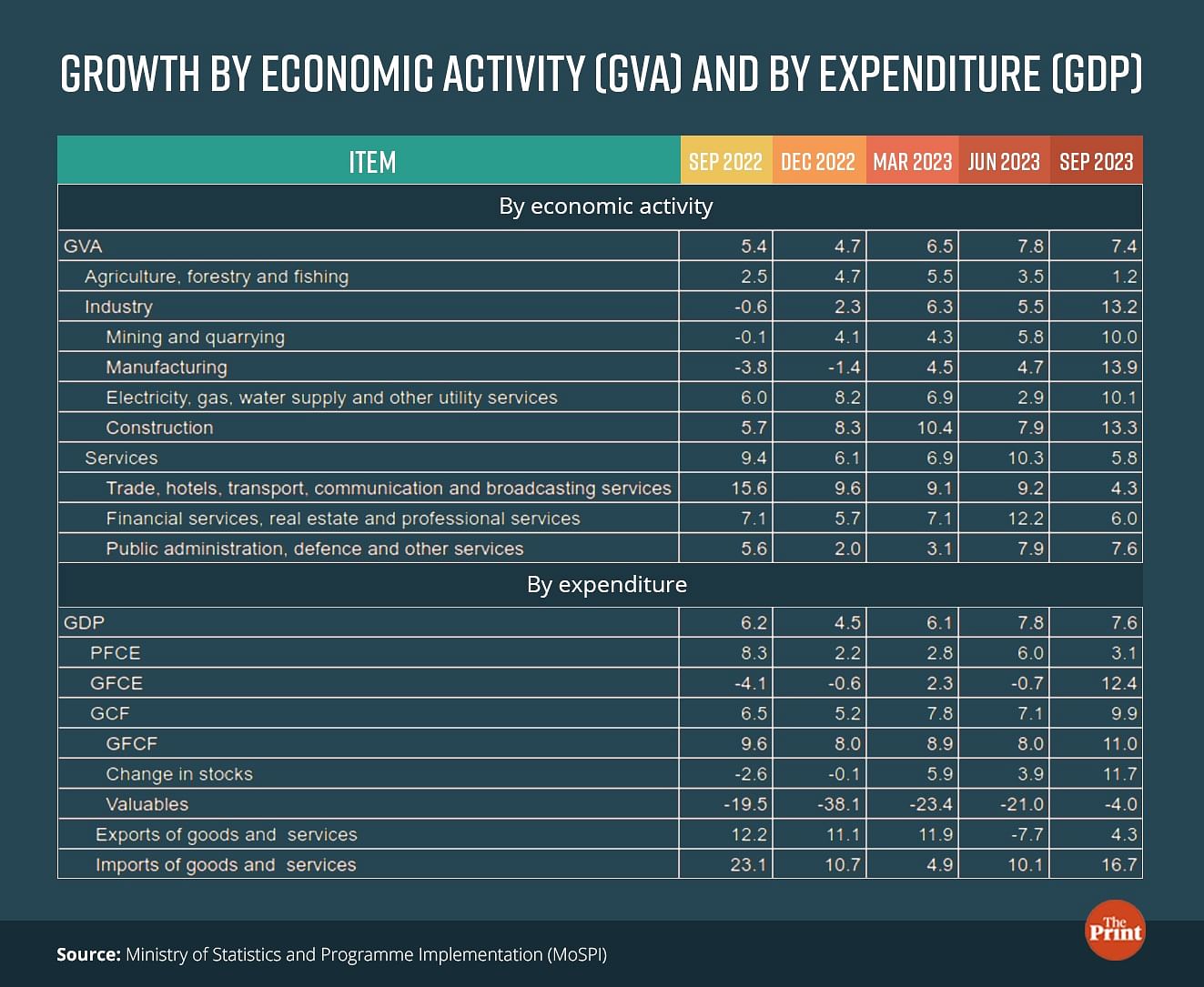

Surpassing by a wide margin, India’s Gross Domestic Product (GDP) posted a growth of 7.6 percent in July-September from 7.8 percent in the previous quarter. The RBI had projected growth to be 6.5 percent in the September quarter. The Gross Value Added (GVA) grew by an impressive 7.4 percent. The strong momentum in GVA was driven by a broad-based revival in the industrial sector, while agriculture and services registered muted growth.

On the expenditure front, while growth was supported by capital formation and government expenditure, private consumption growth slowed owing to elevated inflation and sluggish rural demand.

Going forward, a possible slowdown in capital expenditure ahead of elections, uneven external demand, impact of monetary tightening and uncertain outlook on agriculture could result in a lower growth in the second half. However, the full year GDP numbers will get a boost due to the sharper than expected pace of growth in the second quarter.

