The year 2023 ended on a positive note for the Indian economy. The GDP growth for the second quarter (July-September) came in much better than expected, driven by a strong rebound in the manufacturing sector.

On the expenditure side, investment continued to show a healthy growth driven by a sustained capex push by the Central and state governments. High frequency indicators indicate continuation of growth momentum, possibly leading to a 7 percent annual growth. The current account deficit (CAD) is expected to improve, reaching 1.5-1.7 percent of GDP for the current fiscal year.

As we step into the new year, here are the key factors that will shape the economy in 2024.

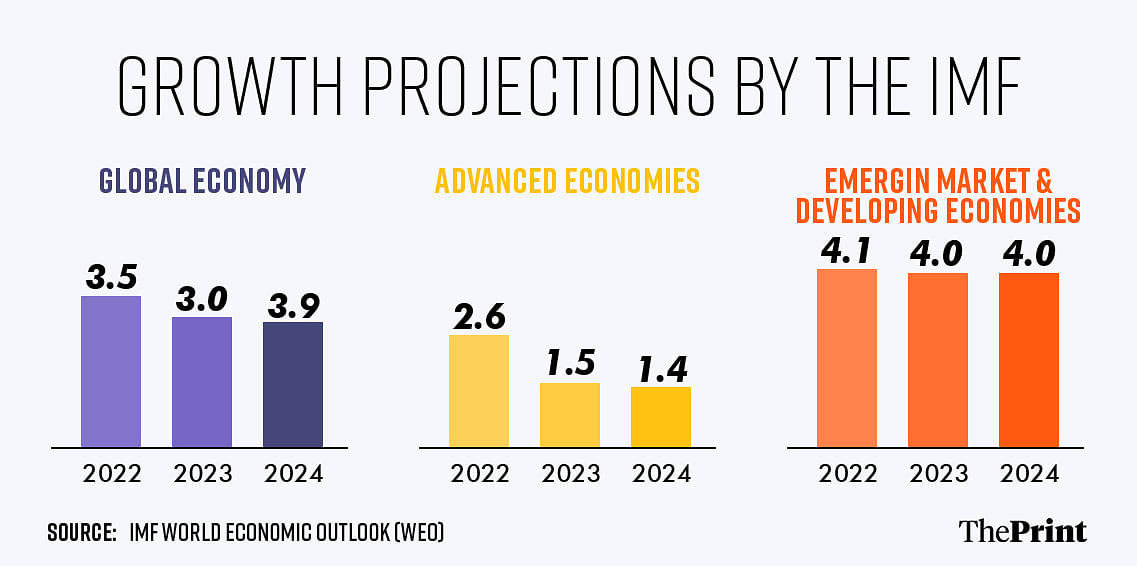

Global growth is likely to slow down further: According to the International Monetary Fund’s (IMF) World Economic Outlook of October, global growth is expected to slow down from 3 percent in 2023 to 2.9 percent in 2024. This growth is much below the historical average growth of 3.8 percent. The slowdown in growth will largely be led by advanced economies such as the US and the European Union (EU). Sustained interest rate hikes by the central banks will start impacting demand and hence growth in the coming year.

Global economic slowdown could have an adverse impact on India’s merchandise exports. In April-November of the current year, India’s goods exports contracted by more than 6 percent compared to the same period last year. The subdued performance of India’s goods exports is likely to continue in 2024. Similar to this year, the cushion provided by the services exports will be crucial in determining the overall balance of payments position in 2024.

