This week, the rupee breached the psychologically significant mark of 80 per dollar for the first time. The depreciation of the rupee is primarily an outcome of the geo-political conflicts, rise in commodity prices and the risk-off sentiments of foreign investors, that have led to the strengthening of the dollar.

While the slide in the rupee will likely hit the government’s finances and lead to an increase in the current account deficit, it should not be a cause of panic as India’s macroeconomic fundamentals continue to remain strong. This is in contrast to the taper tantrum episode of 2013, when India was amongst the worst affected economies due to its high current account deficit and reliance on inflows of foreign capital.

Going forward, the recent moderation in the international commodity prices should slow down the slide of the rupee.

Also Read: Weaker rupee, higher inflation — Why US Fed raising rates is more bad news for Indian economy

Rupee slide & strengthening of dollar

The rupee has been under pressure as aggressive rate hikes by the US Federal Reserve has narrowed the interest rate differential between India and the US. In the last meeting, the US Federal Reserve hiked rates by 75 basis points. The higher than expected June US inflation data has fuelled the possibility of a 75 or a 100 basis points rate hike by the US Federal Reserve in its upcoming meeting.

The possibility of a sharp rate hike intensifies selling by foreign institutional investors (FIIs) and causes the rupee to weaken further. Foreign investors have net sold more than USD 30 billion worth of Indian assets so far in 2022.

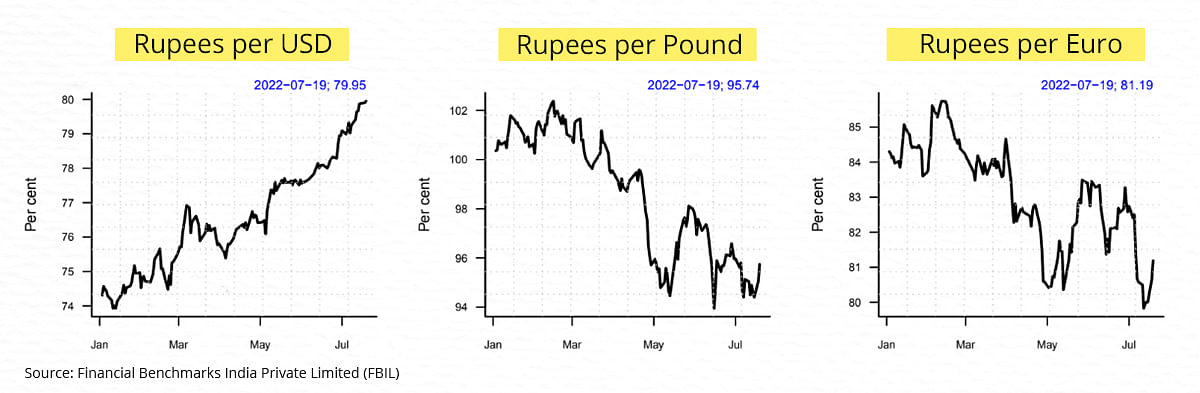

The depreciation of the rupee is linked to the strengthening of the Dollar Index. The Dollar Index measures the strength of the dollar against a basket of six currencies. From 96 at the beginning of the year, the Dollar Index inched up to 108 in the middle of July, clocking an appreciation of more than 12 per cent. The recent surge in the Dollar Index is on account of record inflation in 40 years and surging US bond yields. The rise in US bond yields increases demand for the dollar.

The twin deficit problem

The depreciation of the rupee will impact India’s twin deficits. Already elevated crude, commodity and fertiliser prices have increased the import bill, a weaker rupee will add to the import burden and further to the subsidy burden.

The government has decided not to pass on the burden of higher fertiliser prices to farmers. As a result, the fertiliser subsidy is likely to go up to Rs 2.5 lakh crore. The duty cut on petrol and diesel will lead to a revenue loss of Rs 85,000 crore. However, a higher nominal GDP due to inflation may limit the fiscal slippage.

A continued fall in the rupee will put pressure on imports, resulting in widening of the current account deficit (CAD). The deterioration in the deficit could moderate due to increase in services exports in which India is more competitive as compared to goods exports.