Also read: Low or high, inflation a pain point in poll-bound states. Parties assure sops to ease rising prices

Revival in industry

The key highlight of the GDP release has been the remarkable turnaround of the industrial sector. Industrial growth rebounded to 13.2 percent in the July-September quarter from 5.5 percent in the previous quarter. Manufacturing sector, whose tepid growth had been a cause of worry in the last few quarters, registered a robust growth of 13.91 percent. Construction also posted a growth of above 13 percent. The strong growth in the construction sector bodes well for the employment situation in the country. Mining and electricity posted strong growth of 9.97 percent and 10 percent, respectively.

Industrial segment was expected to post better performance with Index of Industrial Production (IIP) growing at a decent 7.4 percent in the September quarter as compared to 4.8 percent in the quarter ending June. All the sub-segments of IIP viz, mining, manufacturing and electricity registered higher growth in the July-September quarter. The sub-par rains in the July-September quarter led to lesser disruption in mining activities. Electricity demand also remained strong due to heat.

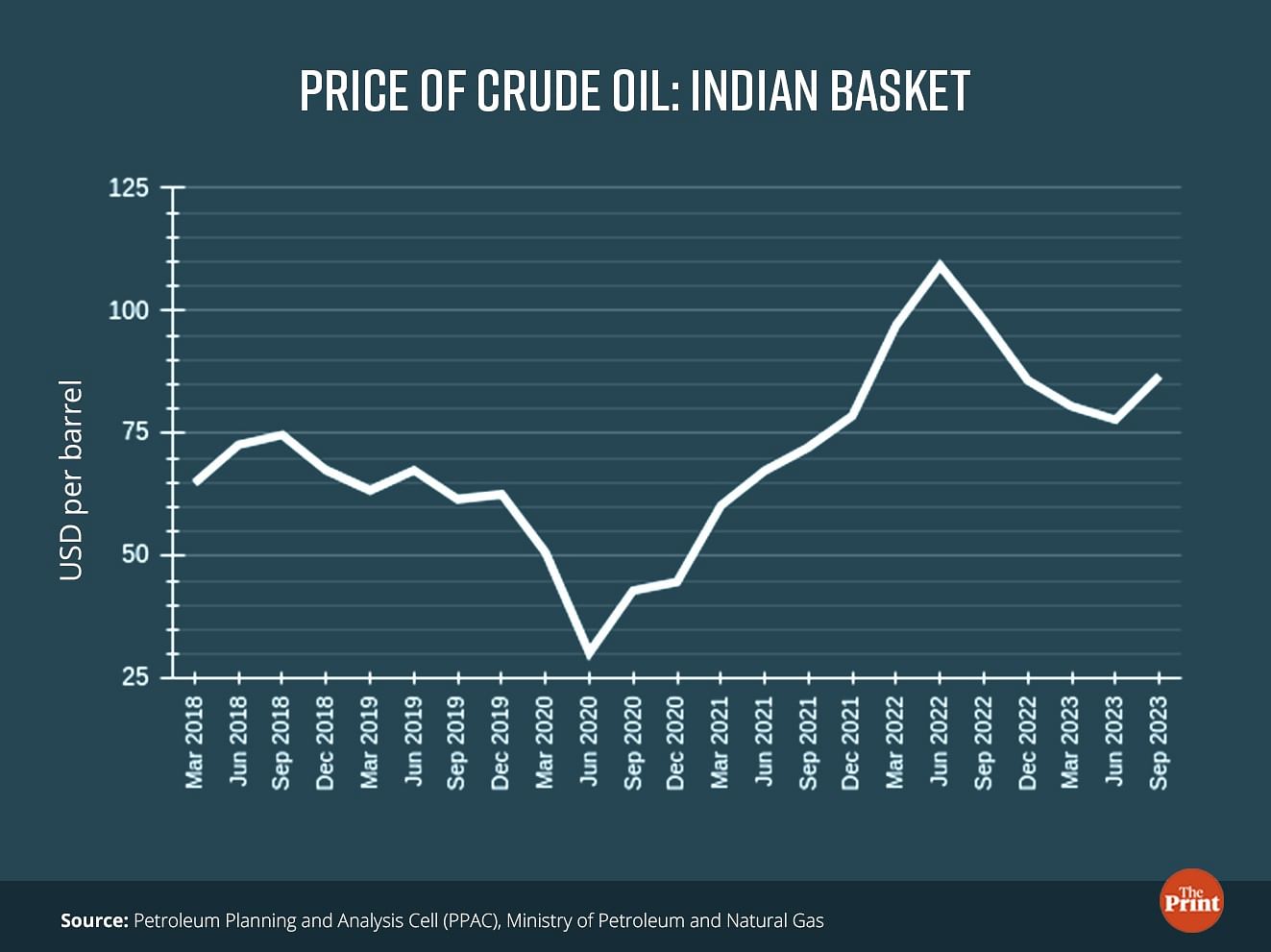

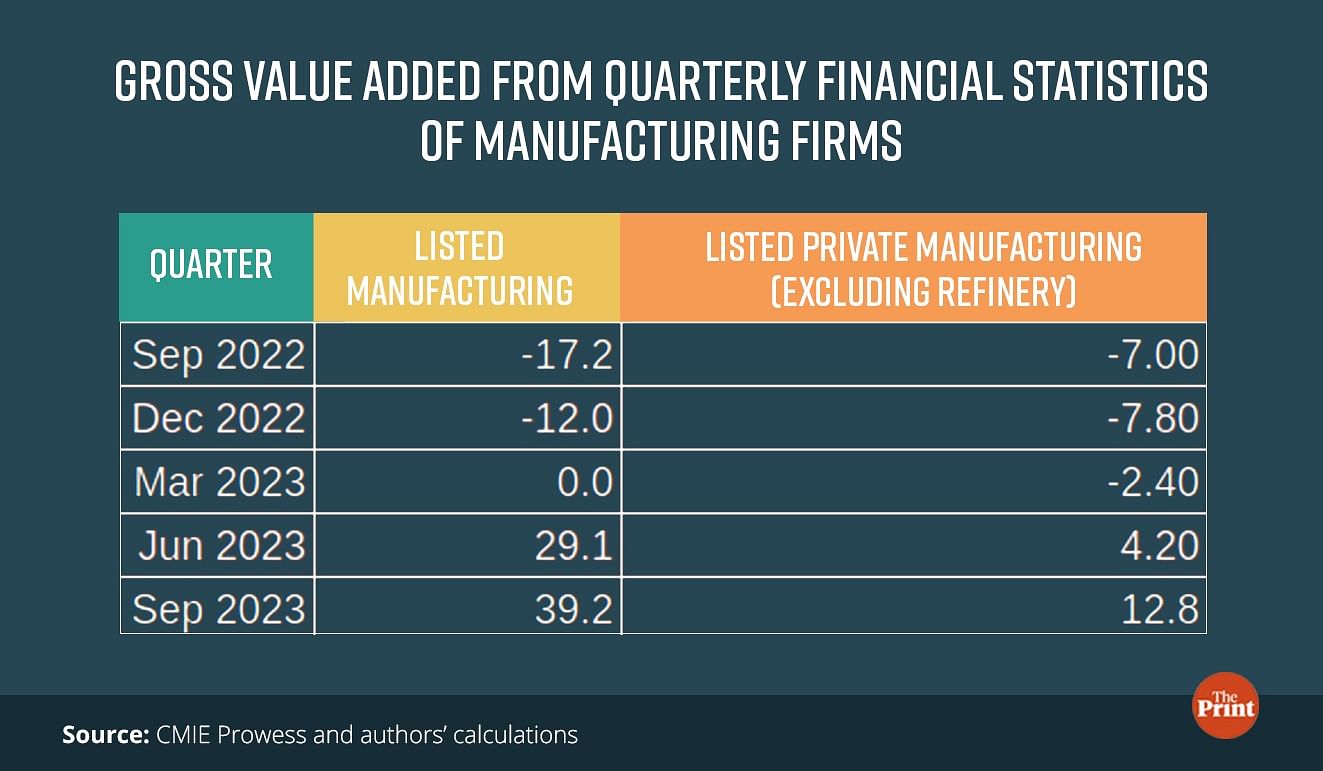

Manufacturing sector got a fillip due to the easing of commodity prices. Energy, metal and food prices have all eased from the highs of September 2022. As an outcome, profitability of firms got a big boost in the July September quarter.

The estimation of the gross value added by the manufacturing sector using the CMIE Prowess database also mirrors the trends seen in the official statistics. Using the Income Approach which involves summing wages and salaries, profit before tax and depreciation yields a GVA growth of 39 percent for all manufacturing firms. Even after excluding the refinery segment, GVA growth is seen at 12.8 percent in the July-September quarter.

Extreme weather conditions hurt agriculture

Agriculture growth declined from 3.5 percent in the April-June quarter to 1.2 percent in the July-September quarter due to erratic monsoon. The kharif sowing was impacted by the El Niño, leading to subdued growth in the July-September quarter.