Also read: IMF’s assertion that RBI over-regulated rupee is weak, but advice on better fiscal targets is useful

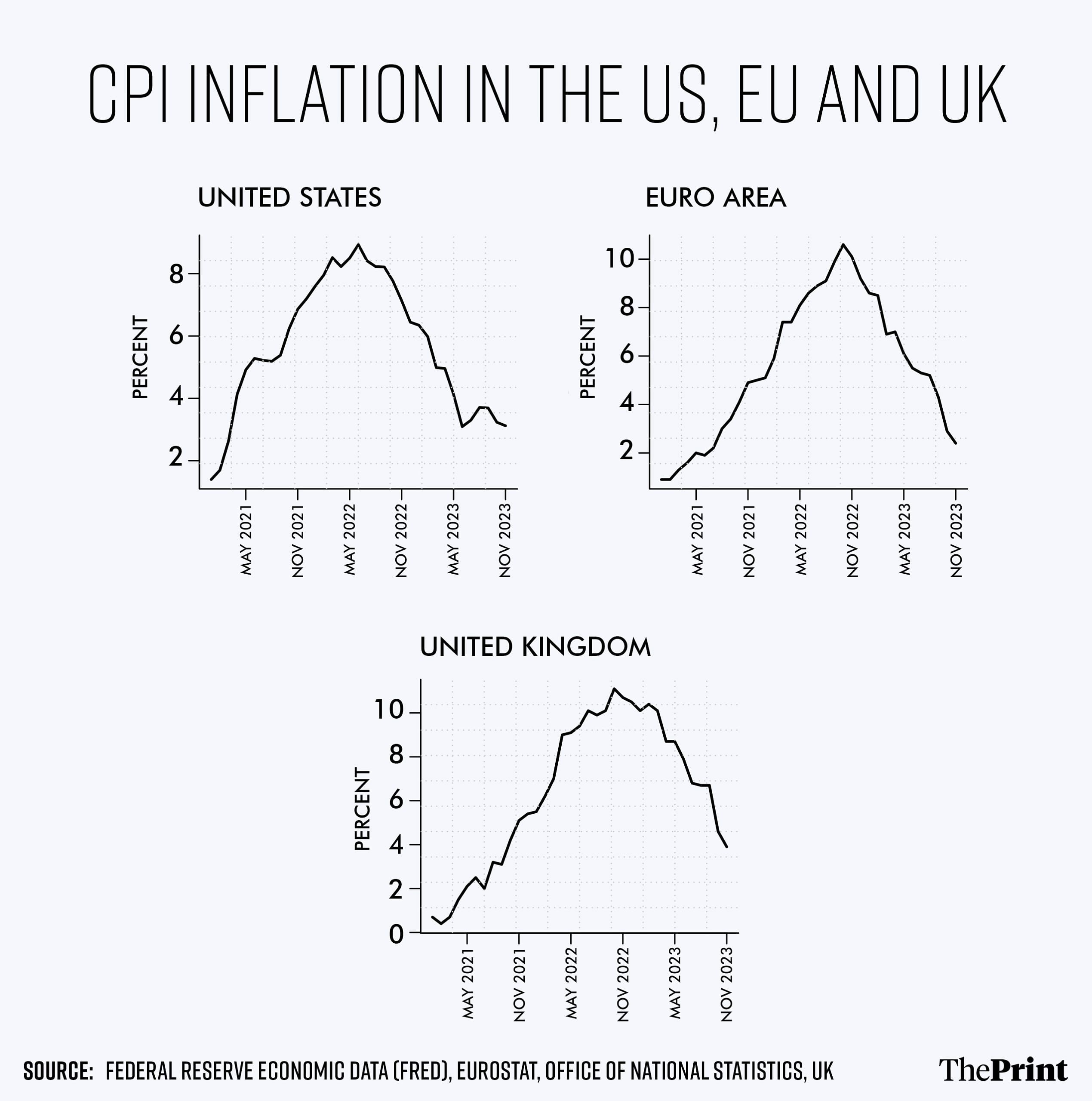

Easing of inflation globally will pave the way for interest rate reductions, the domestic rate cut cycle will follow but with a delay: Globally, there have been signs of continued moderation of consumer price inflation.

