The textile sector is one of the critical sectors of the Indian economy, accounting for more than two per cent of the total GDP and more than 12 per cent of the manufacturing sector gross domestic product (GDP). The sector is also the second largest provider of employment in India, after agriculture. It provides employment to an estimated 45 million people directly and to another 60 million indirectly through allied activities. Not only is the textile sector highly labour intensive, it also employs unskilled and semi-skilled labour force and is also an important source of employment for women.

The textile sector has a diverse value chain spread across fibre to readymade garments. India is the sixth largest exporter of textile and apparel in the world, with four per cent share of the global trade in textiles and apparel. Considering the potential of the textile sector in generating employment and export revenues, the government has taken several measures to promote the sector, including for capacity building, technology upgradation, and to boost employment generation. In September, 2021, the Production Linked Incentive Scheme was launched to promote investments in manmade fabric and apparels.

However, recently the sector has been facing challenges. Domestic production has turned sluggish in recent months. While exports have suffered owing to preferential tariff treatment towards countries like Bangladesh and Vietnam, cheap imports from China and some other countries in certain segments are hurting the domestic industry.

The government is committed to increasing textile exports from India, from the current USD 44.4 billion to USD 100 billion in the next five years. This will require addressing the challenges faced by the sector to ensure an efficient and integrated textile sector.

Also read: November saw a drop in inflation but some major states missed out. Here’s why

Production of textile has seen a decline in recent months

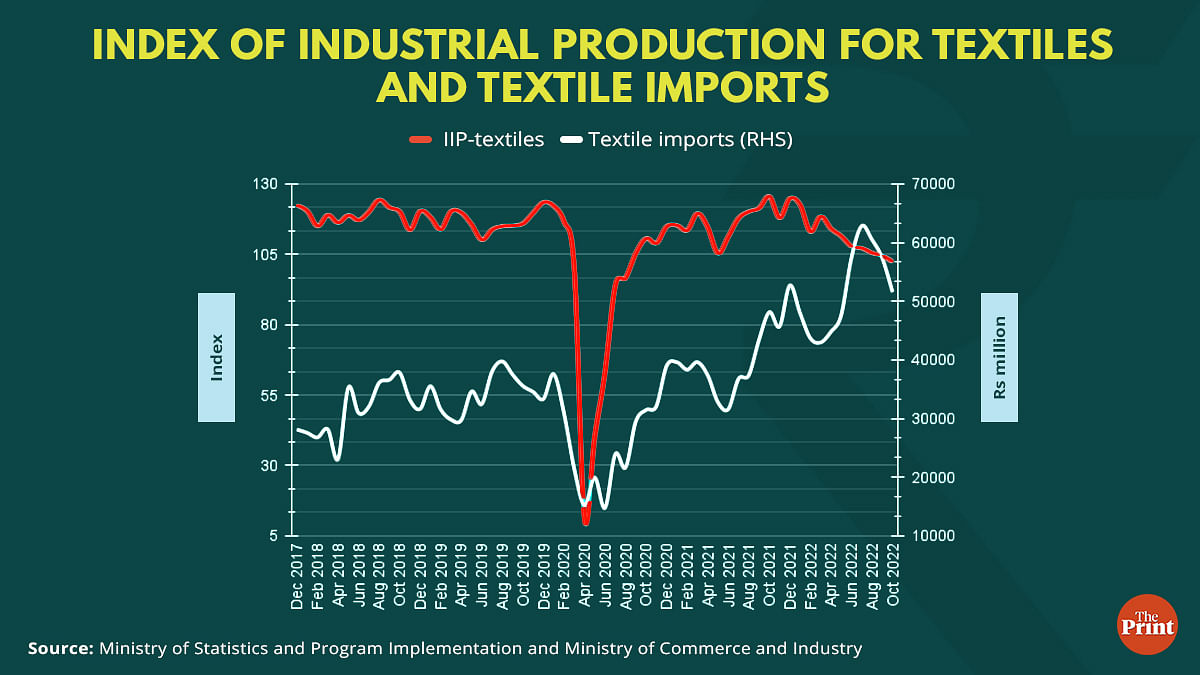

The production of textiles as measured by the Index of Industrial Production (IIP) for textile has seen a consistent decline since March 2022. The index value, which was 118.5 in March 2022, has fallen to 102.3 in October 2022. On a cumulative basis from April to October, 2022, the index value is lower than the corresponding period in the last year.