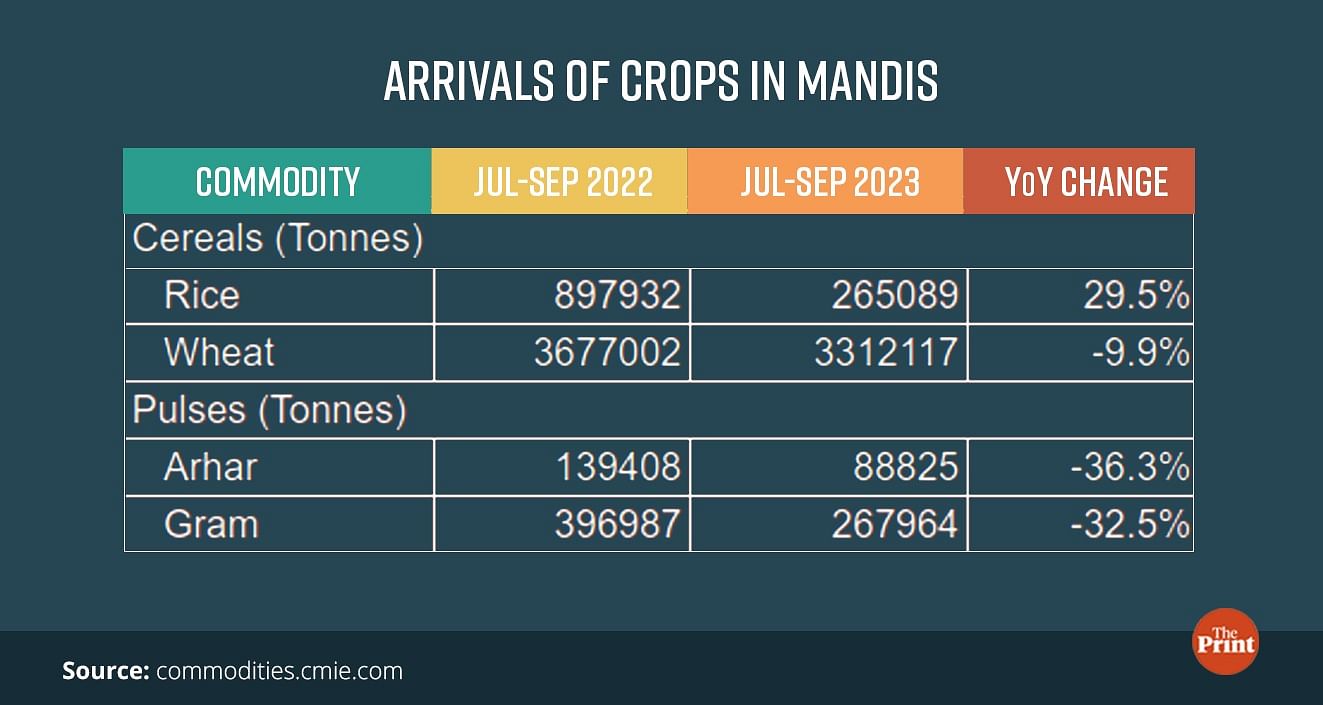

The outlook is likely to remain muted as the First Advance Estimates have projected a decline in output across major Kharif crops. The country’s rice production is estimated to decline by 3.79 percent to 106.31 million tonnes in the kharif season of the 2023-24 crop year due to erratic rainfall in key producer states. The muted arrival of key crops in mandis is also a possible indicator of a shortfall in production.

Lower rainfall and limited availability of irrigation water could slow wheat sowing and impact agricultural growth in the coming quarters.

Double-digit growth in capital formation and government consumption expenditure

Gross fixed capital formation posted a healthy growth of 11 percent, reflecting the government’s continued push towards capex. The Centre’s capex was up 26 percent year-on-year in July-September while states capex was even higher at 41.5 percent in July-September. In the absence of a sustained rise in private sector investment, both central and state governments are doing the heavy lifting on capex. Government final consumption expenditure rose by 12.4 percent. While there is a base effect at play, the spurt in expenditure due to elections has also led to higher growth.

Another positive development has been the performance of exports of goods and services, which grew by 4.3 percent against a contraction of 7.7 percent in the previous quarter. The positive growth in exports suggests that despite the unfavourable geo-political situation, services exports have been providing the necessary cushion to the deficit in trade in goods.