In the US, the CPI inflation eased to 3.1 percent in November. In the EU, inflation has edged down to 2.4 percent in November from a high of 10 percent in November of last year. Unless there is a fresh shock, leading to a rebound in prices, central banks will not hike rates further. The rate setting panel of the US Federal Reserve has indicated that there could be a 75 basis points reduction in interest rates in the coming year. With the Euro area witnessing a shrinking of GDP growth for the second consecutive quarter, the ECB will likely take a lead in interest rate cuts.

Domestically, while the RBI retained a status quo on rates for the fifth consecutive time in December, it is not likely to be in a hurry to cut rates. This will lead to widening of interest rate differential between India and the advanced economies and the likely continuation of strong momentum of foreign portfolio investments (FPIs) seen in recent months.

The year 2023 saw record gross purchases of Indian equities by FPIs. With the easing of US bond yields and expectations of rate cut by the US Federal Reserve, FPI inflows bounced back in November and December after two months of net outflows.

FPIs buying will continue next year due to rise in the interest rate differential. The inclusion of Indian government bonds into JP Morgan’s Emerging Market Index will further add to foreign fund inflows.

Food prices will remain vulnerable to global factors and adverse weather events and could dampen rural consumption while urban demand will remain strong: Urban demand has remained resilient as reflected in robust growth in passenger car sales, housing demand and surge in travel and tourism.

However, the key pain point is the slowdown in the agricultural sector. According to the first advance estimates by the Ministry of Agriculture, the country’s rice production is estimated to decline by 3.79 percent to 106.31 million tonnes in the kharif season of the 2023-24 crop year (July-June) due to poor rainfall in key growing states.

Wheat crop is also likely to be impacted by limited soil moisture. This is at a time when wheat inventories at state warehouses have dropped to a seven-year low. Cereal prices are likely to remain elevated.

In addition, prices of pulses are also not likely to see a significant easing soon. Globally as well, the El Nino event is likely to hamper supplies of rice, wheat, palm oil in key exporting countries. Consequently, high food inflation is likely to continue in 2024 and could pose a dampener to rural demand.

Resilience of the corporate and the banking sector and the likely pick-up of private investment: Last few years have seen a considerable improvement in the twin balance-sheets of the corporate sector and banks. Corporates are benefiting from increased profits, and reduced leverage. Both banks and non-bank financial intermediaries have reported impressive earnings and robust credit expansion in the current fiscal.

An analysis of around 5,300 listed Indian companies reveals that the annual growth rate of output or net sales of these companies has nearly doubled to 15.6 percent in the fiscal year 2022-23, contrasting with the modest growth rate of 8.4 percent seen previously. Likewise, profits have surged by almost 69 percent during the fiscal year 2023-23. While growth in sales contracted partly due to an unfavourable base, profits continued to exhibit double-digit growth in the current year. The improved fundamentals are likely to continue in the coming year.

The resilience of the corporate sector is poised to contribute in two significant ways. Firstly, the increased profits are expected to result in higher corporate tax collections for the government, which can subsequently be allocated towards developmental expenditures.

