Despite global headwinds, emerging markets are adopting cryptocurrencies at a rapid pace. According to the Global Crypto Adoption Index published by US blockchain analysis firm Chainalysis, Vietnam, Philippines, Ukraine and India were the top four adopters of cryptocurrency.

In recent months, political and economic instability in countries like Sri Lanka and Pakistan has led to a flight towards cryptocurrencies.

Rise in food and energy prices due to the geo-political conflict coupled with political instability is fuelling inflation and local currency depreciation. Fall in the value of the fiat currency has prompted flight towards commodities (gold and silver), and, to some extent, towards cryptocurrencies. Other use cases such as online gaming and remittances have also become prevalent in recent years.

Growing adoption of crypto a challenge for policymakers & central banks

Hyperinflation in some Latin American countries is pushing the usage of cryptocurrency. Inflation in Argentina skyrocketed to 104.3 per cent year-on-year in March. Alongside surge in inflation, the devaluation of the Argentine Peso is causing bitcoins to become popular.

In the midst of economic crises, many Argentine cities are turning to cryptocurrencies and stablecoins for regular transactions. To reduce the country’s exposure to crypto assets within its payment systems, Argentina’s central bank has banned payment providers from offering cryptocurrency transactions.

High inflation is a problem in Latin American region as a whole. According to estimates, inflation in Latin America will remain above most central banks’ comfort zones in 2023. In this backdrop, the usage of stablecoins is expected to rise in these economies not only as a store of value but also as a means for transactions. Recent study from Mastercard showed that more than one-third of Latin Americans said they have made an everyday purchase with a stablecoin.

Citizens in Turkey are also adopting cryptocurrencies including stablecoins in the midst of high inflation and rapidly depreciating national currency — Lira. The Turkish were typically keeping their money in US dollars, gold or euros. With the rise of cryptocurrencies, they are presented with a new instrument to store their wealth. They were particularly interested in exchanging their local currency with the stablecoin tether, the value of which is pegged to the US dollar.

The growing adoption of cryptocurrencies is becoming a challenge for policymakers and central banks. Greater currency substitution has weakened the ability of monetary policy to influence prices. The transactions conducted via crypto are not reported for taxation purposes. This jeopardises the already-weak fiscal position of a country.

As a means to evade capital controls

Studies by the International Monetary Fund (IMF) suggest that in addition to high inflation, crypto adoption is also seen to be highly correlated with stringency of capital controls. Cryptocurrencies offer a very efficient and cost-effective way to remit funds across borders while avoiding capital controls almost entirely.

In recent years, transactions involving Chinese traders in Russia seeking to remit money back to China through the use of the stablecoin ‘Tether’ were widely reported. Moreover, Chinese are increasingly using stablecoins to transfer money out of mainland China.

Recent economic uncertainty has driven crypto usage in Pakistan and Sri Lanka with citizens turning to peer-to-peer crypto trading platforms or closed social media groups to purchase cryptocurrency.

Lack of access to banking services

One of the key drivers of crypto adoption in Vietnam has been limited access to standard financial services.

More than 60 per cent of the country’s population resides in rural areas where access to modern banking services is limited. This gap is rapidly being filled by emerging blockchain based networks such as decentralised finance, or DeFi.

DeFi provides peer-to-peer financial networks using security protocols, connectivity and software. The infrastructure enables people to conduct financial transactions without the need for third party and centralised financial institutions.

Risks from the growing use of stablecoins

While dollar denominated stablecoins are gaining popularity in emerging markets as a hedge against inflation and exchange rate volatility, large retail holdings of crypto assets primarily through dollar denominated stablecoins pose a risk of currency substitution.

Such substitution can cause capital outflows, loss of effectiveness of monetary policy and pose a threat to financial stability.

The IMF, the Financial Stability Board (FSB), the Bank for International Settlements (BIS) and other standard setting bodies have highlighted the risks from crypto assets and stablecoins and stressed the need for comprehensive and risk-based regulation of the ecosystem of cryptoassets.

At the same time, policymakers need to improve trust in their economic policies, banking systems and currencies which is seen to be the key driver of crypto adoption in a number of emerging economies.

