Public sector banks (PSBs) have reported a stellar performance in the July-September quarter. The asset quality of PSBs has improved, their profits have been robust and they have recorded an impressive pace of credit growth in the July-September quarter.

The turnaround in the performance of public sector banks is also getting reflected in the stock market performance of banks. Clean-up of stressed assets, better regulation, pick-up in loans and an improvement in corporate credit demand is driving the profitability of public sector banks.

Going forward, the cost of deposits, and the possible stress emerging from the Micro, Small and Medium Industries need to be watched out for.

Also read: Quit stalling & pay up — what’s climate finance and why rich countries must step up urgently

Improving profits

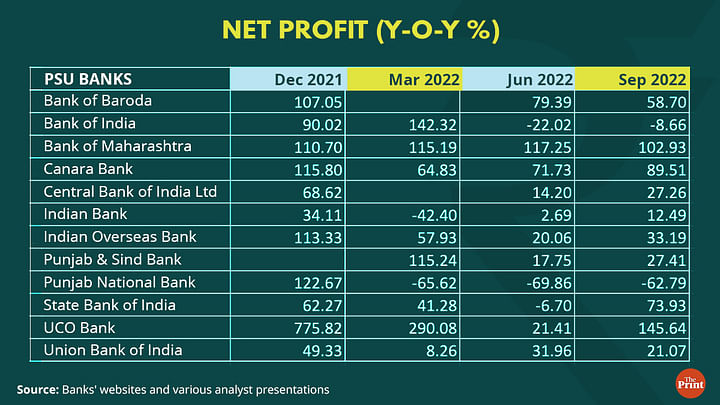

Public sector banks recorded a combined net profit of Rs 25,685 crore in the July-September period, a rise of nearly 50 per cent from the same period a year ago. The country’s largest lender, State Bank of India (SBI) reported the highest-ever quarterly net profit in the three months to September — an increase of 74 per cent over the corresponding quarter of the previous year. Similarly, Canara Bank reported a net profit of 89.4 per cent.

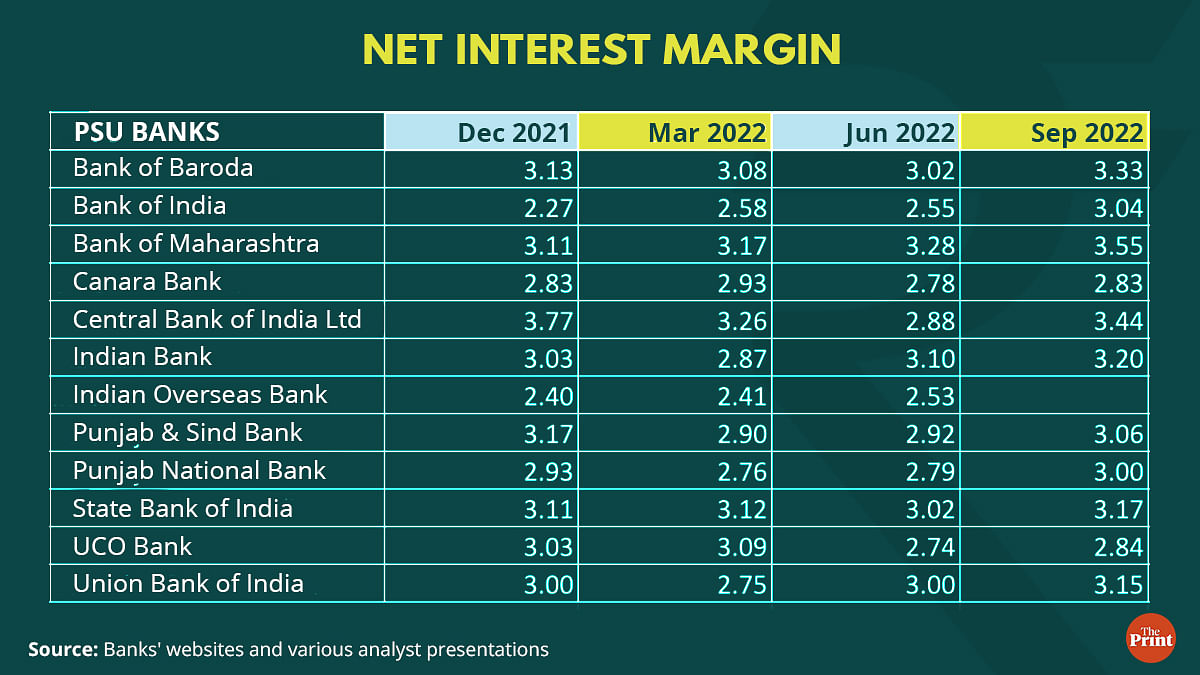

Rise in profits came on the back of a broad-based rise in loans including housing and corporate loans. Interest income, which includes interest on advances and interest on investment has seen a sharp growth. While banks have been able to pass on higher rates to borrowers, their deposit costs have risen only marginally. This has boosted the net interest margins of banks.

The robust financial results posted by the public sector banks has propelled the Nifty PSU Bank Index to record highs. The Nifty PSU Bank index has performed better than the benchmark indices so far this year. It has also done better than the overall Nifty Bank index.