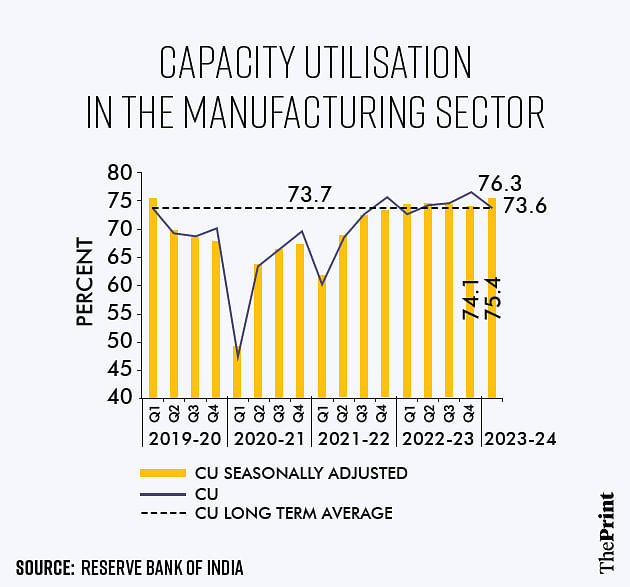

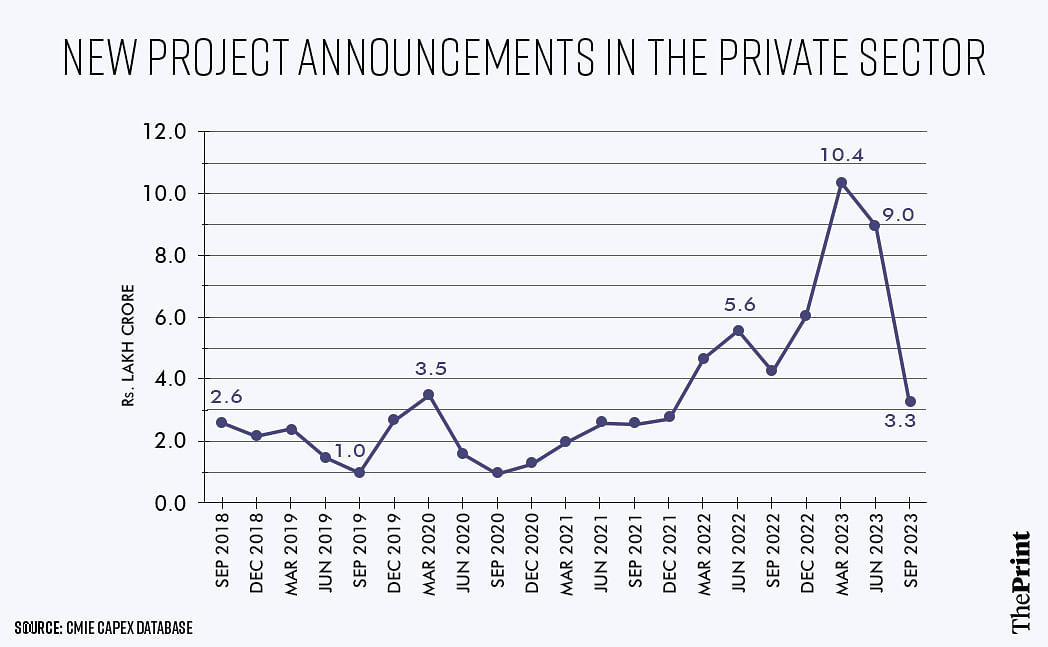

Secondly, the robust financial well-being of corporations should trigger the advent of a fresh investment cycle. Here, however, the signals are mixed. While the capacity utilisation (CU) in the manufacturing sector has shown improvement in Q1:2023-24, with a 130 basis points (bps) jump to 75.4 from the previous quarter, new projects announced saw a deceleration in the first two quarters.