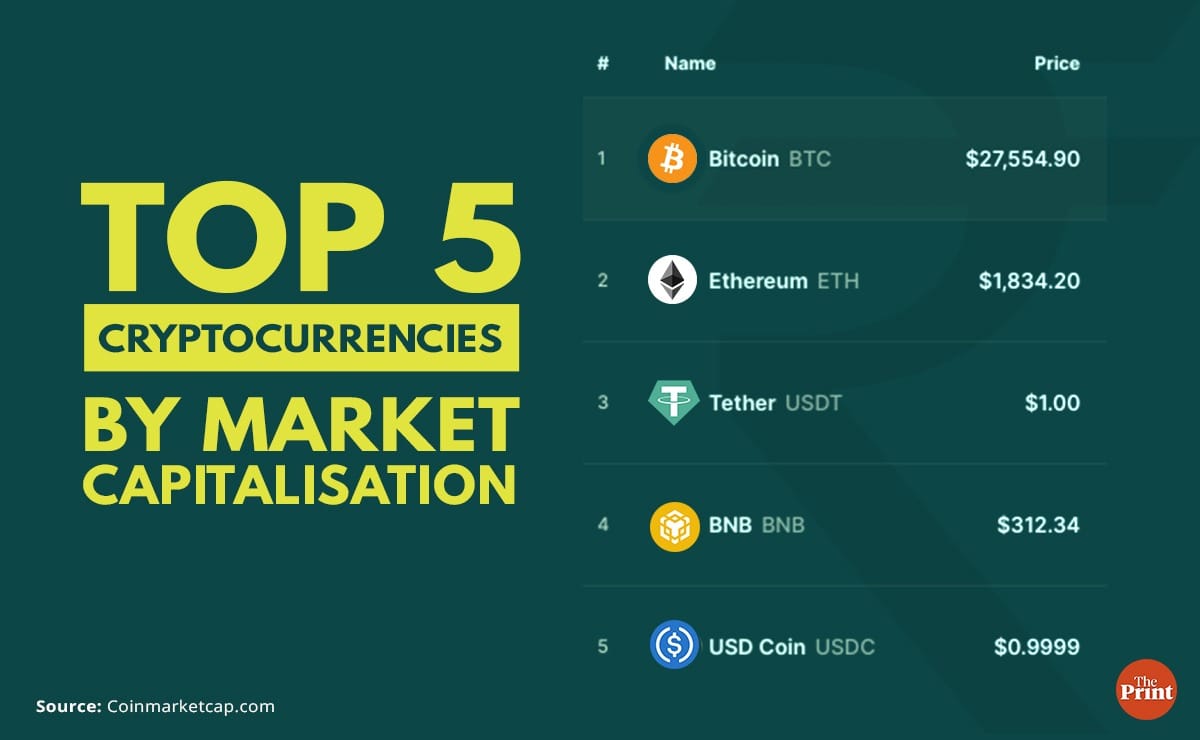

Broadly, there are two types of stablecoins: asset backed and algorithmic.

Asset backed stablecoins are backed by assets such as US dollar, government bonds, short-term corporate debt or bank deposits. There is a centralised intermediary who maintains the reserve of assets and is responsible for coins’ creation and redemption.

For example, USDC is issued by a US Fintech firm called Circle. In contrast, algorithmic stablecoins, such as TerraUSD, rely on complex algorithms that automatically rebalance supply to maintain their value relative to the target currency or asset.

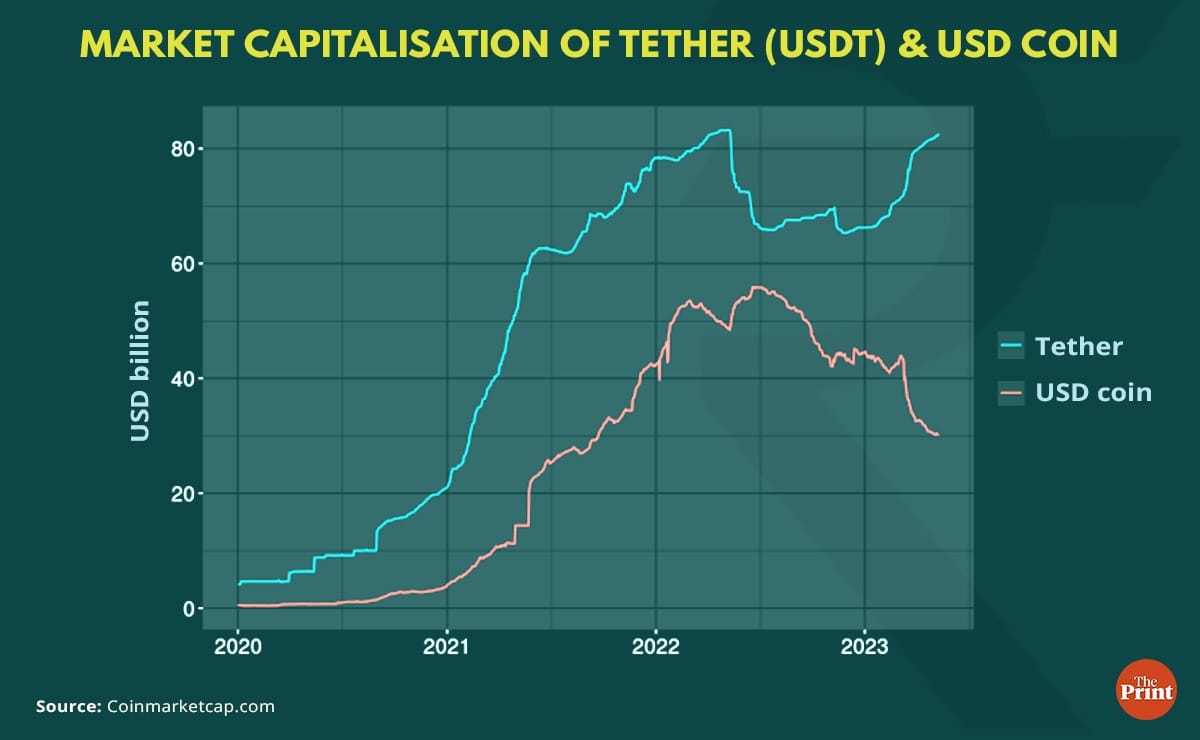

Depending on the composition of reserve assets, there could be linkages with the core financial system. Stress in the mainstream financial sector could have contagion impact on the crypto asset ecosystem. As an example, US firm Circle had parked USD 3.3 billion of its USD 40 billion of USD Coin reserves at Silicon Valley Bank (SVB). The collapse of the SVB led to erosion of market capitalisation of USD Coin.

A key challenge pertains to information asymmetry owing to lack of common standards for disclosure. Issuers of stablecoins are not subject to a common set of standards on the composition of reserve assets. There is also a lack of consistency in disclosure practices. In late 2021, legal action was taken against the issuer of tether stablecoin for making misleading statements in connection with the stablecoin.

Potential spill-over implications

Dollar backed stablecoin issuers are exposed to the potential risk of US debt default. Many issuers are adjusting their mix of reserves in favour of short-dated US treasury securities to avoid getting caught up in a potential US debt default.

Radhika Pandey is Senior Fellow at National Institute of Public Finance and Policy.

Views are personal.