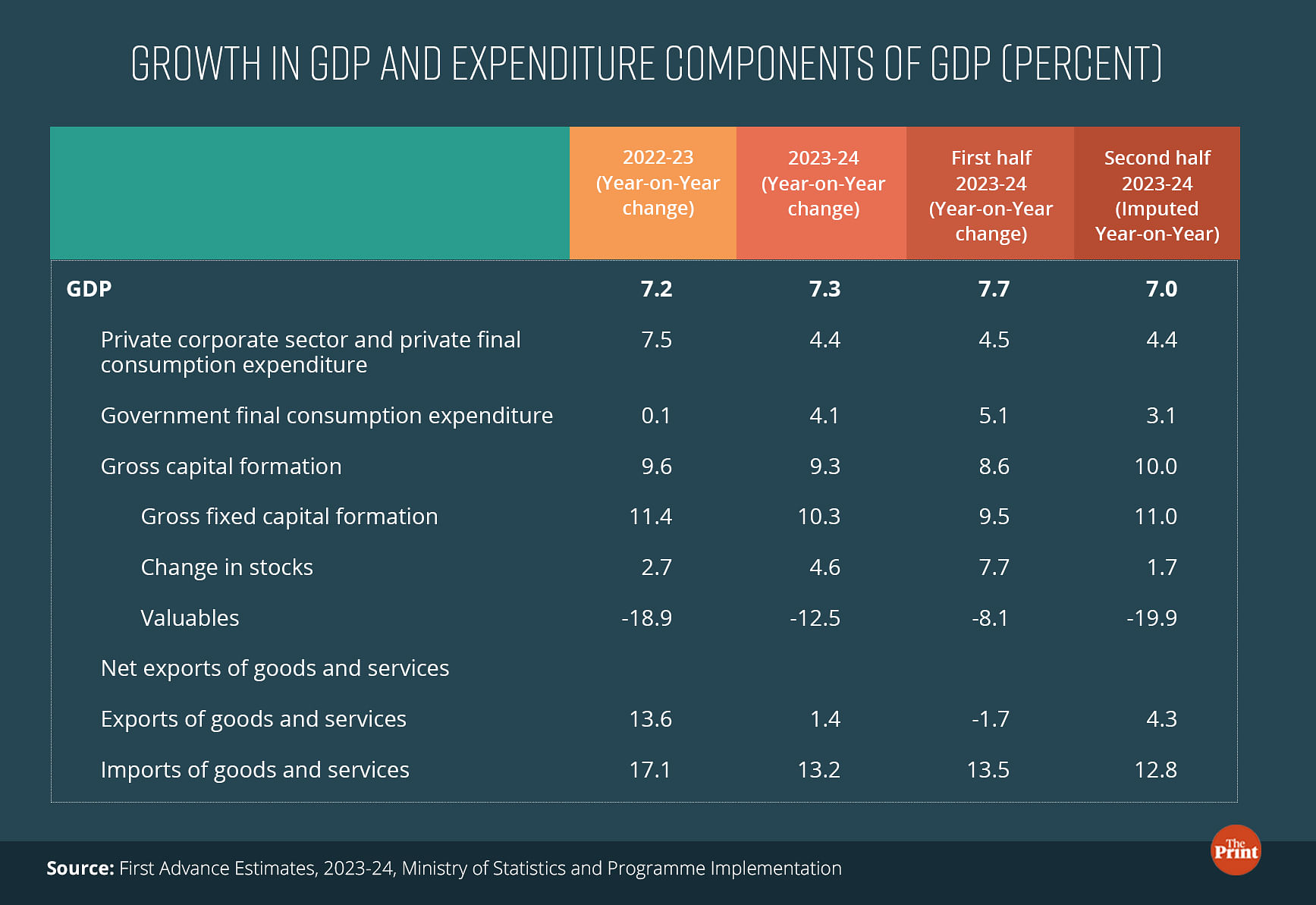

The Indian economy is expected to grow by a robust 7.3 percent in the current financial year, according to the first advance estimates of national income released by the National Statistical Office (NSO). This is higher than the 7.2 percent growth seen in the previous financial year.

