In 1943, Hermann Hesse, then a future Nobel laureate, published a novel titled Magister Ludi (Latin for “Master of the Game”). The “Glass Bead Game”, another title for the book, remains undefined. It takes place in the future, in a place dedicated to the life of the mind. Those playing the game, whose rules are elusive, have to spend years studying unconnected subjects like music, cultural history, and mathematics, and find connections that help them play better. It’s all a bit esoteric, like monetary policy — which is the point of bringing this up just now.

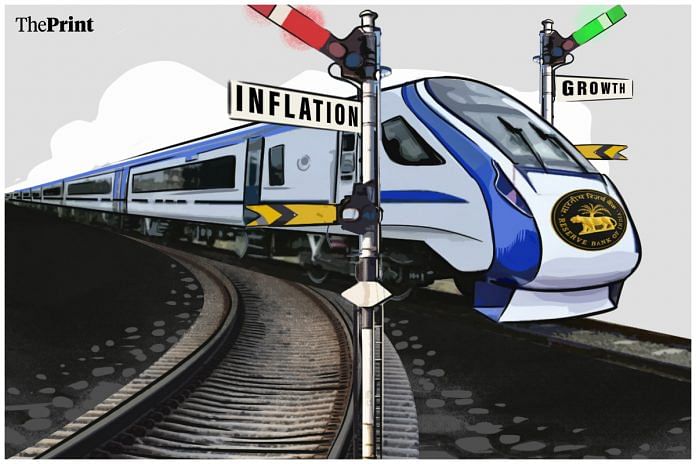

Consider that independent commentators expected, with near-unanimity, the Reserve Bank of India’s (RBI’s) monetary policy committee to announce on Thursday a quarter-percentage point increase in the policy-stipulated interest rate for overnight money. But the committee sprang a surprise and decided — unanimously, please note — to keep the rate unchanged.

The commentators were influenced by the fact that inflation has continued to stay stubbornly above the “upper tolerance limit” of 6 per cent, mandated under the law. The committee, on the other hand, has looked ahead and expects inflation to drop to 5-plus per cent in the near-future.

Note that the legal mandate is actually an inflation rate of 4 per cent, with a two-percentage point latitude on either side. The committee does not expect inflation to be at 4 per cent even a year hence. Yet it has stayed its hand on a policy-rate hike, though not because it admits to any risk to economic growth. In fact, it has fractionally raised its growth expectation for the new fiscal year to 6.5 per cent. This contradictory signalling has not stopped commentators from seeing a Magister Ludi at work.

If this is what goes for expertise, one might be tempted to say that this particular game is no more sophisticated than ludo with all its randomness. The sophistication of the players, experts all, lies largely in their invention of rationale.

The recent history of central bank behaviour across the world should encourage de-mythologising, for central bankers must bear much of the blame for rampant inflation in traditionally low-inflation countries, and then a sudden and sharp turnabout in monetary policy to control prices, which has created fragility in the banking system. If this is indeed what passes for expertise, the lay observer might even be tempted to say, along with an infamous Brexiteer: “…enough of experts”!

Also Read: The pressing need to improve R&D in India & why it can’t emulate the East Asian model

But now, as then, that would be emotive excess. India has its own recent history of non-expert policy action, and that history does not say much for itself. The real issue may be that the RBI does not really subscribe to the mandate it has been given, and the government in a pre-election year quietly supports such agnosticism. Neither therefore gives the required primacy to controlling inflation, or considers economic growth a subsidiary objective. This reversal of priorities is the only non-sophist explanation for the monetary policy committee’s behaviour. Were it otherwise, the committee would have raised the policy rate on Thursday, at the possible cost of slower but still creditable growth.

Bear in mind the politico-economic context. Growth in income per head has averaged barely 2 per cent since the last general election, and 3 per cent in the past six months. The new fiscal year is projected to up that to more than 5 per cent. That is an ask when signals on the economic tempo are still mixed in a slowing world economy, and no easier with higher interest rates. Far better to make sure the projected income growth is achieved, and to forget 4 per cent inflation for the time being.

As for the policy mandate itself, it is legitimate to ask whether it was wise for the government to set inflation control as the primary goal for the RBI. Opinion is divided. Some ask whether it is really in the RBI’s power to control inflation, given how many factors are outside its control. But such questions are beyond the purview of the monetary policy committee. So what we have got may be a gap between the de jure position in law, and the de facto intention of the policymakers.

By special arrangement with Business Standard