The banking sector had a stellar run with record high profits in the March quarter and also for the full financial year. The rise in banks’ profits was driven by continued strong momentum in credit uptake, which boosted their interest income. Alongside a rise in credit growth, banks have managed to keep their bad loans in check, resulting in improved asset quality.

With credit growth continuing to outstrip deposit growth, resulting in higher credit-deposit ratios, the key challenge for banks would be to maintain a healthy deposit base. This could dent banks’ net interest margins as they would need to pay higher interest to attract deposits.

Soaring profits

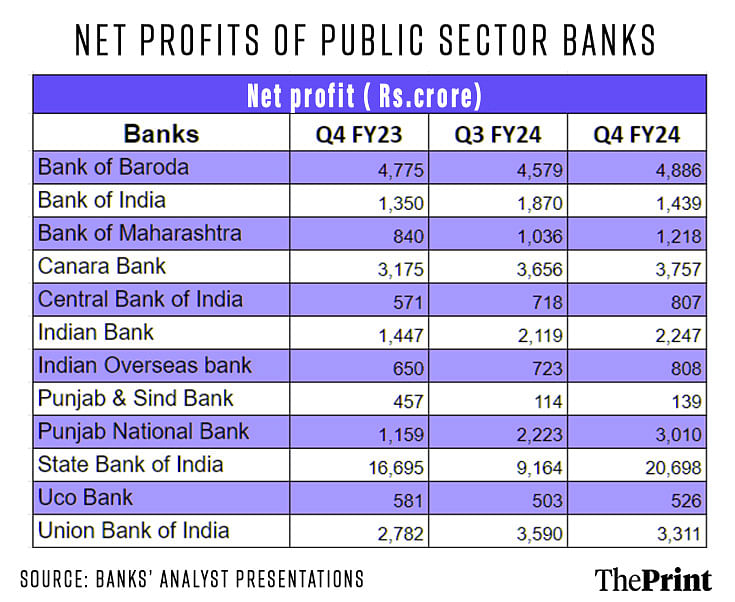

The cumulative net profit of all banks surpassed Rs 3 lakh crore in FY 2023-24. In the previous financial year, the banks’ overall net profit was Rs 2.3 lakh crore. The country’s largest lender, State Bank of India (SBI) posted a net profit of Rs 20,968 crore in the March quarter — a sequential increase of 125 percent. This is the biggest quarterly profit by any Indian bank. The net profit for the full financial year was also the highest ever at Rs 61,077 crore. Among private sector lenders, HDFC bank was a close second with a net profit of Rs 60,812 crore in the last financial year.

The net profit of Punjab National Bank rose to Rs 3,010 crore in the March quarter, propelled by a 17 percent rise in interest income on a year-on-year basis. Notably, the net interest income and net profit has been the highest in the last 16 quarters for the bank.

Among other state-run banks, Bank of Baroda’s net profit was Rs 4,886 crore for the March quarter and Rs 17,789 crore for the full year — a jump of 26 percent compared to last year. However, not all banks reported a growth in profits. UCO bank and Punjab and Sind bank reported a decline in net profit in the last financial year.

Advances and asset quality of banks

Most of the public sector banks reported credit growth in the range of 11-16 percent in March 2024. The only exception was Punjab and Sind bank with a credit growth of 6 percent. In most of the banks, this growth is driven by retail loans. Corporate loans registered tepid growth in some banks. Indian Overseas Bank reported a 4.9 percent growth in corporate loans as compared to a 14 percent growth in retail loans. Bank of Maharashtra also saw a slower 5.7 percent growth in corporate loans as compared to 19 percent growth in retail loans.