The current gross domestic product (GDP) projection by the NSO is higher than the Reserve Bank of India’s (RBI) projection and also exceeds the projections by most international agencies by a wide margin. For instance, the World Bank had projected India’s GDP growth at 6.3 percent for the current year.

On the activity front, manufacturing and construction are likely to be the key drivers of growth while on the expenditure side, strong growth in investment — driven by higher public capex will support growth at a time when consumption growth is uneven and exports are subdued due to global challenges.

Manufacturing sector rebound driven by profits, while sales growth continues to remain tepid

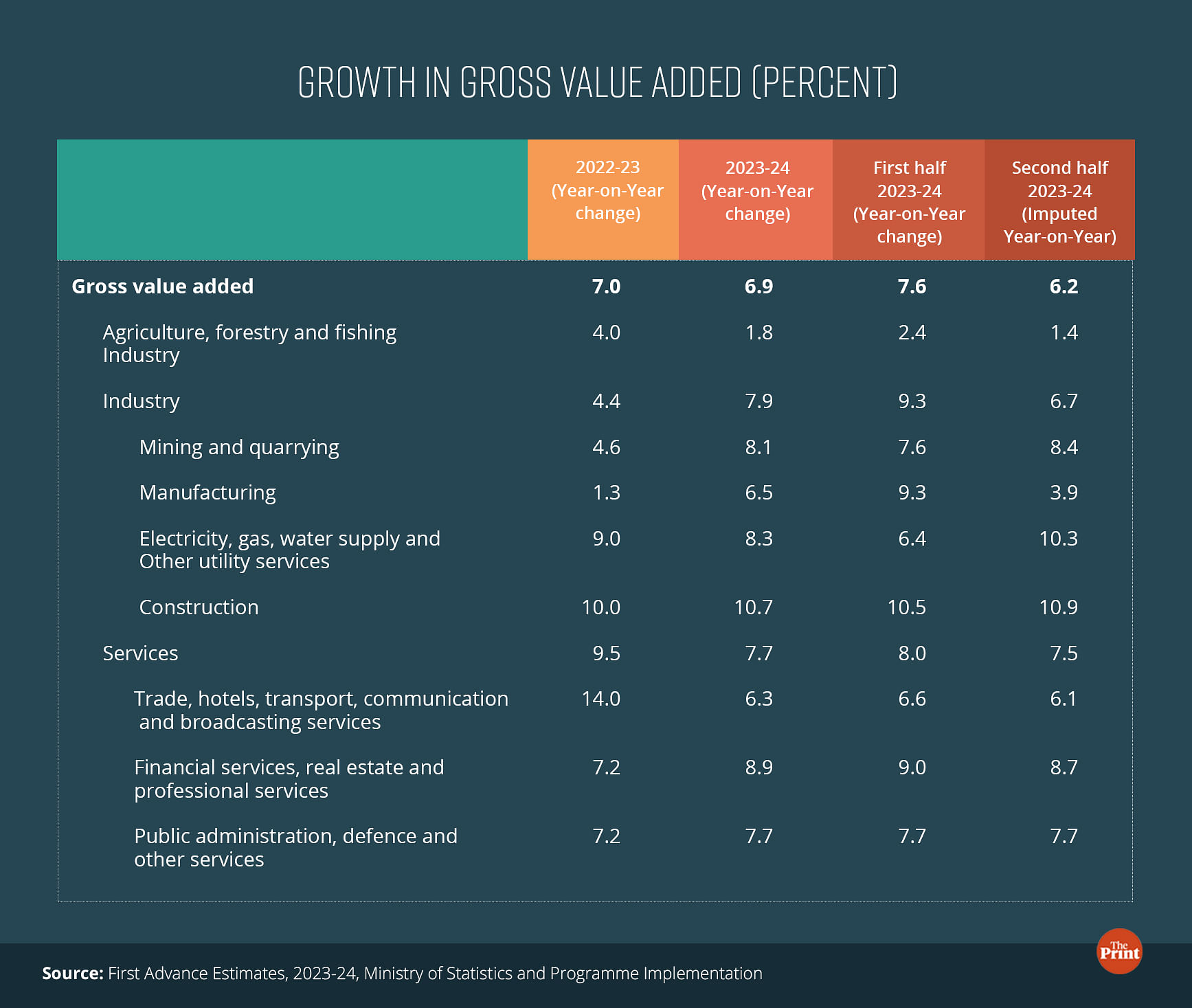

The industrial sector is projected to post a decent 7.9 percent growth up from 4.4 percent registered last year. The key highlight is the strong rebound in manufacturing sector growth estimated at 6.5 percent, up from 1.3 percent registered in the previous financial year.

