The Indian economy ended the fiscal year 2023-24 with a strong gross domestic product (GDP) growth of 8.2 percent, despite global uncertainties and weaker consumption. For the current year, the Economic Survey has projected growth of 6.5-7 percent, while the Reserve Bank of India sees growth at 7.2 percent. For the first quarter (April-June) of the current year, RBI forecasts 7.1 percent growth.

The GDP growth estimates for the first quarter of FY 2024-25 will be released next week. In this backdrop, it is a good time to assess the state of the economy based on the available indicators.

Typically, the first quarter of each fiscal year witnesses a sequential easing in growth. This year, the general elections, slowdown in government spending and the lingering heatwave may have contributed to slackness.

Early data for the April-June quarter suggests that growth in the manufacturing sector could ease amid lower corporate profitability and weaker industrial production. The high frequency indicators are showing a mixed picture.

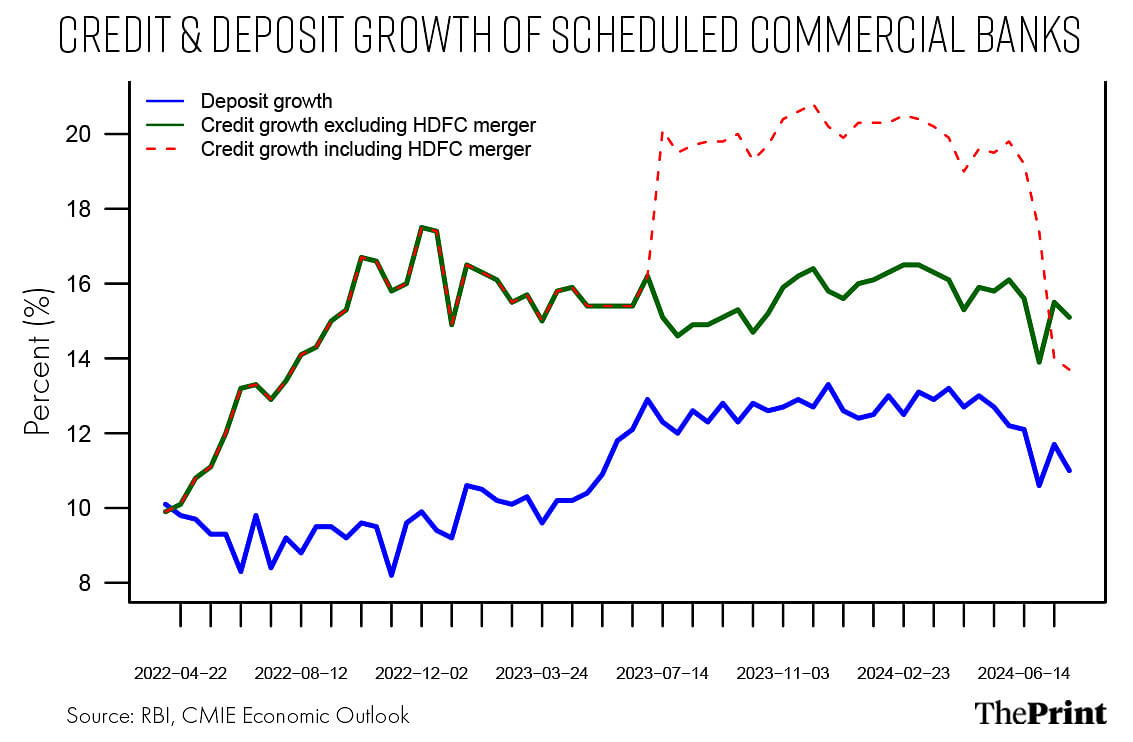

While the purchasing managers’ indices for manufacturing and services remained steady, non-food credit slowed to 13.9 percent in June, after rising around 16 percent in the previous year. Encouragingly, consumption could see an improvement due to a revival in rural demand.

