In the weeks following the announcement of the Union Budget, 20 states have presented their budgets for the current financial year. The budget statements provide an idea about the fiscal position of states in the just concluded financial year (2022-23) and their priorities for the present financial year (2023-24).

On an aggregate basis, the pace of spending in the current financial year is expected to slow down to around 10 per cent from roughly 25 per cent in the previous financial year.

While a higher capital outlay has been budgeted for the current financial year, the trends of the last financial year suggest that states have underspent on capex and are unlikely to achieve their capex targets for the previous financial year, 2022-23. The economic growth estimates that are crucial for fixing the deficit targets and growth in tax collections also appear to be highly ambitious for some of the states.

Also read: How India can reverse investment slowdown and save the 2020s from being a ‘lost’ decade

Over promising and under-spending on capex

Twenty states have committed an increase of 21 per cent in capital outlay for the present financial year over the Revised Estimates (RE) of 2022-23. However, in the last financial year, these states fell short of their budgeted commitment on capital expenditure by 3 per cent.

There are state-level variations. Andhra Pradesh, West Bengal and Haryana have reported massive cuts in their capital expenditures as per the RE, as compared to the commitments made at the time of budget announcement. Rajasthan, Jharkhand, Punjab, Tamil Nadu and Telangana have also revised downwards their expenditure on capex for 2022-23 as compared to the budgeted estimates.

Most of the states have budgeted a higher capital outlay in 2023-24 as compared to the RE for 2022-23. However, Bihar has proposed a 26 per cent reduction in capital outlay in 2023-24 as compared to the RE for 2022-23. Himachal Pradesh has also proposed a decrease of 18 per cent from the RE of 2022-23.

Even for states whose RE on capex exceed their budgeted estimates for 2022-23, the actual trends in spending present a contrasting picture.

As an example, Uttar Pradesh budgeted its capital outlay at Rs 1.24 lakh crore in 2022-23. This was a steep jump from Rs 71,443 (actuals for 2021-22). In the revised estimates, the capital outlay has been raised further to Rs 1.26 lakh crore. But till February, the actual spending has been less than half of the budgetary commitment. Maharashtra also expects to spend more than the budgeted estimate but the actual spending till February has been just 40 per cent of the budgeted figure. These states are unlikely to achieve their capex targets for FY 23.

Fiscal discipline and fiscal marksmanship

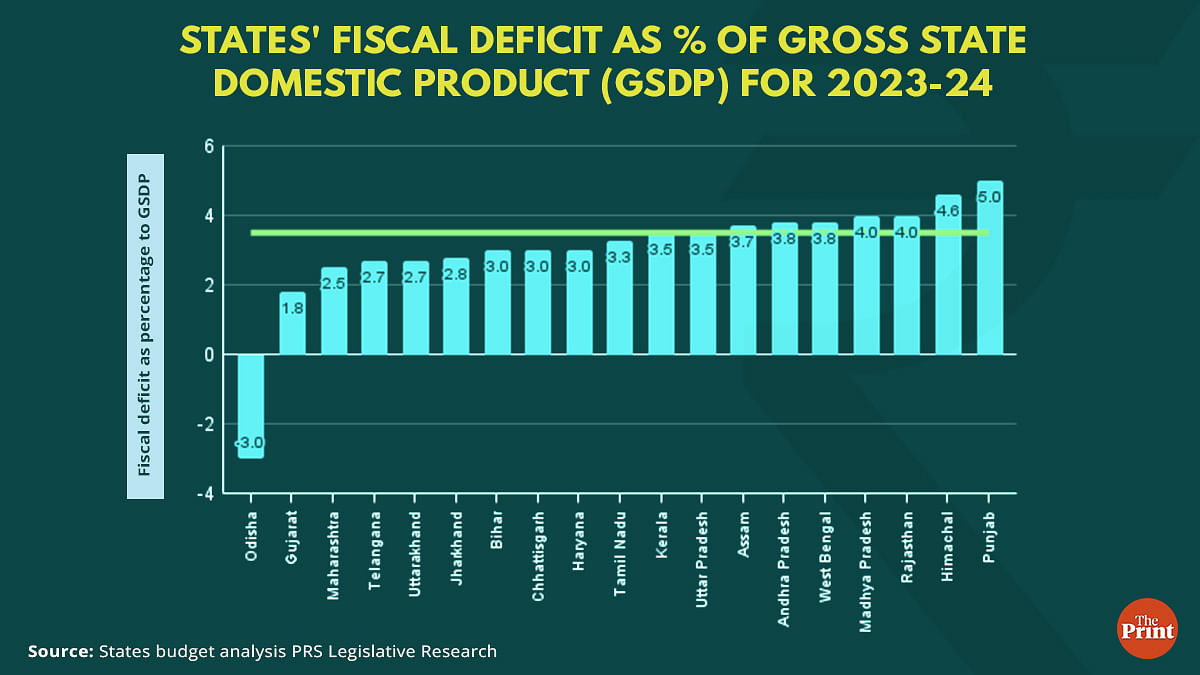

The Fifteenth Finance Commission recommended the fiscal deficit limit of states to be 3 per cent of their gross state domestic product (GSDP) during 2023-26. States are allowed an additional deficit of 3.5 per cent of GSDP if they undertake power sector reforms. Of the 20 states that have announced their budgets, seven have budgeted a deficit of above 3.5 per cent of GSDP for 2023-24. Higher deficits would result in elevated liabilities of states.