Uneven consumption

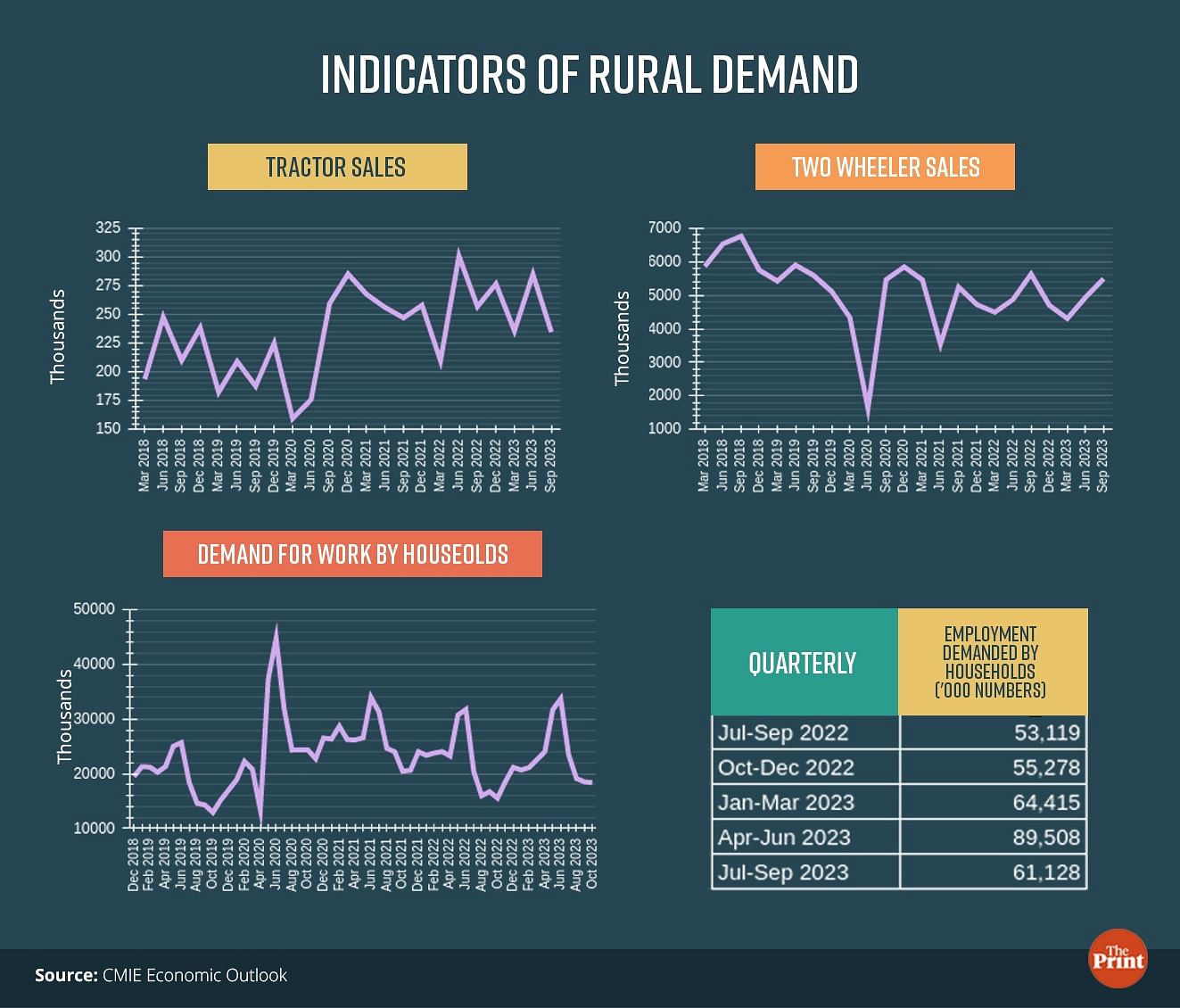

A worrying feature has been the slowdown in private consumption to 3.1 percent in the July-September quarter from 6 percent in the previous quarter. While indicators of urban demand are growing at a sharp pace, rural consumption is in a slow lane. The subdued growth in the agriculture sector and high rural inflation has led to sluggish rural demand. The key indicators of rural demand such as tractor sales and demand for work under Mahatma Gandhi National Rural Employment Guarantee Programme suggests that rural consumption is yet to see a sustained pick-up.

The moderation in private consumption growth has also led to a decline in its share in GDP from 59.3 percent in July-September of 2022-23 to 56.8 percent in July-September 2023-24.

Consumption could get a boost from the moderation in inflation and festival induced demand in the October-December quarter.

It is important for domestic consumption to pick up pace amidst an uneven external demand.

Radhika Pandey is an associate professor and Pramod Sinha is a Fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal

Also read: Though improved, central & states’ debt still higher than pre-Covid levels. How this can be managed