Firm performance

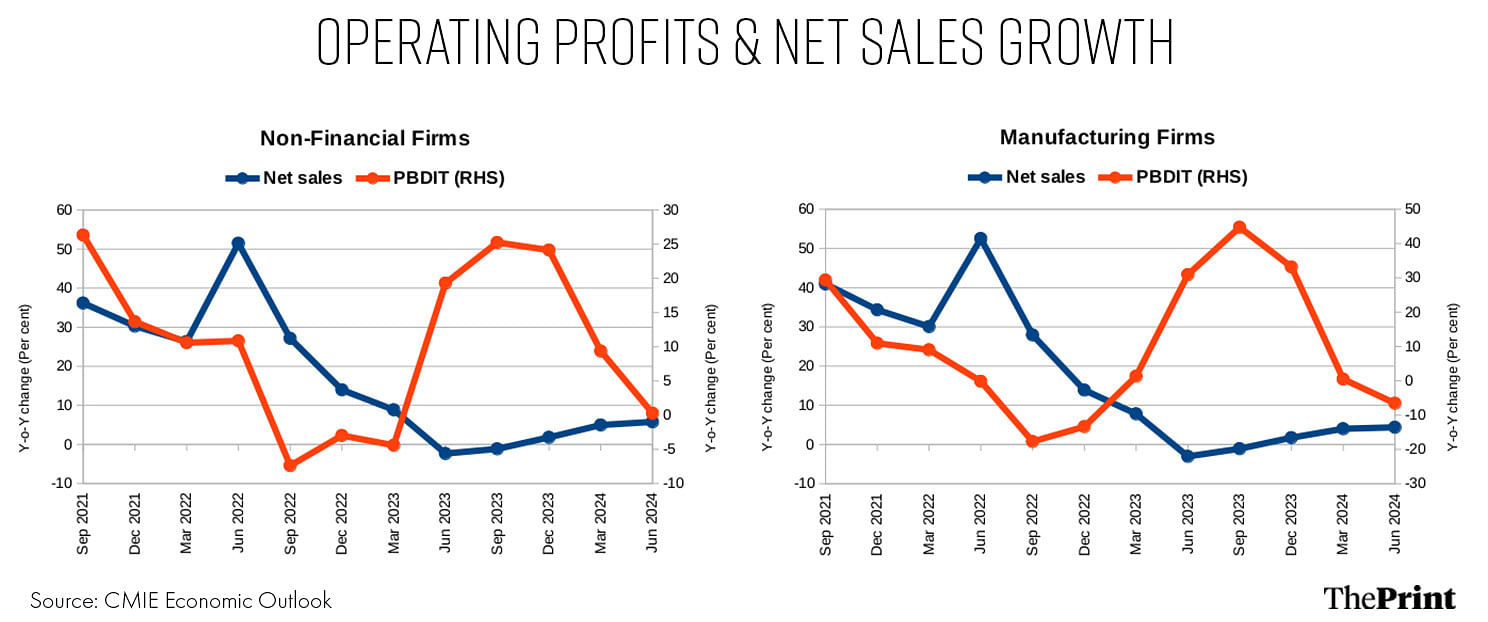

Indicators of the non-financial corporate sector performance point to a moderation in profit growth in the April-June quarter. In the last financial year, firms had managed to post decent profits despite muted revenue growth, due to support from lower input costs. However, this support may be fading with uncertainty associated with input costs.

Consequently, many sectors have reported a correction in profits from the extraordinary spike seen last year.

The year-on-year growth in operating profit, measured by profit before depreciation, interest and tax (PBDIT), of firms in the non-financial sector was flat in the quarter ending June.

For firms in the manufacturing segment, operating profit contracted by 6.6 percent. Within the manufacturing sector, the slide in profit is concentrated in a few sectors, such as petroleum refinery, chemicals and chemical products. In contrast, firms in the consumer goods segment have reported a sharp increase in profit in the June quarter.

Going forward, the trajectory of operating expenses and demand prospects will likely shape the profitability of firms.

Also Read: India enjoys healthy trade surplus with Bangladesh. The political crisis can hurt trade, FTA chances

Industrial production

Growth in industrial production, measured by the Index of Industrial Production (IIP), eased to a five-month low of 4.2 percent in June 2024. For the quarter ending June, IIP grew by 5.1 percent, similar to the growth seen in the March quarter.

Growth was buoyed by mining and electricity segments. Manufacturing sector, which accounts for almost 78 percent of the IIP, registered a weak growth of 3.8 percent—a decline from 4.8 percent growth in the March quarter.

On the use-based classification, growth was supported by primary goods, infrastructure and consumer durables. In contrast, the production of consumer non-durables witnessed a contraction in the June quarter. The contraction in non-durables signifies that growth in demand is yet to see a sustained pick-up. Lower profitability and weaker growth in the manufacturing IIP may pull down the GVA (gross value added) of the manufacturing segment in the June quarter.