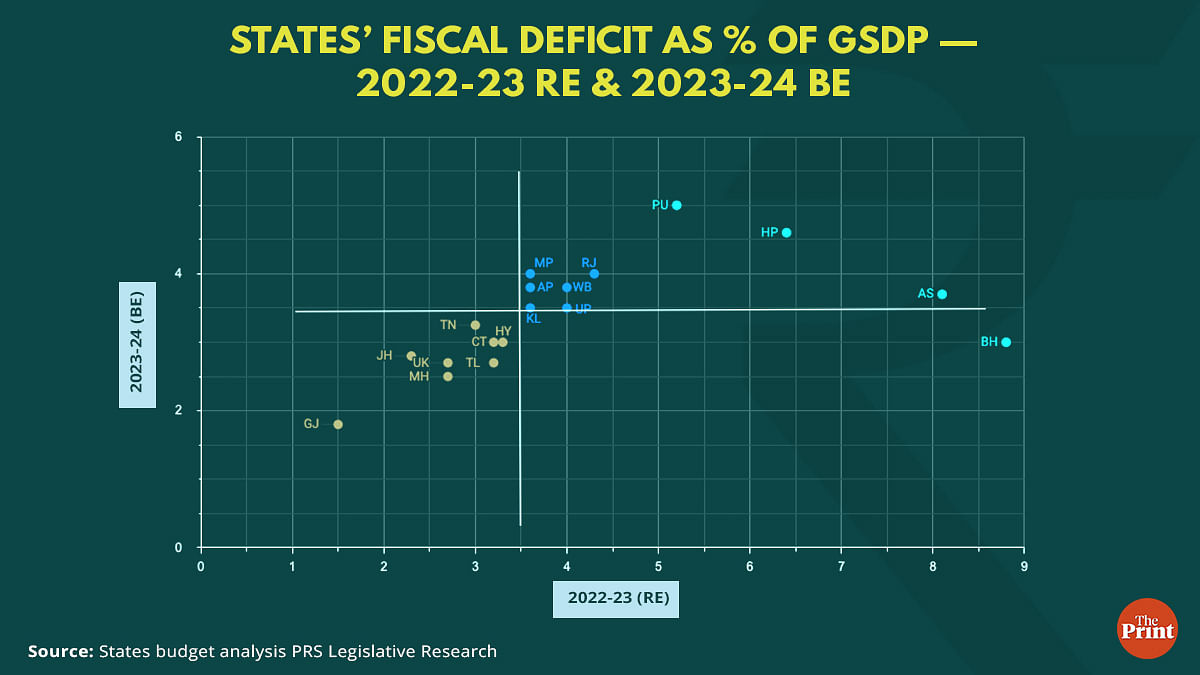

For FY 2022-23, a comparison of budget estimates (BE) and RE shows that there are wide variations in states fiscal performance.

While Odisha has reported a fiscal surplus, states like Madhya Pradesh, Kerala, Jharkhand, Telangana, Gujarat, Tamil Nadu, Uttarakhand and Chhattisgarh have reported their revised estimates of fiscal deficit to GSDP to be lower as compared to the budget estimates.

On the other end of the spectrum are states like Bihar and Assam who have deviated from their committed fiscal deficit numbers by a considerable margin. Assam’s budgeted fiscal deficit for 2022-23 was 3.2 per cent. This has deviated to 8.1 per cent of GSDP according to the RE. Similarly, Bihar’s budgeted fiscal deficit was 3.5 per cent of GSDP, the RE suggest that this will be 8.8 per cent of GSDP.

The figure above shows that for Andhra Pradesh, West Bengal, Rajasthan, Madhya Pradesh, Punjab, Himachal Pradesh and Assam, the Fiscal Deficit as percentage of GSDP in both 2022-23 (RE) and 2023-24 (BE) has been projected to be higher than 3.5 per cent.

Interestingly, the RE also do not present a reasonable assessment of the fiscal position of some of the states. There are discrepancies between BE, RE and actuals. These discrepancies reflect errors in assumptions or the occurrence of unexpected events.

Typically, RE should be closer to actuals, as they contain actual data for 9-10 months of the financial year. For some states it is seen that the RE are significantly higher than BE and actuals. For Bihar, a comparison of the BE, RE and actuals for 2021-22 suggests that while the revised estimate of fiscal deficit shot up to 11.4 per cent of GSDP, the BE and actuals were closer at 3.3 per cent and 3.8 per cent of GSDP, respectively.

