The April edition of the International Monetary Fund’s World Economic Outlook was keenly awaited for its projections of global growth post the announcement of a flurry of tariffs by the United States and counter-tariffs by other countries.

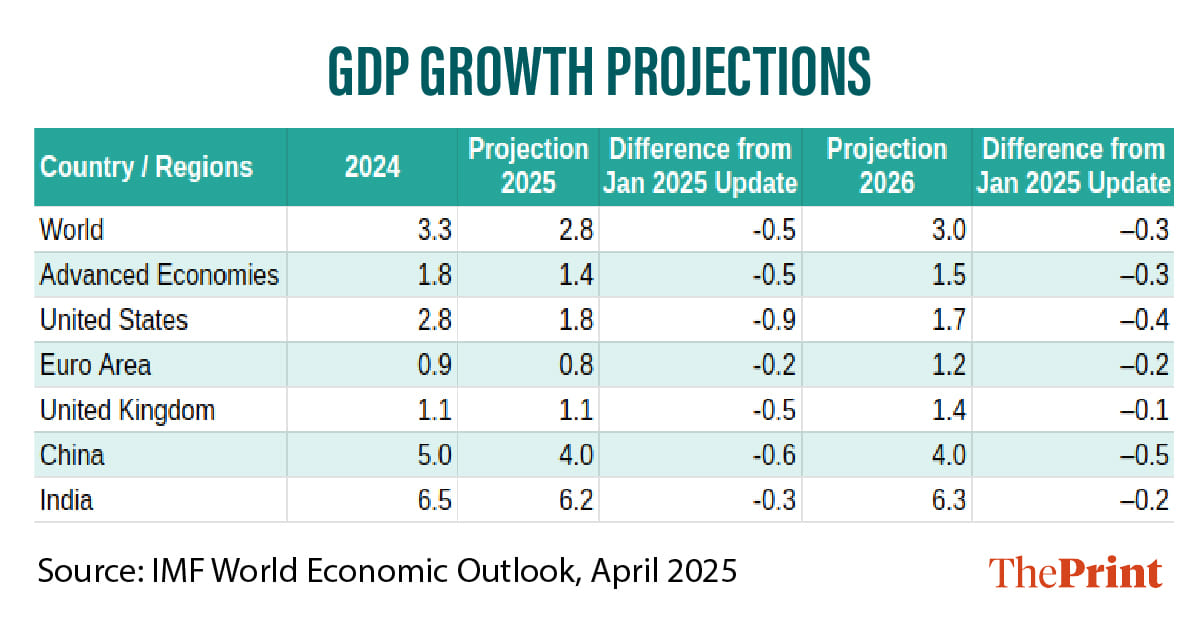

Incorporating the impact of tariffs announced till 4 April, global growth is projected to decline by 0.5 percentage point to 2.8 percent. For next year, growth is projected at three percent, a downward revision of 0.3 percent from the January forecast.

In addition to the reference forecast and to account for the uncertainty in tariff policy, the IMF has put out two alternative growth outlooks—one excluding the impact of the 2 April and subsequent tariffs, and second incorporating the impact of tariff announcements made after 4 April.

The global growth projection masks the substantial variation within countries. The biggest hit to growth is projected for the US and China. For the United States, where tariffs constitute a major supply shock, growth is projected to decrease to 1.8 percent in 2025, 0.9 percent lower than the January forecast. China is projected to grow at four percent in 2025 from 4.6 percent projection in the January update.

Despite a series of monetary and fiscal policy measures announced to lift growth, tariff-induced uncertainty and the consequent demand shock is expected to weigh on China’s growth.

For the Euro area, growth is projected to decline marginally to 0.8 percent in 2025 from 0.9 percent last year. Growth is expected to improve to 1.2 percent in 2026 on the back of fiscal easing due to changes in fiscal rules in Germany.

On account of trade tensions and policy uncertainty, India’s growth is expected to moderate to 6.2 percent—a 0.3 percent downward revision from January update.