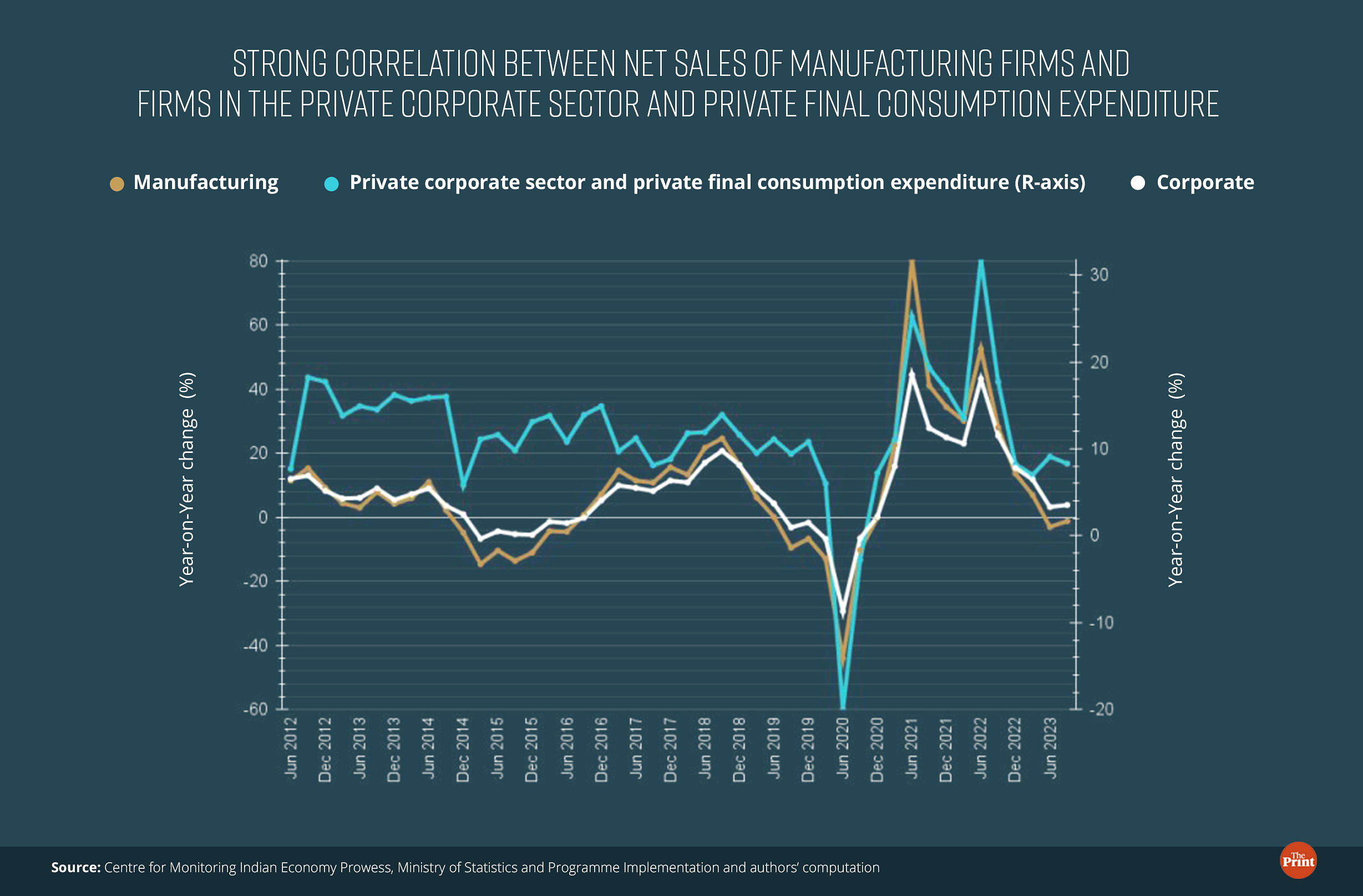

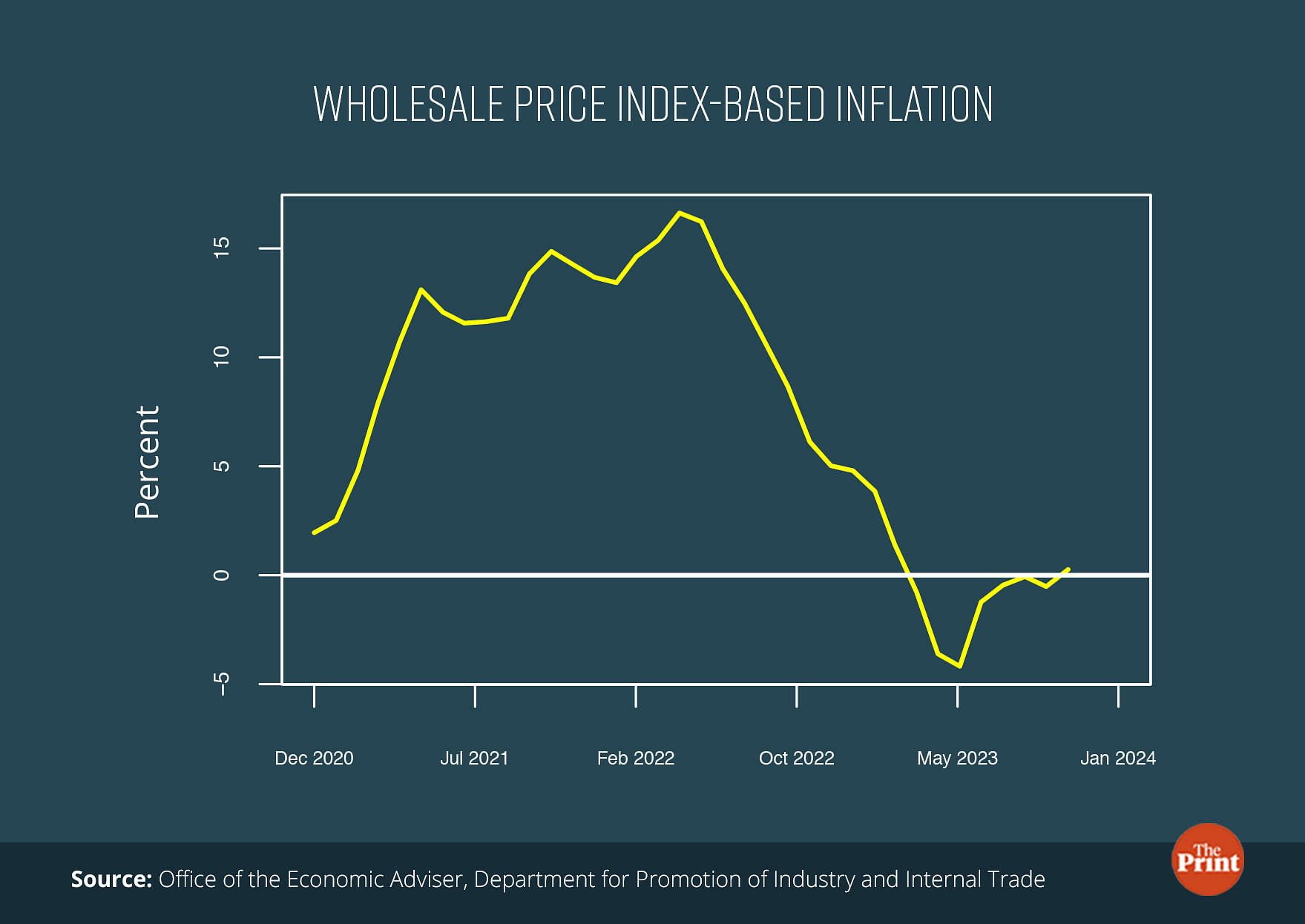

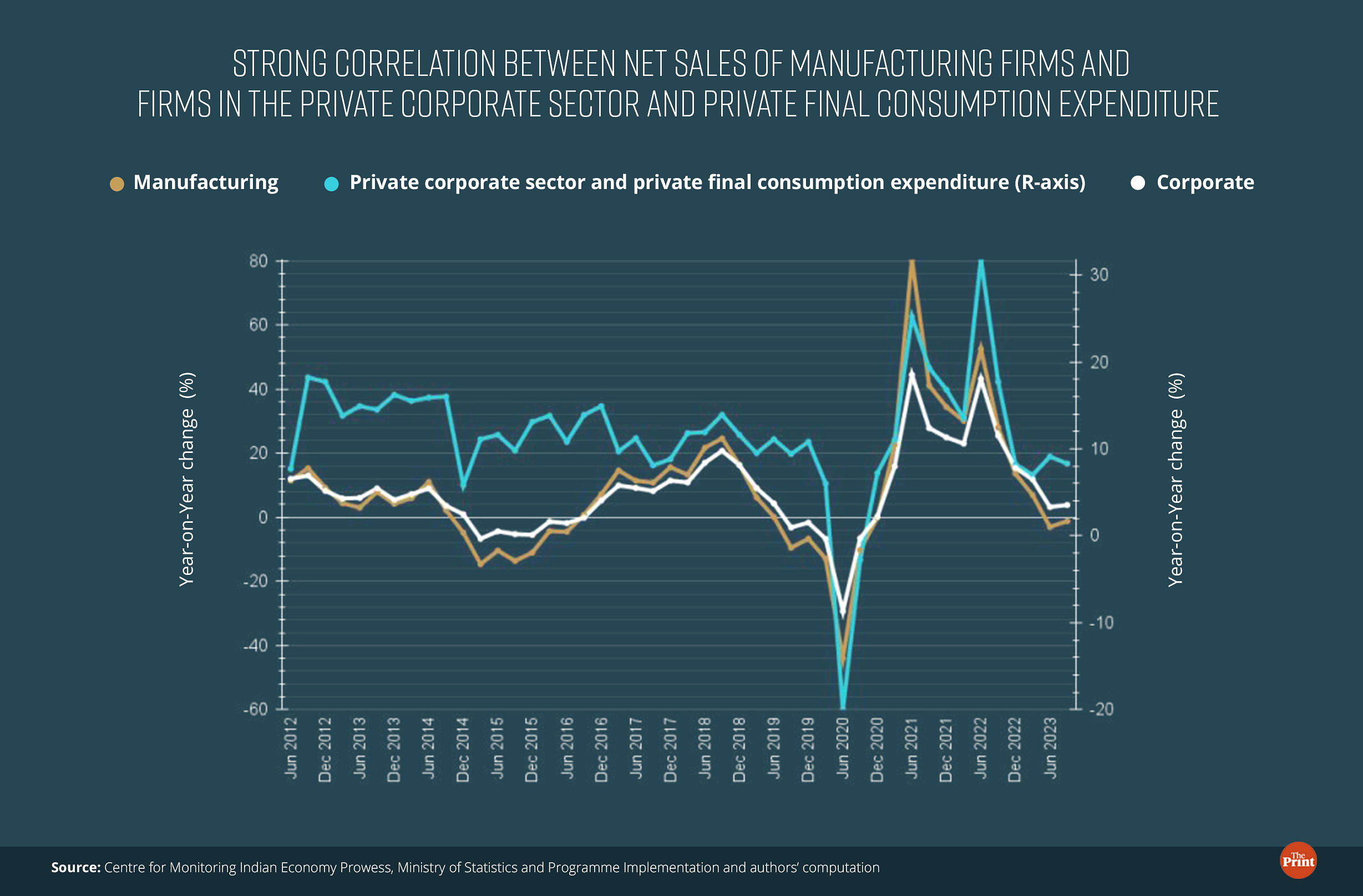

The strong performance by the manufacturing sector is supported by the easing of commodity prices and the resultant boost to the profitability of firms. Energy, metal and food prices eased from the highs of September 2022. The estimation of gross value added (GVA) by the manufacturing sector using the Centre for Monitoring Indian Economy (CMIE) Prowess database also mirrors the trends seen in the official data.