Thus, actuals reflect a downward revision with respect to RE. In fact, the credibility of revised estimates for Bihar has often been put to question. The RE of the last three years pegged the fiscal deficit estimates (as per cent of GSDP) way above the permitted limits. The actuals for these years turned out to be much lower.

Tax generating capacity of states

The pace of revenue generation is projected to slow in 2023-24. Revenue of the 20 states is projected to increase by 10 per cent in 2023-24 over the RE of 2022-23. In the last financial year, revenues of states grew by 20 per cent.

Within the overall revenue position, the state’s own tax revenue (OTR) as a percentage of GSDP indicates the ability of states to reap taxes from the economic activities in the states. Notably for Himachal Pradesh, the OTR as a percentage of GSDP at 5.6 per cent as per the RE is lower than the average for all states at 6.7 per cent for the same period.

Uttar Pradesh and Telangana have the highest projected OTR as a share of GSDP in 2023-24. However, as per the actuals for 2021-22, it was only 7.9 per cent. At a time when GST compensation from the central government is discontinued, it is critical for the states to raise their revenue generation capacity.

Growth assumptions

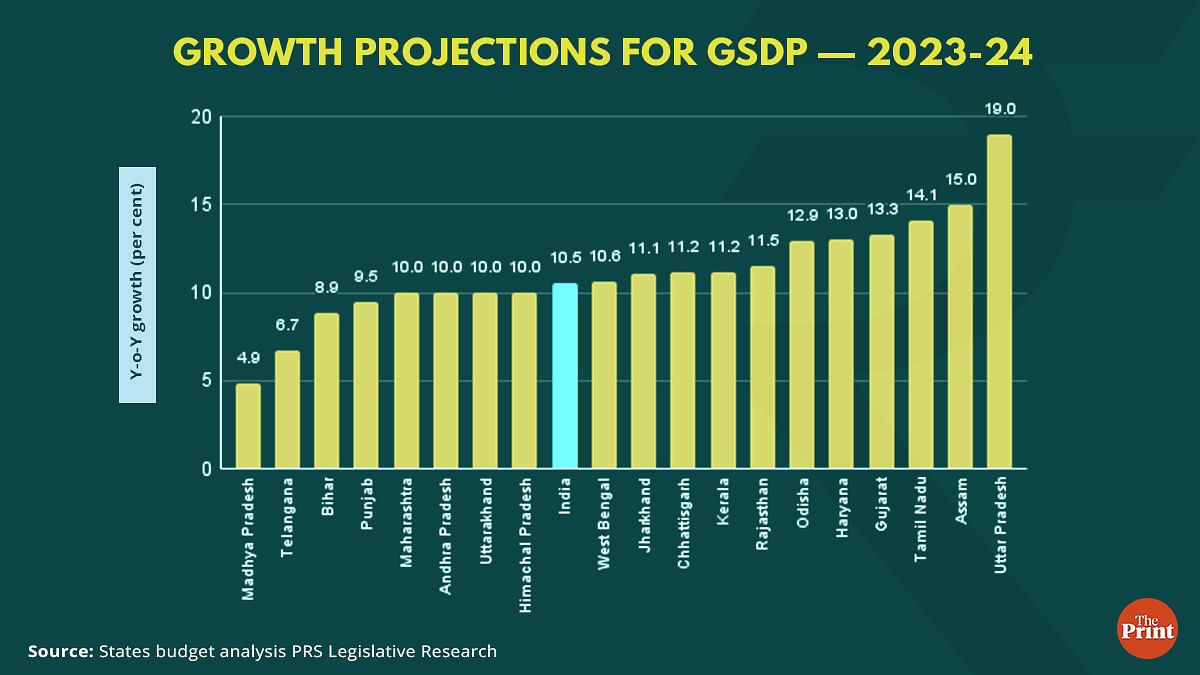

The government has assumed a nominal GDP growth of 10.5 per cent for 2023-24. The nominal GDP growth assumption for 2023-24 is one of the most crucial numbers in the Budget as it determines estimates such as the fiscal deficit and the growth in tax collections.

Eleven states have pegged their GDP growth above the Union government’s GDP estimate of 10.5 per cent. For some of these states, the projection of GSDP growth seems widely out of sync with the government’s GDP estimates. For instance, Uttar Pradesh has projected its GSDP to grow at 19 per cent. While a higher projection for GSDP may act as a cushion against deviation from deficit targets, the numbers seem to be highly unrealistic at a time when India’s growth projections for the current year are being scaled down.

Radhika Pandey is a Senior Fellow and Rachna Sharma is a Fellow at National Institute of Public Finance and Policy (NIPFP)

Views are personal.

Also read: Amid US banking crisis, why central banks’ decision to prioritise price stability is the right move