Better asset quality

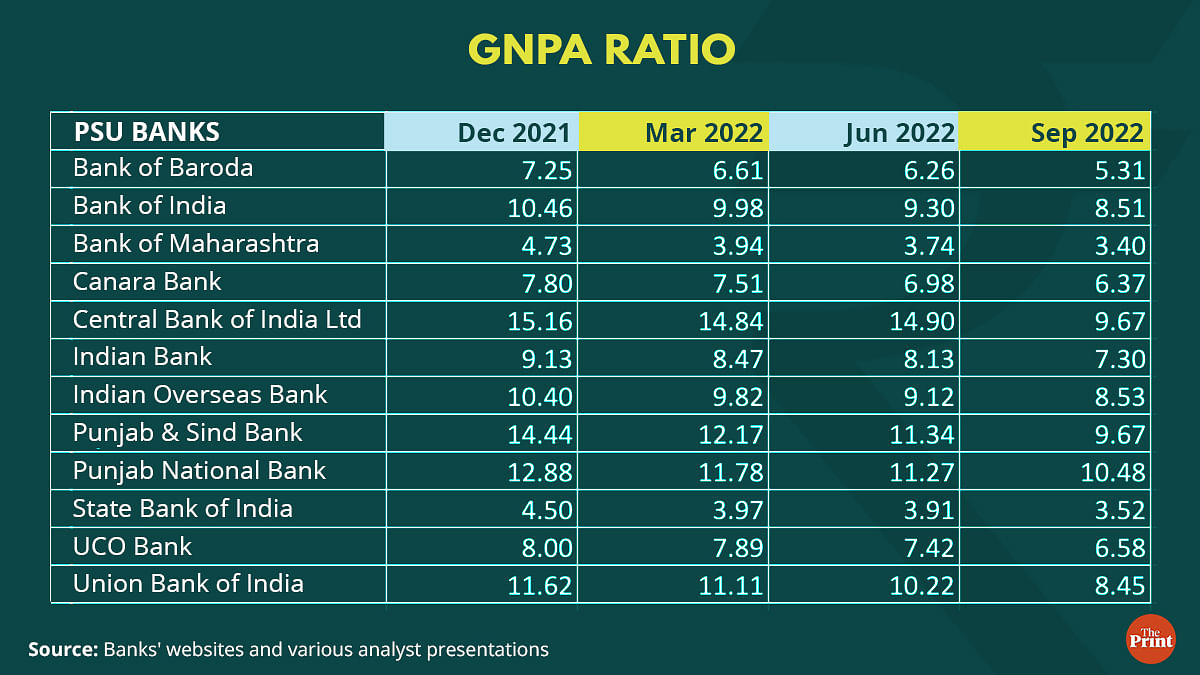

While banks took advantage of the rising interest rates to bolster their interest income, regulatory efforts to reduce stressed assets have resulted in improvement in asset quality and lower provisions for losses. Asset quality measured as Gross Non-Performing Assets as a percentage of total advances (GNPA ratio) has seen a sustained improvement. As an example, Canara Bank’s GNPA ratio has fallen from 7.80 per cent in December, 2021, to 6.37 per cent in September, 2022. Union Bank of India’s GNPA ratio has declined from 11.6 per cent in December, 2021, to 8.45 per cent in September, 2022.

Reduction in GNPAs can be explained by better recoveries. Borrowers who availed the Emergency Credit Line Guarantee Scheme (ECLGS) — a scheme to help borrowers tide over the challenges posed by the pandemic by providing 100 per cent guarantee to lenders — have exhibited good repayment behaviour.

The Non Performing Assets Ratio was 4.8 per cent according to a report published by the TransUnion CIBIL. The study showed that repayment commenced in 38 per cent of the accounts within three months from availing the facility, and went up to 82 per cent in a year. The repayment rate has improved in the case of borrowers who availed ECLGS compared to overall repayment trends in the MSME market.

As the stock of non-performing assets shrink, and fresh slippages from standard to non-performing assets are curtailed, banks do not need to set aside as much funds as they used to set aside in the previous quarters. With a continued improvement in asset quality, provisions have seen a decline. This will further boost profitability of banks.

To be sure, according to the RBI data, bad loans worth Rs 7 trillion have been written off by public sector banks in the past five years. Write-offs are also one of the reasons to report lower bad loans.

Doing better on regulatory forbearance

Traditionally, public sector banks have been plagued by poor asset quality. PSBs reported a high loan growth of almost 17 per cent from FY 2010-14. During the global financial crisis, to address the woes of the borrowers, the norms for recognition of non-performing assets were relaxed. The relaxation meant that they were classified as standard rather than non-performing assets and did not require the kind of provisioning that bad loans attract.

The extended regulatory forbearance post the global financial crisis led to evergreening of loans and hid the banking sector’s vulnerability.

After continuing forbearance for seven years, the RBI decided to conduct an Asset Quality Review (AQR) to know the true status of banks’ NPAs. The review resulted in recognition of bad loans resulting in a big spurt in NPAs in 2017-18.

Since then, there has been improvement in the asset quality of banks. Regulatory forbearance was again rolled out during the pandemic. The resolution plans implemented under the framework included rescheduling of payments, conversion of any granting of moratorium based on an assessment of income streams of the borrower for up to two years.

The resurgence of the pandemic led to another round of regulatory forbearance in the form of Resolution Framework: 2.0. A number of checks and balances were introduced to prevent a repeat of the previous episodes of loan restructuring, which did not succeed in addressing the NPA crisis.

The enactment of the Insolvency and Bankruptcy Code in 2016 is a landmark step towards prompt resolution of stressed assets in the financial system.

Going forward

To sustain higher credit growth, banks have started offering higher interest rates on deposits. With interest rates on fixed deposits rising, the share of low-cost deposits — current account and savings account (CASA) — has seen a dip. This will likely have a bearing on the margins of banks.

Banks will also have to compete with other high-yielding instruments such as mutual funds. The pace of credit and deposit growth will determine the trajectory of income and profits of banks in the coming quarters.

Radhika Pandey is a consultant at National Institute of Public Finance and Policy.

Views are personal.

Also read: Why FPIs are fleeing Indian debt and how bond markets have become volatile