While the GVA grew strongly due to higher profits, the sales growth of firms has not shown an appreciable pickup and reflects the weakness seen in consumption. A strong correlation is seen between the sales growth of the manufacturing and the overall corporate sector and private final consumption expenditure.

Noticeably, the strong performance of the manufacturing sector in the current year is driven by the performance in the first half of the year. In the first half, the manufacturing sector posted a growth of 9.3 percent. The sector is expected to see a muted growth of 3.9 percent in the second half. This implies that the support in the form of lower input prices may not be available in the second half of the year.

A clear indication of this could be seen from the trajectory of the Wholesale Price Index (WPI)-based inflation, which mirrors the trends in global commodity prices. After remaining in the contraction zone for several months, WPI-based inflation inched up to 0.26 percent in November, 2023. Going forward, the movement of the international commodity prices would be a key determinant of the manufacturing sector performance.

As the manufacturing sector continues to evolve, it is essential to consider the broader implications of government figures that show some of India’s output below previous levels, which could impact future growth trajectories.

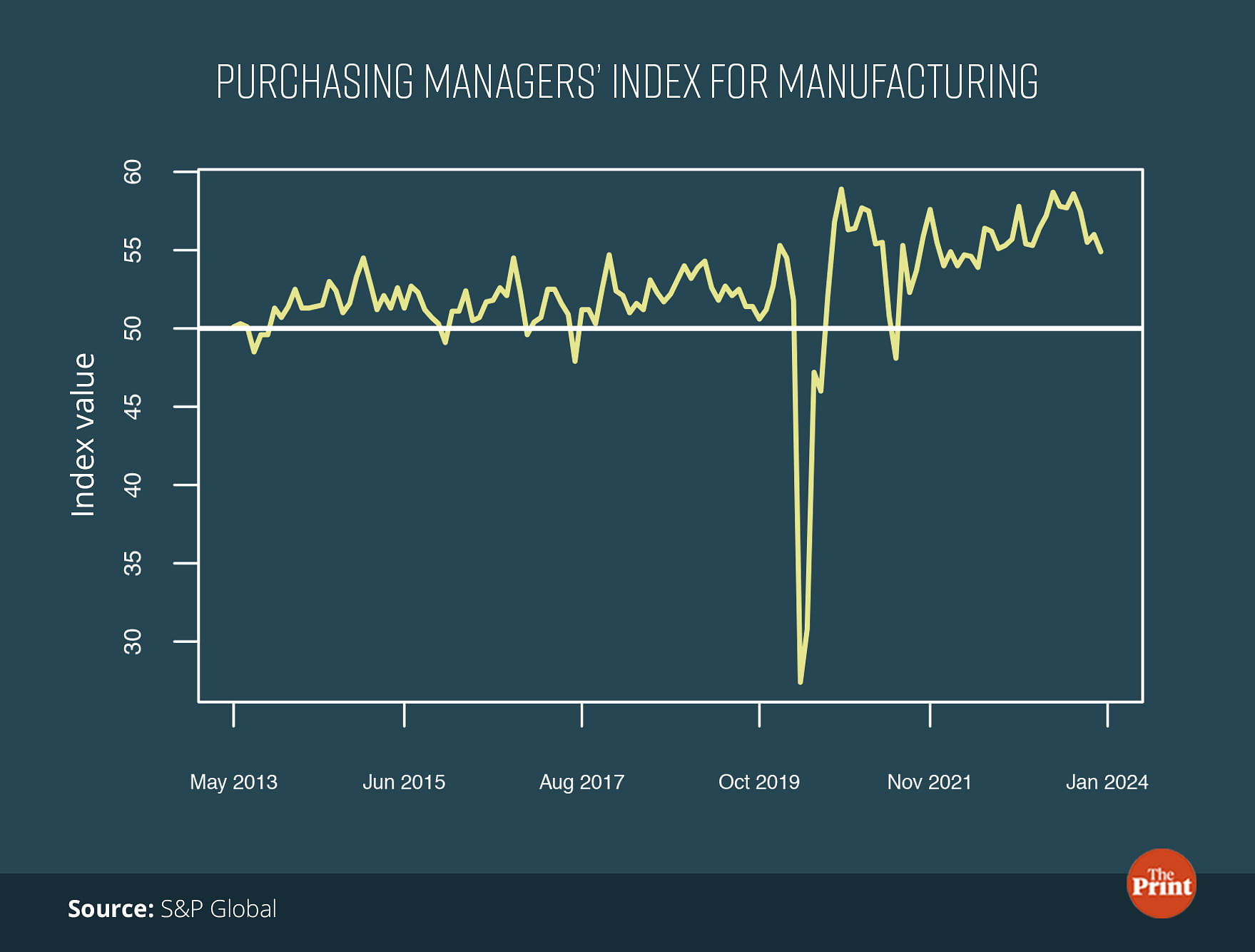

Initial signs of slack are visible in the high-frequency data. The manufacturing Purchasing Managers’ Index (PMI) decreased to 54.9 in December, 2023. This is the lowest reading since June, 2022.

Growth in the agriculture sector is expected to weaken to 1.8 percent in FY 24, from 4 percent recorded in the previous year. Lower Kharif harvest and sluggish Rabi sowing amidst the El Nino impact will hurt the agriculture performance.

Investment-driven growth amidst subdued consumption and global headwinds

On the demand side, gross fixed capital formation (GFCF, a proxy for investment) is likely to be the key driver of growth while consumption demand is likely to be weak. In real terms, GFCF is likely to post a growth of 10.3 percent. The robust growth in investment is primarily due to the sustained push to capital expenditure by the government. As a percentage of GDP, GFCF is expected to rise to 29.8 percent in nominal terms. This is the highest ratio since 2014-15. In real terms, GFCF is likely to touch a high of 34.9 percent of GDP.

