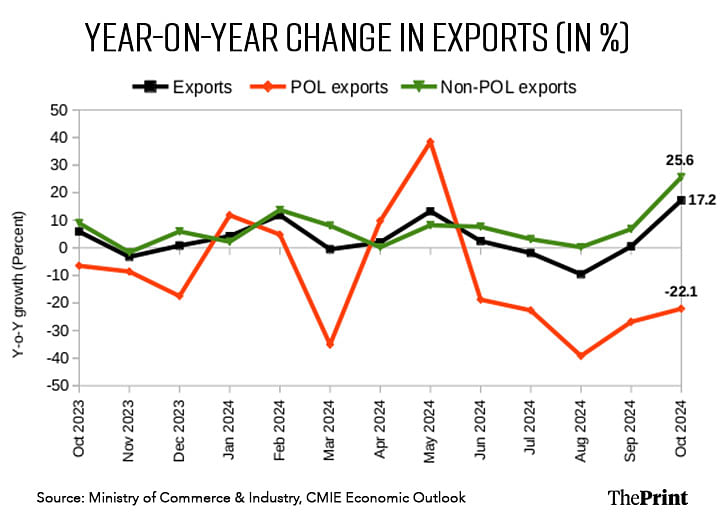

After four months of tepid growth, India’s merchandise exports posted double-digit growth of 17.2 percent in October, marking one of the best months for exports.

Further, non-oil exports, a cleaner measure of exports’ health, grew by an impressive 25.6 percent last month.

The stellar performance of exports in October pushed growth in the first seven months of the current year to three percent, an improvement from a seven percent contraction seen in the same period of last year.

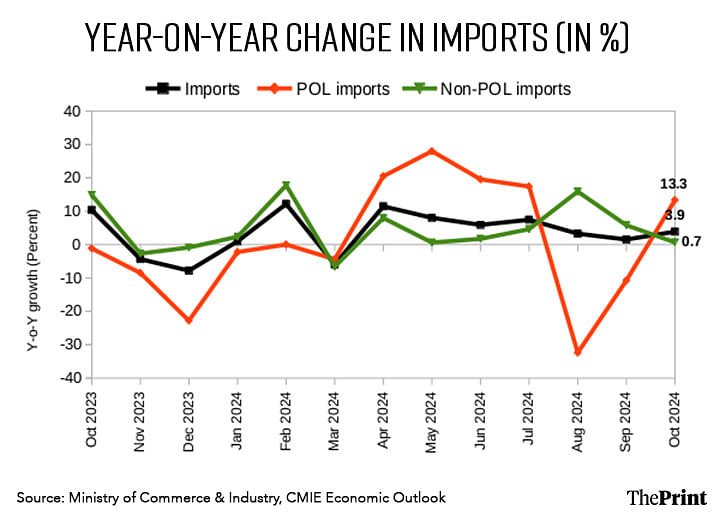

Despite an impressive growth in outbound shipments, the goods trade deficit widened to USD 27 billion in October from USD 20.75 billion in September due to a faster pace of growth in imports. Imports surged to a record high of USD 66.34 billion, up 3.9 percent on a year-on-year basis.

Global trade outlook

Before delving into trade trends, it is instructive to look at the projections for global trade for the current and the next year. The World Trade Organisation (WTO) has raised its projection for merchandise trade growth to 2.7 percent from the previous estimate of 2.6 percent for the current year. For the next year, the projection has been revised downwards from 3.3 percent to three percent.

The revised trade forecasts reflect a significant improvement from the 1.2 percent contraction in merchandise trade in 2023 due to high inflation and interest rates. With easing of inflation and interest rates, global trade prospects have improved.

Amongst countries, Europe continues to remain a drag on trade. In sectors such as chemicals and automobiles, there has been a sharp drop in demand. Dip in demand for automobile exports has repercussions across supply chains. Europe’s imports of machinery have seen a sharp decline.

Asian economies are seen to be propelling trade in the short-term. India, Malaysia, Singapore and Vietnam are the key drivers of import demand, while exports from Asia are seen to be driven by South Korea, Singapore and China.

Turnaround in exports

India’s exports have been affected by sluggish demand in advanced economies, geopolitical tensions and volatility in commodity prices. For April-September, India’s merchandise exports grew by a meagre 0.95 percent on year. However, October saw a sharp turnaround with 17 percent growth in merchandise exports.