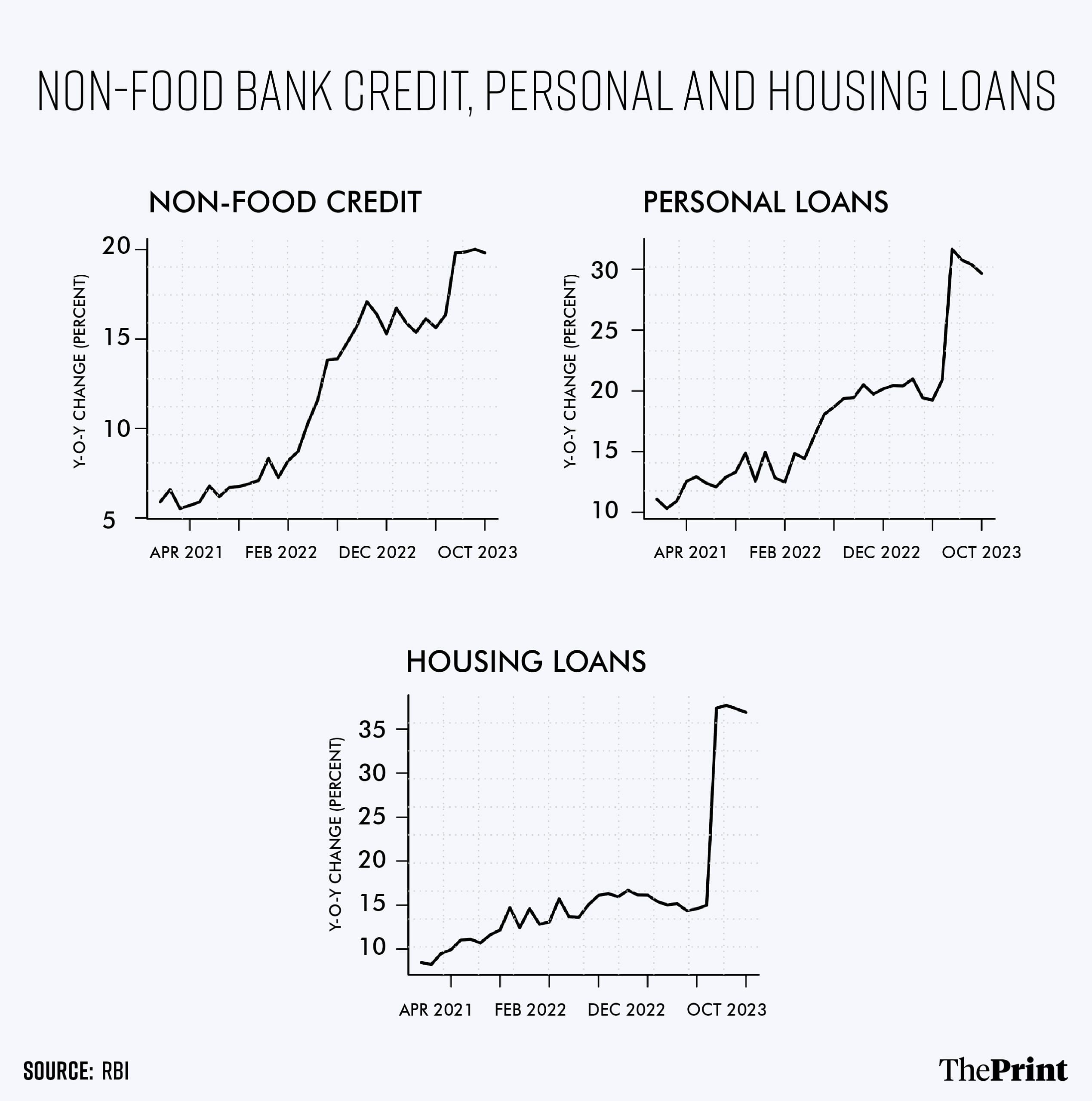

Household borrowings from banks will remain steady despite recent RBI actions: Non-food bank credit registered a strong growth of more than 19 percent till October 2023. The strong growth in bank credit offtake was driven by personal loans (loans to consumers) and services loans.

Personal loans grew at almost 30 percent according to the recent data. In the next financial year, credit growth could moderate to 12-13 percent owing to tight liquidity conditions, subdued demand for agricultural credit and increase in risk weights on unsecured consumer loans and loans to non-bank financial companies. However, demand for loans by households will likely remain robust.

Consumers’ reliance on borrowings has increased to finance their consumption and also for creation of physical assets such as real estate. Household borrowings from banks for creation of physical assets will likely continue in 2024. This is also reflected in record sales of residential property and record launches.

Radhika Pandey is associate professor and Pramod Sinha is a Fellow at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Food inflation getting more persistent & widespread and, unfortunately, showing no signs of easing