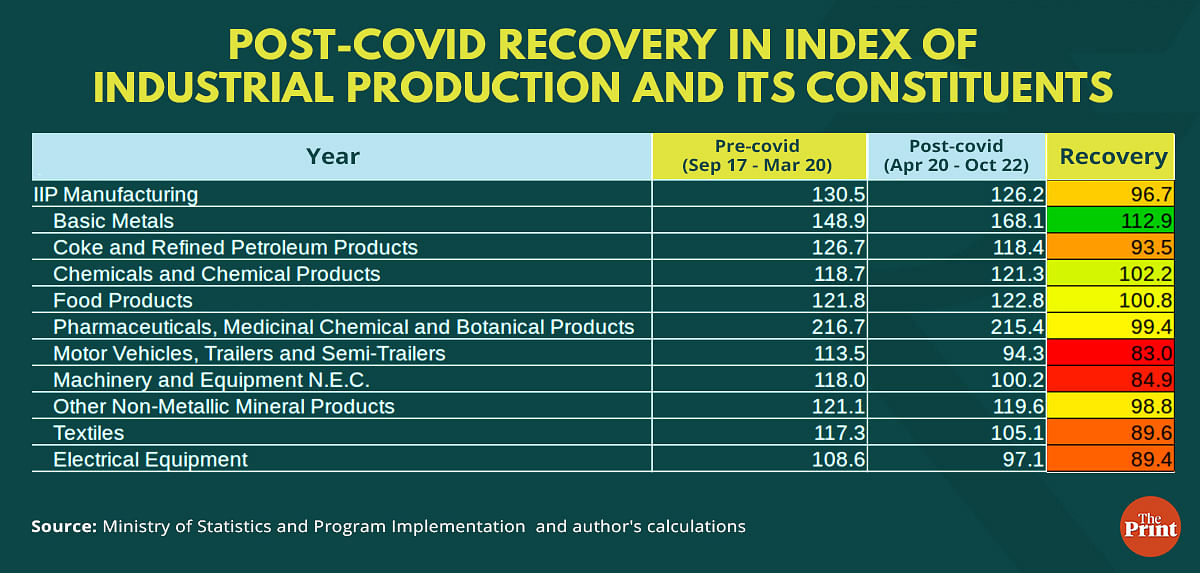

A broader look at the manufacturing sector suggests that it has not yet recovered to the pre-Covid levels of production. Textile is one of the categories in the manufacturing sector that has languished and is yet to reach the pre-Covid level of production. A comparison of the IIP (textiles) for the pre-and-post-Covid period suggests that the average IIP in the post-Covid period is below that in the pre-Covid period.

Estimation of sub-sectoral gross value added from the Centre for Monitoring Indian Economy (CMIE)’s Prowess database also showed that textiles was one of the sectors that witnessed steep contraction in the July-September quarter. The textile sector’s gross value addition (GVA) has seen a contraction for three consecutive quarters.

Imports have surged

While production has taken a hit, imports of textiles have increased. In the period from April to November, 2022, imports of textiles were valued at Rs 433 billion. In the same period of last year, imports of textiles were valued at Rs. 313 billion. In recent months, particularly after the onset of the Russia-Ukraine war, imports have risen from Rs 43 billion in March 2022, to Rs 51 billion in November 2022.

The steady rise in textile imports is not just a recent phenomenon. It owes its origin to policies of the past few years. India allowed duty-free import of readymade garments from Bangladesh under the South Asian Free Trade Agreement (SAFTA) in 2006. This has resulted in an increase in imports of apparels made with Chinese fabrics and yarns. Bangladesh imports Chinese fabrics, converts them into garments using its cheap labour and exports the garments so made to India, without paying any import duties. Thus, the duty-free market access given to Bangladesh is facilitating indirect entry of Chinese textiles into India.

Another segment in the sector that has seen a rise in imports in recent years is the manmade fibre segment, particularly the viscose staple fibre (VSF). Viscose is largely used by the textile and clothing industry to make apparel, mainly for women and children, in the domestic market. Dumping of VSF at low prices from China and Indonesia led the Directorate General of Trade Remedies (DGTR) to recommend imposition of anti-dumping duty in 2010. The extension of the anti-dumping duty was again recommended in 2016.

The anti-dumping duty was lifted in August 2021. Last month, the DGTR has recommended the levying of anti-dumping duty (ADD) on VSF imported from Indonesia. The investigations showed that imports from Indonesia have increased after the lifting of the anti-dumping duty. Indonesia’s imports to India are not subject to tariff under the ASEAN-India Free Trade Area (AIFTA).

There have been other instances of dumping by China, notably of linen fabric and imposition of anti-dumping duty.

Also read: India’s public sector banks are laughing all the way to profits. But new stress can interrupt

Exports suffer due to limited market access

India being an emerging market rather than a less developed country, suffers from the disadvantage of duties being imposed by the importing countries. Countries like Bangladesh, Sri Lanka and African countries get duty-free access and make India’s textiles comparatively less competitive in the international landscape.

For instance, the European Union (EU) introduced the Everything but Arms (EBA) scheme in 2001 which grants duty and quota-free access to EU markets for least developed countries for all products, except arms and armaments. Bangladesh witnessed a rapid rise in apparel exports after 2000, benefiting from duty-free access to the EU market under the EBA programme.

Bangladesh has focussed on CMT (cut, make and trim) production method while sourcing fabrics from other countries such as China, Korea, India, Pakistan, Italy and Turkey. This preferential tariff treatment makes India’s exports less competitive in the international market.

Inverted duty structure

The manmade fibre (MMF) value chain in the textile industry currently faces an inverted duty structure, that is the tax on output or the final product is lower than taxes on inputs, creating an inverse accumulation of input tax credit. This is usually refunded by the government, creating a revenue outflow for the government, but also blocks crucial working capital flow for businesses in the meantime.

Specifically, the tax rate on MMF at present is 18 per cent, MMF yarn 12 per cent, while fabrics are taxed at five per cent. Natural yarns like cotton, silk, wool are in the five per cent slab. While the GST Council in its 45th meeting decided to correct the inverted duty structure by announcing a uniform tax rate of 12 per cent on all textile products except cotton, the decision was rolled back amid protests from industry.

The differential structure needs to be rationalised to ensure better compliance and to enable the sector to compete with global counterparts.

Radhika Pandey is Senior Fellow at National Institute of Public Finance and Policy.

Views are personal.

Also read: How India’s economy fared in a year of shocks, aftershocks & slowing global growth