The HSBC India Manufacturing Purchasing Managers Index also got a boost in October from strong growth in new export orders from Asia, Europe, Latin America and the US.

The surge in exports is partly on account of inventory-build up for Christmas sales. Logistical challenges as most of India’s trade to Europe and Africa is routed through the Red Sea route has also prompted countries to maintain inventories.

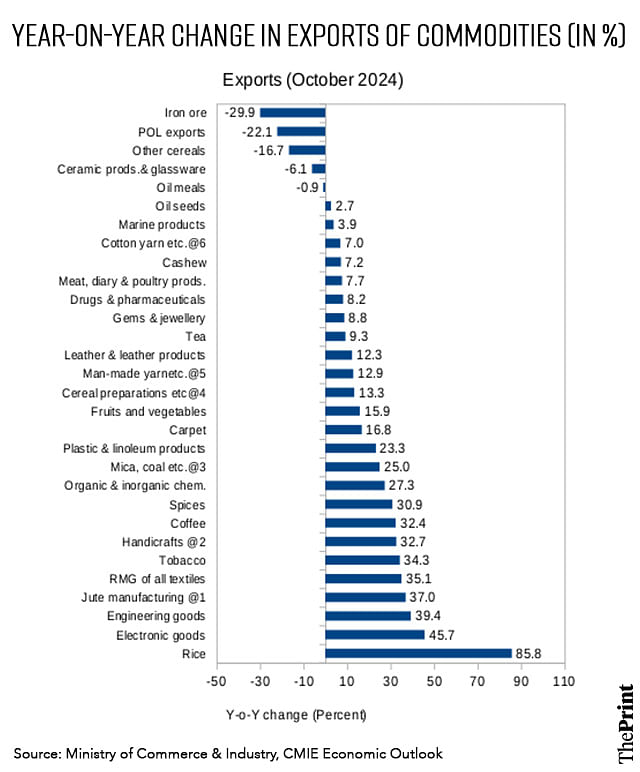

Most of the categories of manufactured goods posted healthy growth in exports. Engineering goods (39.4 percent), electronic goods (45.7 percent), readymade garments (35 percent), organic and inorganic chemicals (27.3 percent) were the key drivers of the sharp growth in exports.

Notably, exports of gems and jewellery, which had been languishing in recent months, posted a welcome uptick last month, with a growth of 8.8 percent year-on-year. The demand for cut and polished diamonds was the key driver. This trend of a revival in demand is likely to continue with the approaching holiday season in the West.

In contrast, exports of petroleum products—accounting for 12 percent of the overall goods exports—contracted by 22 percent due to continued decline in global crude oil prices.

Imports spike on sequential basis

Merchandise imports grew by 3.9 percent on year, driven by a 13.3 percent rise in crude oil imports. In contrast, non-oil imports grew by just 0.67 percent and after excluding gold and silver as well, imports grew by 3.58 percent. Notably, imports of vegetable oil rose by 50.9 percent as refiners sought to replenish stock amid strong festive demand.

On a sequential basis (month-on-month), imports surged by 19.9 percent, driven by surge in petroleum products and festive season-led uptick in gold demand.

Trade outlook subject to challenges

While October saw a turnaround in exports, the near-term outlook is challenging. To boost exports, the government has been focusing on six sectors—engineering, electronics, pharmaceuticals, chemicals, plastics and agriculture—and 20 countries.

With Donald Trump set to become the US president, India could face higher tariffs on some of the focus areas, like pharmaceuticals, auto and engineering products. His criticism of outsourcing and proposal of tighter H-1B visa rules could potentially impact growth of Indian IT firms.

India has a trade surplus with the US, which was USD 21 billion in the first half of the current year. India will need to brace for potential increase in US tariffs and a slowdown in trade. But this may also be an opportunity to undertake a strategic review of India’s tariff structure, which could help in boosting the competitiveness of India’s exports.

On the bright side, there is hope for certain other sectors, such as textiles, as the Trump administration will aim at reducing imports from China, which may benefit textile industries in India.

The overall impact would also hinge on the policy stance on exchange rate and the trajectory of global commodity prices. Greater exchange rate flexibility would enhance the attractiveness of India’s exports.

Radhika Pandey is associate professor and Rachna Sharma is a fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.