The worst of inflation may be over

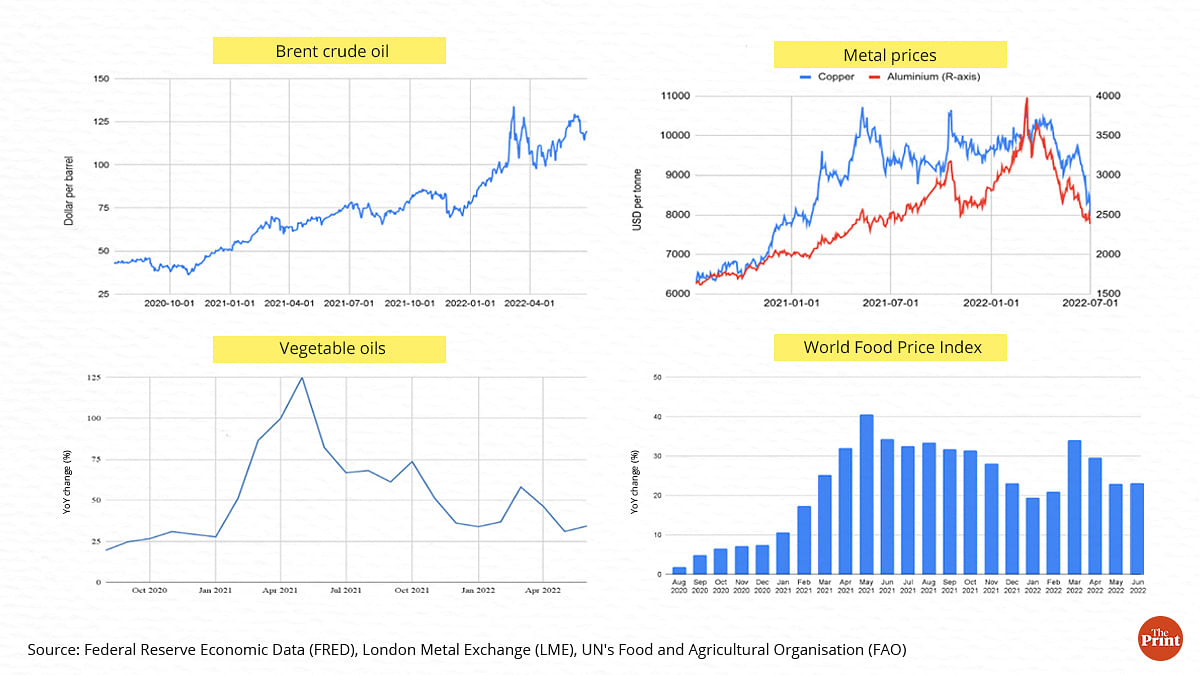

The last few days have seen a correction in commodity and crude prices. Global food prices measured by the UN Food and Agricultural Organisation’s (FAO’s) Food Price Index declined for the third straight month in June. Particularly, the vegetable oil sub-index has dropped by more than 15 per cent between March and June.

The prices of industrial metals have moderated after peaking in March. International prices of crude oil have also shown signs of moderation since the beginning of July owing to recessionary concerns. A sustained moderation in prices of imports bodes well for India’s CAD. To the extent that the widening of the CAD is contained, the currency might not fall much.

The hike by the US Federal Reserve in its upcoming policy has already been priced by the markets. As a consequence, while FIIs have been selling Indian equities, selling intensity has abated in July. FIIs have turned net buyers also on some days in July.

While the focus is on the rupee dollar rate, it is worthwhile to note that rupee has appreciated against other major currencies like the pound, euro and yen. Against the dollar, the pace of depreciation of the rupee has been lesser than some of the other emerging economies’ currencies.

RBI intervention and policy measures

The trajectory of the rupee in the short-run will be determined by the magnitude of rate hike by the US Fed in its upcoming meeting.

The RBI has been intervening to stem the slide of the rupee. It has sold close to USD 50 billion from its reserves in an effort to arrest the rupee slide. It would be increasingly difficult to defend the rupee in an environment where the dollar is strengthening. According to RBI’s latest data on external debt, about 43 per cent of external debt comes up for maturity this year. This will create additional demand for dollars and pose challenges for RBI to manage reserves.

The RBI’s recent decision to ease capital controls to boost the inflows of dollars is a positive move. While the recent decision to allow settlement of international trade in rupees won’t have a material short-term impact, in the medium to long term, it will lead to a gradual shift in demand from dollars to rupees.

Radhika Pandey is a consultant at National Institute of Public Finance and Policy.

Views are personal.

Also Read: What the RBI’s sharp interest rate hike portends for the Indian economy