Amazon.com Inc.’s investors were bracing for the worst a day after Meta Platforms Inc.’s dreary earnings report sparked a historic stock plunge and spread worries that tech stalwarts were losing their mojo. Amazon’s shares tumbled nearly 8% in regular trading Thursday ahead of its own earnings news.

But Amazon’s so-so results and the announcement of a price increase on Amazon Prime memberships was enough to placate investors, who sent the retailer’s stock price up 14% in after-hours trading.

Late Thursday, the internet giant reported revenue of $137.4 billion for the three months ended in December, up 9% from a year earlier but slightly below the $137.8 billion median estimate of analysts surveyed by Bloomberg. For the third quarter in a row, Amazon offered a subdued forecast, projecting revenue growth of 3% to 8% for the current quarter, lower than the 11% median estimate.

Shareholders seemed relieved that the business didn’t deteriorate further. And a couple of bright spots offset the disappointing revenue figure. First, the company’s industry-leading cloud-computing unit, Amazon Web Services, had another stellar showing, growing by 40% in the latest quarter. That was slightly faster than the prior three-month period.

Second, the company announced it would increase the price of its U.S. Prime membership, which offers faster delivery and other benefits like streaming video, to $139 a year from $119.

Amazon has clearly made the calculation that the price increase will make up for any subscriber losses. That’s not guaranteed, however. While the company held on to subscribers after its past increases four and eight years ago, there is a chance people will balk at the latest jump. That’s especially true now that consumers have better alternatives: The e-commerce operations of its main competitors, including Walmart Inc., Target Corp. and software provider Shopify Inc., are all more robust now than they were a few years ago.

The latest results underscored Amazon’s other challenges. One reason the company said it was boosting the cost of Prime was to counter the rise in labor and transportation costs. As one of the largest employers in the world with 1.6 million workers, Amazon feels wage pressures acutely.

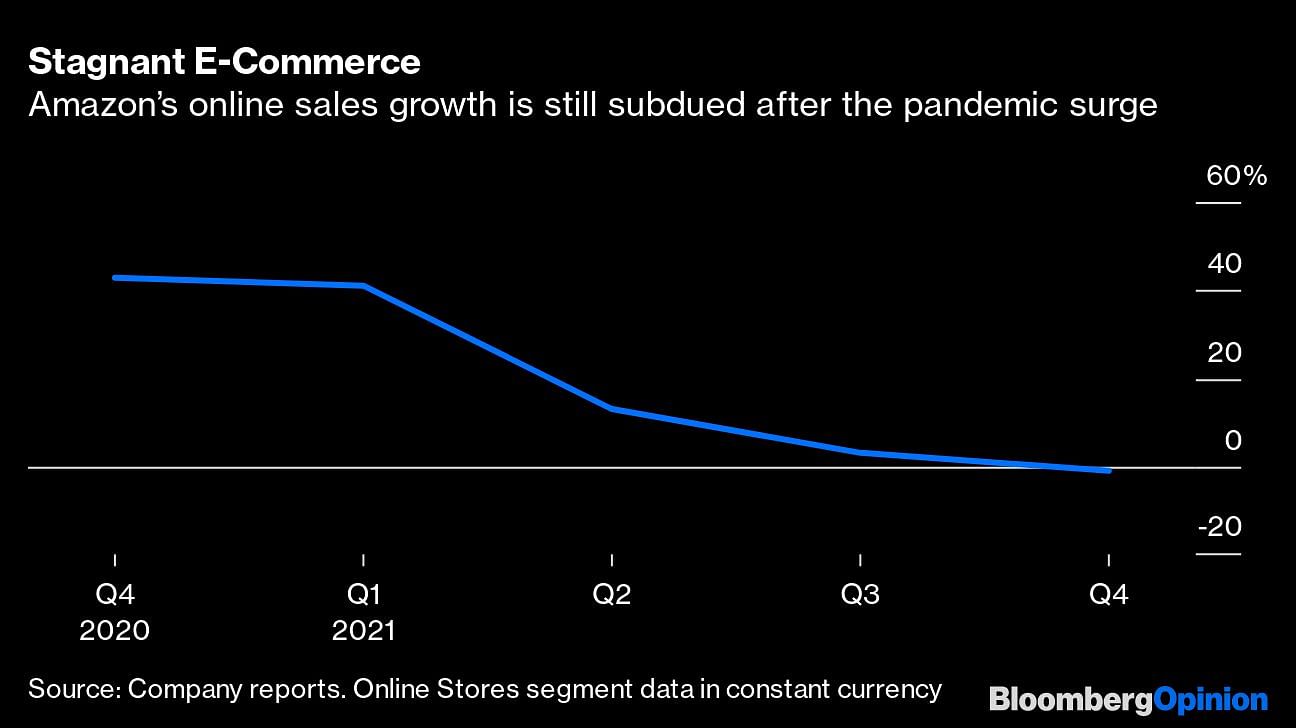

There are other warning signs. Amazon’s online sales fell slightly during the holiday period compared with those in the 2020 quarter, when it benefited from a sustained surge in online shopping during the Covid-19 pandemic.

Consumers are spending less online across the retail sector. According to credit card data from Bank of America, U.S. e-commerce sales fell 3% in December compared with those a year earlier, after rising 6% in November. Sales stayed negative in early January, the data showed.

That’s a problem for a stock like Amazon. While investors weren’t completely surprised by its stagnant results, the shares still aren’t cheap at 56 times the 2022 median earnings estimate, even using Thursday’s downtrodden closing price.

After a brief bounce, investors looking for strong growth aren’t likely to pile back in until there is some indication of a rebound in sales. It could be a long wait. –Bloomberg

Also read: Rakesh Jhunjhunwala’s new airline Akasa plans to use stock options to lure staff