The Paris Air Show, one of the biggest events for the global aviation industry, returned after a four-year hiatus. Industry experts and analysts were expecting a slew of aircraft and engine deals in the wake of the resurgent air travel industry following the Covid-19 pandemic. They were not disappointed, thanks to India’s two prominent airlines – IndiGo and Air India.

About 80% of the new aircraft orders were placed by the two Indian airlines, contributing to the show’s near-record levels of orders.

According to an analysis by consultancy IBA, leading European aircraft manufacturer Airbus and the US-headquartered Boeing jointly announced orders for more than 1,200 aircraft, with Indian airlines accounting for nearly 1,000 of those orders.

And that is why aviation deals is ThePrint’s Newsmaker of the Week.

Putting up a show

IndiGo took the lead on 19 June by placing a historic order for 500 aircraft with Airbus, surpassing Air India’s February announcement to acquire 470 new aircraft whose purchase agreement it signed at the show.

In addition to its existing order of 72 aircraft, India’s youngest airline, Akasa Air, also revealed plans to add four more Boeing 737 Max planes as part of its expansion strategy. The airline said it is on track to “finalise another significant three-digit aircraft order”, which it will announce before the end of 2023.

With its order of 500 aircraft – consisting of A320 and A321 — the Indian low-cost carrier IndiGo now boasts an order book of nearly 1,000 aircraft, set to be delivered over the next decade. Currently, the company operates a fleet of over 300 aircraft, and had previously placed an orders for 480 additional aircraft.

While IndiGo did not disclose the deal size, industry estimates suggest it is around $50 billion at list prices, which is lower than the $70 billion value of the Air India deal. However, actual costs for these airlines are expected to be significantly lower, as bulk orders often receive significant discounts.

Pieter Elbers, CEO of IndiGo, emphasised the significance of this historic order for 500 Airbus A320 family aircraft. “This order strongly reaffirms IndiGo’s belief in the growth of India,” he said, adding that the company expects 100 million customers on board this year.

Meanwhile, the CEO of Air India, following the February announcement, had emphasised how the aircraft order was really about “recognising the opportunity for Indian aviation” and putting the investment “for India’s benefit”.

Also read: Nationalisation did not kill Air India, politics did. Tata’s challenge lies beyond fixing it

Heading towards a duopoly?

The deals signed at the Paris Air Show reflect the optimistic outlook for India’s aviation market. But there is also an underlying concern.

India’s aviation industry has experienced contrasting developments in recent months. While the domestic airlines registered a surge in demand and passenger growth on one hand — 132.14 lakh passengers in May, up from 114.67 lakh in April – key airline GoFirst filed for insolvency and SpiceJet is grappling with widening losses and grounded airplanes on the other. Moreover, unprecedented surge in air fares in recent weeks have added to the customer woes.

In such a scenario, the massive orders by IndiGo and Air India, which already dominate the Indian aviation market, indicate a potential duopoly in the sector. According to the latest data released by aviation regulator DGCA, IndiGo’s market share reached an all-time high of 61.4% in May, with the Air India Group holding a distant second place at 26.3% through its airlines, including Air India, Vistara, and AirAsia India. Akasa Air accounted for 4.8% of the market share, while SpiceJet held 5.4% during the same month.

While concerns have been raised about potential “overordering” by airlines to address supply chain issues and secure their position in the delivery queue, proponents argue that the Indian aviation industry requires additional aircraft to cater to the growing number of passengers.

India is currently estimated to be the fastest-growing aviation market globally, and it is expected that 450 million passengers will fly from over 200 airports by 2030, representing a growth of 300% over the current 145 million passengers.

Views are personal.

(Edited by Prashant)