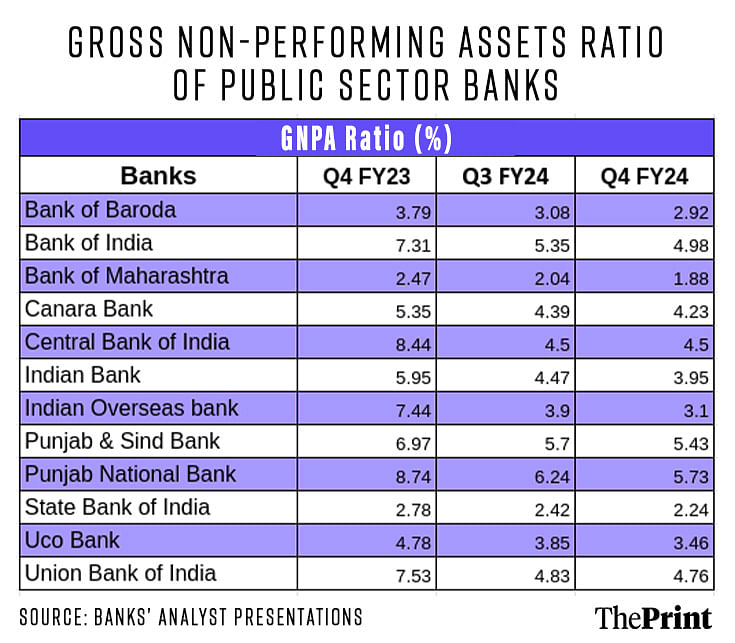

Most of the banks reported a significant improvement in their asset quality. Punjab National Bank reported a gross non-performing asset (GNPA) ratio of 5.73 percent in March, 2024, as compared to 8.74 percent in March 2023. Similarly, Union Bank of India reported a notable improvement in the GNPA ratio to 4.76 percent in March 2024, compared to 7.53 percent in March 2023.

Sectorally, retail loans and loans to corporates had lower GNPAs as compared to loans to agriculture and MSMEs. But there, too, there is an improvement. For State Bank of India, the GNPA ratio for agriculture has declined from 11.47 percent in March 2023 to 9.58 percent in March 2024. Other banks such as Bank of Maharashtra and Punjab National Bank have also reported a decline in NPAs in the agriculture segment.

Credit-to-deposit ratio

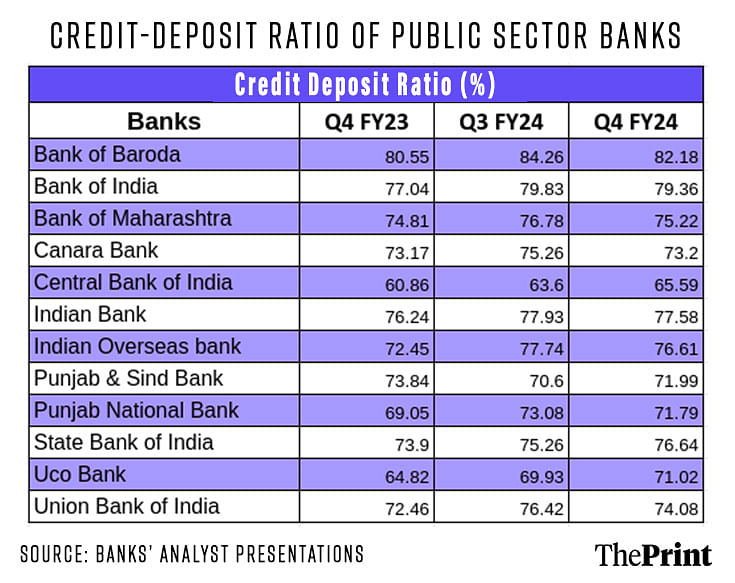

The credit-to-deposit ratio or loans to deposit ratio is a key measure of liquidity. It shows how much of the deposits have been given out as loans. If a high proportion of deposits is given out as loans, and if there is a sudden spurt in withdrawals, there could be a liquidity risk for banks.

There is a considerable variation among banks as far as the credit-deposit ratio is concerned. Punjab National Bank reported a credit deposit (CD) ratio of 71.79 percent in the March quarter — a decline from 73 percent reported in the December quarter. The deposit growth was also at the lower side at 6.9 percent but given that the credit-deposit ratio at 71 percent was also on the lower side, the bank does not see much of a concern as of now.

In contrast, Bank of Baroda’s CD ratio was reported at 82.18 percent in the March quarter. Though this is a moderation of 200 basis points compared to the previous quarter, it needs to be managed through higher deposits.

For banks with a CD ratio of above 75 percent, deposit mobilisation would be the key. As banks compete for higher deposits, banks’ cost of deposits will inch up and will subsequently weigh on their Net Interest Margins.

Raising deposits and competition from other instruments

Raising deposits will not be easy as banks are facing tough competition not just from each other but from mutual funds and from physical assets such as gold and real estate. Some figures are worth noting here. The share of shares and debentures and mutual funds in household savings has seen a noteworthy rise in the post-Covid period. The National Statistical Office data suggests a rise in household savings in physical assets.

Mutual Funds Assets Under Management (AUM) as on April stood at Rs 57.3 lakh crore, registering a growth of 37.5 percent over last year.

Bank deposits on the other hand witnessed a growth of 15 percent in March 2024. The sustained bull run has propelled investors to park their savings in Systematic Investment Plans (SIPs). SIP inflows touched a record high of Rs 20,371 crore in April. The number of active SIP accounts increased to 8.7 crore in April. Amid a clear shift in investor preference, raising deposits would necessitate a rise in interest cost. Banks would need to brace for rise in interest expenses in the coming quarters.

Radhika Pandey is associate professor and Madhur Mehta is research fellow at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Don’t jump at 1st unemployment number you see. Different databases yield varying but valid results