The early bird results for the January-March quarter of 2022-23 show that firms’ revenue and profits have been subdued. Interest expenses of firms have surged owing to the cumulative 250 basis points rate hike by the Reserve Bank of India (RBI) since May 2022.

To present an early assessment of the health of the corporate sector, we look at data on quarterly financial performance of listed firms other than finance and oil. Finance companies have very different concepts underlying their accounting data. Oil companies sometimes experience huge swings in revenue owing to decisions by the government. These are not a feature of underlying growth conditions. Thus, we focus on non-finance and non-oil companies. Our sample includes firms in the services sector.

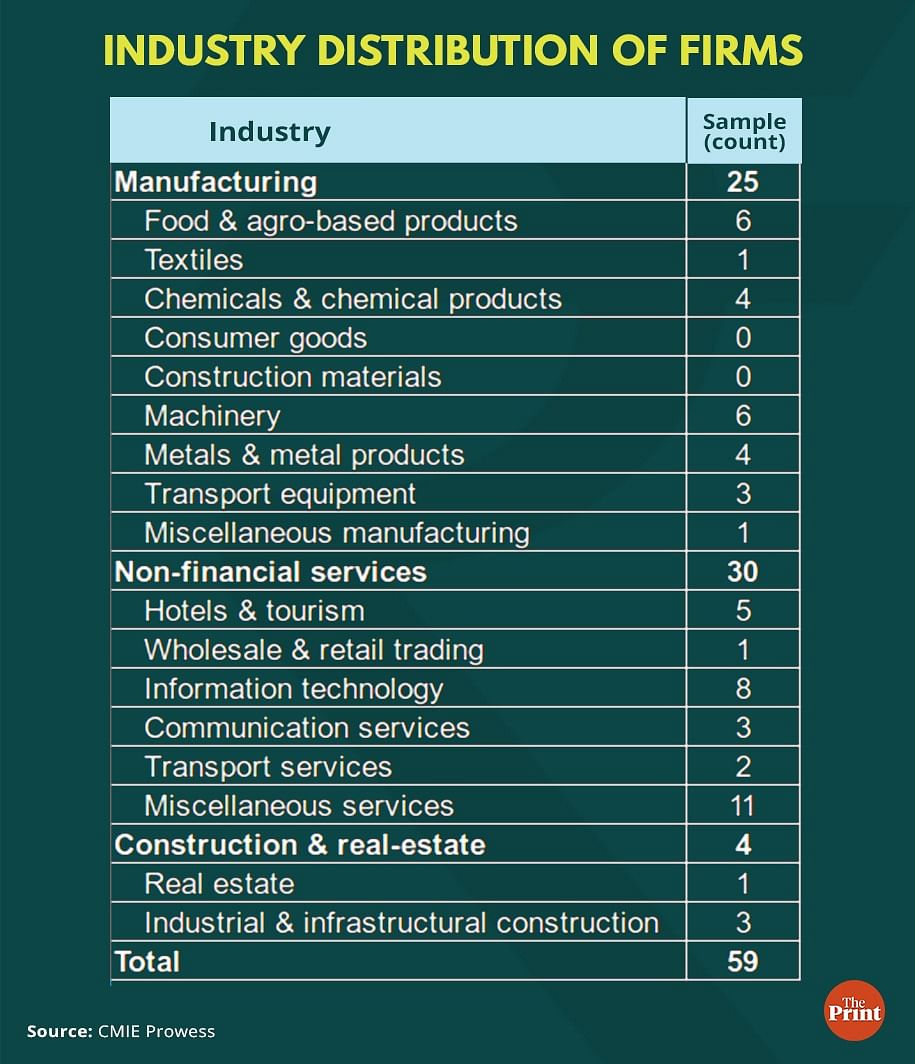

To analyse the quarterly financial performance, we restrict our analysis to a uniform set (common sample) of companies. We compare the performance of those companies who have declared their financial results for the January-March quarter. This gives us a set of 59 companies.

Also read: IMF’s growth downgrade is noteworthy, but developing nations’ rising debt levels demand attention

Industry-distribution of early birds

Of the 59 firms, 25 belong to the manufacturing sector and 30 are non-financial services firms and 4 belong to the construction and real estate sector. The manufacturing set includes firms in food and agro-based products, machinery, metals, transport equipment and chemicals.

It is important to note that firms in the consumer goods segment, construction materials and textiles do not have adequate representation in this sample. The findings could thus change materially as more firms announce their financial results.

