As Maharashtra and Jharkhand prepare for elections this month, both state governments have introduced a wave of welfare schemes to attract voters, making this a fitting time to examine their financial health.

The revenue and debt position show that while Maharashtra has the headroom to spend on the poll promises, additional spending through supplementary demand will cause a deviation from budgeted deficit estimates and would likely weigh on the state’s ability to ramp up capital spending.

Jharkhand has been in revenue surplus since 2016-17. The quality of expenditure is improving, but the projections on revenue receipts look optimistic, and may limit the surplus on the revenue account and the fiscal space to fulfill poll promises.

Maharashtra: Deficits & debt

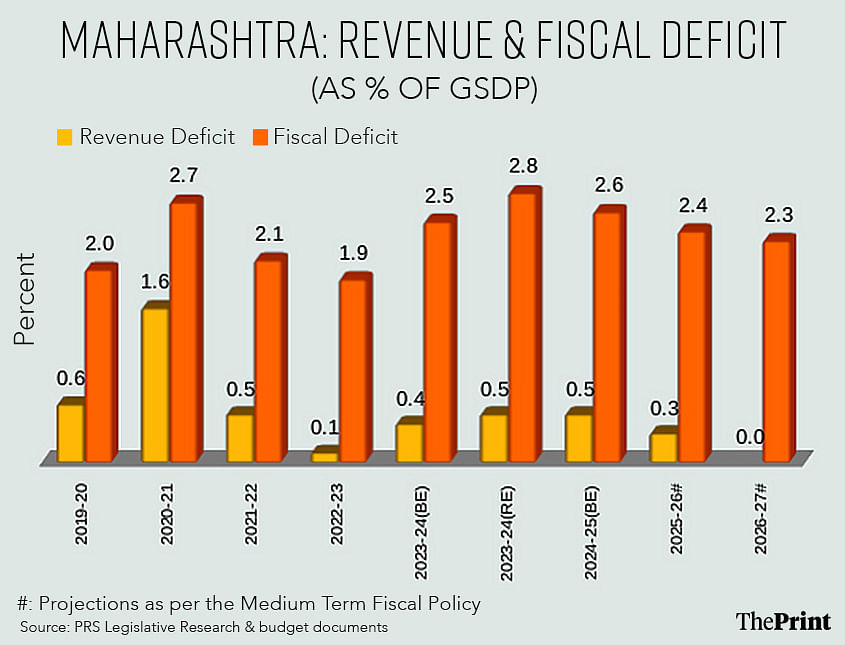

Maharashtra has budgeted its fiscal deficit at 2.6 percent of the Gross State Domestic Product for the current year. For 2023-24, while the budgeted fiscal deficit was 2.5 percent of GSDP, according to revised estimates, the fiscal deficit will likely rise to 2.8 percent of GSDP.

Successive Finance Commissions have recommended the elimination of the states’ revenue deficit. Maharashtra’s Fiscal Responsibility and Budgetary Management Act and Rules also require the state to eliminate its revenue deficit after 2021-22. However, the revenue deficit for the current year is budgeted at 0.5 percent of GSDP, same as the revised estimate for 2023-24.

Notably, in July, the state government tabled supplementary demands of Rs 94,889.6 crore, which will cause a deviation from the budgeted estimates for the fiscal and revenue deficit. If the proposed spending is implemented fully, the state’s revenue deficit is likely to increase from the budgeted 0.5 percent of GSDP to almost 2.3 percent of GSDP in the current year.

Maharashtra fares well on the debt front as its debt as a share of GSDP is among the lowest in the country. The state’s outstanding liabilities to GSDP were 17.6 percent of GSDP as per the revised estimates of 2023-24. At the end of the current year, the outstanding liabilities are estimated to be 18.4 percent of GSDP.