Cautiously optimistic projections

The projections for the US seem to be at odds with the rising probability of recession put out by various agencies.

For instance, in early April, J.P. Morgan Research raised the probability of occurrence of recession in the US in 2025 to 60 percent from 40 percent. Even with the current step-back from the “Liberation Day” measures, the probability of recession remains unchanged at 60 percent. Similarly, Goldman Sachs raised the odds of a US recession to 45 percent from 35 percent in early April.

In general, IMF’s growth projections seem to be cautiously optimistic. The projections do not seem to take into account the impact on growth of a full blown tariff war and volatility in financial markets.

Tariff impact, projections on investments & deficits

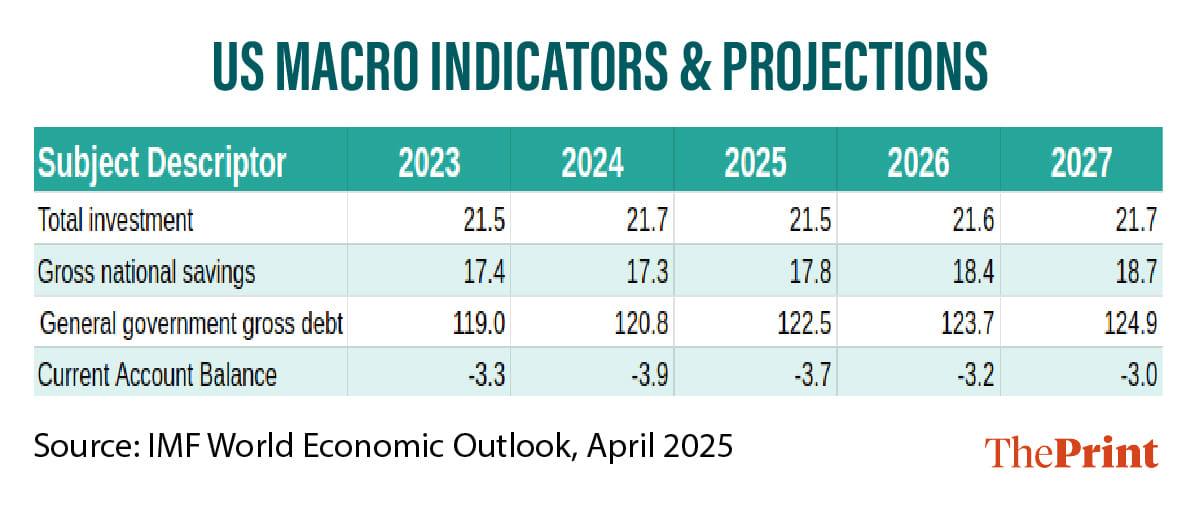

In addition to the growth projections, the IMF WEO database provides projections about key macroeconomic variables for countries. Projections for the US show that while savings are expected to rise from 17.3 percent of GDP in 2024 to 18.4 percent in 2026, they do not translate into higher investments.

If the objective of the comprehensive rollout of tariffs is to raise the rate of investment in the US, the projections do not indicate an increase in investment in the post-tariff world.

Another area of concern is the rise in projection for general government debt-GDP ratio, from 120.8 percent of GDP in 2024 to 123.7 percent of GDP in 2026. The WEO projects a reduction in current account deficit and fiscal deficit from 2024 to 2026.

However, the reduction in fiscal deficit from 7.3 percent of GDP in 2024 to 6.6 percent in 2025 is contingent on higher tariff revenues. Higher tariffs could lead to a reduction in imports and the extent of reduction would depend on the price elasticity of demand for imports. Thus, the projected reduction in fiscal deficit in the US is highly uncertain.

Divergent inflation path

The global inflation path is likely to turn divergent this year. While inflation in advanced economies is projected to increase by 0.4 percentage points, in emerging economies, it is projected to decline, compared to the January update. In particular, the inflation in the US is projected to rise by one percentage point, compared to January update.

For trade partners, tariffs constitute a demand shock and would lead to a downward pressure on prices. The inflation projection for China, likely to be subject to a massive demand shock, is revised down by 0.8 percentage points.