Interest expenses witness a sharp rise

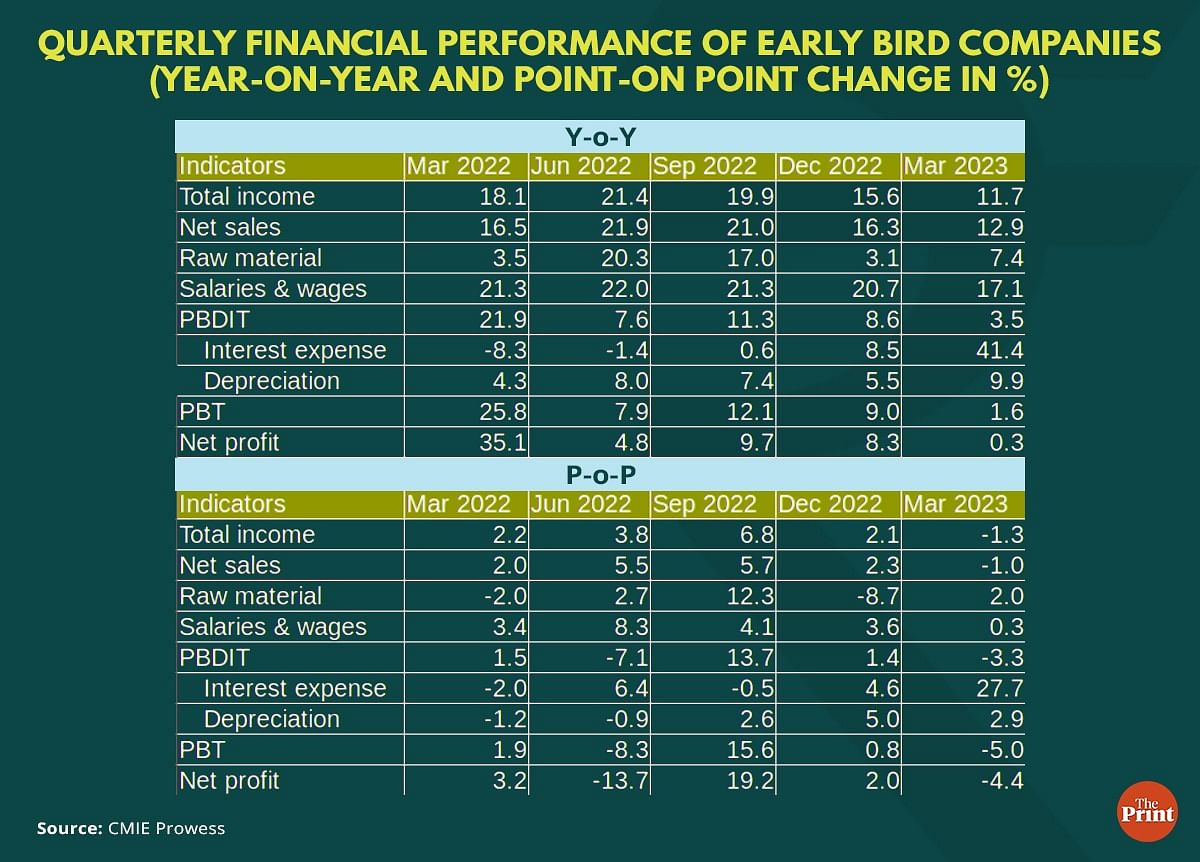

The combined interest expenses for these companies registered a year-on-year growth of 41.4 per cent in the March 2023 quarter. This is in sharp contrast to the quarter ended March 2022 when interest expenses for this set of firms had registered a contraction. To avoid the confounding impact of the low base (March 2022), we look at the quarter-on-quarter growth in interest expenses.

As compared to the previous quarter (December 2022), interest expenses shot up by 27.7 per cent, indicating a sequential rise in borrowing costs of firms. It is possible that the headwinds from monetary policy tightening are intensified as more companies from interest-sensitive sectors such as metals and infrastructure release their financial results for the January-March quarter.

The recent pause by the RBI was welcomed by the industry bodies as it will help in containing the rise in companies’ borrowing costs.

Deceleration in sales revenue

The initial batch of quarterly financial performance results of firms shows a moderation in sales revenue on a year-on-year basis from 16.3 per cent in December 2022 to 12.9 per cent in March 2023. On a quarter-on-quarter basis, sales revenue of firms saw a contraction.

The sample includes top Information Technology (IT) services companies — Tata Consultancy, Infosys and HCL Technologies. India’s IT companies have been struggling amid fears of looming recession in advanced economies and banking crisis in the US and Europe.

The uncertainty and turmoil in the global economy has led to deferring or complete halt of new work orders and pricing challenges. As an outcome, the IT companies reported weak financial results in the March quarter. The company officials indicated that the US and North America are the biggest markets for the IT sector and these are unlikely to improve in the next 2-3 quarters.

Uncertainty in the banking, insurance and financial services in North American markets resulted in a weak Q4 for the sector.

Early signs of moderation in input costs yet to show up in corporate sector data

There are signs of easing input cost pressures. Wholesale Price Index (WPI) based input cost inflation is showing a moderation in recent months. Inflation for both industrial inputs and farm inputs has declined in recent months.

The Purchasing Managers’ Index data has shown a lower magnitude of expansion in input costs across manufacturing and services. For service sector firms, the overall rate of input price inflation in March softened to its lowest since September 2020. Similarly, in the manufacturing sector, with improved availability of raw materials, input cost inflation retreated to one of its lowest levels in two and a half years.