Also Read: Recession has been averted, inflation is down. But latest IMF reports sound alarm on global debt

Committed expenditure projected to rise, likely to weigh on capital outlay

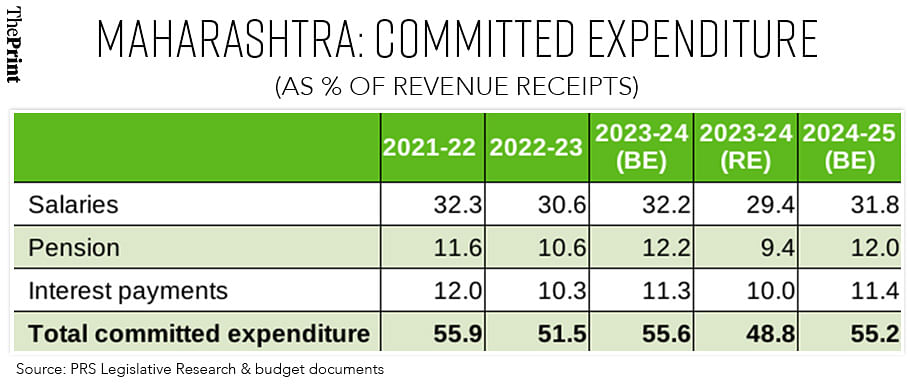

Committed expenditure typically includes expenditure on salaries, pension and interest payments. In 2024-25, Maharashtra is estimated to spend Rs 2.75 lakh crore on committed expenditure—an increase of 16 percent over revised estimates of 2023-24.

All three components of the committed expenditure are estimated to report a double-digit growth over the revised estimates of the last year. Notably, the expenditure on pension is projected to rise by 30 percent over 2023-24 revised estimates.

With increase in levels, committed expenditure is projected to occupy a greater share of the state’s revenue receipts. Committed expenditure as a share of revenue receipts is expected to rise from 48.8 percent, according to 2023-24 revised estimates, to 55.2 percent in 2024-25.

A higher proportion of expenditure allocated for committed expenditure limits the ability of the state to prioritise capital spending. In contrast to the budgeted increase in committed expenditure, the capital outlay for the current year is projected at the same level as the revised estimate of last year.

Consequently, the share of capital outlay in total expenditure is budgeted at 13.9 percent, lower than 14.3 percent as per the revised estimates of last year. The share of revenue expenditure in total expenditure is budgeted at 84.8 percent and will rise further with the inclusion of supplementary demand for expenses.

Fiscal space due to higher share of own tax revenue

The revenue receipts of the state is projected to grow by three percent to Rs 4.99 lakh crore in the current year. Encouragingly, the state’s own tax revenue accounts for almost 69 percent of the revenue receipts.

As a share of GSDP, Maharashtra’s own tax revenue at eight percent is among the highest across all states. The state’s own tax revenues are projected to rise by five percent over revised estimates of last year. Even last year, the state’s own tax revenue performance was better than the budgeted estimates.

A higher share of own tax revenues in overall revenue receipts and a lower debt ratio does give the state some fiscal space to spend on electoral promises, but they may have to defer capital spending.

One of the key schemes announced in the run-up to the assembly elections include ‘Mukhyamantri Majhi Ladki Bahin Yojana’, under which eligible women are provided Rs 1,500 per month. The state has also promised to cover the cost of three free cooking gas cylinders for eligible households, in addition to the schemes for farmers and youth.