Divergent inflation path warrants differential monetary policy response. Rise in inflation outlook may warrant a more calibrated response in advanced economies, while in emerging economies, monetary easing may be desirable to support tariff-induced demand shock. The US Federal Reserve, while calibrating monetary policy response, would like to ascertain if the impact of tariffs on prices is one-time or more lasting.

The inflation outlook is influenced by commodity price projections. While prices of fuel commodities are expected to decline, non-fuel commodity projections are expected to rise.

Rise in debt burden driven by handful of big economies

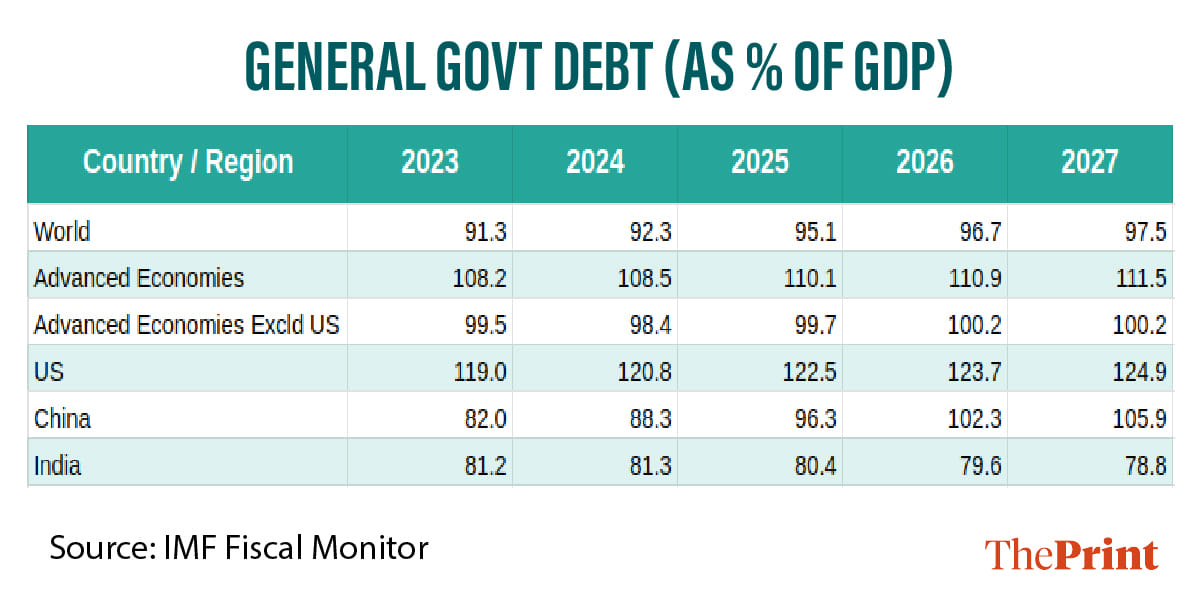

The elevated uncertainty amid trade policy shifts have contributed to worsening of global debt outlook. The IMF’s Fiscal Monitor projects global public debt to rise from 92.3 percent in 2024 to 95.1 percent in 2025, a sharp increase of 2.8 percentage points.

Global public debt is projected to touch 100 percent of GDP in 2030. Brazil, China, France, South Africa, the United Kingdom, and the United States, are key contributors to the increase in global public debt. Excluding these countries, the debt outlook is mostly stable for other countries. Notably, India’s public debt is projected to be on a declining path from 81.3 percent in 2024 to 80.4 percent in 2025.

Going forward, countries’ expenditure needs could rise to offset the trade dislocations, and to reconfigure the disrupted supply chains.

Further, those emerging economies with a large share of dollar-denominated debt could face a surge in their liabilities. However, the recent weakness in the dollar, if sustained, could cushion the debt-servicing burden.

Radhika Pandey is an associate professor and Pramod Sinha is a fellow at National Institute of Public Finance and Policy.

Views are personal.