These trends are yet to get translated into lower raw material expenses for the 59 firms. In absolute level terms, the raw material expenses of the 59 firms peaked in September 2022 and have since moderated. But they still remain elevated. On a year-on-year basis, raw material expenses posted a growth of 17 per cent in the September quarter. This eased to 3 per cent in the December quarter but again grew at more than 7 per cent (year-on-year) in the latest March quarter.

Elevated expenses and subdued revenue have led to shrinking profitability of early bird companies. The operating profits of firms posted a year-on-year growth of 3.5 per cent in the March quarter as against 8.6 per cent in the previous quarter. Net profit growth (after excluding interest expenses, depreciation and taxes) has also shrunk both in year-on-year and quarter-on-quarter.

Annual performance and estimation of Gross Value Addition

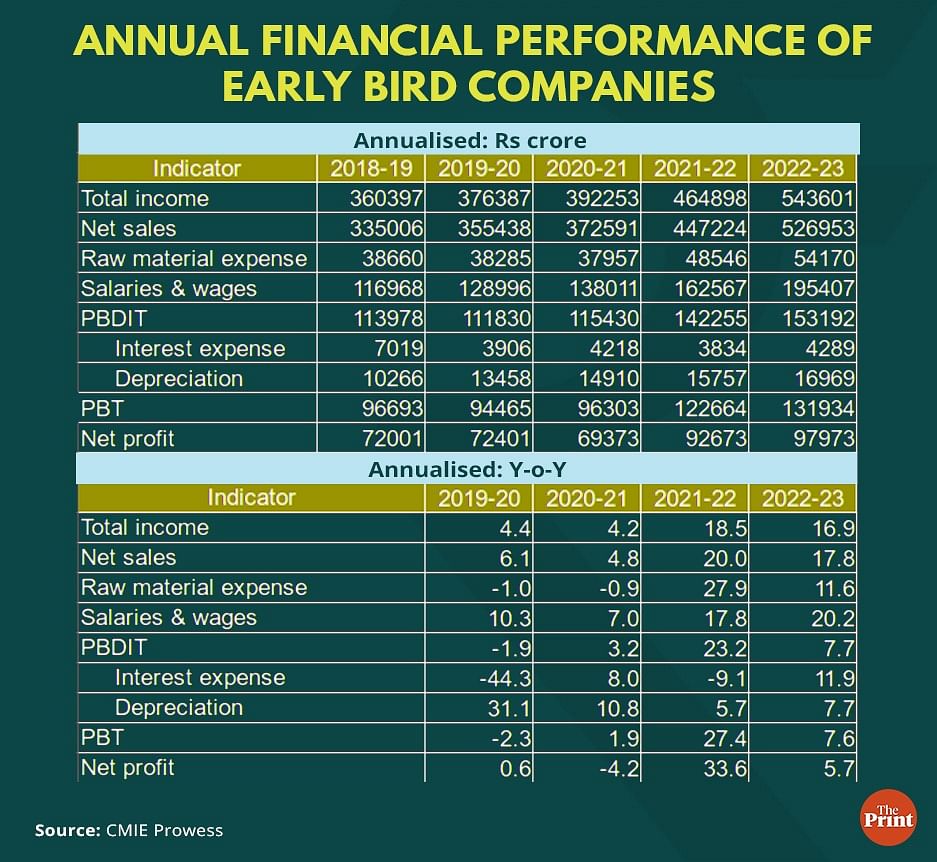

The quarterly results may show some volatility as they are influenced by developments around that period. It is thus worthwhile to also look at the performance of companies on an annual basis. On an annual basis, while sales revenue of firms has moderated, it is still in double digits.

Encouragingly, raw material expenses of firms have declined in 2022-23 as compared to the previous year. The worrying aspect is the surge in interest expenses and decline in profitability of firms. Particularly, in this sample, the profitability of firms in the information technology and textile sector has been hit by global headwinds and subdued demand. However, firms in some categories, such as food and agro products, have done better. With resumption in hiring activity in FY 23, salaries and wage expenses of firms have seen a rise in FY 2023.

How do these numbers translate into the Gross Value Addition (GVA) of firms? GVA is a summary measure to assess the economic performance of firms. GVA is arrived at by summing up staff costs (wages and salaries), profit before tax and depreciation from the quarterly financial results of listed companies. This serves as an important input in the annual GDP calculations. We present the GVA estimates of the early bird companies.

Table shows a nominal GVA growth of 14.4 per cent. While this is lower than last year’s nominal GVA growth, it is still a reasonable growth in the midst of a challenging economic environment. Real GVA after excluding the impact of inflation is seen to be around 5 per cent. This is again on expected lines and represents only a marginal dip from last year’s estimates. This estimate will likely undergo a change as the sample set becomes wider.

Radhika Pandey is a Senior Fellow and Pramod Sinha is a Fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.