Jharkhand: Optimistic deficit ratios, but improvement in quality of expenditure

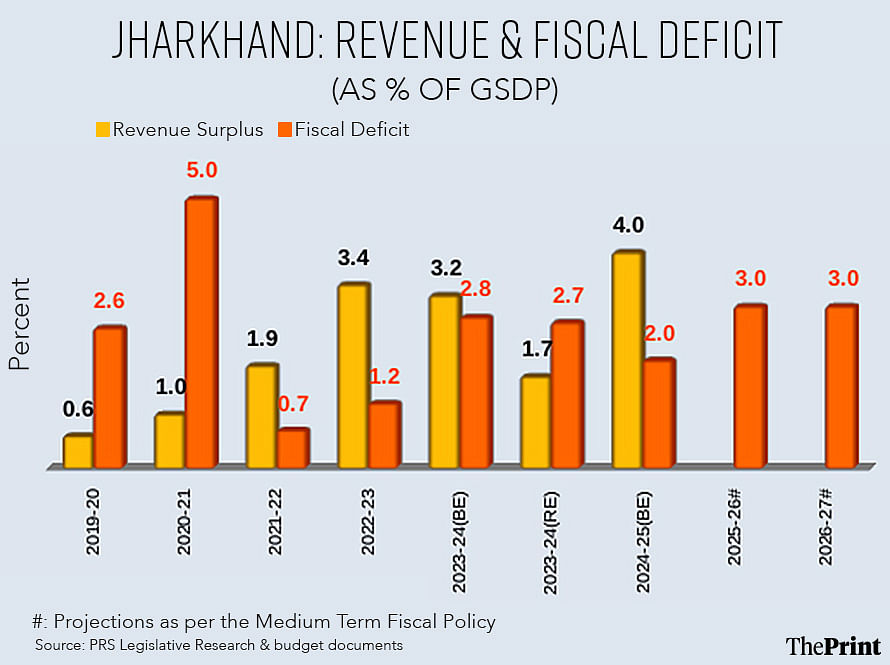

Jharkhand has budgeted fiscal deficit at two percent of GSDP for the current year, significantly lower than the 2.7 percent according to revised estimates for 2023-24. Notably, Jharkhand has budgeted a revenue surplus of four percent of GSDP for the current year. Last year, the state had budgeted a revenue surplus of 3.2 percent of GSDP, but revised estimates peg the surplus at 1.7 percent of GSDP.

An encouraging feature of Jharkhand’s finances is the improvement in quality of expenditure. The share of capital outlay in total expenditure, which was 16.5 percent in 2022-23, is expected to rise to 19.9 percent this year. Consequently, the share of revenue expenditure is expected to decline from 78.5 percent to 76.3 percent during the same period.

The state has budgeted an 11 percent increase in capital outlay and a four percent increase in revenue expenditure over revised estimates of 2023-24.

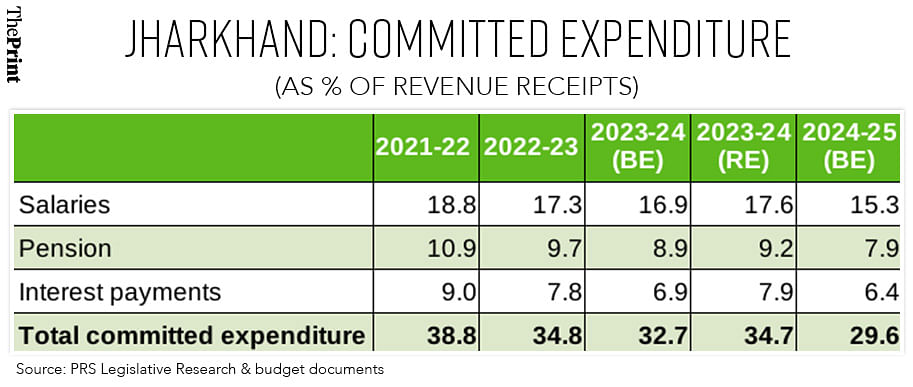

The state is seen to be making efforts at limiting the spending on committed expenditure. Committed expenditure for the current year is budgeted to be one percent lower than revised estimates for 2023-24.

It will be crucial to see if the state is able to put a lid on its committed expenditure, given that last year, committed expenditure grew by 18 percent over 2022-23 levels. Notably, salaries and interest payments grew by 20 percent in 2023-24 RE, compared to 2022-23 actuals.

The projections on the receipts front appear optimistic. The state’s revenue receipts and own tax revenues are projected to rise by 16 percent and 19 percent, respectively, over the revised estimates of 2023-24.

The state’s non-tax revenue is projected to rise by 20 percent over revised estimates of 2023-24.

A large part of the non-tax revenues consists of royalty from mining. The latest Supreme Court judgment allowing states to impose taxes on mineral lands retroactively from 1 April, 2005 will give a boost to the state’s non-tax revenues.

Overall, the optimistic revenue projections may limit the ability of the state government to fulfill the poll promises that include a monthly transfer of Rs 2,500 for women heads of families, increase in monthly ration, and hike in Minimum Support Price for crops, to mention a few.

Radhika Pandey is associate professor and Rachna Sharma is a fellow at the National Institute of Public Finance and Policy.

Views are personal.

Also Read: The global sovereign ratings space needs revamp. Indian agency’s entry a welcome change