High frequency indicators

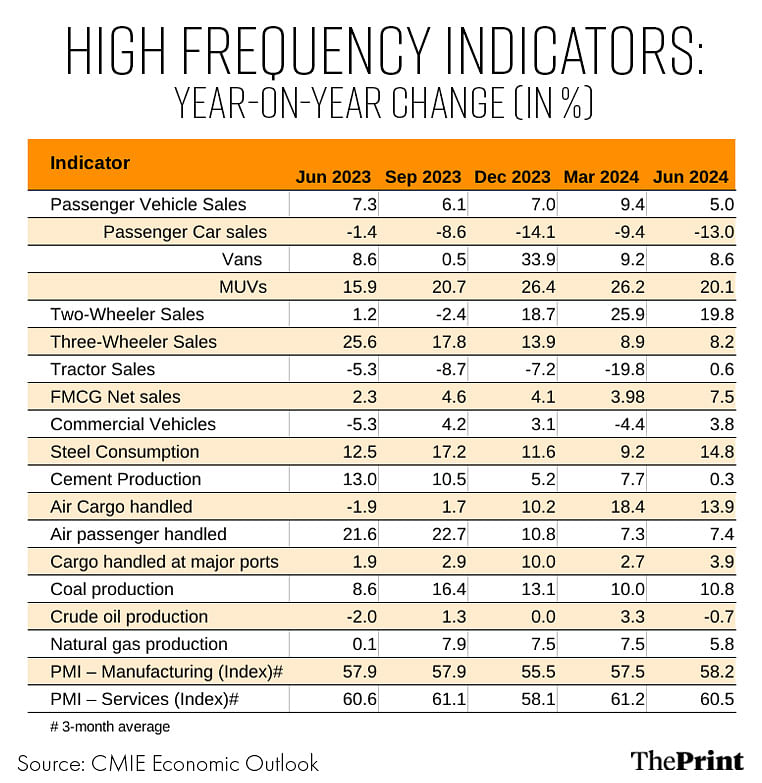

Sales of passenger vehicles eased to five percent in the June quarter from 9.4 percent in the previous quarter. This was driven by a contraction in the sales of passenger cars. Sales of vans and multi-utility vehicles grew by 8.6 and 20 percent, respectively.

As compared to the March quarter, a broad-based decline is seen in sales of passenger vehicles in the June quarter. Lok Sabha elections, widespread heat waves alongside a high base of last year could have led to tapering of passenger vehicle sales in the June quarter.

Commercial vehicles, particularly passenger carrier sales, posted a robust growth of 40 percent in the June quarter. However, there was a sequential moderation across all segments of commercial vehicles in the June quarter. Extreme heat and slowdown in infrastructure projects due to elections impacted sales. Overall sales are likely to see a boost in the September quarter with renewed focus on infrastructure projects and onset of festivals.

Indicators capturing the state of construction activity exhibited a mixed picture, with steel consumption growing at 14.8 percent and cement production growing by a meagre 0.29 percent in the June quarter.

Rural demand

Indicators of rural demand paint a mixed picture, though there are signs of recovery. Sales of two-wheelers and three-wheelers grew by 19.8 and eight percent, respectively, in the June quarter. To be sure, sales growth of two-wheelers have benefitted from the low base of last year.

Quarterly financial performance of listed fast-moving consumer goods (FMCG) point to early indications of recovery in the mass consumer market. This recovery is powered by volume growth amid price cuts in rural markets. Overall sales growth of FMCG companies improved to 7.5 percent in the June quarter from four percent in the previous quarter.

Going forward, better monsoon, improved sowing of Kharif crops (Kharif sowing was up 2.1 percent as of 20 August), increase in Minimum Support Price (MSP) of Kharif crops, and the government budgetary allocation towards supporting the rural economy, augurs well for rural demand. But high food inflation still remains a persistent concern and may temper the resurgence in rural demand.

Bank credit

Non-food bank credit slowed to 13.9 percent in the June quarter, though in July, credit growth improved to 15 percent. Deposit growth has continued to trail credit growth resulting in a rise in credit-deposit ratio (CD ratio). Interestingly, all states and Union Territories, except Chandigarh, saw an increase in their CD ratio in FY 2024 from the previous year.

The quarterly financial statements of most banks show an uptick in credit-deposit ratio and a squeeze in the net interest margin. Slower growth in current and savings account deposits has strained the net interest margins of banks due to a shift in household savings from bank accounts to mutual funds and equity.

Competition amongst banks to woo depositors could lead to further straining of net interest margins in the coming quarters. This could result in moderation of credit growth in the coming quarters.

Radhika Pandey is associate professor and Rachna Sharma is a fellow at National Institute of Public Finance and Policy (NIPFP). Views are personal.

Also Read: Near-term volatility can bother Indian markets. US slowdown, Middle East tensions may spook them