Data from the Controller General of Accounts (CGA) shows that in the first eight months of the current year, the government has spent 58.5 percent of its budgeted capital expenditure. This is a growth of 31 percent over the first eight months of the last year. It needs to be seen whether the momentum in capex growth would be maintained in the remaining months of the current financial year.

Growth in private final consumption expenditure (PFCE) is likely to slow down to 4.4 percent in the current year from 7.5 percent last year. This is the slowest growth seen in the 2011-12 base year series, barring the Covid year. High-frequency indicators suggest robust growth in demand for goods purchased by urban households, particularly in the upper income bracket while subdued agricultural growth and high food inflation have led to weak demand by rural households.

On the external front, exports are projected to grow at 1.4 percent in the current year. While the first half of the year saw a contraction in exports, the second half is expected to see a growth of 4.3 percent. This seems to be an optimistic projection as exports could take a hit due to the crisis in the Red Sea and the lingering global growth challenges

Lower nominal GDP growth and its impact on fiscal math

The first advance estimates peg India’s nominal GDP growth at 8.9 percent — the lowest since the Covid-hit year and nearly half of the 16.1 percent growth registered in the previous year. The growth is lower than the 10.5 percent growth assumed by the government in its budget numbers for the current year. A lower base would entail a minor slippage of 10 basis points in the fiscal deficit to GDP ratio even if the government sticks to its budgeted fiscal deficit estimate of Rs 17.87 lakh crore.

If the government aims to meet its target of 5.9 percent, it would have to cut its fiscal deficit by roughly Rs 40,000 crore. While disinvestment receipts have been sharply lower than the budgeted estimate, huge dividends from the RBI and robust tax collections could help the government meet its fiscal deficit target.

Radhika Pandey is associate professor and Pramod Sinha is a Fellow at National Institute of Public Finance and Policy (NIPFP).

Views are personal.